Small-Scale LNG Market Size, Share, Trends, Industry Analysis Report

By Mode of Supply (Trucks, Trans-shipment & Bunkering, Others), By Type, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 118

- Format: PDF

- Report ID: PM5892

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

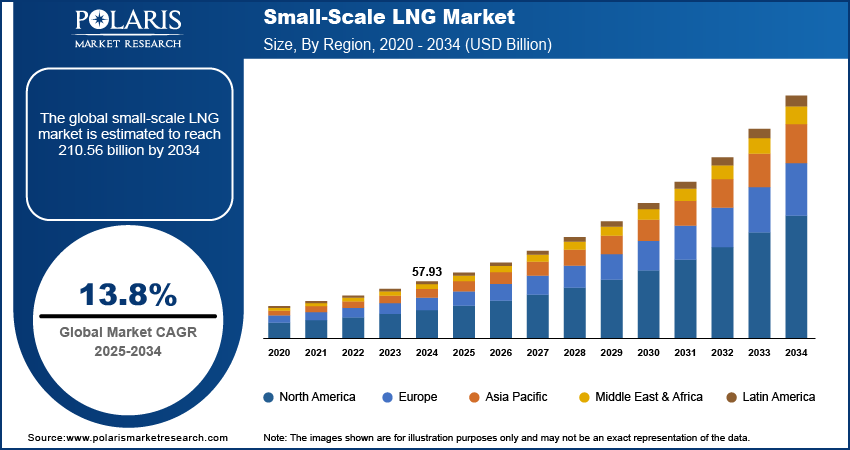

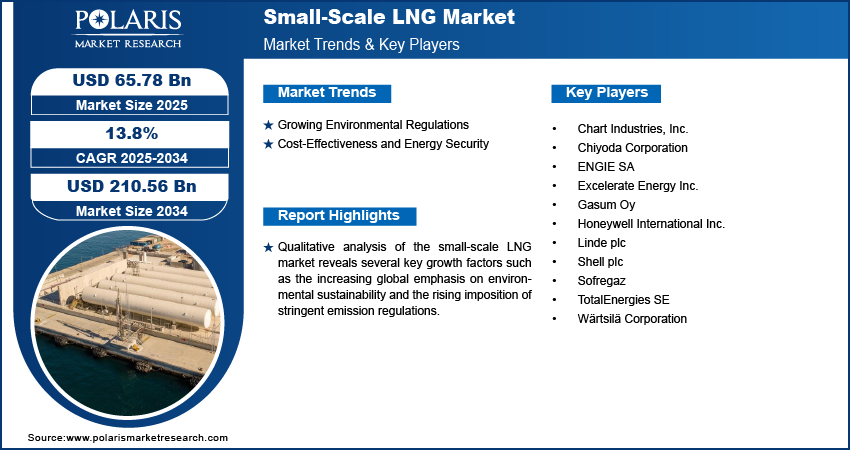

The global small-scale LNG market size was valued at USD 57.93 billion in 2024 and is anticipated to register a CAGR of 13.8% from 2025 to 2034. The market is witnessing significant growth due to the increasing demand for cleaner energy sources, especially in remote areas without large gas pipeline networks.

The small-scale LNG involves the production, distribution, and use of liquefied natural gas in smaller volumes, typically for applications that are not connected to large pipeline networks. This includes supplying fuel to remote industries, providing power to isolated communities, and serving as a cleaner alternative fuel for vehicles and ships.

To Understand More About this Research: Request a Free Sample Report

The growth of the market is significantly driven by continuous advancements in infrastructure development, making LNG more accessible to diverse end users. This includes the expansion of liquefaction and regasification facilities, as well as improvements in the logistics for transporting LNG in smaller quantities. The development of modular and portable units reduces the initial capital investment and deployment time, making it feasible to establish supply chains in areas previously considered uneconomical.

Technological advancements are a crucial driver, continuously improving the efficiency, safety, and cost-effectiveness of small-scale LNG operations. Innovations in liquefaction processes, such as the development of more compact and energy-efficient mini-LNG plants, are making it easier to produce LNG closer to demand centers or even from stranded gas fields. These advancements also include improvements in cryogenic storage tanks and transportation methods, such as ISO containers, which enhance the logistics of small-volume LNG distribution.

