Small Molecule Drug Discovery Outsourcing Market Size, Share, Trends, Industry Analysis Report

By Workflow (Target Identification & Screening, Target Validation & Functional Informatics), By Service, By Therapeutics Area, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6202

- Base Year: 2024

- Historical Data: 2020-2023

Overview

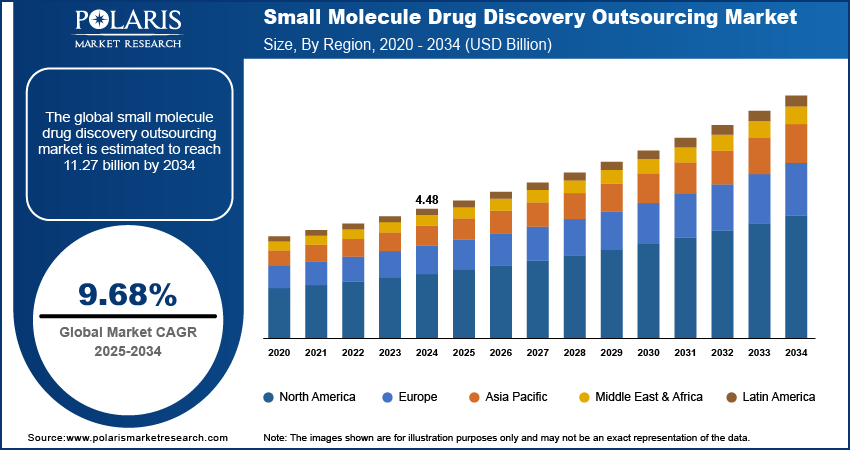

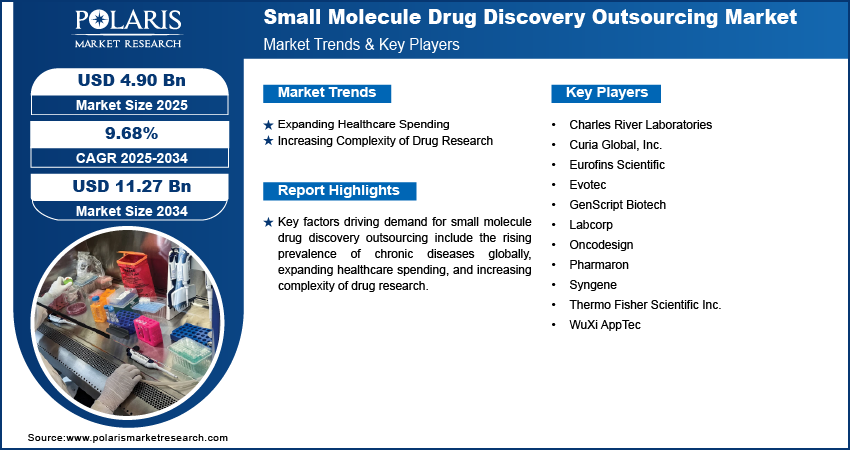

The global small molecule drug discovery outsourcing market size was valued at USD 4.48 billion in 2024, growing at a CAGR of 9.68% from 2025 to 2034. Key factors driving demand for small molecule drug discovery outsourcing include the rising prevalence of chronic diseases globally, expanding healthcare spending, and increasing complexity of drug research.

