Smart Airports Market Size, Share, & Industry Analysis Report

: By Component (Hardware, Software, and Services), By Infrastructure, By Solution, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 120

- Format: PDF

- Report ID: PM1581

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

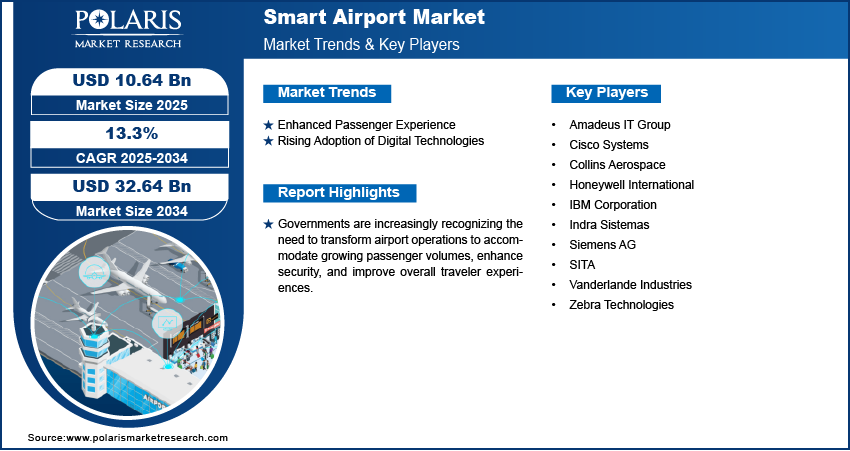

The smart airports market size was valued at USD 8.39 billion in 2024, growing at a CAGR of 9.8% during 2025–2034. The market is driven by rising air traffic, demand for seamless travel, airport modernization efforts, and the adoption of advanced digital technologies.

Key Insights

- The hardware segment leads the market due to heavy investments in physical infrastructure such as security systems, kiosks, and baggage handling.

- Security systems hold the largest share, reflecting a strong industry focus on advanced surveillance, threat detection, and passenger safety.

- Aeronautical operations hold a larger share, driven by the adoption of technologies that enhance navigation, communication, and flight safety.

- North America leads the market due to advanced infrastructure, high air traffic, and early adoption of smart airport technologies.

- Asia Pacific is expected to register the fastest growth, fueled by airport development, rising passenger volumes, and strong government support for modernization.

Industry Dynamics

- Increasing air passenger traffic requires efficient operations, driving demand for automation, real-time data, and streamlined airport processes.

- Focus on enhanced passenger experience and improved security systems fuels investment in smart technologies across airport infrastructure.

- Growth in non-aeronautical services such as retail and digital services within airports is expanding revenue streams beyond core operations.

- High infrastructure investment and integration complexity can hinder the adoption of smart technologies, especially in developing regions.

Market Statistics

2024 Market Size: USD 8.39 billion

2034 Projected Market Size: USD 21.31 billion

CAGR (2025–2034): 9.8%

North America: Largest market in 2024

AI Impact on Smart Airports Market

- AI enhances airport efficiency by automating processes such as check-in, baggage handling, and security screening, reducing wait times and congestion.

- It enables real-time data analysis for predictive maintenance and operational decision-making, minimizing delays and equipment failures.

- AI improves passenger experience through personalized services, such as smart navigation, tailored notifications, and dynamic queue management.

- Security is strengthened with AI-powered surveillance, facial recognition, and threat detection systems, ensuring safer and more responsive airport environments.

To Understand More About this Research: Request a Free Sample Report

A smart airport utilizes advanced technologies to enhance operational efficiency, improve passenger experience, and bolster security measures. These airports implement interconnected systems, leveraging technologies such as the Internet of Things (IoT), artificial intelligence (AI), and data analytics to optimize processes. This includes streamlining check-in, security screening, and baggage handling, reducing wait times, and providing real-time updates to passengers. The integration of these technologies creates a seamless and intelligent airport ecosystem, offering personalized services and improving overall satisfaction. Smart airports are revolutionizing air travel by focusing on automation, data-driven insights, and enhanced connectivity.

