Scaffold Technology Market Size, Share, Trends, Industry Analysis Report

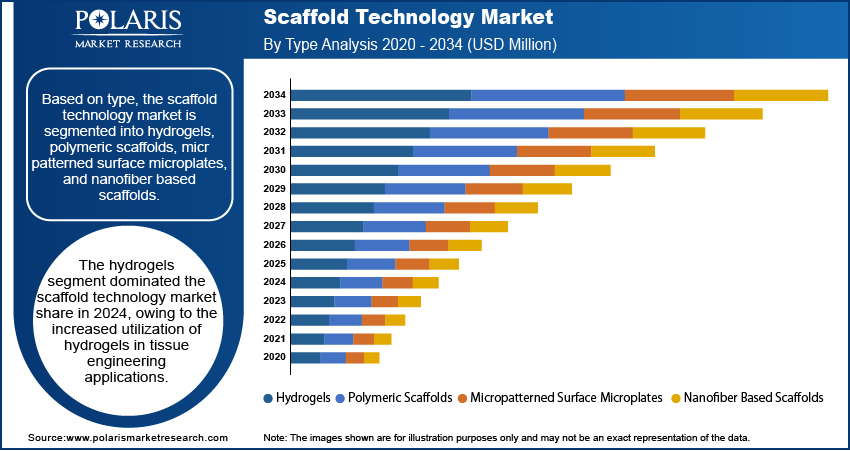

: By Type (Hydrogels, Polymeric Scaffolds, Micropatterned Surface Microplates, and Nanofiber Based Scaffolds), Disease Type, Application, End Users, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1531

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

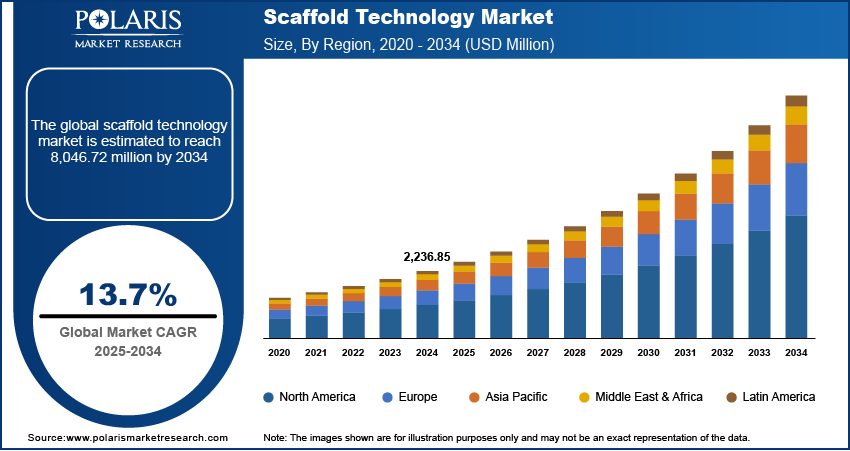

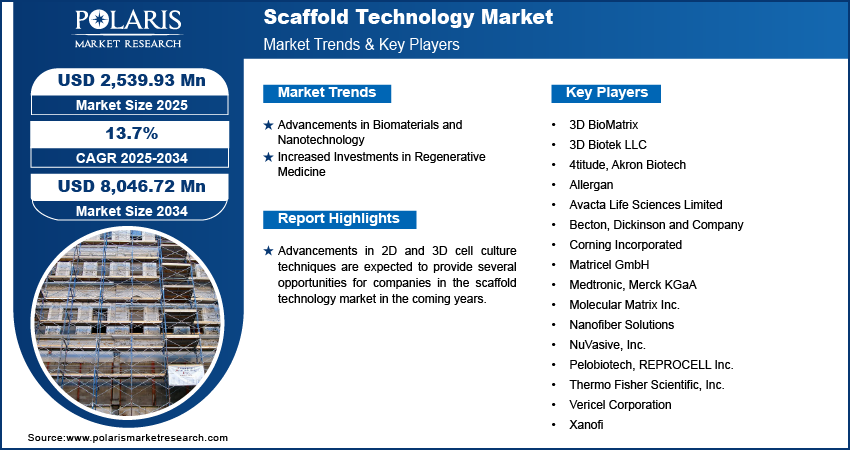

The global scaffold technology market size was valued at USD 2,236.85 million in 2024, growing at a CAGR of 13.7% from 2025 to 2034. The market growth is primarily fueled by the increased demand for reconstructive surgeries among affluent individuals, the introduction of new and innovative products, and increased accessibility of organ transplantation procedures globally.

Key Insights

- The hydrogels segment led the market in 2024, driven by their increased utilization in tissue engineering applications.

- The neurology segment is expected to register the highest CAGR during the projection period, primarily due to the increased adoption of regenerative therapies for treating neurodegenerative disorders.

