Rental Economy Solutions Market Size, Share, Trends, Industry Analysis Report

: By Asset Type (Physical Assets and Digital Assets), End User, Duration of Rental, Industry Vertical, Platform Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5592

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

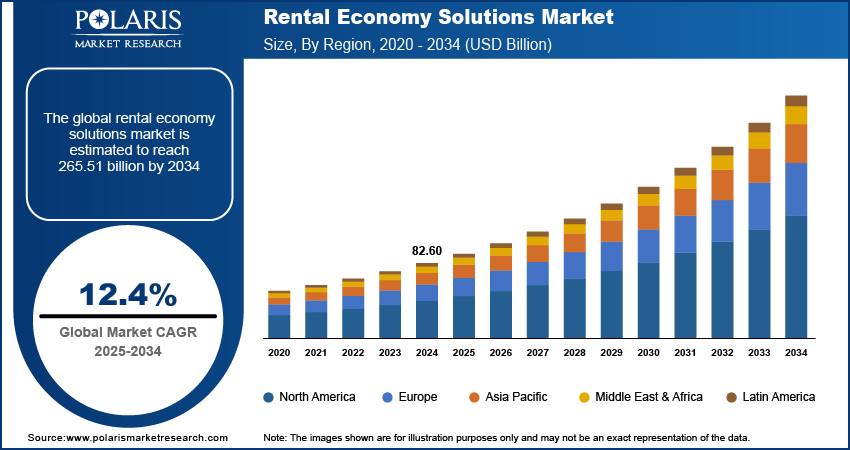

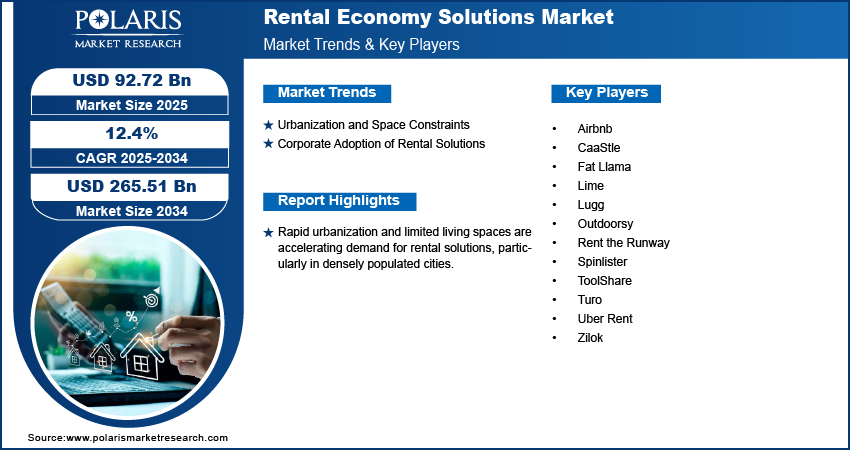

The global rental economy solutions market size was valued at USD 82.60 billion in 2024, exhibiting a CAGR of 12.4% during 2025–2034. The market is driven by shifting consumer preference for flexible renting, rapid urbanization, sharing economy platforms, rising infrastructure demand, and increased corporate adoption of rentals.

Key Insights

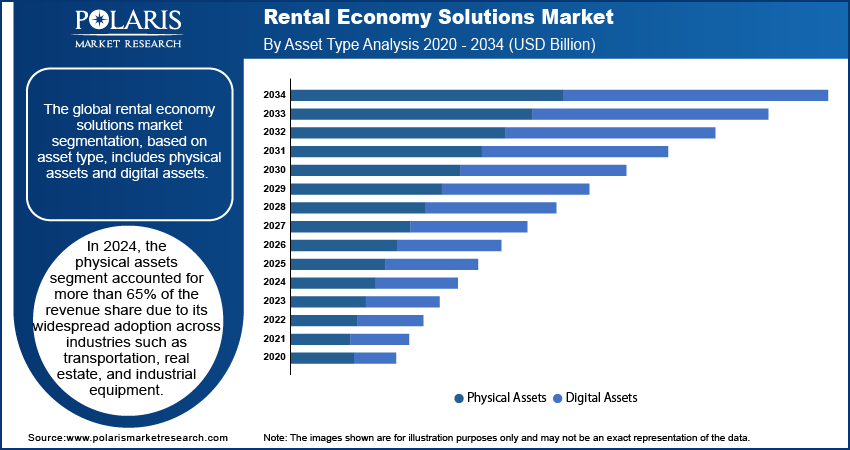

- Physical assets dominated over 65% of revenue due to widespread use in transportation, real estate, and industrial sectors.