The increasing volume of air passengers globally necessitates smarter airport operations to manage the flow efficiently. The demand for enhanced passenger experiences, including real-time information and reduced wait times, pushes airports to adopt advanced technologies. Furthermore, the rising focus on security and the need for optimized operations contribute to the expansion. Government investments in modernizing airport infrastructure and the increasing adoption of digital technologies across all sectors further fuel the growth.

Market Dynamics

Increasing Air Passenger Traffic Demands Efficient Operations

The continuous growth in global air passenger traffic boosts the demand for smart airport solutions. Airports worldwide are facing increasing pressure to handle larger volumes of passengers efficiently without compromising safety or the passenger experience. According to a report by the Airports Council International (ACI), global passenger traffic was projected to double over the next two decades in their 2023 long-term forecast. Global passenger traffic has recovered and surpassed pre-pandemic levels in 2024, marking a new era of growth. By November 2024 year-to-date, global passenger traffic increased by 8% year-on-year (YoY), reaching 103% of the November 2019 year-to-date level. Looking ahead, global passenger traffic is forecast to reach 9.9 billion in 2025 with a 4.8% YoY growth rate. This surge in air travel necessitates the adoption of smart technologies to optimize airport operations, including check-in processes, security screenings, baggage handling, and gate management. Smart airport solutions, such as self-service kiosks, automated baggage systems, and intelligent security systems, enhance throughput and reduce congestion. Consequently, the need to manage escalating passenger numbers effectively is a key factor propelling the growth.

Heightened Focus on Passenger Experience and Satisfaction

Modern air travelers increasingly expect a seamless and convenient airport experience. Technologies that provide real-time flight information, personalized services, and efficient navigation within the airport are becoming essential. A study published in the journal Transportation Research Part C: Emerging Technologies in 2021 by researchers from the National Center for Transportation Systems Productivity and Management (NCTSPM) highlighted that passengers value real-time information and efficient processes as key determinants of their airport experience. Smart airport initiatives, such as mobile applications for wayfinding and flight updates, self-boarding gates, and personalized retail offers, directly address these expectations. Therefore, the imperative to elevate passenger experience and satisfaction is significantly driving the adoption of smart airport solutions.

Enhanced Security Concerns and Regulatory Compliance

Governments and aviation authorities worldwide are continuously updating security protocols to address emerging threats. Smart airport technologies play a crucial role in enhancing security through advanced surveillance systems, biometric system identification, and sophisticated screening processes. The Transportation Security Administration (TSA) in the US has been actively deploying advanced imaging technology and credential authentication technology at airport checkpoints, as highlighted in various official announcements and reports since 2021. These technologies improve threat detection capabilities and streamline security procedures. Thus, the increasing emphasis on robust security measures and adherence to stringent regulations fuels the demand for smart airports.

Segment Insights

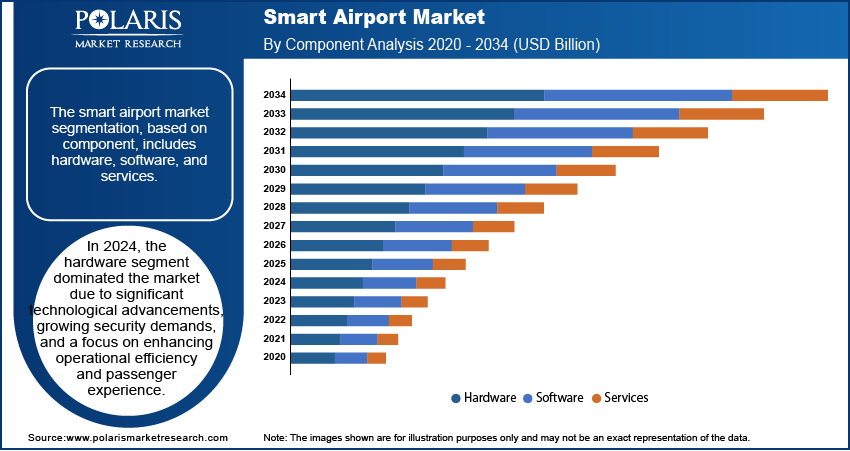

Market Assessment – By Component

The smart airports market, by component, is segmented into hardware, software, and services. The hardware segment holds the largest share. This dominance is primarily attributed to the substantial investments in physical infrastructure upgrades required for smart airport functionalities. These include the deployment of advanced equipment such as automated baggage handling systems, self-service kiosks, sophisticated security screening devices, and digital signage. The tangible nature and the scale of these installations necessitate significant capital expenditure, thereby contributing to the hardware segment's leading share.

