Rodenticides Market Share, Size, Trends, Industry Analysis Report

By Type (Anticoagulants and Non-Anticoagulants); By Form; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 118

- Format: PDF

- Report ID: PM4640

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

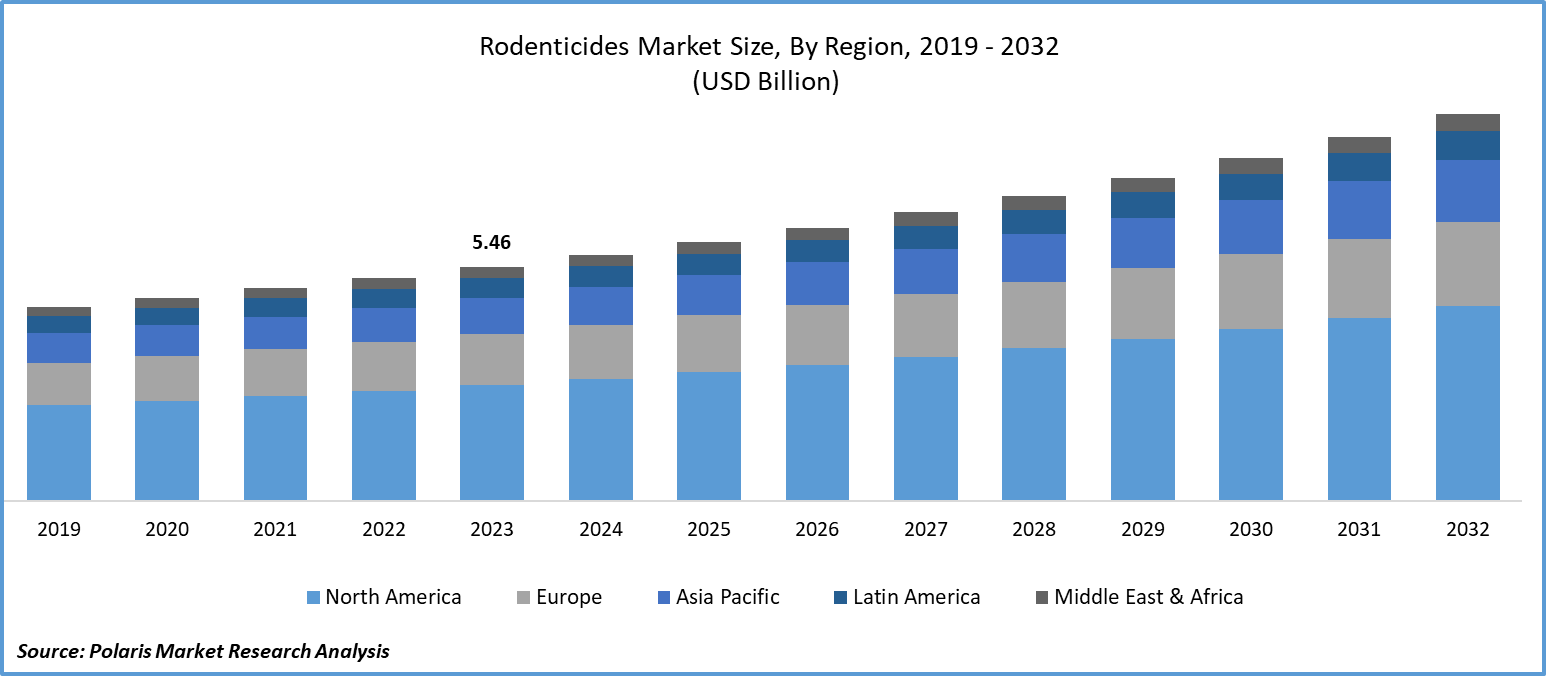

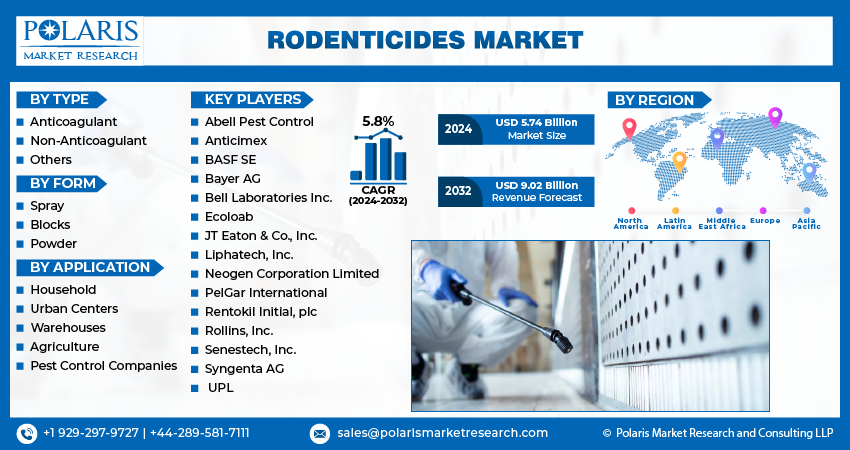

Global rodenticides market size was valued at USD 5.46 billion in 2023. The market is anticipated to grow from USD 5.74 billion in 2024 to USD 9.02 billion by 2032, exhibiting the CAGR of 5.8% during the forecast period

