Robo Taxi Market Size, Share, Trends, & Industry Analysis Report

By Level of Autonomy (Level 4 and Level 5), By Propulsion Type, By Component Type, By Vehicle Type, By Service Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5780

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

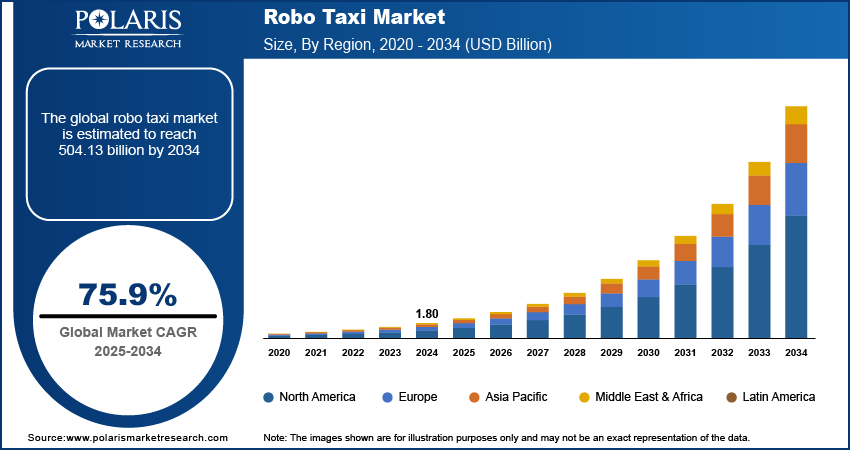

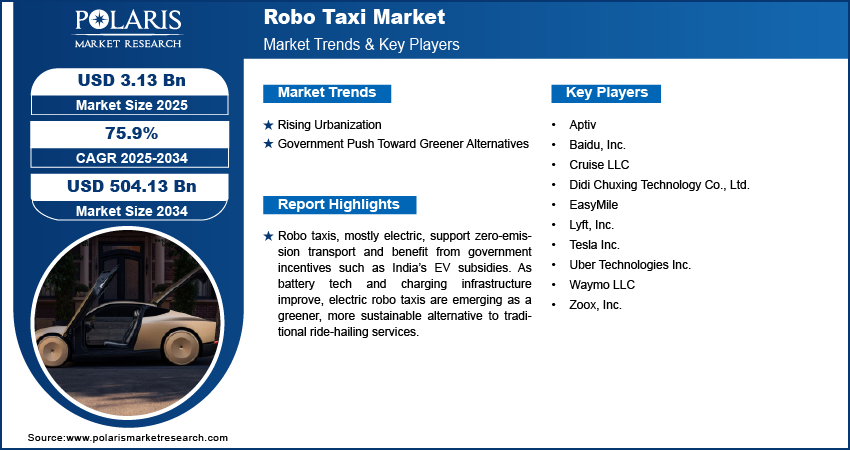

The global robo taxi market size was valued at USD 1.80 billion in 2024, growing at a CAGR of 75.9% during 2025–2034. The growth is driven by rising urbanization and the government's push toward greener alternatives.

A robotaxi is a self-driving vehicle designed to operate as a taxi without a human driver, using autonomous driving technology to transport passengers. It aims to offer safe, efficient, and cost-effective mobility as part of ride-hailing or shared transportation services.

Operating a robo taxi fleet is more cost-effective in the long term than using human drivers. These vehicles work around the clock, don’t require salaries, and reduce fuel and maintenance costs when electric. Fleet operators benefit from data analytics to optimize routes, manage energy use, and reduce downtime. Passengers may further enjoy lower fares due to reduced labor costs. These efficiencies create a strong business case for companies to invest in robo taxi services and encourage cities to integrate them into public transport networks, thereby driving the growth of the industry.

To Understand More About this Research: Request a Free Sample Report

Rapid improvements in artificial intelligence (AI), sensors, and computing power are making autonomous vehicles smarter and safer. Technologies such as LiDAR, radar, and computer vision support robo taxis in detecting obstacles, reading traffic signs, and making real-time decisions. These innovations reduce the chance of accidents and improve ride comfort. Robo taxis are expected to be more widely adopted as these systems become more reliable and cost-effective. The performance and safety of self-driving vehicles continue to improve with continuous investments from tech giants and automakers, thereby driving growth.