- The technology & electronics segment leads with a 22% CAGR, supported by subscription-based rentals and IoT advancements.

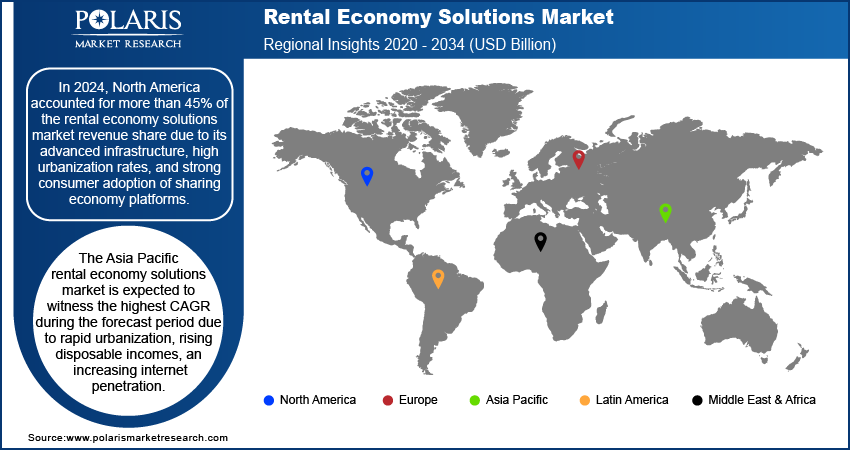

- North America holds over 45% of market revenue, benefiting from advanced infrastructure and the adoption of the sharing economy.

- Asia Pacific expected to record the highest CAGR, supported by rapid urbanization, rising incomes, and government initiatives.

Industry Dynamics

- Rapid urbanization and limited living spaces are increasing demand for flexible rental solutions, such as furniture and storage services.

- Corporate adoption is growing as companies seek to optimize asset utilization and reduce upfront costs through flexible rentals.

- Smart city projects and IoT integration are enhancing rental logistics and service efficiency, especially in the Asia Pacific region.

- Economic fluctuations and inflation are driving individuals and businesses to prefer rentals over ownership for cost savings.

- Regulatory challenges and concerns about asset quality and availability are restraining the growth of the rental economy solutions market.

Market Statistics

2024 Market Size: USD 82.60 billion

2034 Projected Market Size: USD 265.51 billion

CAGR (2025–2034): 12.4%

North America: Largest share in 2024

AI Impact on Rental Economy Solutions Market

- AI enhances asset management by optimizing inventory, predicting maintenance needs, and improving rental availability.

- Intelligent pricing algorithms enable dynamic rental pricing based on demand, seasonality, and competitor rates.

- AI-powered chatbots and virtual assistants improve customer service by providing instant support and streamlining booking processes.

- Machine learning analyzes user behavior to personalize rental recommendations and improve user experience.

- AI-driven data analytics helps platforms identify market trends, optimize operations, and reduce operational costs.

To Understand More About this Research: Request a Free Sample Report

The rental economy solutions market refers to the ecosystem of platforms, services, and technologies that facilitate the temporary use or leasing of assets such as goods, equipment, vehicles, real estate, or digital tools in exchange for a fee. This market thrives on the principles of access over ownership, cost efficiency, and sustainability, catering to both individual consumers and businesses. Shifting consumer behavior toward renting instead of purchasing, particularly among younger demographics who prioritize flexibility and cost efficiency, is contributing to the rental economy solutions market growth. Rising infrastructure development across urban and industrial sectors is driving increased demand for crane rental services to support large-scale construction activities. This trend is also fueling growth in the broader rental economy solutions market, as businesses seek cost-effective, flexible equipment access.

The proliferation of sharing economy platforms such as Airbnb and Turo is driving rental economy solutions market development by creating ecosystems that encourage peer-to-peer asset sharing and utilization. Additionally, economic fluctuations and inflationary pressures are encouraging individuals and businesses to adopt rental models as a cost-effective alternative to ownership, which is boosting market expansion.