Industry Dynamics

Growing Environmental Regulations

Governments and international organizations worldwide are imposing stricter rules to control pollution and promote cleaner energy sources. These regulations aim to reduce the environmental impact of various industries, especially those that rely heavily on fossil fuels. This global push for a cleaner environment is a significant factor driving the demand for small-scale LNG solutions. For example, the International Maritime Organization (IMO) has implemented regulations such as the IMO 2020 sulfur cap, which limits the sulfur content in marine fuels to 0.5% globally. This rule has made LNG an attractive alternative for the shipping industry due to its significantly lower sulfur emissions. According to an article titled "How do IMO 2020 regulations impact the LNG market?" published by ECOnnect Energy in August 2021, the IMO 2020 regulations are encouraging shipping companies to explore and adopt lower carbon fuel sources such as LNG. This strong regulatory push is directly accelerating the adoption of small-scale LNG as a compliant and environmentally friendly fuel, thereby fueling the market expansion.

Cost-Effectiveness and Energy Security

The cost-effectiveness of LNG, especially in areas where traditional pipeline infrastructure is not available, fuels the market growth. When compared to other alternative fuels such as diesel or propane, LNG can offer significant cost savings over time. This makes it an appealing option for industries, power generation, and transportation in remote or off-grid locations.

Furthermore, small-scale LNG systems contribute to improved energy security by providing a reliable and diversified energy supply. This is particularly important for regions that are dependent on a single energy source or are prone to supply disruptions. A study by the Council on Energy, Environment and Water (CEEW) in "Small-scale LNG Price Competitive with Diesel, LPG in India: CEEW" from April 2021 suggests that small-scale LNG can be delivered at prices competitive with diesel and LPG for industrial use in India. The ability of small-scale LNG to offer both economic benefits and a stable energy supply strongly contributes to its growing appeal and market growth.

Segmental Insights

Mode of Supply Analysis

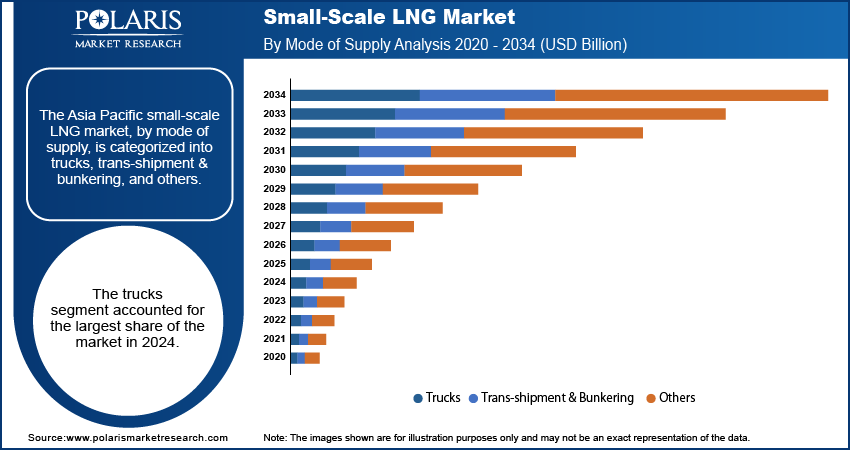

The trucks segment held the largest share of the market in 2024 as trucks offer unparalleled flexibility in delivering LNG to various end users, especially in areas without pipeline infrastructure. They are crucial for supplying LNG to industrial facilities, power plants, and vehicle refueling stations located in remote or off-grid regions. The ability of trucks to reach diverse locations quickly and with relatively lower initial investment compared to building pipelines makes them a preferred mode of supply.

The trans-shipment and bunkering segment is anticipated to grow at the highest growth rate during the forecast period. This surge is largely driven by the increasing adoption of LNG as a marine fuel due to tightening environmental regulations in the shipping industry. Trans-shipment facilities allow for the transfer of LNG from larger vessels to smaller ones, making it possible to deliver LNG to minor ports or remote islands. Bunkering, on the other hand, involves supplying LNG directly to ships for fuel. The rise in LNG-fueled ships and the establishment of dedicated bunkering infrastructure in ports worldwide are significant factors.