Industry Dynamics

Rising Urbanization

Urban areas are becoming more crowded, leading to increased traffic congestion, longer travel times, and higher pollution. According to the World Bank, the urban population increased from 53% in 2014 to 57% in 2023. Robo taxis help ease this problem by reducing the number of cars on the road through shared rides and optimized routing. They further make it easier to manage traffic flow with real-time data and connectivity. Robo taxis fit into plans for efficient urban mobility as city governments push for smarter, cleaner transportation systems, making them an attractive solution to modern traffic problems, thereby driving growth.

Government Push Toward Greener Alternatives

Robo taxis are mostly electric, helping reduce harmful emissions from gasoline and diesel vehicles. Governments are supporting clean transportation with incentives for electric vehicles (EVs) and stricter emissions regulations, with global concerns about climate change and air pollution. According to the Niti Aayog, the Indian government provides incentives of INR 10,000 per kWh (USD 115,92) for four-wheel electric vehicles to promote EV adoption. Robo taxis support environmental goals by offering zero-emission rides, especially in cities with strong sustainability goals. Electric robo taxis are expected to become a greener alternative to traditional ride-hailing as battery technology improves and charging infrastructure expands, pushing more adoption in both private and public sectors, thereby driving the growth.

Segmental Insights

By Propulsion Type Analysis

The segmentation, based on propulsion type, includes electric vehicles, hybrid electric vehicles, and fuel cell vehicles. In 2024, the electric vehicles segment dominated with the largest share due to their lower emissions, reduced fuel costs, and growing global support for green transportation. EV-powered robo taxis are quieter, cleaner, and more energy-efficient compared to gas-powered vehicles, making them ideal for urban environments. Governments are offering incentives for EV adoption, and advancements in battery technology are extending driving range and reducing charging times. EV-based robo taxis are becoming the preferred choice for both service providers and users as cities prioritize sustainability and aim to reduce pollution, thereby driving the segment growth.

By Component Type Analysis

The segmentation, based on component type, includes LiDAR, radar, camera, and sensor. The LiDAR segment held the largest share in 2024, as they are essential for the safe and accurate operation of robo taxis. LiDAR uses laser beams to create a 3D map of the vehicle's surroundings, helping the robo taxi detect objects, measure distances, and navigate safely. This technology is critical in low-light or complex traffic situations where cameras or radar alone might struggle. The precision and reliability offered by LiDAR systems make them a preferred choice in most autonomous car designs, especially for companies focused on Level 4 self-driving capabilities, thereby driving the segment growth.

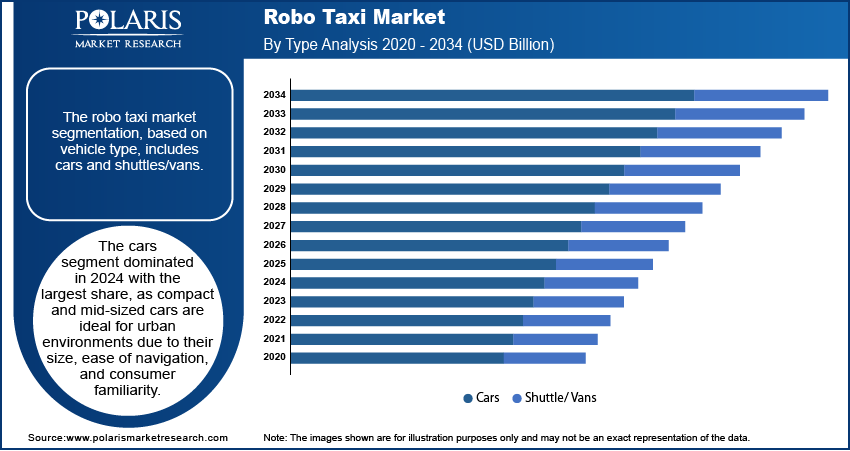

By Vehicle Type Analysis

The segmentation, based on vehicle type, includes cars and shuttle/vans. The cars segment dominated in 2024, with a larger share, as compact and mid-sized cars are ideal for urban transportation due to their size, ease of navigation, and consumer familiarity. Most early-stage robo taxi services are designed around typical ride-hailing use cases like daily commuting or short trips, which are best served by traditional car models. These vehicles also benefit from easier integration of autonomous hardware and software. As a result, robo taxi services using passenger cars were the first to scale commercially, thereby driving the segment dominance.

