Silver Wound Dressing Market Size, Share, & Industry Analysis Report

: By Product (Traditional and Advanced), By Application, By Distribution Channel, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5688

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

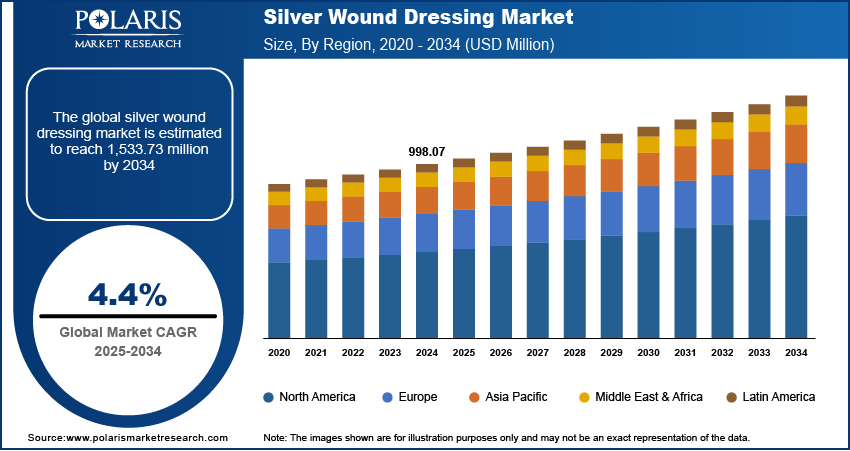

The global silver wound dressing market size was valued at USD 998.07 million in 2024 and is expected to grow at a CAGR of 4.4% during 2025–2034. Improved healthcare infrastructure and rising awareness among medical professionals about the benefits of antimicrobial dressings support market expansion.

Silver wound dressing is a type of antimicrobial dressing infused with silver ions, which are known for their broad-spectrum antibacterial properties. These dressings are used to manage and prevent infections in acute and chronic wounds such as burns, ulcers, surgical wounds, and traumatic injuries. Silver works by disrupting bacterial cell function, thereby inhibiting microbial growth and promoting a cleaner wound environment conducive to healing. Ongoing innovations in dressing formats such as hydrocolloids, foams, and nanotechnology-based silver applications enhance efficacy and patient compliance.

To Understand More About this Research: Request a Free Sample Report

Rising focus on reducing healthcare-associated infections (HAIs) encourages the adoption of antimicrobial-impregnated dressings in hospitals and clinics. Moreover, older adults are more prone to chronic wounds and slower healing processes, which is increasing the usage of advanced wound care products, including silver-based dressings.

Market Dynamics

Rising Prevalence of Chronic Wounds and Diabetic Ulcers

The growing cases of chronic conditions such as diabetes, obesity, and peripheral vascular diseases are contributing to a sharp rise in the prevalence of chronic wounds and diabetic foot ulcers. According to the World Health Organization, around 20 million new cancer cases were reported globally in 2022. Projections suggested that these cases will rise above 35 million by 2050. Thus, the increasing number of complex and minimally invasive surgical procedures is further driving demand for advanced medical products and care. These non-healing wounds often exhibit prolonged inflammation and high susceptibility to bacterial colonization, making them particularly difficult to treat through conventional means. Silver dressings, known for their broad-spectrum antimicrobial activity and ability to maintain a moist wound environment, have become integral to advanced wound care management. The increasing need to minimize hospitalization durations, reduce complications, and improve healing outcomes is accelerating their adoption in both inpatient and outpatient settings. Healthcare providers are increasingly turning to evidence-based, cost-effective solutions such as silver-infused dressings to manage chronic wounds and reduce the risk of infection-related complications.