The software segment is anticipated to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by the increasing need for intelligent systems to manage and analyze the vast amounts of data generated by connected airport devices. Software solutions are crucial for optimizing operational efficiency, enhancing passenger experiences through personalized airport services, and improving security through advanced analytics. The demand for sophisticated platforms that enable seamless integration of various airport systems, provide real-time insights, and facilitate predictive maintenance is fueling the robust growth of the software segment.

Market Evaluation – By Infrastructure

The smart airports market, by infrastructure, is segmented into communication systems, air/ground traffic control, security systems, passenger, cargo & baggage ground handling control, endpoint devices, and others. Currently, the security systems segment accounts for the largest share. This significant share is a reflection of the paramount importance placed on safety and security within the aviation industry. Substantial investments are consistently directed in implementing advanced security measures, including sophisticated surveillance technologies, access control systems, and threat detection equipment. The critical nature of ensuring passenger safety and airport security makes this infrastructure segment the most substantial in terms of investment.

The endpoint devices infrastructure segment is projected to experience the highest growth rate during the forecast period, fueled by the increasing deployment of various connected devices throughout the airport ecosystem aimed at enhancing both operational efficiency and passenger experience. These devices include self-service kiosks, digital signage, point-of-sale terminals, and various sensors and beacons for data collection and passenger interaction. As airports strive to create more connected and data-driven environments, the demand for these endpoint devices is expected to increase in the coming years.

Market Evaluation – By Solution

The smart airports market, by solution, is segmented into terminal side, air side, and landside. Presently, the terminal side solution segment holds the largest share. This dominance stems from the extensive implementation of technologies aimed at improve passenger flow management and experience at the airport terminals. Investments in automated check-in kiosks, advanced baggage handling systems, digital signage for wayfinding and information dissemination, and sophisticated security screening technologies contribute significantly to the substantial share held by the terminal side segment.

The air side solution segment is anticipated to record the highest growth rate during the forecast period. This rapid expansion is driven by the increasing adoption of smart technologies focused on enhancing operational efficiency and safety on the airfield. This includes solutions for air traffic management, ground operations optimization, predictive maintenance of airport assets, and drone-based surveillance. The growing emphasis on improving turnaround times, reducing operational costs, and enhancing safety protocols on the air side is fueling the accelerated growth of this segment.

Market Evaluation– By Application

The smart airports market, by application, is segmented into aeronautical operations and non-aeronautical operations. Currently, the aeronautical operations segment holds a larger share, owing to the extensive implementation of advanced technologies aimed at optimizing core aviation processes. These include air traffic management systems, communication and navigation systems, and solutions for enhancing safety and efficiency in aircraft operations on the ground and in the air. The fundamental importance of these applications to the functioning of an airport contributes to the substantial share of the aeronautical operations segment.

The non-aeronautical operations application segment is projected to experience the highest growth rate during the forecast period. This rapid growth is driven by the increasing focus on enhancing passenger experience and generating revenue from non-flight-related services. This includes the deployment of smart solutions for retail, food and beverage services, parking management, and advertising within the airport premises. As airports increasingly recognize the potential of these areas to improve customer satisfaction and generate additional revenue streams, the adoption of smart technologies in non-aeronautical operations is accelerating, leading to the highest growth in this segment.

