Refrigerator Benchtop Centrifuges Market Size, Share, & Industry Analysis Report

By Product Type (Microcentrifuges, Multipurpose Centrifuges, High-Speed Centrifuges, Others), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6030

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

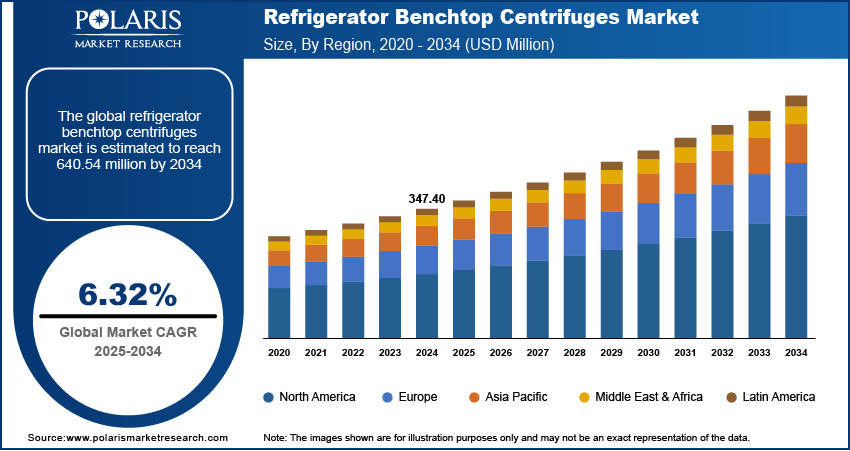

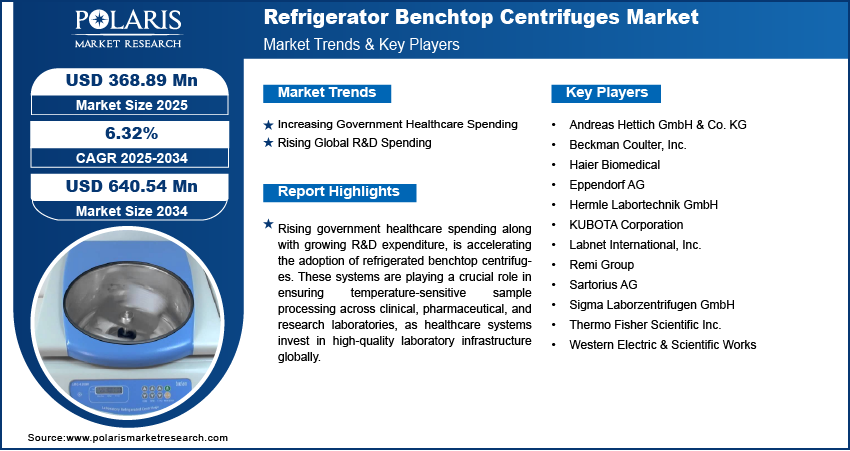

The global refrigerator benchtop centrifuges market size was valued at USD 347.40 million in 2024, growing at a CAGR of 6.32% during 2025–2034. Rising government healthcare expenditure and the increasing medical research and development (R&D) spending is fueling the growth of refrigerator benchtop centrifuges market.

Key Insights

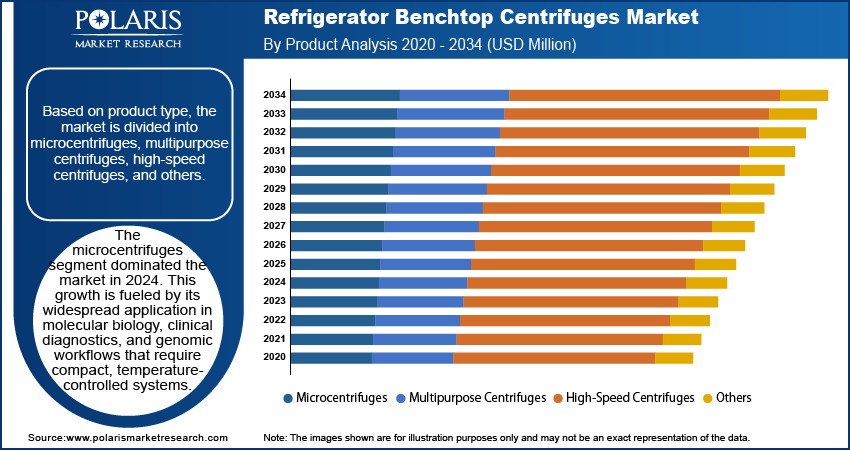

- The microcentrifuges segment accounted for largest market share in 2024.

- The genomics segment is projected to grow at a rapid pace in the coming years, driven by increasing research activities in molecular biology and precision medicine.