Key Insights

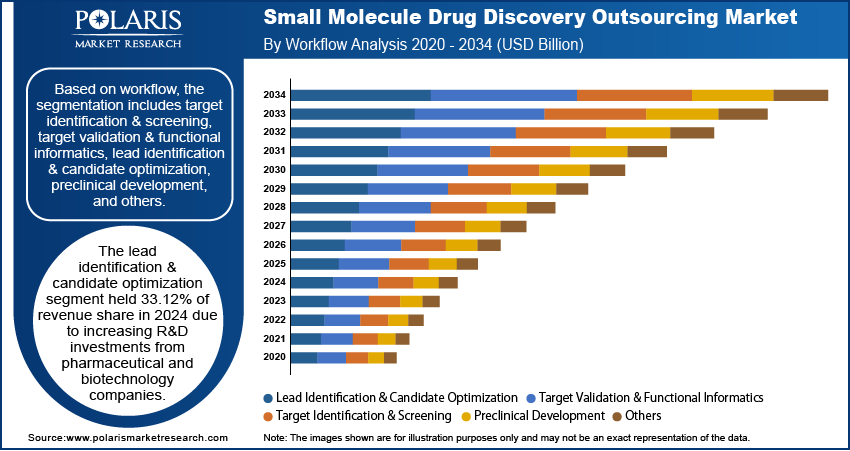

- The lead identification & candidate optimization segment held 33.12% of revenue share in 2024 due to increasing investments from pharmaceutical companies for drug discovery.

- The chemistry services segment dominated the revenue share in 2024 due to the ongoing drug development activities.

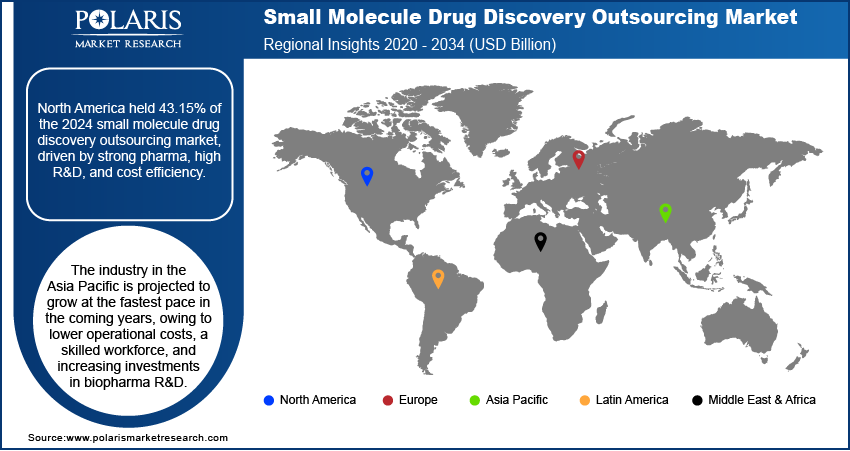

- North America accounted for 43.15% of global small molecule drug discovery outsourcing market revenue share in 2024, due to its strong pharmaceutical and biotech industry.

- The U.S. held the largest revenue share in the North America small molecule drug discovery outsourcing landscape in 2024, due to the strong biopharma industry.

- The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to the presence of a skilled workforce.

Industry Dynamics

- The expanding healthcare spending globally is fueling the growth of small-molecule drug discovery outsourcing by expanding research funding.

- The increasing complexity of drug research is driving the market growth by encouraging pharma companies to opt for small molecule drug discovery outsourcing.

- The rising investments in cancer research are expected to create a lucrative market opportunity during the forecast period.

- The loss of direct control over critical processes may discourage pharma companies from choosing outsourcing for small molecule drug discovery.

Market Statistics

- 2024 Market Size: USD 4.48 Billion

- 2034 Projected Market Size: USD 11.27 Billion

- CAGR (2025–2034): 9.68%

- North America: Largest Market Share

AI Impact on Small Molecule Drug Discovery Outsourcing Market

- Pharma and biotechnology companies opt for AI-enabled CROs due to the rise in preference for precision medicine and targeted therapies as the technology speeds up the drug development process and improves success rates.

- CROs use AI infrastructure to automate various repetitive tasks such as data processing, virtual screening, and synthesis planning, reducing manual workload.

- The technology automates routine analysis, streamlines workflows, and reduces human error and time consumption.

- The AI adoption enables outsourcing partners to deliver faster, cost-effective, and more precise drug discovery solutions.

Small molecule drug discovery outsourcing refers to the practice of pharmaceutical and biotechnology companies contracting external service providers to conduct various stages of the drug discovery process for small molecule compounds. Small molecules are low molecular weight organic compounds that can easily enter cells and modulate biological processes, making them effective for a wide range of diseases. The outsourcing process typically includes services such as target identification and validation, hit discovery, lead optimization, and preclinical development. Companies outsource these functions to access specialized expertise, reduce development costs, accelerate timelines, and mitigate the risks associated with in-house R&D.