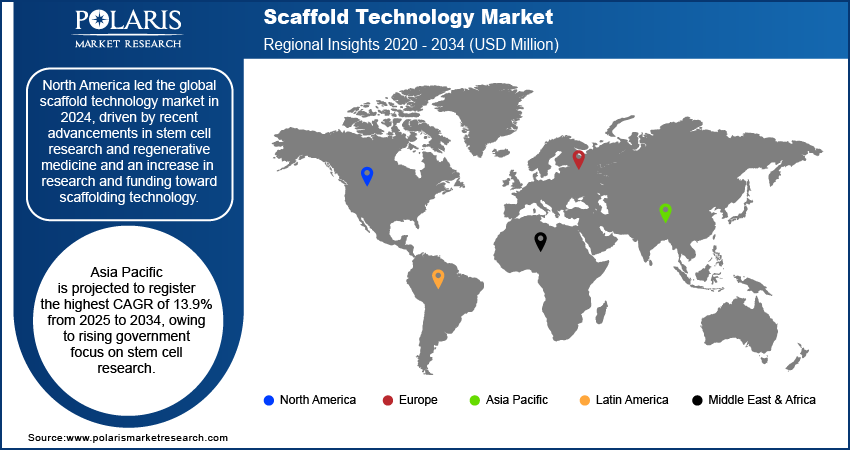

- North America dominated the market in 2024, owing to increased funding in scaffolding technology and the presence of major market participants.

- Asia Pacific is anticipated to register the highest CAGR during the projection period. The regional market growth is driven by increased government focus on stem cell research.

Industry Dynamics

- Advancements in biomaterials and nanotechnology, which are advancing scaffold technology, are driving market expansion.

- Increased investments in companies focused on advanced tissue engineering, including those utilizing scaffold technology, are fueling market development.

- Advancements in 2D and 3D cell culture techniques are expected to provide lucrative market opportunities in the coming years.

- Regulatory hurdles and lengthy approval processes may present challenges to the growth of the market.

Market Statistics

2024 Market Size: USD 2,236.85 million

2034 Projected Market Size: USD 8,046.72 million

CAGR (2025-2034): 13.7%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Scaffold technology is a biotechnology technique that employs 3D scaffolds to create organs and tissues for a variety of purposes, including bone formation, heart valve replacement, and cartilage development. Scaffolds help develop a favorable environment for cells to grow and regenerate. They can also be used to deliver genes, cells, and drugs inside the body.

The high demand for reconstructive surgeries among affluent individuals and the growing accessibility of organ transplantation procedures worldwide are among the major factors driving the scaffold technology market growth. The introduction of biological scaffolds with enhanced features, such as inertness, biodegradability, and the ability to produce fluorescence for imaging, is propelling the market development. In addition, new and innovative product launches by market participants are also supporting market growth.

The shift toward 3D printing of customized scaffolds based on the anatomy of each patient is one of the major scaffold technology market trends anticipated to drive market expansion in the company years. Advancements in 2D and 3D cell culture techniques are expected to provide several scaffold technology market opportunities during the projection period.

Market Dynamics

Advancements in Biomaterials and Nanotechnology

Innovations in biomaterials, which are substances that can be used to treat, replace, and enhance biological functions, are advancing scaffold technology. Researchers are optimizing materials such as hydrogels, natural polymers, and synthetic polymers to ensure better biocompatibility and biodegradability, improving the efficacy of scaffolds in tissue repair and regeneration. Further, the integration of nanotechnology into scaffold design is enabling the creation of scaffolds with enhanced mechanical properties and cell interaction. Thus, innovations in biomaterials and nanotechnology are propelling the scaffold technology market demand.

Increased Investments in Regenerative Medicine

Venture capitalists and private equity firms are making investments in startups and companies focused on advanced tissue engineering, including the ones utilizing scaffold technology. These investments are supporting research and development (R&D) initiatives and accelerating the development of advanced scaffold products. Further, governments worldwide are recognizing the potential of regenerative medicine in advancing public health and providing funding for R&D in scaffold technology. Thus, the increase in investments by governments and private organizations is driving the scaffold technology market development.

Segment Insights

Scaffold Technology Market Outlook Based on Type

The scaffold technology market, based on type, is segmented into hydrogels, polymeric scaffolds, micropatterned surface microplates, and nanofiber based scaffolds. The hydrogels segment dominated the market with a revenue share of 43.18% in 2024. Technological advancements in microfabrication procedures for hydrogels have led to their increased utilization in tissue engineering applications. In addition, the introduction of advanced hydrogels by companies for drug depots and cell transplantation contributes to the robust growth of the segment.

Scaffold Technology Market Evaluation Based on Disease Type

The scaffold technology market, based on disease type, is segmented into orthopedics, musculoskeletal, and spine; cancer; skin & integumentary; dental; cardiology & vascular; neurology; urology; gynecology; and others. The neurology segment is projected to register the highest CAGR of 15.91% from 2025 to 2034, owing to the increased adoption of regenerative medicine and stem cell therapy for the treatment of neurogenerative disorders. In addition, rising research efforts for the development of new scaffolds for nerve regeneration are expected to contribute to the segment growth during the forecast period.