The shuttle/vans segment is expected to record significant growth during the forecast period. These larger vehicles are ideal for transporting groups of passengers, making them perfect for use in airports, business parks, campuses, and public transit routes. They support shared, scheduled rides and help reduce traffic congestion by moving more people with fewer vehicles. Shuttle-based robo taxis offer better economics for operators by maximizing passenger capacity per trip, thereby driving the segment growth.

Regional Analysis

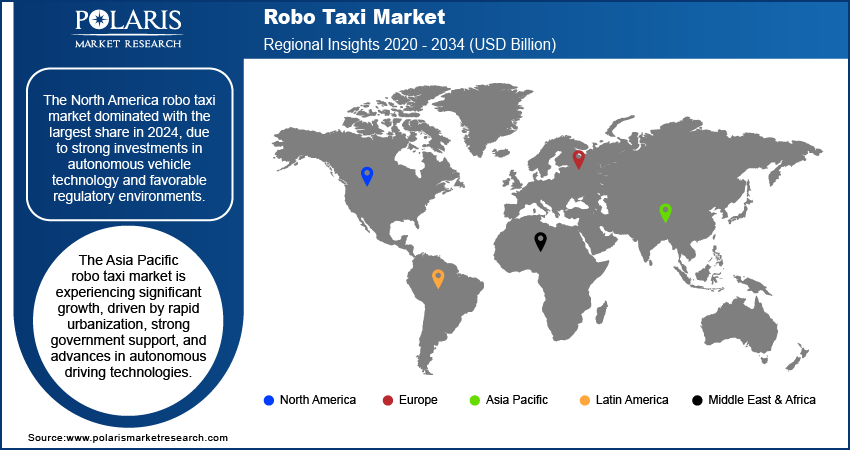

Robo Taxi Market in North America

The North America robo taxi market dominated with the largest share in 2024, due to strong investments in autonomous vehicle technology and favorable regulatory environments. The region is home to leading robo taxi companies such as Waymo, Cruise, and Zoox, which have actively tested and deployed services in cities such as San Francisco, Phoenix, and Las Vegas. Supportive government policies, advanced infrastructure, and public-private partnerships helped accelerate deployment. Additionally, the presence of major tech companies and automotive manufacturers further boosted innovation. Consumers in North America are more open to adopting new mobility solutions, thereby driving the industry growth in North America.

Robo Taxi Market in US

The US robo taxi market is expected to witness significant growth during the forecast period, due to the presence of key companies such as Waymo, Cruise, Tesla, and Uber. The companies conduct extensive testing and commercial pilots across major states. Some cities have created autonomous vehicle testing zones and passed AV-friendly regulations to support innovation. Additionally, large-scale investments in AI, cloud computing, and sensor technologies have strengthened the ecosystem. The US also benefits from high consumer demand for ride-hailing services and growing interest in EVs, both of which support the adoption of robo taxis.

Robo Taxi Market in Asia Pacific

The Asia Pacific robo taxi market is projected to witness substantial growth, driven by rapid urbanization, strong government support, and advancements in autonomous driving technologies. Countries such as China, Japan, and South Korea are heavily investing in smart transportation systems and have made autonomous mobility a national priority. Local companies such as Baidu, DiDi, and AutoX are actively testing and deploying robo taxis in major cities. Infrastructure improvements, widespread 5G networks, and favorable pilot programs have created a strong foundation for expansion, thereby driving the growth in Asia Pacific.

Robo Taxi Market in China

The China robo taxi market is expected to experience significant growth during the forecast period, driven by its strong tech ecosystem, supportive government policies, and large urban population. Leading Chinese firms such as Baidu and DiDi have launched pilot programs in cities such as Beijing, Shanghai, and Guangzhou. The Chinese government has created AV-friendly zones and provided funding for research and development. Additionally, China’s push for electric vehicles complements contributes to the rise of robo taxis, most of which run on EV platforms. Moreover, China is rapidly adopting robo taxi solutions to modernize its transportation system with a growing middle class and increasing urban congestion, thereby driving the growth.

