Biobanks Market Share, Size, Trends, Industry Analysis Report

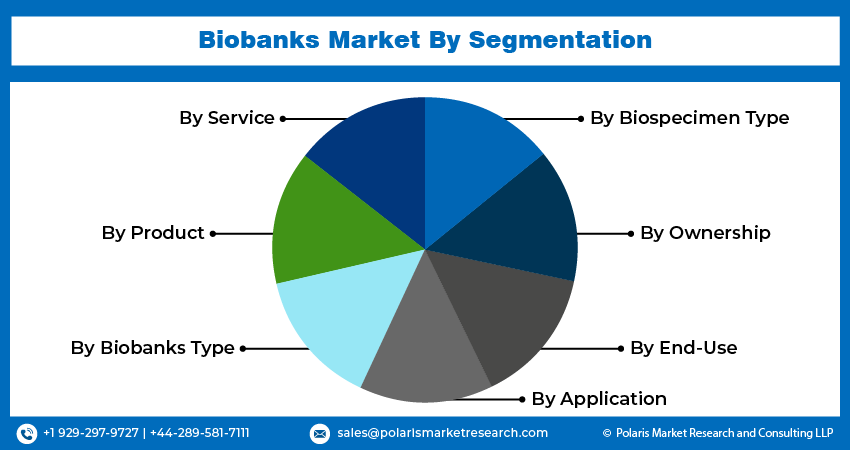

By Service; By Product; By Biobanks type; By Biospecimen Type; By Ownership; By Application; By End-use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4527

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

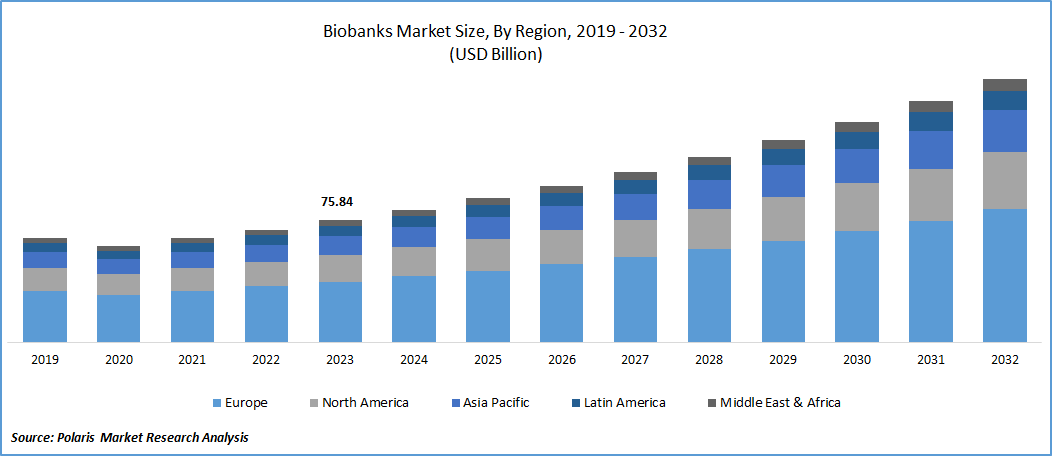

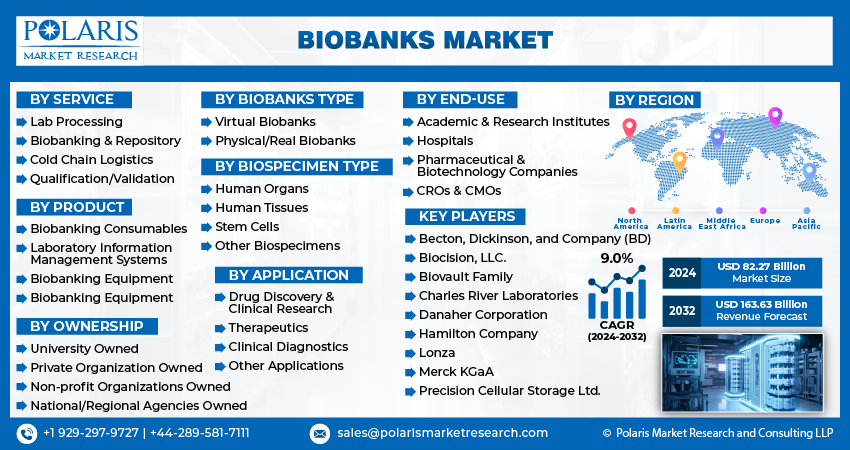

Global biobanks market size and share was valued at USD 75.84 billion in 2023. The market is anticipated to grow from USD 82.27 billion in 2024 to USD 163.63 billion by 2032, exhibiting a CAGR of 9.0% during the forecast period

Biobanks Market Overview

A biobank provides a repository for biological samples (such as blood) alongside healthcare data. Biobanks vary in size, ranging from extensive collections with thousands of samples to smaller ones with only a few hundred. Various biobanks gather distinct samples and information tailored to assess specific functions. Key market players have enhanced their expansion through a combination of organic and inorganic growth strategies.