Growing Number of Surgical Procedures and Burn Injuries

The rising frequency of surgical interventions, driven by an aging population and growing access to elective and emergency care, is intensifying the demand for reliable post-operative wound care. Burn injuries, whether accidental or occupational, also contribute significantly to the volume of complex wounds requiring specialized treatment. Silver dressings are widely utilized for their ability to control bioburden, reduce inflammation, and accelerate tissue repair. These dressings offer a critical barrier against multidrug-resistant pathogens and secondary infections, which are common in post-surgical and burn wounds. Increasing awareness among clinicians about antimicrobial stewardship and infection prevention is further supporting the use of silver-based wound management products in hospitals, surgical centers, and trauma care facilities. According to the data from the Insurance Institute for Highway Safety (IIHS) showed that the US recorded 42,514 traffic-related fatalities in 2022. This translates to a death rate of 12.8 per 100,000 people and 1.33 deaths per 100 million vehicle miles traveled. The growing number of fatalities is driving increased demand for advanced wound care products, boosting the silver wound dressing market as effective infection control becomes critical.

Segment Insights

Market Assessment by Product

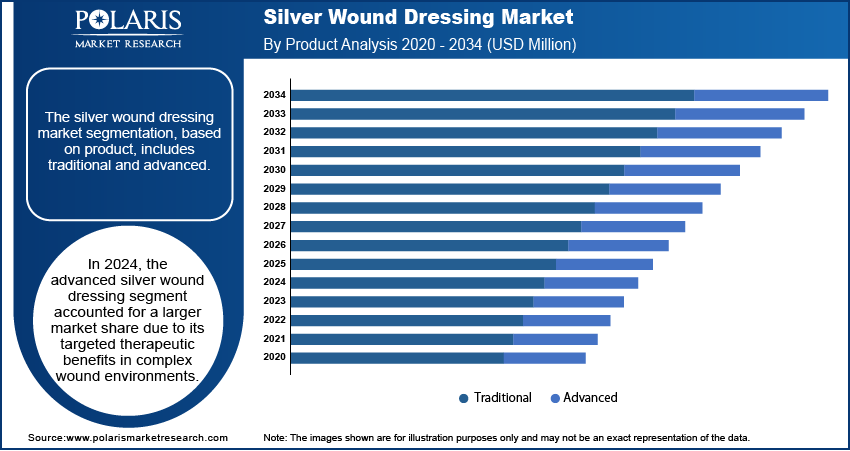

The silver wound dressing market segmentation, based on product, includes traditional and advanced. In 2024, the advanced silver wound dressing segment accounted for a larger market share due to its targeted therapeutic benefits in complex wound environments. These dressings, which include hydrofiber, alginate, foam, and hydrocolloid forms impregnated with ionic silver, offer superior antimicrobial efficacy and prolonged wear time, reducing the frequency of dressing changes. Their ability to manage exudate, promote autolytic debridement, and maintain an optimal moisture balance makes them highly preferred in treating infected surgical sites and hard-to-heal wounds. Clinician preference for evidence-backed formulations that minimize hospital readmission rates and support faster healing timelines has propelled the dominance of this segment across both acute care and outpatient settings.

Market Evaluation by Application

The silver wound dressing market segmentation, based on application, includes chronic wounds and acute wounds. The acute wound segment is expected to witness a higher CAGR over the forecast period due to the increasing number of surgical procedures, trauma-related injury cases, and emergency admissions. Acute wounds, such as surgical incisions, abrasions, and first- or second-degree burns, require prompt and effective antimicrobial management to prevent infections and support rapid epithelialization. Silver dressings are gaining traction in treating acute wound cases due to their immediate antimicrobial action and compatibility with primary and secondary healing processes. Demand is being further accelerated by clinical protocols emphasizing short hospital stays and reduced antibiotic usage, positioning silver-based products as essential components of post-operative and emergency wound care regimens.