Type Analysis

The liquefaction terminal segment held the largest share in 2024. These terminals are crucial for converting natural gas into its liquid form, which significantly reduces its volume and enables efficient storage and transportation to areas without direct pipeline access. This makes them crucial for monetizing stranded gas reserves and supplying cleaner energy to remote industries, communities, and off-grid power generation. For instance, in March 2024, GAIL (India) Limited commissioned its first small-scale LNG unit at its Vijaipur site in Madhya Pradesh, with a capacity to produce 36 tonnes of LNG per day, demonstrating the ongoing investments in liquefaction capabilities.

The regasification terminal segment is anticipated to register the highest growth rate during the forecast period. Regasification terminals are vital for converting the transported LNG back into gaseous natural gas for end-use consumption. As more industries, power generators, and transportation sectors adopt LNG, the need for efficient and strategically located regasification facilities increases. These terminals, often smaller than large-scale import terminals, are crucial for making LNG readily available at consumption points. The increasing global awareness about the environmental impact of traditional fossil fuels further drives the demand for regasification terminals, as more regions seek cleaner energy alternatives for their immediate needs.

Application Analysis

The transportation segment held the largest share in 2024, as LNG is increasingly being adopted as a cleaner fuel for various types of vehicles, particularly heavy-duty trucks, buses, and marine vessels. The drive to reduce carbon emissions and air pollution from the transportation sector, along with the availability of LNG-powered engines, has made it a popular alternative to traditional fuels such as diesel and heavy fuel oil.

The power generation segment is anticipated to register the highest growth rate during the forecast period. Small-scale LNG is becoming a crucial energy source for generating electricity, especially in remote areas or islands that are not connected to national power grids. It offers a cleaner and more flexible alternative to diesel or other fossil fuels for off-grid power plants and backup power systems.

Regional Analysis

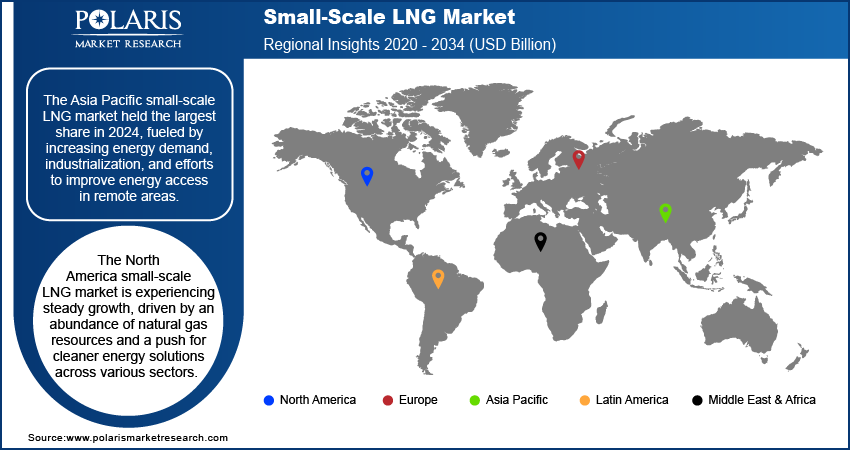

The Asia Pacific small-scale LNG market held the largest share in 2024 and is a rapidly expanding market for small-scale LNG, fueled by rising energy demand, rapid industrialization, and increasing efforts to improve energy access in remote areas. Many countries in this region have vast archipelagos or remote inland regions where extending large gas pipelines is impractical. Small-scale LNG offers a viable solution for providing energy to these isolated communities for power generation and industrial use. Additionally, the growing awareness of environmental concerns is driving the adoption of LNG as a cleaner fuel for transportation across the region.

China Small-Scale LNG Market Trends

The market in China stands out as a major player in Asia Pacific. The country's strong economic growth and its significant efforts to combat air pollution are key drivers. China has extensively developed its small-scale LNG infrastructure, including liquefaction plants and truck delivery networks, to supply natural gas to industries, power plants, and a rapidly expanding fleet of LNG-fueled vehicles. The government's policies promoting natural gas consumption and emissions reduction strongly support the continued growth in China.

North America Small-Scale LNG Market Overview

The North America market is experiencing steady growth, driven by an abundance of natural gas resources and a push for cleaner energy solutions across various sectors. The region has a well-developed natural gas pipeline network, but small-scale LNG offers a flexible solution for off-grid industrial users, remote communities, and the growing demand for LNG as a transportation fuel. The use of LNG in heavy-duty vehicles, marine bunkering, and localized power generation facilities is contributing to this expansion. This market benefits from ongoing infrastructure development and technological advancements that improve the efficiency and cost-effectiveness of small-scale LNG operations.

