Subscription Billing Management Market Share, Size, Trends, Industry Analysis Report

By Component (Software and Services); By Deployment; By Enterprise Size; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3302

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

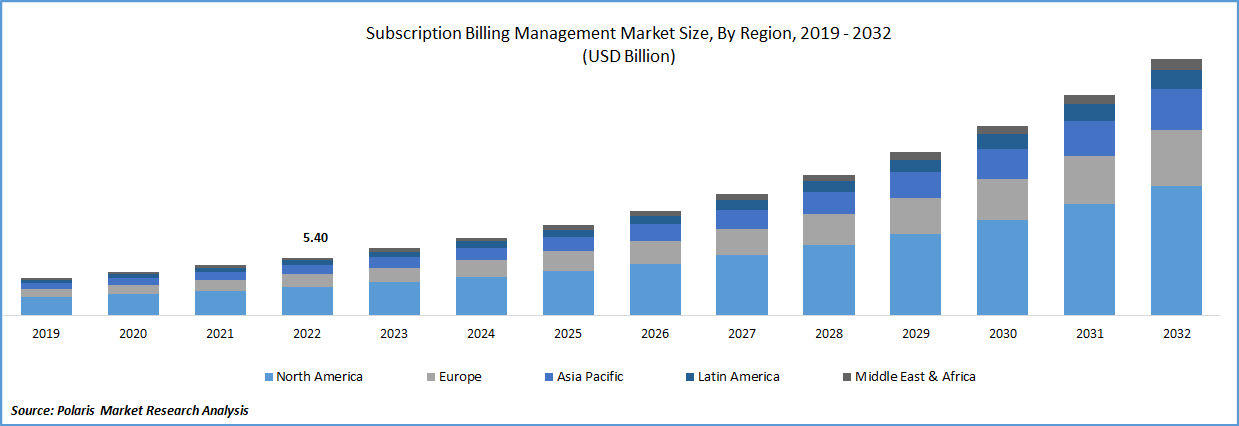

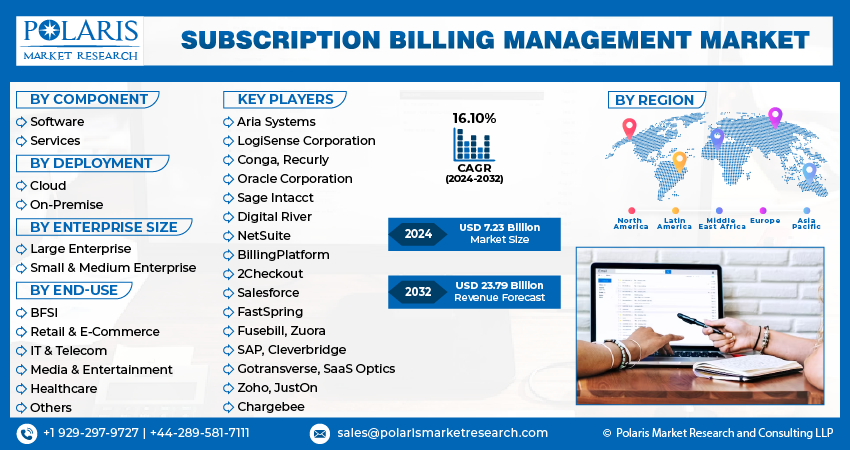

The global subscription billing management market size and share was valued at USD 6.24 billion in 2023 and is expected to grow at a CAGR of 16.10% during the forecast period. Increasing adoption of the subscription business models, the rising need to reduce or mitigate subscriber churn, and boosting the customer retention rate coupled with the increased penetration for the upgradation of legacy systems and demand for adhering to compliances, are primary factors propelling the demand and growth of the global market.

Subscription billing management is the procedure of handling the customer's subsidies and ascertaining that their involvement with the product or service is contended. The procedure commences when the customer enrolls to subscribe to a commodity or a service, and it terminates when the customer abandons the subscription. Conventional billing models normally depend on a solitary transaction with a single-time remission for freehold rights, service, and continuation accountability. Alternatively, subscription billing models provide businesses and their customers the scope to advance more zestful and liquefied relationships.