Rodenticides Market Overview

The availability of natural rodenticides, a growing rodent population, the rising incidence of diseases linked to pests, and the growing need for pest control are all anticipated to be significant growth factors in the market development. In the course of a year, 14.8 million of the 124 million inhabited residences in the United States reported seeing mice or rats inside their homes, according to the 2019 American Housing Survey.

- For instance, in May 2023, World Pest Control and Rentokil North America worked together. For 69 years, World Pest Control has provided residential and business services to its clientele. The company's mission is to safeguard homes, companies, and families by offering pest control services.

To Understand More About this Research: Request a Free Sample Report

The rising population of rodents is a key contributor to the increasing spread of infectious diseases such as plague, Hantavirus infection, and Lassa fever, impacting the environment, wildlife, and human health. This has led to a surge in the use of rodent control products in commercial, residential, and industrial settings, with significant demand seen in major cities worldwide. Companies are innovating to create products that can efficiently manage rodent populations. The growing presence of offices, hospitals, hotels, and housing, coupled with the increasing emphasis on hygiene, is anticipated to drive the demand for these products.

The increasing worry about economic losses from rodent damage in agricultural fields is expected to drive growth in the coming years. However, concerns about the environmental impact of chemicals and their effects on humans and other organisms are likely to limit demand. As a result, the application of these products is subject to strict regulations. Regulations governing the use of chemical rodenticides have been put in place in North America and Europe. For example, all pesticide products must be registered with the U.S. EPA before being sold to the public. The EPA regulates these products under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

Rodenticides Market Dynamics

Market Drivers

Raising the Damage Inflicted by rat attacks to promote growth

Commensal rats and mice live and breed in various locations, including buildings, sewers, granaries, attics, warehouses, ships, agricultural fields, agricultural fields, and underneath concrete slabs. They can cause damage to electric wiring and walls in both commercial and residential areas. Globally, rodents damage more than 20 percent of the food supply. Rats can even prey on chickens and attack the legs of domestic livestock. The primary concern with the increasing rodent population is food contamination. They can contaminate ten times the amount of food they consume, leading to significant losses due to contamination. Rats and mice also cause physical damage to structures such as homes, walls, commercial buildings, railroad embankments, outbuildings, utility lines, and sewers, primarily through gnawing and burrowing. The rising economic and food losses from rodent damage are expected to drive the demand for rodenticides worldwide.

Rat’s displacement as a result of urbanization

urbanization is a critical factor in land use, especially in developing countries where it is predicted that 90% of the population will live in urban areas. This shift is expected to have implications for public health as pathogens from rural areas adapt to urban settings, leading to an increase in their prevalence. The construction of new buildings often displaces rat populations, causing them to migrate to urban environments. According to a report from the Building and Construction Authority, there is a growing demand for construction activities, which can disrupt rodent nesting places in rural regions, pushing them towards urban areas. Black rats, as highlighted in a recent Frontiers article, are among the rat species that have successfully adapted to urban environments worldwide, showing resilience to environmental changes caused by human activities. Therefore, the rapid pace of urbanization highlights the importance of rodent control, especially in developing urban areas.

Market Restraints

Tight government regulations to limit the expansion of the market

Governmental agencies closely monitor rodenticides and other pesticides, which can impede market growth. According to the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), administered by the United States Environmental Protection Agency (EPA), all pesticides must be documented with the EPA before being sold or distributed. Pesticides that are unlikely to harm humans or the environment when used as directed are classified as general-use pesticides. However, if a rodenticide has the potential to harm humans or the ecosystem, even when used correctly, it is considered a restricted-use rodenticide. Inhibited use of pesticides can only be applied by certified pesticide applicators or under their direct supervision. For example, all rodenticide tracking powders are classified as restricted use and require a license for purchase or use. The strict regulatory requirements for launching a new rodenticide are expected to restrain market growth.

Report Segmentation

The market is primarily segmented based on type, form, application, and region.

|

By Type |

By Form |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Rodenticides Market Segmental Analysis

By Type Analysis

- The non-anticoagulant segment is projected to grow at the fastest CAGR during the projected period. The use of acute rodenticides has been essential for rodent control. In China, field rodents are the primary application for zinc phosphide. In the nation, anticoagulants are regarded as lawful. But because of their sluggish effects, farmers have begun shifting their choices in recent years.