Substantial funding in the research and development of cutting-edge therapies, including personalized medicine, regenerative medicine, and cancer genomic studies, constitutes key driving forces.

The research report offers a quantitative and qualitative analysis of the biobanks market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

To Understand More About this Research: Request a Free Sample Report

The biobanks market has experienced substantial growth, driven by the rising adoption of genetic testing and personalized or precision medicine. Biobanks have emerged as pivotal contributors to biomedical research. In recent years, there have been notable advancements in tools and platforms employed in genetic studies, resulting in an elevated requirement for biospecimens to formulate for genetic testing. In the field of biobanking, the alliance between public and private institutions has a crucial role in advancing the market.

The biobank industry is undergoing significant transformation due to the swift integration of precision medicine, digitalization, and virtualization. Collaborative synergies initiated by both private and public organizations are driving this change. Companies from various sectors are forming partnerships with biobanks, contributing to the accelerated growth of the biobank market.

- For instance, in October 2023, the collaboration between UK Biobank and several philanthropists provided access to funding amounting to US $ 34.5 million.

Middle East countries are making investments in biobanks to propel advancements in the field of medical research. For instance, in September 2023, the Prince of Abu Dhabi revealed the establishment of a biobank aimed at meeting the demands of personalized medicine. This initiative involves utilizing human tissues and stem cells in medical research to develop advanced treatments. The research conducted by this biobank is expected to contribute to the treatment of more than 80 diseases and immune system issues, concurrently enhancing the UAE's standing in the biobank market.

Biobanks Market Dynamics

Market Drivers

Establishment of Cord Blood Stem Cell Preservation Facilities bolstering the growth of the Biobanks market.

Cord blood, the blood that remains in the umbilical cord after a baby's delivery, serves as the richest source of stem cells, which are preserved and processed for clinical research. The preservation of cord blood is experiencing high demand within the biobanking field, indicating a potential increase in market opportunities in the forthcoming years. The introduction of cord blood stem cell biobanking notably propels the biobanks market. For instance, in February 2020, the launch of the world's largest stem cell biobanking by Lund University in Sweden. This biobank is anticipated to contribute to researchers' understanding of the origins of prevalent disorders such as Alzheimer's disease and Parkinson's disease. Furthermore, the escalating global incidence of chronic diseases is a significant factor influencing the establishment of stem cell biobanks. Consequently, the proliferation of biobanks is expected to drive growth in the biobanking market during the forecast period.

Market Restraints

Ethical dilemmas in developing nations are likely to hamper the growth of the market.

Ethical considerations play a crucial role in biobanking, encompassing aspects like obtaining informed consent from patients and the proper handling, storage, and distribution of samples. However, challenges arise in emerging countries due to factors such as high levels of poverty, lower literacy rates, and adherence to traditional practices, hindering the seamless nonmedical ethics for biobank personnel acts as a limiting factor for the global market's growth. Furthermore, misconceptions about biobanking among the patient population can also impact market expansion. These challenges are anticipated to have an enduring effect on the overall market dynamics in the coming years.

Report Segmentation

The market is primarily segmented based on service, product, biobank type, biospecimen type, ownership, application, end-user, and region.

|

By Service |

By Product |

By Biobanks type |

By Biospecimen Type |

By Ownership |

By Application |

By End-Use |

By Region |

|

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Biobanks Market Segmental Analysis

By Service Analysis

- In 2023, the biobanks market saw a significant presence in the biobanking & repository segment, holding a substantial share. This dominance is attributed to the widespread acceptance of these services and the increasing need to preserve biosamples for advancing disease-specific research and precision medicine. The segment's robustness is further strengthened by the expansion of biobanking services, reaching beyond academic research to include clinical enterprises, government initiatives, and adaptable, well-connected ventures.

- The qualification or validation segment is anticipated to claim the highest revenue share by 2032. Validation services play a crucial role in various scenarios, such as installing new equipment, relocating units, initiating major projects, handling sample storage and extraction, and managing cold chain logistics. These validation services need to be meticulously designed and executed, adhering to U.S. FDA regulations and quality standards set by governing bodies. Biobanks align their services with regulatory requirements, offering standardized, high-quality services for the collection, processing, storage, and transportation of samples. Validation services are vital in qualifying shippers, validating processes, assessing testing equipment to ensure the integrity of biological samples is maintained throughout the chain of processes, and facilitating the effective management of biological samples.