The demand for small molecule drug discovery outsourcing is growing rapidly due to the rising complexity of drug development, high failure rates in early-stage research, and the increasing pressure to bring new drugs to market quickly. Contract research organizations (CROs) and academic research institutions offer advanced technologies such as high-throughput screening, artificial intelligence, and computational chemistry to enhance drug discovery efficiency. Outsourcing also enables pharmaceutical companies to focus on their core competencies, such as clinical development and commercialization. This model is particularly attractive to small and mid-sized biotech firms that may lack the infrastructure for in-house research, making outsourcing a vital component of the global drug development ecosystem.

The global small molecule drug discovery outsourcing market demand is driven by the rising prevalence of chronic diseases globally. The total number of people affected by diabetes is projected to rise to 853 million by 2050, according to International Diabetes Foundation. This is creating pressure on pharma companies to develop innovative therapies quickly and cost-effectively, which is propelling them to outsource small molecule drug discovery to leverage specialized expertise, advanced technologies, and scalable resources from contract research organizations (CROs) without heavy upfront investments. Hence, the increasing prevalence of chronic diseases globally is fueling the demand for small molecule drug discovery outsourcing as it speeds up the drug development process, reduces operational costs, and enables companies to focus on core competencies.

Drivers & Opportunities

Expanding Healthcare Spending: Expanding healthcare spending is prompting governments, insurers, and patients to invest more in advanced treatments, increasing demand for innovative small-molecule drugs and outsourced drug discovery services. The growing financial support for healthcare is also encouraging smaller biotech firms to enter the market, further driving demand for small molecule drug discovery outsourcing as they rely on external partners for expertise. According to a report published by the American Medical Association, health spending in the U.S. increased by 7.5% in 2023 from 2022. Thus, higher healthcare spending is directly fueling the growth of small-molecule drug discovery outsourcing by expanding research funding and incentivizing efficiency-driven partnerships

Increasing Complexity of Drug Research: The increasing complexity of drug research needs specialized expertise, advanced technologies, and multidisciplinary approaches that many pharmaceutical companies lack in-house, which encourages them to opt for small molecule drug discovery outsourcing. Contract research organizations (CROs) offer advanced tools like AI-driven drug design, high-throughput screening, and structural biology, which speed up development and improve success rates. Additionally, the rising regulatory and scientific hurdles in drug development are pushing companies to collaborate with CROs to mitigate risks and reduce costs.

Segmental Insights

Workflow Analysis

Based on workflow, the segmentation includes target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and others. The lead identification & candidate optimization segment held 33.12% of revenue share in 2024 due to increasing R&D investments from pharmaceutical and biotechnology companies. These firms prioritized external collaborations to accelerate hit-to-lead optimization, SAR studies, and compound profiling, aiming to streamline the discovery timeline and reduce internal resource burdens. The growing complexity of early drug discovery, coupled with the demand for high-throughput screening, fueled the need for outsourcing specialized services during this critical stage. Additionally, advancements in AI-driven molecular design and virtual screening technologies made the segment a strategic focal point for companies aiming to improve the quality of molecules before entering preclinical studies.

The target identification and screening segment is projected to grow at a robust pace in the coming years, owing to the rising adoption of omics technologies, bioinformatics, and AI in early-stage research. The surge in precision medicine and the need to identify novel therapeutic targets across complex disease areas such as oncology, neurodegenerative disorders, and rare diseases are prompting companies to outsource small-molecule drug discover services to providers with expertise in data-driven target discovery.

Service Analysis

In terms of service, the segmentation includes chemistry services and biology services. The chemistry services segment dominated the revenue share in 2024 due to the critical role chemistry plays in early-stage drug development, including hit-to-lead optimization, medicinal chemistry, and lead generation. Pharmaceutical and biotech companies increasingly outsourced chemistry services to leverage specialized expertise, reduce costs, and accelerate timelines. The growing demand for novel small molecule therapeutics, particularly in oncology, CNS disorders, and infectious diseases, further drove the need for advanced chemistry services. Additionally, the rise of drug discovery activities highlighted the reliance on outsourcing partners with advanced computational and synthetic chemistry capabilities.