Market Dynamics

Urbanization and Space Constraints

Rapid urbanization and limited living spaces are accelerating rental economy solutions market demand, particularly in densely populated cities. Urban residents are increasingly prioritizing flexibility and minimalism, leading to the rise of services such as furniture rentals services (e.g., Feather) and on-demand storage solutions (e.g., Neighbor). A 2023 report by the United Nations Department of Economic and Social Affairs (UN DESA) highlighted that 56% of the global population now resides in urban areas, a figure expected to grow to 68% by 2050. This trend is driving innovation in space-saving solutions, such as modular furniture rentals and compact vehicle-sharing platforms such as Zipcar.

Corporate Adoption of Rental Solutions

Enterprises are increasingly adopting rental solutions to optimize asset utilization and reduce upfront costs. Companies across industries are leveraging rental services for equipment, office spaces, and IT infrastructure to adapt to dynamic business environments. According to a 2023 survey by JLL (Jones Lang LaSalle), over 40% of Fortune 500 companies have shifted to flexible office space rentals, driven by hybrid work models post-pandemic. Thus, rising corporate adoption of rental solutions is contributing significantly to rental economy solutions market expansion.

Segment Insights

Market Assessment by Asset Type Outlook`

The global rental economy solutions market segmentation, based on asset type, includes physical assets and digital assets. In 2024, the physical assets segment accounted for more than 65% of the rental economy solutions market revenue share due to its widespread adoption across industries such as transportation, real estate, and industrial equipment. Platforms such as Airbnb, Turo, and United Rentals have capitalized on the growing demand for tangible asset rentals driven by urbanization and sustainability trends. The versatility of physical assets from cars to homes ensures broad market appeal, making this segment a dominant force in the market.

The digital assets segment is expected to register a higher CAGR of 18% over the forecast period due to the increasing reliance on cloud-based services and subscription models. Platforms offering software-as-a-service (SaaS), digital tools, and virtual storage solutions, such as Adobe Creative Cloud and AWS, are driving demand. The shift toward remote work and digital transformation has further accelerated this trend.

Market Evaluation by Industry Vertical Outlook

The global rental economy solutions market segmentation, based on industry vertical, includes transportation, real estate, technology & electronics, industrial & commercial, and others. According to the rental economy solutions market statistics, the real estate segment accounted for more than 40% of the revenue share in 2024 due to the booming demand for residential and commercial property rentals. Platforms such as Airbnb and Zillow Rentals have revolutionized this space by providing seamless access to short-term and long-term rental properties. Urban migration and the rise of remote work have further fueled this demand, with Airbnb reporting a 25% increase in bookings in tier-2 cities in 2023. This segment benefits from high consumer trust and established regulatory frameworks, ensuring its continued dominance in the market.

The technology & electronics segment is expected to register the highest CAGR of 22% over the forecast period due to the rapid adoption of subscription-based gadgets and software rentals. Platforms such as Grover and Adobe Creative Cloud are capitalizing on the affordability and flexibility these models offer, particularly among tech-savvy millennials and Gen Z users. This trend is further supported by advancements in IoT and AI, which enhance device usability and rental logistics, making this segment a key driver of future growth.

Regional Analysis

By region, the study provides rental economy solutions market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for more than 45% of the revenue share of the global market due to its advanced infrastructure, high urbanization rates, and strong consumer adoption of sharing economy platforms. The region benefits from a robust digital ecosystem and widespread acceptance of rental models across industries such as real estate, transportation, and technology. According to a 2023 report by the US Census Bureau, over 36% of households in major metropolitan areas rely on rental housing, highlighting the entrenched culture of renting. Additionally, government initiatives promoting sustainable practices, such as the Environmental Protection Agency’s (EPA) push for car-sharing programs, have further accelerated demand for rental solutions, solidifying North America’s leadership in this market.

The Asia Pacific rental economy solutions market is expected to record the highest CAGR during the forecast period due to rapid urbanization, rising disposable incomes, and increasing internet penetration. Governments of the region are actively supporting rental ecosystems to address overcrowding and resource scarcity. According to the Indian Ministry of Housing and Urban Affairs, in 2023, the urban housing shortages have led to a 30% increase in demand for co-living spaces and rental properties in metropolitan cities. Similarly, countries such as China and Japan are investing in smart city projects, integrating IoT-enabled rental solutions for vehicles and electronics. These initiatives, coupled with the growing preference for flexible lifestyles, are driving unprecedented growth in the region’s rental economy.

