Rice Syrup Market Share, Size, Trends, Industry Analysis Report

By Type (White Rice and Brown Rice); By Category (Organic, Conventional); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3504

- Base Year: 2023

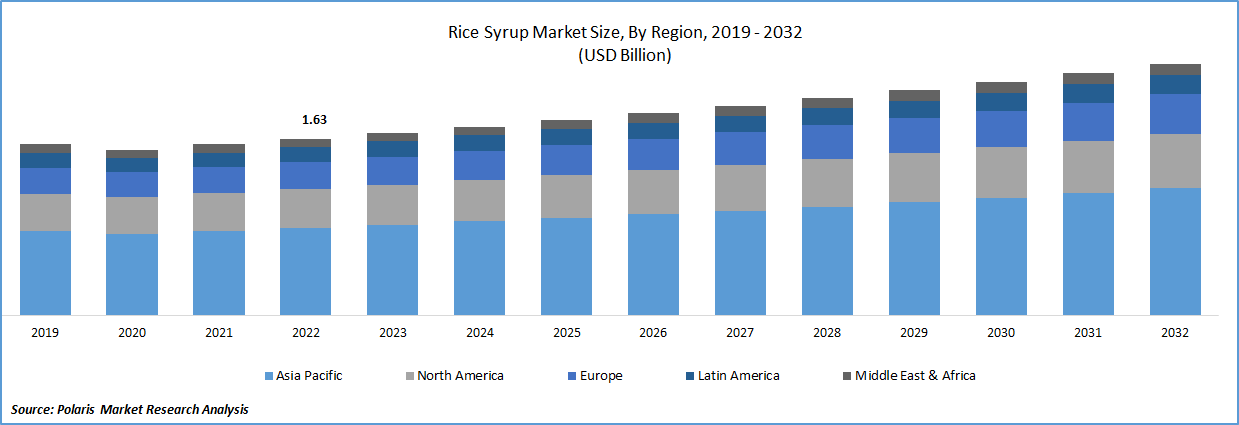

- Historical Data: 2019-2022

Report Outlook

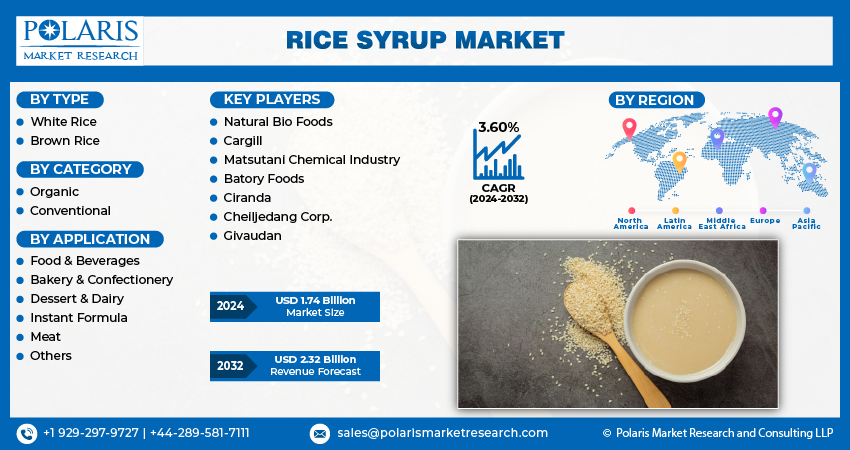

The global rice syrup market was valued at USD 1.69 billion in 2023 and is expected to grow at a CAGR of 3.60 % during the forecast period. The growth of the market is attributed to the growing awareness of the negative health effects of refined sugars and the desire for healthier alternatives. The market has been growing steadily in recent years due to increasing consumer demand for natural and organic sweeteners.

To Understand More About this Research: Request a Free Sample Report

The increasing demand for natural and organic sweeteners and the growing food and beverage industry drive market growth. Rice syrup, also known as rice malt syrup, is a sweetener derived from rice that is often used as a natural alternative to refined sugars. It is made by breaking down the starch in cooked rice with enzymes or acids, which results in a syrup that is mostly glucose, maltose, and maltotriose.

Rice syrup is commonly used as a sweetener in natural and organic food products because it is considered to be a healthier option than refined sugars. It has a subtle sweetness and a mild flavor that is not overpowering, which makes it a versatile ingredient in many recipes. Rice syrup is also used in some alcoholic beverages, such as sake and beer, to provide sweetness and contribute to the fermentation process. As rice syrup is a sweetener it should be consumed in moderation. It contains a high concentration of carbohydrates and calories, and may not be suitable for people with certain health conditions such as diabetes.

The food and beverage industry is the largest end-user of rice syrup, as it is used as a natural sweetener in various products such as breakfast cereals, energy bars, baked goods, and beverages. Rice syrup is also used in the production of organic and natural products, including baby food, pet food, and dietary supplements. The key players are focusing on product innovation, expansion into new markets, and strategic partnerships to increase their market share and remain competitive.