Therapeutic Area Analysis

In terms of technology, the segmentation includes respiratory system, pain and anesthesia, oncology, ophthalmology, hematology, cardiovascular, endocrine, gastrointestinal, immunomodulation, anti-infective, central nervous system, dermatology, and genitourinary system. The oncology segment accounted for a major revenue share in 2024 due to the rising burden of cancer and the urgent demand for effective and targeted treatments. Pharmaceutical and biotechnology companies prioritized cancer research owing to its high unmet clinical need, strong return on investment, and supportive regulatory pathways, such as accelerated approvals and orphan drug designations. Outsourcing in this area surged as developers sought specialized partners with capabilities in screening anticancer compounds, conducting tumor-specific in vitro and in vivo studies, and identifying predictive biomarkers. The complexity of cancer biology also required advanced medicinal chemistry and integrated biology platforms, making oncology a key therapeutic area for outsourcing partnerships with CROs.

The central nervous system segment is expected to grow at a rapid pace from 2025 to 2034, owing to the rising prevalence of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, epilepsy, and multiple sclerosis. Drug discovery in this area presents significant challenges due to the complexity of the blood-brain barrier, heterogeneity of disease mechanisms, and the lack of validated biomarkers. This is encouraging companies to increasingly engage external experts for target validation, neuropharmacology studies, and the development of CNS-penetrant compounds. The growing societal burden of mental health and neurodegenerative diseases, combined with advances in brain-targeted delivery systems and high-content imaging, is projected to accelerate outsourcing within this therapeutic domain.

End Use Analysis

In terms of end use, the segmentation includes pharmaceutical & biotechnology companies and academic institutes. The academic institutes segment is expected to grow at a robust pace in the coming years. Growing public and private funding, including grants from government health agencies and partnerships with industry, is encouraging academic labs to conduct translational research and develop novel therapeutic targets. These institutes are increasingly collaborating with CROs to access resources such as high-throughput screening platforms, medicinal chemistry support, and in vivo testing capabilities that may not be available in-house. The integration of academic institutes into commercial drug development pipelines is projected to expand segment growth.

Regional Analysis

North America small molecule drug discovery outsourcing market accounted for 43.15% of the global revenue share in 2024. This dominance is attributed to its strong pharmaceutical and biotech industries, high R&D investments, and the need for cost-efficient drug development. The region's demand for small molecule drug discovery outsourcing is further driven by increasing complexity in drug discovery, a shortage of in-house expertise, and the need to accelerate timelines. Additionally, the rise of precision medicine and targeted therapies has pushed companies in the region to outsource to specialized contract research organizations (CROs) with advanced technologies such as artificial intelligence and high-throughput screening.

U.S. Small Molecule Drug Discovery Outsourcing Market Insights

The U.S. held the largest revenue share in the North America small molecule drug discovery outsourcing landscape in 2024, due to the strong biopharma sector, stringent regulatory requirements, and the need to reduce R&D costs. Pharmaceutical companies in the country increasingly outsourced drug discovery to leverage external expertise in medicinal chemistry, computational modeling, and lead optimization. The growing focus on oncology, CNS disorders, and rare diseases further drove demand for small molecule drug discovery outsourcing in the U.S. in 2024.

Europe Small Molecule Drug Discovery Outsourcing Market Trends

The market in Europe is projected to hold a substantial revenue share by 2034 due to cost pressures, the need for innovation, and increasing collaborations between academia, biotech firms, and CROs. The region’s stringent regulatory environment (EMA) and emphasis on generics and biosimilars are pushing companies to outsource for drug discovery services. Additionally, the rise of personalized medicine and the need for novel therapies in areas such as immunology and metabolic disorders are fueling the market growth in the region. Countries such as the UK, France, and Switzerland are major contributors to the regional market due to their strong pharmaceutical presence.

Germany Small Molecule Drug Discovery Outsourcing Market Overview

The demand for small molecule drug discovery outsourcing in Germany is being driven by its strong focus on innovation and generics. The country’s established chemical and pharmaceutical industries are driving collaborations with CROs for lead discovery and optimization. Cost efficiency, access to specialized technologies, and a skilled workforce are also contributing to the rising demand for small molecule drug discovery outsourcing. Additionally, Germany’s emphasis on oncology and autoimmune diseases is accelerating the need for external expertise in small molecule development.