The advantage to the customer is that one can acquire passage to a wider gamut of commodities and services as contrasted to a single-time conventional foothold. The Subscription billing management market size is expanding as the advantages to businesses involve robust customer association and depreciation in customer turbulence through superior value creation. The disadvantage of this model includes strain in handling the model if the appropriate technology solution is not availed of.

To Understand More About this Research: Request a Free Sample Report

In addition, organizations across the globe are increasingly transitioning towards software-based subscription billing solutions, that help them reduce their operational costs, mitigate errors, and reduce the complexities of the monetization models are further anticipated to create significant growth opportunities for the market.

For instance, in April 2022, Expeed Software introduced its new subscription and revenue management platform named “Saaslogic”, which help companies to launch products quickly and manage them very efficiently. It provides a comprehensive solution for the SaaS product companies, that features to quickly adapt to the changing market conditions and scale.

Moreover, the companies operating in the market are highly focused on the integration of various improved and highly enhanced technologies such as artificial intelligence, the Internet of Things, and blockchain in their platforms aiming at improving their offerings. Several digital infrastructure companies are also implementing on cloud billing platforms into their existing products to cater to the rising data connectivity demand from their customers, which is positively contributing to the market.

The outbreak of the COVID-19 pandemic has had a moderately positive impact on the growth of the market. During the pandemic, there has been tremendous growth in the need and demand for this software among the companies offering video streaming services, digital news & media, online learning, communication software, and e-commerce among others, as it helps in managing their customer payment systems efficiently without errors.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Subscription Billing Management Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

The subscription billing management market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Dynamics

Growth Drivers

The rapidly increasing adoption of cloud-based services and solutions evolves in transforming the business models which helps a wide range of domains to effectively cope with consistently changing demands of the market along with the emerging trend of business models from static and linear product offerings to subscription-based models mainly for recurring, predictable, and stable revenue, are among the major factors driving the growth of the global subscription billing management market.

Furthermore, a significant rise in the trend of bringing your own device and innovative solutions across the major developed countries like the US, Canada, and Germany, has led to growth in the digitization of subscription techniques across several sectors and encouraged businesses to invest more in the purchase of subscription and billing software, are further contributing towards the global market growth.

Report Segmentation

The market is primarily segmented based on component, deployment, enterprise size, end-use, and region.

|

By Component |

By Deployment |

By Enterprise Size |

By End-Use |

By Region |

|

|

|

|

|

To Understand More About this Research: Speak to Analyst

Software segment accounted for the largest market share in 2022

Software segment accounted for the largest market share and is likely to retain its position over the coming years, on account of the growing popularity and prevalence of working closely with several types of accounting tools and the continuously growing trend of shifting to subscription-based business models among companies. Also, rising need to track the details of their customers efficiently.

Moreover, the increasing focus of key market players on acquiring and collaborating with collection management companies to introduce and further expand their receivables management solutions is likely to have a positive impact on the growth of the segment. For instance, in February 2022, Chargebee, a leading subscription management solution and services provider, announced the acquisition of Numberz, a collection management platform, and introduced Chargebee Receivables to the market. The newly launched platform allows automating of the receivables process from purchase to payment efficiently.

On-premise segment is expected to register significant market growth over the forecast period

The on-premise segment is expected to register a significant growth rate during the forecast period, which is mainly driven by its wide range of beneficial features including effectively cater the change in business needs and ability to run on the systems installed in the organization without the involvement of any kind of third parties. Additionally, on-premise the billing software has several other advantages like providing better flexibility and connectivity, which in turn, propelling the segment.

The cloud deployment segment led the industry market with considerable revenue share, owing to its ability to accommodate the changes and effectively manage the organization's shifting needs. Moreover, the growing prevalence of cloud-based solutions due to their automated process, scalability, business operations support, end-to-end customer life cycle management, and automated processes is further influencing the growth of the market.