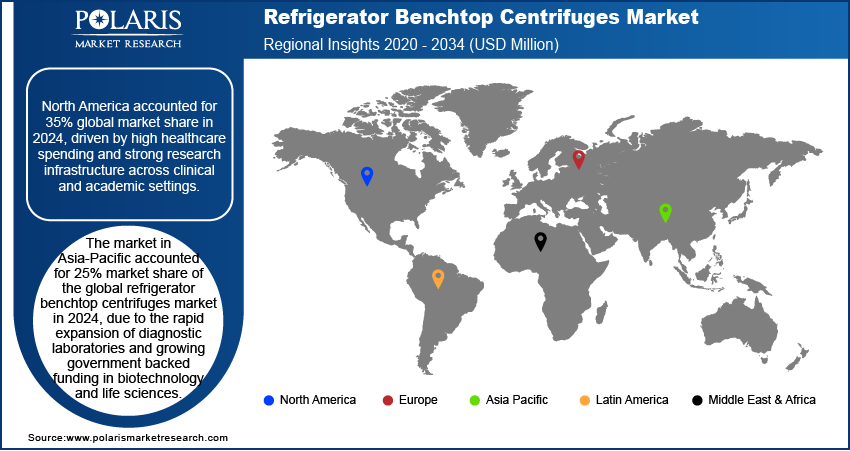

- The North America refrigerator benchtop centrifuges market accounted for largest global market share in 2024.

- The US refrigerator benchtop centrifuges market held significant share of the North America market in 2024, driven by elevated healthcare spending and widespread adoption of advanced laboratory equipment.

- The market in Asia Pacific is projected to grow with a significant CAGR during the forecast period, propelled by increasing government funding and expansion of diagnostic and biotech laboratories.

- Countries such as China and Japan are playing a key role in regional growth, due to large-scale investments in clinical research, pharmaceutical innovation, and academic collaborations.

Refrigerator benchtop centrifuges are compact laboratory instruments designed to separate biological samples at controlled temperatures to preserve sample integrity. These centrifuges are commonly used in clinical diagnostics, research laboratories, pharmaceutical development and academic institutions for processing blood, cells, proteins and nucleic acids. These centrifuges are equipped with features such as programmable settings, interchangeable rotors and safety locks to support efficient and consistent results. These instruments are used in hospitals, diagnostic labs, research centers and biotechnology facilities, where their ability to maintain low temperatures during high-speed operation helps preserve sensitive biological materials.

The global rise in diagnostic testing and disease surveillance is fueling demand for refrigerator benchtop centrifuges due to the need for precise and temperature-sensitive sample handling across healthcare and public health systems. Growing focus on early detection of infectious and chronic diseases is expanding laboratory capacity in hospitals, diagnostic chains, and research centers. According to the Eurostat 2023, at least 50.6% of total adult population in Finland and 43.2% of total adult population in Germany are living with chronic illness. Simultaneously, according to the latest report of the US Department of Health and Human Services, an estimated 129 million people in the US suffer with at least 1 major chronic disease. This trend continues to support procurement of high-performance centrifuges that enable efficient plasma separation, pathogen detection, and biomarker analysis, ensuring its crucial role in routine diagnostics and outbreak monitoring.

Technological advancements in high-speed centrifuge systems is driving growth in the refrigerator benchtop centrifuges market by enhancing operational efficiency, precision, and temperature control. The innovations are enhancing operational efficiency in clinical diagnostics, genomics, and pharmaceutical research by ensuring reliable performance and preserving sample integrity. Therefore, laboratory upgrades to more streamlined and high-performance systems are driving continuous demand for advanced benchtop centrifuges across healthcare and research environments.

Drivers & Opportunities/Trends

Increasing Government Healthcare Spending: Rising government expenditure on healthcare is fueling demand for refrigerator benchtop centrifuges due to expanded investments in diagnostics, public hospitals, and biomedical research infrastructure. According to the World Health Organization (WHO), global health expenditure reached nearly USD 9 trillion in 2021. Moreover, government health spending rose in 2023, accounting for 10.1% of GDP in Germany, 9.5% in Japan, and 7.9% in Canada from 9.8%, 9.2%, and 7.7% in 2019. This increase in funding is enabling laboratories and diagnostic centers to procure advanced centrifugation systems that ensure accurate sample separation and cold-chain preservation. Thus, government focus on accessible and efficient healthcare delivery is driving steady demand for reliable benchtop centrifuges across public sector facilities.