Asia Pacific Small Molecule Drug Discovery Outsourcing Market Assessment

The industry in Asia Pacific is projected to grow at the fastest pace in the coming years, owing to lower operational costs, a skilled workforce, and increasing investments in biopharma R&D. Countries such as China and India are major hubs, offering cost-effective chemistry and preclinical services. The rise of domestic pharmaceutical companies, government incentives, and expanding clinical trial capabilities are further boosting outsourcing demand. Additionally, the growing prevalence of chronic diseases and the need for affordable generics in the region are driving partnerships with global CROs for efficient drug discovery, leading to market growth.

Key Players & Competitive Analysis

The small molecule drug discovery outsourcing (SM-DDO) market is highly competitive, with key players differentiated by scale, geographic reach, technological specialization, and service integration. WuXi AppTec and Thermo Fisher Scientific dominate as full-service providers, offering end-to-end solutions from target identification to preclinical development. WuXi’s cost-efficient, China-based operations and "CRDMO" model make it a preferred partner for global biopharma, though geopolitical tensions have prompted some clients to diversify suppliers. Thermo Fisher, through acquisitions such as PPD and Patheon, provides a Western-centric alternative with strong regulatory expertise and high-throughput capabilities. Charles River Laboratories excels in early-stage discovery, leveraging deep medicinal chemistry and in vitro/in vivo biology expertise. Labcorp Drug Development combines discovery services with its vast clinical and CRO capabilities, appealing to sponsors seeking seamless transition into trials.

A few major companies operating in the small molecule drug discovery outsourcing industry include Charles River Laboratories; Curia Global, Inc.; Eurofins Scientific; Evotec; GenScript Biotech; Labcorp; Oncodesign; Pharmaron; Syngene; Thermo Fisher Scientific Inc.; and WuXi AppTec.

Key Players

- Charles River Laboratories

- Curia Global, Inc.

- Eurofins Scientific

- Evotec

- GenScript Biotech

- Labcorp

- Oncodesign

- Pharmaron

- Syngene

- Thermo Fisher Scientific Inc.

- WuXi AppTec

Small Molecule Drug Discovery Outsourcing Industry Developments

In May 2025, Peptone announced a strategic partnership with Evotec aimed at accelerating and scaling the creation of small molecule therapeutics targeting intrinsically disordered proteins (IDPs) across diverse therapeutic areas.

In March 2025, Curia Global, Inc., a contract research, development, and manufacturing organization, announced expansion plans for its Glasgow, UK facility.

Small Molecule Drug Discovery Outsourcing Market Segmentation

By Workflow Outlook (Revenue, USD Billion, 2020–2034)

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Others

By Service Outlook (Revenue, USD Billion, 2020–2034)

- Chemistry Services

- Biology Services

By Therapeutic Area Outlook (Revenue, USD Billion, 2020–2034)

- Respiratory System

- Pain and Anesthesia

- Oncology

- Ophthalmology

- Hematology

- Cardiovascular

- Endocrine

- Gastrointestinal

- Immunomodulation

- Anti-infective

- Central Nervous System

- Dermatology

- Genitourinary System

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Small Molecule Drug Discovery Outsourcing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.48 Billion |

|

Market Size in 2025 |

USD 4.90 Billion |

|

Revenue Forecast by 2034 |

USD 11.27 Billion |

|

CAGR |

9.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.48 billion in 2024 and is projected to grow to USD 11.27 billion by 2034.

The global market is projected to register a CAGR of 9.68% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are Charles River Laboratories; Curia Global, Inc.; Eurofins Scientific; Evotec; GenScript Biotech; Labcorp; Oncodesign; Pharmaron; Syngene; Thermo Fisher Scientific Inc.; and WuXi AppTec.

The lead identification & candidate optimization segment dominated the market revenue share in 2024.

The academic institutes segment is projected to witness the fastest growth during the forecast period.