Regional Footprint

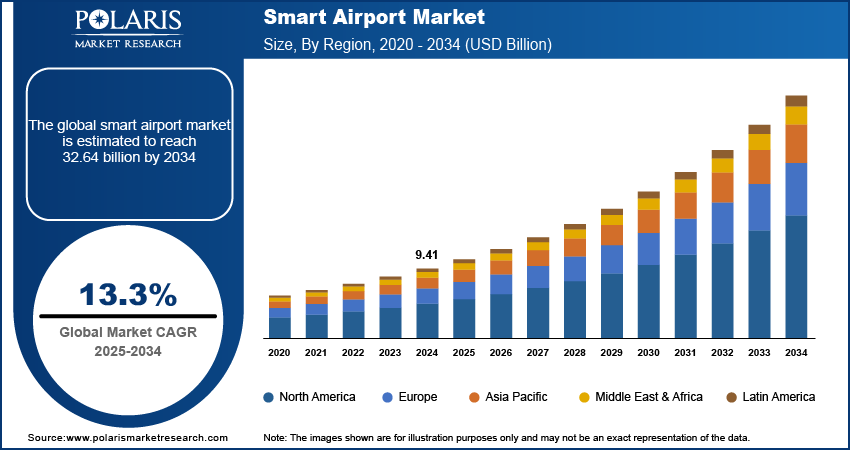

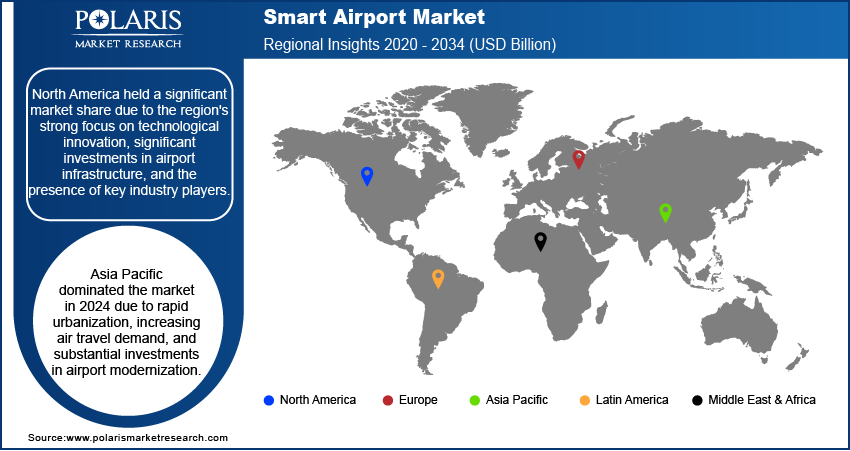

The smart airports market demonstrates a global presence, with key regions exhibiting varying levels of adoption and growth. North America and Europe have been early adopters of smart airport technologies, driven by stringent regulations, the presence of technologically advanced infrastructure, and a strong focus on enhancing passenger experience. The Asia Pacific region is emerging as a significant market, fueled by rapid airport infrastructure development and increasing air passenger traffic. Latin America and the Middle East & Africa are also witnessing growing interest in smart airport solutions as they invest in modernizing their aviation infrastructure.

North America holds the largest share, owing to the region's well-established airport infrastructure and the early implementation of advanced technologies across various airport operations. A strong emphasis on security, coupled with significant investments in airport modernization initiatives and a high volume of air traffic, has solidified North America's leading position. The presence of major technology providers and stringent regulatory frameworks further contributes to the region's substantial share.

The Asia Pacific smart airports market is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by substantial investments in new airport construction and the modernization of existing infrastructure across the region, particularly in countries such as China, India, and Southeast Asian nations. The burgeoning air passenger traffic, coupled with a growing focus on technological advancements and the desire to enhance passenger experience, is fueling the accelerated adoption of smart airport solutions in the region. Government initiatives supporting airport development and the increasing penetration of digital technologies are also significant growth factors for this region.

Key Players and Competitive Insights

A few of the major players active in the smart airports market are SITA, Thales, Amadeus IT Group SA, Indra Sistemas SA, Collins Aerospace (RTX Corporation), Siemens AG, NEC Corporation, IBM Corporation, ADB SAFEGATE, and Honeywell International Inc. These companies offer a range of solutions and services designed to enhance airport operations, improve passenger experiences, and bolster security through the integration of advanced technologies.