Key Players & Competitive Analysis Report

The competitive landscape of the rental economy solutions market is defined by rapid digital transformation, rising consumer demand for flexible ownership models, and increasing pressure to offer seamless, user-centric platforms. Market players are vying to differentiate themselves through specialized offerings across various sectors, including mobility, real estate, equipment, and lifestyle goods. The competition is particularly intense in areas where integration of advanced technologies such as AI, IoT, and real-time analytics enhance operational efficiency and improve user experience. Key differentiators include ease of use, inventory management capabilities, pricing transparency, and customer support services. Additionally, platforms that facilitate peer-to-peer transactions and prioritize sustainability are gaining traction, especially among younger, tech-savvy demographics. As the market matures, scalability and localization have become crucial, with competitors focusing on expanding geographic reach while tailoring services to local preferences and regulations. Furthermore, companies are increasingly investing in strategic partnerships, subscription billing management, and flexible rental terms to build brand loyalty and improve retention. The evolving regulatory environment and shifting consumer behavior continue to shape competition, encouraging constant innovation and adaptation to stay relevant in a fast-paced, experience-driven economy.

Airbnb, founded in 2008, is engaged in providing a peer-to-peer platform for short-term lodging and rental services. Headquartered in California, US, the company specializes in connecting hosts who wish to rent out their homes or spare rooms with travelers seeking unique accommodations. Airbnb's product portfolio includes vacation rentals, long-term stays, luxury properties, and local experiences offered by hosts. The company operates through an online marketplace where hosts list details about their properties, including pricing, availability, and amenities, while guests can search and book accommodations that suit their preferences. The platform also features a review system to enhance trust between users. Airbnb has an extensive global presence, with over 8 million listings across more than 200 countries and regions. It serves millions of users annually, facilitating bookings for both leisure and business travel.

Turo, founded in 2010 and headquartered in San Francisco, California, US, is engaged in providing a peer-to-peer car-sharing platform. The company specializes in connecting vehicle owners with individuals looking to rent cars for short-term use. The company product portfolio includes a wide range of vehicles, from economy cars to luxury models, allowing users to select options tailored to their needs. Turo operates through an online platform where car owners list their vehicles with details such as pricing, availability, and features, while renters can browse and book vehicles directly. Services provided include insurance coverage for both owners and renters, as well as roadside assistance during rentals. Turo has a presence across the US, Canada, the UK, and other regions, offering an alternative to traditional car rental services by leveraging underutilized assets in the sharing economy.

List of Key Companies

- Airbnb

- CaaStle

- Fat Llama

- Lime

- Lugg

- Outdoorsy

- Rent the Runway

- Spinlister

- ToolShare

- Turo

- Uber Rent

- Zilok

Rental Economy Solutions Industry Developments

In November 2024, Airbnb launched Airbnb-friendly apartments in the UK through a collaboration with Greystar.

In November 2024, Housewise launched MostlyNRI, a robust platform designed to provide Non-Resident Indians (NRIs) with extensive support across various financial and regulatory domains.

Market Segmentation

By Asset Type Outlook (Revenue – USD Billion, 2020–2034)

- Physical Assets

- Digital Assets

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Peer-to-Peer (P2P) Rentals

- Corporate Rentals

- Others

By Duration of Rental Outlook (Revenue – USD Billion, 2020–2034)

- Short-Term Rentals

- Long-Term Rentals

By Industry Vertical Outlook (Revenue – USD Billion, 2020–2034)

- Transportation

- Real Estate

- Technology & Electronics

- Industrial & Commercial

- Others

By Platform Type Outlook (Revenue – USD Billion, 2020–2034)

- Online Platforms

- Offline

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 82.60 billion |

|

Market Size Value in 2025 |

USD 92.72 billion |

|

Revenue Forecast by 2034 |

USD 265.51 billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global rental economy solutions market size was valued at USD 82.60 billion in 2024 and is projected to grow to USD 265.51 billion by 2034.

The global market is projected to register a CAGR of 12.4% during the forecast period.

In 2024, North America accounted for the largest market share due to its advanced infrastructure, high urbanization rates, and strong consumer adoption of sharing economy platforms.

A few of the key players in the market are Airbnb, CaaStle, Fat Llama, Lime, Lugg, Outdoorsy, Rent the Runway, Spinlister, ToolShare, Turo, Uber Rent, and Zilok.

In 2024, the physical assets segment accounted for a larger market share due to its widespread adoption across industries such as transportation, real estate, and industrial equipment.

In 2024, the real estate segment accounted for the largest market share due to the booming demand for residential and commercial property rentals.