U.S. Small-Scale LNG Market Insight

In North America, the U.S. is a dominant market, largely due to its significant domestic natural gas production, particularly from shale gas. This abundant and relatively inexpensive supply makes LNG an attractive alternative to other fuels for a range of applications. The U.S. market sees strong demand from industrial users, particularly in manufacturing and mining, as well as a growing adoption in the transportation sector for long-haul trucking and marine vessels. The nation's focus on reducing emissions and increasing energy independence further supports the expansion of small-scale LNG infrastructure and usage.

Europe Small-Scale LNG Market

Europe is a key region for the small-scale LNG market, driven by its strong commitment to decarbonization and energy diversification. With a considerable focus on reducing reliance on pipeline gas and promoting cleaner transportation, there is a growing adoption of LNG as a marine fuel and for heavy-duty road transport. European countries are actively investing in bunkering infrastructure and encouraging the conversion of fleets to LNG to meet strict environmental targets. The market also sees demand from industries located in areas without direct pipeline access, utilizing small-scale LNG for power generation and industrial processes.

Germany Small-Scale LNG Market Assessment

As a major economy in Europe, Germany is playing an increasingly important role in the field of small-scale LNG. The country's strong environmental agenda and its strategic move away from traditional fossil fuels are driving the adoption of LNG, particularly in its maritime sector. German ports are developing LNG bunkering capabilities, and there is a growing interest in LNG as a fuel for heavy-duty transport to comply with national and European emission regulations. The German government's support for cleaner energy solutions and the expansion of LNG infrastructure further contribute to the market growth in the country.

Key Players and Competitive Insights

The small-scale LNG market is characterized by a mix of established energy companies and specialized technology providers. Competition often revolves around offering complete solutions, from liquefaction and storage to distribution and end-use applications. Companies are focusing on innovation in modular designs, improving cost-effectiveness, and expanding their supply networks to cater to the diverse needs of industrial, transportation, and power generation sectors. Strategic partnerships and regional expansions are common strategies employed to gain a stronger foothold in this evolving industry.

Shell plc; Linde plc; Wärtsilä Corporation; Honeywell International Inc.; TotalEnergies SE; ENGIE SA; Chart Industries, Inc.; Gasum Oy; Sofregaz; Excelerate Energy Inc.; and Chiyoda Corporation are among the prominent companies in the industry.

Key Players

- Chart Industries, Inc.

- Chiyoda Corporation

- ENGIE SA

- Excelerate Energy Inc.

- Gasum Oy

- Honeywell International Inc.

- Linde plc

- Shell plc

- Sofregaz

- TotalEnergies SE

- Wärtsilä Corporation

Industry Developments

July 2024: DESFA, Greece’s gas transmission system operator, announced its plans to inaugurate a new small-scale LNG station in Aspro Skydras to boost the regional LNG supply for the transportation and industrial sectors.

July 2024: New Fortress Energy (NFE) reached an agreement to sell its small-scale liquefaction and storage facility in Miami, Florida. The transaction, expected to close in the third quarter of 2024 pending standard conditions, involves a site capable of processing 100,000 gallons of natural gas per day.

Small-Scale LNG Market Segmentation

By Mode of Supply Outlook (Revenue – USD Billion, 2020–2034)

- Trucks

- Trans-shipment & Bunkering

- Others

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Liquefication Terminal

- Regasification Terminal

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Transportation

- Industrial Feedstock

- Power Generation

- Other Applications

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Small-Scale LNG Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 57.93 billion |

|

Market Size in 2025 |

USD 65.78 billion |

|

Revenue Forecast by 2034 |

USD 210.56 billion |

|

CAGR |

13.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 57.93 billion in 2024 and is projected to grow to USD 210.56 billion by 2034.

The global market is projected to register a CAGR of 13.8% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few key players in the market include Shell plc; Linde plc; Wärtsilä Corporation; Honeywell International Inc.; TotalEnergies SE; ENGIE SA; Chart Industries, Inc.; Gasum Oy; Sofregaz; Excelerate Energy Inc.; and Chiyoda Corporation.

The trucks segment accounted for the largest share of the market in 2024.

The regasification terminal segment is expected to witness the fastest growth during the forecast period.