- The anticoagulant segment led the industry market with a substantial revenue share in 2023. Anticoagulants are substances that cause internal bleeding, potentially leading to death from blood loss. These products are classified into two generations. The first generation includes chlorophacinone, warfarin, and diphacinone, while the second generation includes difenacoum, brodifacoum, bromadiolone, and difethialone. Both generations work by blocking a rodent's ability to produce blood clotting factors, ultimately causing their demise. First-generation anticoagulants typically require multiple doses to be effective. However, if other animals consume these anticoagulants, there is a risk of secondary poisoning. First-generation anticoagulants are primarily used in agriculture for controlling pocket gophers, voles, and below-ground moles.

By Form Analysis

- The block segment accounted for the largest rodenticides market share in 2023 and is likely to retain its position throughout the market forecast period. These products are suitable for outdoor applications because they are waterproof and able to withstand environmental conditions. The anticipated increase in usage by pest control companies is expected to drive growth in the future.

- The powder segment is expected to achieve notable revenue over the coming years. The product's simple accessibility to dogs, people, and animals carries risks. Therefore, the market is anticipated to grow slowly in the years to come. These items are not meant to be used in ventilation ducts because doing so may cause particles to disperse into the air and contaminate food and other delicate goods.

By Application Analysis

- Based on application analysis, the market has been segmented on the basis of households, warehouses, urban centers, and agriculture. The urban center segment held a significant market share in revenue share in 2023. Urban areas, with their high human populations, provide rodents with plenty of food and shelter. The closeness of buildings, infrastructure, and waste systems creates ideal conditions for rodent infestations to grow. In cities, various structures like buildings, sewers, and subways offer rodents places to live and reproduce. Cracks and gaps in buildings allow rodents to enter indoor spaces, increasing the chances of infestations.

Rodenticides Market Regional Insights

The North America region dominated the global market with the largest market share in 2023

The North America region dominated the global market with the largest market share in 2023 and is expected to maintain its dominance over the anticipated period. North America is home to over 300 rodent species, many of which are regarded as pests in agricultural, urban, and forestry settings because they have adapted to live in human environments. Changes in climate, such as milder winters and warmer springs, have contributed to the breeding and survival of specific rodent species, leading to outbreaks like the one seen with house mice in the US. The North American region, including the United States, Canada, and Mexico, accounts for about 60% of the global pest control services market, according to major service providers. Companies such as Ecolab and Rentokil Initial plc are prominent in this market segment due to their extensive services in the US and the high levels of urbanization in both the US and Canada. These factors have led to an increased use of rodenticides in North America.

The Asia Pacific region is expected to be the fastest-growing region, with a healthy CAGR during the projected period. The market opportunity in Asia Pacific is competitive because there are more than 3,000 pest control businesses operating there. Unusual weather patterns like cyclones, floods, and intense rain are the main reasons why rat infestations occur in the area. Furthermore, the higher-than-normal food supply found in agricultural areas gives rats a better place to reproduce, which raises the rodent population. Throughout the projection period, these factors are expected to fuel regional demand for efficient pest management measures.

Competitive Landscape

The Rodenticides market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These market players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Abell Pest Control

- Anticimex

- BASF SE

- Bayer AG

- Bell Laboratories Inc.

- Ecoloab

- JT Eaton & Co., Inc.

- Liphatech, Inc.

- Neogen Corporation Limited

- PelGar International

- Rentokil Initial, plc

- Rollins, Inc.

- Senestech, Inc.

- Syngenta AG

- UPL

Recent Developments

- In April 2023, Target Specialty Products launched Strike MAX CITO Paste, a rodenticide paste praised for its fast-acting formula and easy application. This paste is designed for use both indoors and outdoors, serving as a soft bait paste that owes its quick efficacy to its main ingredient, brodifacoum.

Report Coverage

The Rodenticides market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, form, application, and their futuristic growth opportunities.

Rodenticides Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.74 billion |

|

Revenue forecast in 2032 |

USD 9.02 billion |

|

CAGR |

5.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Form, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Rodenticides Market are BASF SE, Bayer, Syngenta AG, UPL, Neogen Corporation Limited, Anticimex, Ecolab

Rodenticides Market exhibiting the CAGR of 5.8% during the forecast period

The Rodenticides Market report covering key segments are type, form, application, and region.

key driving factors in Rodenticides Market Raising the Damage Inflicted by rat attacks.

The global rodenticides market size is expected to reach USD 9.02 billion by 2032