Industry Dynamics

Growth Drivers

The increasing awareness among consumers about the harmful effects of artificial sweeteners and synthetic ingredients has led to a rise in demand for natural and organic products, including rice syrup. For example, in 2020, Clif Bar & Company, a popular maker of energy bars and snacks announced that it would be using rice syrup as a natural sweetener in its products. The rising prevalence of health issues such as diabetes, obesity, and heart disease has led to a growing demand for healthier alternatives to refined sugars. Rice syrup is considered a healthier alternative to sugar due to its lower glycaemic index and calorie content. For instance, in 2021, Nestle announced that it would be replacing sugar with rice syrup in some of its products to make them healthier.

The growing trend of veganism and vegetarianism has led to a rise in demand for plant-based sweeteners. Rice syrup is a plant-based sweetener and is suitable for people following a vegan or vegetarian diet. For example, in 2021, Trader Joe's announced that it would be replacing honey with rice syrup in some of its products to cater to its vegan and vegetarian customers. The increasing demand for natural and organic products, as well as the growth of the functional food and beverage industry, are key factors driving the growth of the rice syrup market. For instance, in 2021, Soylent, a popular maker of meal replacement drinks, announced that it would be using rice syrup as a natural sweetener in its products.

Report Segmentation

The rice syrup market is segmented based on type, category, application, and region.

|

By Type |

By Category |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The brown rice segment is expected to witness the fastest growth over the forecast period

The brown rice segment is expected to witness fastest growth in the forecast period owing to the growing demand for organic & natural products, nutritional benefits, and its gluten-free and non-allergic nature. Brown rice is considered to be a healthier option compared to white rice, as it contains higher amounts of fiber, vitamins, and minerals. With the increasing awareness about the health benefits of organic and natural products, consumers are increasingly shifting towards healthier alternatives to traditional sweeteners.

The organic segment holds a significant share in 2022

In 2022, the organic category segment accounted for the largest market share as it is produced from plant sources it is suitable for vegan products. It acts as a sweetener in tea, coffee, snacks bar, juices, and other food products. It also acts as a hypo-allergenic diet supplement and is used by diabetic patients and is also useful in other diseases. It is a gluten-free and non-allergenic sweetener, making it suitable for consumers with gluten intolerance or allergies to common allergens such as soy and dairy.

Conventional rice syrup is expected to hold a steady share in the market owing to numerous health benefits such as lowering the risk of diabetes and obesity. The application of conventional rice syrup in the food & beverages industry and the rising influence of online retailers are expected to boost the market segment.

The Food & Beverage segment accounts for the largest market revenue in 2022

The food & beverage segment holds the market share and is expected to propel the market in the forecast period. The growth of the segment is attributed to the growing consumer demand for organic or natural products. manufacturers are using rice syrup to manufacture food products like canned drinks, fruit drinks, snacks bar, soft drinks, and other food products. The bakery & confectionary segment is expected to boost the market growth in the coming years owing to rising demand for bakery & confectionery products.

Asia Pacific garnered the largest revenue share in 2022

Asia Pacific is the largest market for rice syrup, accounting for the largest revenue of the global market share due to the gradual shift of consumers towards convenience food. The increasing demand for natural & organic products and the growth of the food & beverage industry are key factors driving the growth of the rice syrup market in this region. The key players operating in China, Japan, India, and South Korea are propelling the market. In June 2021, Matsutani Chemical partnered with Ciranda to launch a new organic brown rice syrup in the US market.

North America is a significant market for rice syrup, driven by the increasing demand for natural and organic products and the growth of the functional food and beverage industry. The US is the largest market in North America, followed by Canada and Mexico. In May 2021, Cargill launched a new organic rice syrup, which is Non-GMO Project Verified and certified organic.

Competitive Insight

Some of the major players operating in the global market include Natural Bio Foods; Cargill; Matsutani Chemical Industry; Batory Foods; Ciranda; Cheiljedang Corp.; and Givaudan.

Recent Developments

- In June 2021, Batory Foods launched a new organic brown rice syrup, which is Non-GMO Project Verified, certified organic, and gluten-free. This syrup has multifunctional properties and has led additives and preservatives.

- In February 2021, Briess Malt & Ingredients Co. launched a new organic rice syrup, which is made from 100% organic brown rice and is gluten-free and Non-GMO Project Verified.

- In January 2021, Givaudan launched a new rice protein and rice flour range, which includes organic brown rice syrup as one of the ingredients.

Rice Syrup Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.74 billion |

|

Revenue forecast in 2032 |

USD 2.32 billion |

|

CAGR |

3.60% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Category, By Application, By Region |

|

Regional scope |

North America, Latin America, Europe, Middle East & Africa, Asia Pacific |

|

Key companies |

Natural Bio foods; Cargill; Matsutani Chemical Industry; Batory Foods; Ciranda; Cheiljedang Corp.; Givaudan |

FAQ's

The global rice syrup market size is expected to reach USD 2.34 billion by 2032.

Key players in the rice syrup market are Natural Bio Foods; Cargill; Matsutani Chemical Industry; Batory Foods; Ciranda

Asia Pacific contribute notably towards the global rice syrup market.

The global rice syrup market is expected to grow at a CAGR of 3.6% during the forecast period.

The rice syrup market report covering key segments are type, category, application, and region.