Robo Taxi Market in Europe

The Europe robo taxi market is expected to experience significant growth during 2025–2034, driven by strong environmental policies, urban mobility initiatives, and investments in smart infrastructure. The European Union is actively working on regulations for autonomous driving, promoting safety and standardization across member countries. Robo taxi pilots have been launched in cities such as Paris, Berlin, and Helsinki, in collaboration with public transportation systems. The focus on reducing emissions and traffic congestion aligns well with electric and autonomous vehicles, thereby driving the growth.

Robo Taxi Market in Germany

The Germany robo taxi market is expected to experience significant growth in the coming years, owing to its strong automotive industry and advanced research in autonomous driving. German automakers such as Mercedes-Benz, BMW, and Volkswagen are actively developing robo taxi technologies, often in partnership with tech companies and startups. Berlin and Munich have hosted robo taxi pilot projects, supported by clear legal frameworks and government-backed innovation programs. Germany’s emphasis on vehicle safety and engineering excellence makes it a hub for AV development, thereby driving the growth in the country.

Key Players and Competitive Analysis Report

The robotaxi market is highly competitive, with major players leveraging advanced autonomous technologies and strategic partnerships. Waymo and Cruise lead in US deployments, with extensive real-world testing. Tesla focuses on full self-driving capabilities integrated into its vehicle lineup. Uber and Lyft pivoted from in-house AV efforts to partnerships with firms such as Motional and Waymo. Didi and Baidu dominate China’s market, advancing L4 systems with government backing. Zoox, owned by Amazon, and Aptiv focus on purpose-built AVs, while EasyMile specializes in low-speed shuttles. This dynamic landscape is shaped by regulatory hurdles, tech maturity, and regional adoption strategies.

Key Players

- Aptiv

- Baidu, Inc.

- Cruise LLC

- Didi Chuxing Technology Co., Ltd.

- EasyMile

- Lyft, Inc.

- Tesla Inc.

- Uber Technologies Inc.

- Waymo LLC

- Zoox, Inc.

Robotaxi Industry Developments

In May 2025, Uber partnered with Chinese startup Momenta to launch a robotaxi service in Europe by early 2026, combining Uber’s rideshare network with Momenta’s autonomous driving technology. This marked Uber’s first major international autonomous vehicle deployment.

In April 2023, DiDi Autonomous Driving launched its first mass-produced L4 Robotaxi model in partnership with GAC Aion, integrating it into DiDi’s ride-hailing platform by 2025, and unveiled the Kargobot trucking business and futuristic DiDi Neuron concept Robotaxi.

Robo Taxi Market Segmentation

By Propulsion Type Outlook (Revenue, USD Billion, 2020–2034)

- Electric Vehicles

- Hybrid Electric Vehicles

- Fuel Cell Vehicle

By Component Type Outlook (Revenue, USD Billion, 2020–2034)

- LiDAR

- Radar

- Camera

- Sensor

By Level of Autonomy Outlook (Revenue, USD Billion, 2020–2034)

- Level 4

- Level 5

By Vehicle Type Outlook (Revenue, USD Billion, 2020–2034)

- Cars

- Shuttles/Vans

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- Car Rental

- Station-Based

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Passenger

- Goods

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Robo Taxi Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.80 Billion |

|

Market Size in 2025 |

USD 3.13 Billion |

|

Revenue Forecast by 2034 |

USD 504.13 Billion |

|

CAGR |

75.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.80 billion in 2024 and is projected to grow to USD 504.13 billion by 2034.

The global market is projected to register a CAGR of 75.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Aptiv; Baidu, Inc.; Cruise LLC; Didi Chuxing Technology Co., Ltd.; EasyMile; Lyft, Inc.; Tesla Inc.; Uber Technologies Inc.; Waymo LLC; and Zoox, Inc.

The electric vehicle segment dominated the market share in 2024.

The shuttles/vans segment is expected to witness the significant growth during the forecast period.