Large enterprises segment captured the largest market share in 2022

The large enterprises segment captured the majority market share, which is highly attributable to aggressively increasing investments in subscription billing management solutions by large enterprises across the globe, as they have a very large customer base and high spending capacity as compared to SMEs. Additionally, various payment companies are entering into strategic partnerships with cloud-based solution providers for the expansion of their customer reach, which will further drive the demand and growth of the market.

The small & medium enterprises segment is anticipated to grow at the fastest CAGR throughout the projected period, owing to increasing proliferation to automate their manual accounting and financial processes and provide efficient services to their customers while maximizing their customer retention rates across the globe.

BFSI segment held a significant market revenue share in the base year

The BFSI segment held a significant market share with a substantial growth rate, which is highly accelerated by the rapidly growing adoption of various types of latest innovative technologies and growing prevalence among several payment service providers around the world to partner with large subscription management platforms and services providers to offer seamless payment solutions to their customers.

The retail & e-commerce segment is projected to expected to gain a promising growth rate throughout the projected period. The continuous change in consumer buying preferences and demands along with the extensive use of online-based channels to purchase several types of consumer goods from automated platforms, bode well for the growth of the segment over the next coming years.

North America region dominated the industry in 2022

North America region dominated the global market and is projected to maintain its dominance over the anticipated period. The growth of the regional market can be largely attributed to an increased focus on major market players in the region to develop innovative billing management solutions by aiming at providing improved customer service. In addition, the widespread use of these solutions among both large and small market players to manage their customers' data effectively and increase their market reach with improved overall experience, which in turn, has propelled the growth of the market in the region.

Asia Pacific region is anticipated to be the fastest growing region with a high CAGR that is highly attributable to a rapid increase in the adoption of digital transactions and automated solutions for online shopping and food delivery services and in-app fitness solutions. These solutions have gained significant traction in the region as they enable subscription-based businesses to efficiently collect payments from their subscribers, which is resulting in high demand, especially in countries like India, China, and Indonesia.

Competitive Insight

Some of the major players operating in the global subscription billing management market include Aria Systems, LogiSense Corporation, Conga, Recurly, Oracle Corporation, Sage Intacct, Digital River, NetSuite, BillingPlatform, 2Checkout, Salesforce, FastSpring, Fusebill, Zuora, SAP, Cleverbridge, Gotransverse, SaaS Optics, Zoho, JustOn, & Chargebee.

Recent Developments

- In September 2022, Stax announced the launch of its new software solution called “Stax Bill” which offers SaaS to purveyors and various other subscription businesses. It will help the finance teams of organizations to effectively leverage multiple Stax solutions within their easy-to-use platform.

- In August 2022, ZYRO, introduced its new Zyro-Book, a cloud-deployed GST & billing software that simplifies complex accounting functions by offering a wide range of features, accounting, & lot of utility.

Subscription Billing Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.23 billion |

|

Revenue Forecast in 2032 |

USD 23.79 billion |

|

CAGR |

16.10% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Deployment, By Enterprise Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aria Systems Inc., LogiSense Corporation, Conga, Recurly Inc., Oracle Corporation, Sage Intacct, Digital River, NetSuite, BillingPlatform, 2Checkout, Salesforce, FastSpring, Fusebill, Zuora, SAP SE, Cleverbridge AG, Gotransverse, SaaSOptics, Zoho, JustOn, and Chargebee. |

Navigate through the intricacies of the 2024 subscription billing management market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

C2C E-Commerce Market Size, Share 2024 Research Report

Opthalmic Eye Dropper Market Size, Share 2024 Research Report

North America Technical Textile Market Size, Share 2024 Research Report

Construction Equipment Market Size, Share 2024 Research Report

FAQ's

The global subscription billing management market size is expected to reach USD 23.79 billion by 2032.

Key players in the subscription billing management market are Aria Systems, LogiSense Corporation, Conga, Recurly, Oracle Corporation, Sage Intacct, Digital River, NetSuite, BillingPlatform, 2Checkout.

North America contribute notably towards the global subscription billing management market.

The global subscription billing management market expected to grow at a CAGR of 16.0% during the forecast period.

The subscription billing management market report covering key segments are component, deployment, enterprise size, end-use, and region.