Regional Analysis

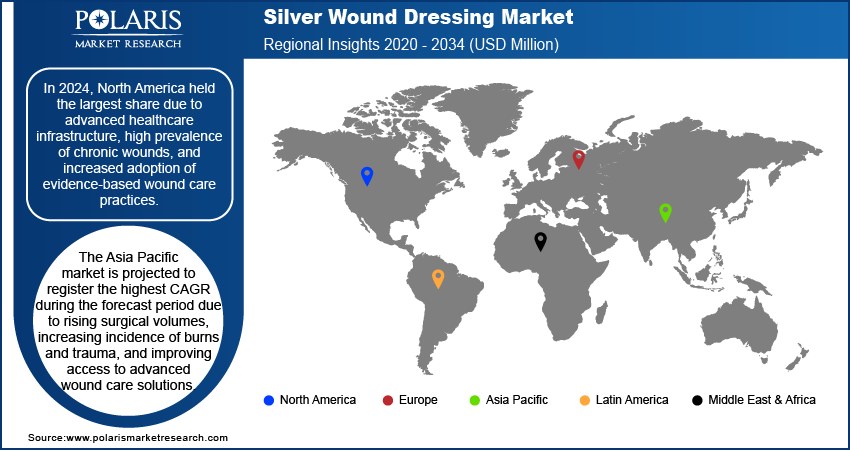

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America silver wound dressing market held the largest share due to advanced healthcare infrastructure, high prevalence of chronic wounds, and increased adoption of evidence-based wound care practices. A growing elderly population, along with high rates of diabetes and obesity, has led to a surge in chronic wound cases such as diabetic foot ulcers and pressure injuries, which require long-term antimicrobial management. According to the Administration for Community Living, in 2022, seniors aged 65 and above made up 17% of the US population, projected to rise to 22% by 2040. The population aged 85 and above is expected to more than double from 6.5 million in 2022 to 13.7 million by 2040, marking a 111% increase. Strong reimbursement frameworks, availability of skilled clinicians, and widespread awareness of silver-based technologies among healthcare providers have driven product utilization. In addition, continuous innovation in dressing formats and the presence of key market players have supported early adoption and integration of advanced silver wound dressings into clinical guidelines across hospitals and ambulatory surgical centers.

The Asia Pacific silver wound dressing market is projected to register the highest CAGR during the forecast period due to rising surgical volumes, increasing incidence of burns and trauma, and improving access to advanced wound care solutions. Rapid urbanization and industrialization have contributed to higher rates of occupational injuries, while growing healthcare expenditure and government-led initiatives to strengthen hospital infrastructure are expanding the regional wound care ecosystem. Emerging economies such as China and India are experiencing greater adoption of modern antimicrobial dressing products, supported by enhanced physician training and availability of cost-effective silver-infused technologies. Increasing awareness about infection control and the clinical benefits of silver dressings is further accelerating market growth across both public and private healthcare settings in the region.

Key Players & Competitive Analysis

The competitive landscape for silver wound dressing market is shaped by aggressive market expansion strategies, technological advancements, and increased collaboration across the healthcare sector. Industry analysis reveals that leading players are focusing on product innovation and expanding their portfolios through advanced antimicrobial wound care solutions. Strategic alliances and joint ventures are being leveraged to penetrate emerging markets and enhance distribution networks, especially in regions witnessing a surge in chronic wound cases. Mergers and acquisitions are playing a pivotal role in consolidating capabilities and accelerating product commercialization, with post-merger integration aimed at operational efficiency and R&D synergy. The launch of next-generation silver-based dressings with controlled ion release, enhanced absorption capacity, and longer wear time reflects the industry’s shift toward performance-oriented, patient-centric solutions. Companies are increasingly incorporating nanotechnology and bioactive materials into their offerings, creating differentiation in a highly competitive landscape. In addition, adherence to regulatory frameworks and investments in clinical studies support market credibility and product adoption. The integration of digital platforms for wound monitoring and remote care is also gaining traction, driving value-added innovation. Overall, the market is characterized by dynamic shifts, where adaptability, technological leadership, and strategic collaborations are central to sustaining growth and expanding the footprint in the advanced wound care sector.