The competitive landscape is characterized by a mix of global technology providers, specialized aviation technology firms, and multinational corporations. Competition is driven by factors such as technological innovation, the breadth of product and service offerings, the ability to integrate solutions seamlessly with existing airport infrastructure, and the provision of customized solutions to meet specific airport needs. Key competitive strategies include forming strategic partnerships and collaborations, focusing on research and development to introduce advanced technologies, and expanding geographical presence to capitalize on the growing demand across different regions.

SITA, headquartered in Geneva, Switzerland, provides a wide array of IT and telecommunication solutions specifically for the air transport industry. Their offerings include passenger processing solutions, baggage management systems, airport operations management, and air traffic control solutions.

Thales, with its headquarters in Courbevoie, France, offers integrated solutions across various domains, including aerospace, security, and digital identity. Thales provides solutions such as advanced security systems, including biometric identification and access control, air traffic management systems, and passenger experience enhancement technologies.

List of Key Companies

- ADB SAFEGATE

- Amadeus IT Group SA

- Collins Aerospace (RTX Corporation)

- Honeywell International Inc.

- IBM Corporation

- Indra Sistemas SA

- NEC Corporation

- Siemens AG

- SITA

- Thales

Smart Airports Industry Developments

- April 2025: Amadeus announced a collaboration with Vancouver International Airport (YVR) to implement its cloud-based passenger handling platform. This deployment aims to streamline passenger processing, enhance operational efficiency, and provide a more seamless travel experience for passengers at YVR.

- November 2024: Collins Aerospace (part of RTX Corporation) secured a contract with a major airport in the Middle East to deploy its advanced ARINC airport operational database and resource management system.

Smart Airports Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Infrastructure Outlook (Revenue – USD Billion, 2020–2034)

- Communication Systems

- Air/Ground Traffic Control

- Security Systems

- Passenger

- Cargo & Baggage Ground Handling Control

- Endpoint Devices

- Others

By Solution Outlook (Revenue – USD Billion, 2020–2034)

- Terminal Side

- Air Side

- Landside

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Aeronautical Operations

- Non-Aeronautical Operations

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart Airports Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.39 billion |

|

Market Size Value in 2025 |

USD 9.19 billion |

|

Revenue Forecast by 2034 |

USD 21.31 billion |

|

CAGR |

9.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The smart airports market has been segmented into detailed segments of component, infrastructure, solution, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

A key growth strategy in the smart airports market involves emphasizing the tangible benefits of technological adoption, such as enhanced operational efficiency leading to cost savings and improved passenger satisfaction driving loyalty. Marketing efforts must focus on showcasing successful implementations and highlighting the return on investment for airports. Collaborations with airport authorities and technology providers are crucial for developing tailored solutions. Emphasizing data security and privacy will build trust among stakeholders. In addition, highlighting scalability and future-proofing of solutions will attract airports seeking long-term investments in their infrastructure.

FAQ's

The market size was valued at USD 8.39 billion in 2024 and is projected to grow to USD 21.31 billion by 2034.

The market is projected to register a CAGR of 9.8% during the forecast period.

North America had the largest share of the market.

A few of the major players include SITA, Thales, Amadeus IT Group SA, Indra Sistemas SA, Collins Aerospace (RTX Corporation), Siemens AG, NEC Corporation, IBM Corporation, ADB SAFEGATE, and Honeywell International Inc.

The hardware segment accounted for the largest share of the market in 2024.

Following are a few of the trends: ? Increasing Adoption of Biometrics: For seamless and secure passenger identification across various airport touchpoints such as check-in, security, and boarding. ? Advancements in Automation and Robotics: For tasks such as baggage handling, security screening, cleaning, and providing passenger assistance, improving efficiency and reducing the need for manual intervention. ? Leveraging Artificial Intelligence (AI) and Machine Learning: To enhance decision-making, personalize services, optimize operations such as passenger flow and baggage handling, and improve security through threat detection.

A smart airport is an airport that leverages advanced technologies, such as the internet of things (IoT), artificial intelligence (AI), big data analytics, and automation, to enhance operational efficiency, improve the passenger experience, and strengthen security. These technologies are integrated across various airport functions, from check-in and baggage handling to security screening, air traffic control, and terminal operations. The goal of a smart airport is to create a more seamless, efficient, and convenient travel experience for passengers while optimizing airport resources and ensuring safety and security.