Rising Global R&D Expenditure: The steady rise in global R&D spending is fueling demand for refrigerator benchtop centrifuges to support precise sample separation and reproducible, temperature-sensitive research across biotech, pharma, and academic labs. According to World Intellectual Property Organization (WIPO), global R&D spending including medical accounted to 2.39% in 2020 and it increased to 2.75% by 2023. This surge in funding is boosting the adoption of high-performance lab equipment that ensures precise temperature control and efficient sample processing. Thus, the market is expected to witness constant growth driven by increasing emphasis on precision-driven laboratory operations.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes microcentrifuges, multipurpose centrifuges, high-speed centrifuges, and others. The microcentrifuges segment accounted for the largest market share in 2024, due to its widespread use in clinical diagnostics and molecular biology laboratories. For example, Hettich launched the next-generation MIKRO 2.0 and MIKRO 2.0 R microcentrifuges, designed for research, diagnostics, and routine laboratory use. These compact devices offer rapid sample processing at lower volumes, making them ideal for DNA extraction, RNA separation, and routine analysis workflows. The ease of use, small footprint, and compatibility with standard lab protocols support its integration across hospital labs and academic research facilities.

The multipurpose centrifuges segment is projected to expand at a notable pace through 2034, due to its flexible design that supports a variety of rotor heads and sample formats ranging from blood tubes to microplates across diagnostics and clinical research settings. Laboratories seeking to consolidate multiple centrifugation tasks into a single instrument are gradually investing in multipurpose models for resource-optimized facilities across emerging markets.

Application Analysis

In terms of application, the segmentation includes diagnostics, microbiology, cellomics, genomics, proteomics, blood component separation, and other applications. The diagnostics segment held the dominant market share in 2024, due to high-volume sample processing needs in disease screening and pathology labs. It plays a key role in serum and plasma separation, enabling precise diagnostic assays in hospital laboratories and point-of-care settings. Automation compatibility and improved refrigeration control further support their effectiveness in maintaining sample integrity.

The genomics segment is estimated to hold a significant market share in 2034, fueled by advancements in gene sequencing, nucleic acid purification coupled with personalized medicine research. The integration of genomic testing into clinical and research applications, is creating the need for consistent, high-speed centrifugation to isolate DNA/RNA samples. Thus, the centrifuge systems that support high-throughput and contamination-free workflows are continously adopted across genomics laboratories and biotechnology firms to streamline sample preparation and enhance operational efficiency.

End User Analysis

Based on end user, the segmentation includes hospitals, biotechnology & pharmaceutical companies, and academic & research institutes. The biotechnology & pharmaceutical segment accounted for the largest market share in 2024, due to its extensive demand for high-speed and temperature-controlled centrifugation in drug discovery, cell culture preparation, and bioprocessing. Research labs and manufacturing units rely on refrigerated benchtop centrifuges for reproducible results and to ensure sample integrity during various phases of R&D and quality control.

The academic & research institutes segment is projected to grow at the fastest CAGR during the forecast period, driven by growing investments in laboratory modernization that support advanced research in molecular biology, cell sciences, and biomedical innovation. It is widely used in educational setups for hands-on training, small-scale research projects, and collaborative clinical studies, providing reliable sample separation and preparation capabilities essential for foundational and applied research activities. The expansion of research funding and government-backed innovation programs is further enhancing demand across universities and research clusters globally.

Regional Analysis

North America refrigerator benchtop centrifuges industry accounted for 35% global market share in 2024. This growth is driven by the strong presence of clinical laboratories and high demand for precision-based sample processing in diagnostics. Additionally, the expansion of molecular diagnostics and biobanking programs across the US and Canada is further increasing demand for compact, temperature-controlled centrifuges in routine and specialized laboratory settings.

US Refrigerator Benchtop Centrifuges Market Insight

The US dominated the regional market, capturing largest regional market share. This is driven by rising healthcare expenditure and increasing focus on laboratory automation across hospitals, diagnostic centers, and research institutes. According to the Centers for Medicare & Medicaid Services (CMS), national health spending in the US reached approximately USD 4.9 trillion in 2023 from USD 4.1 trillion in 2020. Moreover, investments in high-throughput laboratory infrastructure and integration of cold-chain processing tools are driving wider adoption of refrigerator benchtop centrifuges across academic and clinical applications.

Asia-Pacific Refrigerator Benchtop Centrifuges Market

The Asia-Pacific refrigerator benchtop centrifuges industry captured 25% share in 2024. This is driven by expanding biomedical research, government funding for lab modernization, and increasing diagnostic testing volumes. Also, many countries such as China, Japan and South Korea are witnessing higher deployment of temperature-sensitive lab equipment in genomics, virology and cell biology research. Moreover, domestic manufacturing capabilities and rising healthcare access are improving equipment availability across regional labs and diagnostic service providers.