Regional Analysis

By region, the market report offers scaffold technology market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America led the market with a revenue share of 43.41% in 2024. Recent advancements in stem cell research and regenerative medicine, an increase in research and funding toward scaffolding technology, and the presence of prominent players are driving the adoption of scaffold technology in North America. Further, the presence of a large number of academic institutions involved in biotechnology research is also favoring the regional scaffold technology market expansion.

The Asia Pacific scaffold technology market is projected to register the highest CAGR of 13.9% from 2025 to 2034, driven by rising government focus on stem cell research. For instance, the Indian Council of Medical Research (ICMR) and the National Centre for Cell Science, both of which are government-funded organizations, focus on regenerative medicine and scaffold technology. In addition, the growing research initiatives aimed at advanced therapy areas are expected to increase the penetration of scaffold technology in the region.

Key Players and Competitive Insights

The leading market players are introducing new, advanced scaffold products to cater to the evolving market needs. Also, they are expanding their presence across various geographies and entering new markets in developing regions to increase their customer base and strengthen their market presence. To expand and survive in a highly competitive environment, market participants must offer cost-effective scaffold technology solutions.

In recent years, the market for scaffold technology has witnessed several innovation breakthroughs, with the top market participants providing solutions that help meet sustainability goals. The scaffold technology market research report offers a market assessment of all the leading players, including Merck KGaA; Thermo Fisher Scientific, Inc.; Pelobiotech; Corning Incorporated; Avacta Life Sciences Limited; Vericel Corporation; Becton, Dickinson and Company; 3D Biotek LLC; Xanofi; Molecular Matrix Inc.; REPROCELL Inc.; Matricel GmbH; Akron Biotech; Nanofiber Solutions; 4titude; 3D BioMatrix; NuVasive, Inc.; Allergan; and Medtronic.

List of Key Players

- 3D BioMatrix

- 3D Biotek LLC

- 4titude

- Akron Biotech

- Allergan

- Avacta Life Sciences Limited

- Becton, Dickinson and Company

- Corning Incorporated

- Matricel GmbH

- Medtronic

- Merck KGaA

- Molecular Matrix Inc.

- Nanofiber Solutions

- NuVasive, Inc.

- Pelobiotech

- REPROCELL Inc.

- Thermo Fisher Scientific, Inc.

- Vericel Corporation

- Xanofi

Scaffold Technology Industry Developments

March 2023: Evonik expanded its partnership with BellaSeno for the commercialization of 3D-printed scaffolds for bone regeneration. According to Evonik, the bone scaffolds, made from Evonik’s Resomer polymers, are meant for large, complex bone defects.

March 2022: Akron BioProducts entered into a collaborative agreement with Vor Bio for the development and manufacturing of cGMP nucleases. Arkon stated that the partnership will boost its portfolio of off-the-shelf gene editing technologies while enhancing Vor Bio’s collection of nucleases.

Scaffold Technology Market Segmentation

By Type Outlook

- Hydrogels

- Polymeric Scaffolds

- Micropatterned Surface Microplates

- Nanofiber Based Scaffolds

By Disease Type Outlook

- Orthopedics, Musculoskeletal, and Spine

- Cancer

- Skin & Integumentary

- Dental

- Cardiology & Vascular

- Neurology

- Urology

- Gynecology

- Others

By Application Outlook

- Stem Cell Therapy, Regenerative Medicine, and Tissue Engineering

- Drug Discovery

- Others

By End Users Outlook

- Biotechnology and Pharmaceutical Industries

- Research Laboratories and Institutes

- Hospitals and Diagnostic Centers

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Scaffold Technology Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,236.85 million |

|

Market Size Value in 2025 |

USD 2,539.93 million |

|

Revenue Forecast by 2034 |

USD 8,046.72 million |

|

CAGR |

13.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The scaffold technology market size was valued at USD 2,236.85 million in 2024 and is projected to grow to USD 8,046.72 million by 2034.

The market is projected to register a CAGR of 13.7% from 2025 to 2034.

North America accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Merck KGaA; Thermo Fisher Scientific, Inc.; Pelobiotech; Corning Incorporated; Avacta Life Sciences Limited; Vericel Corporation; Becton, Dickinson and Company; 3D Biotek LLC; Xanofi; Molecular Matrix Inc.; REPROCELL Inc.; Matricel GmbH; Akron Biotech; Nanofiber Solutions; 4titude; 3D BioMatrix; NuVasive, Inc.; Allergan; and Medtronic.

The hydrogels segment accounted for the largest market share in 2024.

The neurology segment is anticipated to register the highest CAGR during the forecast period.