By Biobanks Type Analysis

- In the forecast period, the physical/real biobanks segment took the lead in the Biobank market, commanding the highest share of revenue. These biobanks leverage a well-established network, making a significant contribution to the overall revenue, with their operational strategy shifting due to rapid advancements in bioinformatics analysis and precision medicine playing a crucial role in their dominance.

- The virtual biobanks segment is expected to witness the fastest growth throughout the forecast period. These virtual biobanks serve as a solution to challenges related to biospecimen accessibility. Entities like Tissue Solutions (Scotland) and Human Focused Testing (Littleport) exemplify organizations primarily focused on procuring and distributing samples based on specific requirements. Virtual biobanking not only enhances the potential to meet biospecimen needs but also facilitates the tracing and acquisition of rare samples. The convenient accessibility associated with virtual biobanks further contributes to the segment's lucrative growth.

Biobanks Market Regional Insights

The European region held the largest biobanks market share in 2023

Ongoing investments in gathering, establishing, and processing extensive datasets have fueled significant growth in the region. Countries like the UK, Germany, and France are actively contributing to market expansion by investing in biobank solutions. An exemplary instance is the collaboration between The Medicines and Healthcare Products Regulatory Agency (MHRA) and Genomics England, leading to the launch of a genetic biobank in June 2023.

The Asia Pacific region is poised to experience the fastest CAGR throughout the forecast period, driven by investments from emerging economies such as India, China, and Japan. These nations are actively fortifying the biobank market through various business initiatives to enhance their market presence. For instance, AIG Hospital inaugurated its inaugural biobank in the southern region of India in November 2023, with plans to collect more than one lakh tissue and blood samples over the next decade.

The proliferation of private biobanks in India is propelling biobank services, exemplified by state-of-the-art facilities like JIPMER PBMC Puducherry, International Institute of Innovation and Technology Bio-repository (i3tBR), MCRI, and the National Liver Disease Biobank. In Australia, the presence of biobanks stimulates the adoption of research activities and receives financial support from the Australian Department of Health. The country hosts several other biobanks, including the South Australian Cancer Research Biobank, Human Studies Unit - Institute for Molecular Bioscience Saint Lucia, Australian Breast Cancer Tissue Bank, and Victorian Cancer Biobank. Moreover, Australia has established the necessary infrastructure to support the development of large-scale population-based biobanks.

Competitive Landscape

The Biobanks market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant biobanks market share.

Some of the major players operating in the global market include:

- Becton, Dickinson, and Company (BD)

- Biocision, LLC.

- Biovault Family

- Charles River Laboratories

- Danaher Corporation

- Hamilton Company

- Lonza

- Merck KGaA

- Precision Cellular Storage Ltd. (Virgin Health Bank)

- Promocell Gmbh

- Qiagen

- Stemcell Technologies

- Taylor-Wharton

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

Recent Developments

- In December 2023, Charles River Laboratories International, Inc. announced a collaboration with CELLphenomics to expand their 3D In Vitro Services for screening cancer therapy drugs. The CELLphenomics biobank includes over 500 in vitro models, covering approximately 20 tumor entities. It distinguishes itself by offering one of the most comprehensive collections of intricate in vitro models, encompassing rare and ultra-rare tumors such as thymomas or sarcomas.

- In October 2023, AstraZeneca's research unveiled distinctive connections between rare alterations in plasma proteins and genes, potentially advancing drug discovery, leveraging data sourced from over 50,000 participants in the UK Biobank.

- In January 2023, Quibim, in collaboration with the European Commission, inaugurated the European Federation for Cancer Images (EUCAIM) biobank. This initiative aims to advance treatments for various cancers and pioneer early detection techniques.

Report Coverage

The Biobanks market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as service, product, biobank type, biospecimen type, ownership, application, end-user, and their futuristic growth opportunities.

Biobanks Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 82.27 billion |

|

Revenue Forecast in 2032 |

USD 163.63 billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Service, By Product, By Biobanks type, By Biospecimen Type, By Ownership, By Application, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Uncover the dynamics of the biobanks sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Ackee Market Size, Share 2024 Research Report

Geosynthetics Market Size, Share 2024 Research Report

Smart Electric Drive Market Size, Share 2024 Research Report

FAQ's

The global Biobanks market size is expected to reach USD 163.63 billion by 2032

Danaher Corporation, Hamilton Company, Lonza, Merck KGaA, Precision Cellular Storage Ltd are the top market players in the market.

European region contribute notably towards the global Biobanks Market.

Biobanks Market is CAGR of 9.0% during the forecast period.

The Biobanks Market report covering key segments are service, product, biobank type, biospecimen type, ownership, application, end-use, and region.