India Refrigerator Benchtop Centrifuges Market Insight

Government-backed investment in laboratory modernization is driving demand in the India refrigerator benchtop centrifuges market due to increasing focus on solidifying national research infrastructure and diagnostic capabilities. For instance, programs such as the FIST initiative and Level ‘C’ funding scheme by India’s Science & Technology Ministry is offering up to USD 1.2 million over five years to top academic institutions, enabling procurement of advanced lab equipment for high-precision sample processing and research excellence. This initiative focuses on enabling institutions to acquire state-of-the-art equipment and establish advanced research labs capable of conducting internationally competitive research. This is accelerating lab modernization and boosting demand for high-performance tools including refrigerator benchtop centrifuges for sample processing and analysis.

Europe Refrigerator Benchtop Centrifuges Market Overview

The market in Europe accounted for 28% market share of the global refrigerator benchtop centrifuges market in 2024, due to higher demand for efficient sample processing in life sciences, pharmaceuticals, and academic research. This includes countries such as Germany, France and the UK continue to invest in cold-storage-enabled lab infrastructure to support disease surveillance, vaccine development, and cell therapy research. According to the Eurostat data, research and development (R&D) expenditure in the EU reached over USD 446.42 million in 2023, with R&D intensity, measured as a percentage of GDP, rose to 2.22% in 2023 from 2.08% in 2013. This rise in funding is boosting laboratories to upgrade analytical infrastructure, including centrifugation systems that offer precise temperature control and high-speed performance.

Key Players & Competitive Analysis Report

The refrigerator benchtop centrifuges market is moderately competitive, with major players such as Thermo Fisher Scientific Inc., Eppendorf AG, Beckman Coulter, Inc., Sigma Laborzentrifugen GmbH, Andreas Hettich GmbH & Co. KG, Sartorius AG, KUBOTA Corporation, and Hermle Labortechnik GmbH. These companies focus on developing advanced centrifuges with features such as programmable settings ad high-speed operation to meet the evolving needs of clinical, research, and biopharmaceutical laboratories. Strategic initiatives including product launches, partnerships, and regional expansion is driving growth and enhancing competitiveness in this specialized laboratory equipment market.

Key companies in the industry include Thermo Fisher Scientific Inc., Eppendorf AG, Beckman Coulter, Inc., Sigma Laborzentrifugen GmbH, Andreas Hettich GmbH & Co. KG, Sartorius AG, KUBOTA Corporation, Hermle Labortechnik GmbH, Labnet International, Inc., Western Electric & Scientific Works, Remi Group, and Haier Biomedical.

Key Players

- Andreas Hettich GmbH & Co. KG

- Beckman Coulter, Inc.

- Haier Biomedical

- Eppendorf AG

- Hermle Labortechnik GmbH

- KUBOTA Corporation

- Labnet International, Inc.

- Remi Group

- Sartorius AG

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

- Western Electric & Scientific Works

Industry Developments

October 2023: Haier Biomedical launched a new line of benchtop high-speed refrigerated centrifuges designed to deliver advanced performance, safety, and reliability for a wide range of laboratory applications. The latest centrifuge lineup is tailored to support modern laboratory workflows, incorporating high-precision temperature control, simplified user interfaces, and expanded capacity to enhance efficiency and usability in scientific and clinical settings.

Refrigerator Benchtop Centrifuges Market Segmentation

By Product Type Outlook (Revenue, USD Million, 2020–2034)

- Microcentrifuges

- Multipurpose Centrifuges

- High-Speed Centrifuges

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Diagnostics

- Microbiology

- Cellomics

- Genomics

- Proteomics

- Blood Component Seperation

- Other Applications

By End User (Revenue, USD Million, 2020–2034)

- Hospitals

- Biotechnology & Pharmaceutical

- Academic & Research Institutes

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Refrigerator Benchtop Centrifuges Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 347.40 Million |

|

Market Size in 2025 |

USD 368.89 Million |

|

Revenue Forecast by 2034 |

USD 640.54 Million |

|

CAGR |

6.32% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Refrigerator Benchtop Centrifuges Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 347.40 million in 2024 and is projected to grow to USD 640.54 million by 2034.

The global market is projected to register a CAGR of 6.32% during the forecast period.

North America dominated the market with 35% share in 2024.

A few of the key players in the market are Thermo Fisher Scientific Inc., Eppendorf AG, Beckman Coulter, Inc., Sigma Laborzentrifugen GmbH, Andreas Hettich GmbH & Co. KG, Sartorius AG, KUBOTA Corporation, Hermle Labortechnik GmbH, Labnet International, Inc., Western Electric & Scientific Works, Remi Group, and Haier Biomedical.

The microcentrifuges segment dominated the market share in 2024 due to its widespread use in routine laboratory protocols requiring rapid and efficient processing of small-volume samples

The multipurpose centrifuges segment is expected to witness the fastest growth during the forecast period due to its ability to handle a wide range of sample volumes and applications across clinical, pharmaceutical, and academic laboratories.