Convatec Group PLC, established in 1978, is a global medical products and technologies company focused on solutions for the management of chronic conditions. The company operates in advanced wound care, ostomy care, continence care, and infusion care. Convatec's product portfolio includes advanced dressings for chronic and acute wounds, devices and accessories for individuals with a stoma, products for urinary continence management, and disposable infusion sets for insulin pump therapy in diabetes patients.

B. Braun Melsungen AG, a medical equipment manufacturing company based in Melsungen, Germany, specializes in cardio-thoracic surgery, continence care & urology, degenerative spinal disorders, diabetes care, infection prevention, extracorporeal blood treatment, infusion therapy, vascular diagnostics, wound management, neurosurgery, nutrition therapy, ostomy care, pain therapy, regional anesthesia, laparaoscopic surgery, spine surgery, clinical nutrition, and orthopedic joint replacement. The company offers therapies such as continence care & urology, dental care, extracorporeal blood treatment therapies, infection prevention & control, infusion therapy, interventional vascular therapy, minimally invasive surgery, neosurgery, nutrition therapy, oncology, orthopedic surgery, ostomy care, pain therapy, spine surgery, sterile goods management, surgical power systems, sutures & surgical specialties, and wound management.

List of Key Companies in Silver Wound Dressing Market

- 3M

- Advanced Medical Solutions Group plc

- B. Braun SE

- Bravida Medical

- Cardinal Health

- Coloplast Group

- Convatec Group PLC

- Datt Mediproducts Private Limited

- DermaRite Industries, LLC.

- Medline Industries, LP

- MedWay Group

- Mölnlycke AB

- PAUL HARTMANN AG

- Smith+Nephew

- URGO MEDICAL

Silver Wound Dressing Industry Developments

In April 2025, Convatec received regulatory approval for ConvaNiox, a new technology utilizing nitric oxide, a strong antimicrobial and antibiofilm agent.

In March 2025, Imbed Biosciences received FDA approval for an Investigational Device Exemption (IDE) to conduct a feasibility clinical trial on the safety of their polymeric matrix with silver and gallium ions in human donor site wounds.

Silver Wound Dressing Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Traditional

- Silver Bandages

- Others

- Advanced

- Silver Foam Dressing

- Silver Plated Nylon Fiber Dressing

- Silver Hydrogel/Hydrofiber

- Silver Alginates

- Nano Crystalline Silver Dressings

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Chronic Wounds

- Acute Wounds

- Surgical & Traumatic Wounds (Skin Tears Included)

- Burns

By Distribution Channel Outlook (Revenue, USD Million, 2020–2034)

- Online

- Offline

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Clinics

- Home Healthcare

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Silver Wound Dressing Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 998.07 million |

|

Market Size Value in 2025 |

USD 1,040.99 million |

|

Revenue Forecast by 2034 |

USD 1,533.73 million |

|

CAGR |

4.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 998.07 million in 2024 and is projected to grow to USD 1,533.73 million by 2034.

The global market is projected to register a CAGR of 4.4% during the forecast period.

In 2024, North America held the largest share due to advanced healthcare infrastructure, high prevalence of chronic wounds, and increased adoption of evidence-based wound care practices.

A few of the key players in the market are 3M; Advanced Medical Solutions Group plc; B. Braun SE; Bravida Medical; Cardinal Health; Coloplast Group; Convatec Group PLC; Datt Mediproducts Private Limited; DermaRite Industries, LLC.; Medline Industries, LP; MedWay Group; Mölnlycke AB; PAUL HARTMANN AG; Smith+Nephew; and URGO MEDICAL.

In 2024, the advanced silver wound dressing segment accounted for a larger market share due to its targeted therapeutic benefits in complex wound environments.

The acute wound segment is expected to witness a higher CAGR during the forecast period due to the increasing number of surgical procedures, trauma-related injuries, and emergency admissions.