Smart TV Market Size, Share, Trends, Industry Analysis Report

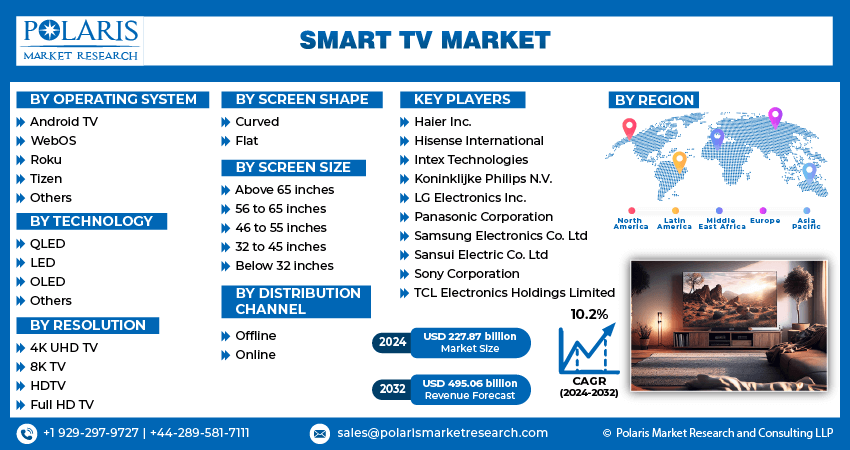

: By Operating System, By Technology, By Resolution, By Screen Shape, By Screen Size, By Distribution Channel, and By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) – Market Forecast, 2024 - 2032

- Published Date:Aug-2024

- Pages: 115

- Format: PDF

- Report ID: PM1095

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

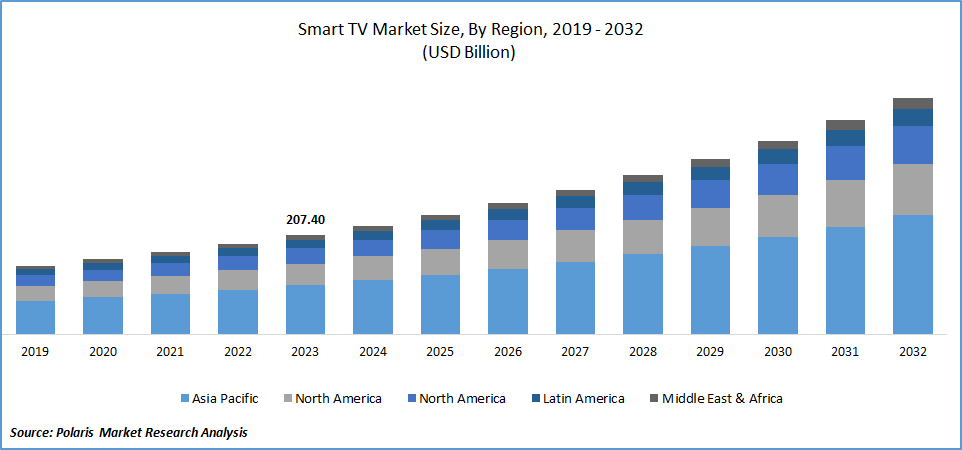

The global smart TV market size was valued at USD 207.40 billion in 2023. The market is projected to grow from USD 227.87 billion in 2024 to USD 495.06 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 10.2% during the forecast period.

The smart TV market refers to televisions that can connect to the internet and offer interactive features like streaming services, apps, and web browsing. It allows users to access a wide range of content-enhancing entertainment options and usability.

The smart TV market is growing rapidly as it allows users to access a wide range of functions, such as downloading apps, streaming video, and purchasing content directly on the television. In addition, leading manufacturers offer a variety of smart TVs, with options ranging from entry-level to high-end models, each with different features and quality, all at affordable prices. This variety appeals to a wider consumer base and contributes to the smart TV market growth.

To Understand More About this Research:Request a Free Sample Report

The rise of video-on-demand (VoD) has significantly contributed to the growth of the smart TV market. Smart TVs now support a variety of popular video platforms, offering on-demand content. Users can browse the internet and use supported applications, including news channel apps, on their smart TVs.

For example, in March 2023, Samsung partnered with Sky News Australia to launch Sky News Now, a 24/7 channel available on Samsung smart TVs nationwide. The channel will feature content from various network channels such as Sky News, Sky News Weather, and Sky News Extra on Samsung's free ad-supported streaming TV platform.

Smart TV Market Trends

Integration of Artificial Intelligence in Smart TVs

The smart TV market is experiencing rapid growth, largely due to the integration of artificial intelligence (AI) in smart TVs. AI enhances the user experience and enables advanced features. AI-powered smart TVs analyze content to optimize picture quality and audio, providing exceptional visuals and sound.

AI allows smart TVs to recognize user preferences and provide personalized content recommendations, making it easier for viewers to discover new shows and movies. As consumer demand for advanced lifestyle features rises, the integration of AI in smart TVs continues to advance, driving market expansion.

For instance, in April 2024, Samsung introduced AI-driven Neo QLED 8K smart TVs in India, offering audio enhancing and image upscaling through on-device artificial intelligence. According to Samsung, these TVs, powered by TizenOS, come with features such as cloud gaming and an education hub, which can be accessed by connecting the smart TV with AI.

Advancements in Display Technology

The smart TV market is experiencing significant growth, driven by advancements in display technology, such as higher resolution (like 4K and 8K), improved color reproduction, and HDR (High Dynamic Range), enhancing the viewing experience.

The technologies offer sharper images, more vibrant colors, and better contrast, which appeal to consumers seeking superior picture quality for immersive entertainment and better compatibility with high-definition content from streaming services, driving the smart TV market revenue.

For instance, in April 2024, TCL introduced the Premium QD-Mini LED TVs series, integrated with Optical Technology, advanced AiPQ Pro, and ULTRA Processing, guaranteeing precise dimming zones and high-quality image processing. The technology boasts an impressive number of dimming zones exceeding 5,000, exceptional brightness reaching up to 5,000 Peak Nits, and QLED ULTRA with over 97% of DCI-P3 color gamut, full-color volume, and enhanced color accuracy.

Smart TV Market Segment Insights:

Smart TV Market Breakdown by Operating System Insights

The global market segmentation, based on the operating system, includes Android TV, webOS, Roku, Tizen, and others. The roku segment is expected to register the highest CAGR in the market during the forecast period, owing to its compatibility with Apple AirPlay. This feature allows users to easily stream movies, photos, music, and other content from an Apple device to a smart TV.

Numerous smart TV companies are collaborating with Roku to offer built-in Roku software, eliminating the need for a separate set-top box. For instance, in July 2024, TCL, a manufacturer of smart TVs, released its streaming service, TCLtv Plus, on Roku devices and TCL smart TVs equipped with the Roku TV operating system. Roku provides an exceptional user interface and a smooth viewing experience.

Smart TV Market Breakdown by Technology Insights

The global market segmentation, based on technology, includes QLED, LED, OLED, and others. The QLED category dominated the market in 2023 due to the quantum dots technology which is characterized for its durability, stability, inorganic nature, and ability to enhance color and brightness.

The rising demand for this product has prompted industry leaders to introduce new products utilizing QLED technology. For instance, in July 2024, Hisense introduced an advanced lineup of smart TVs, including QLED, Mini LED, Google TV, and 4K smart TVs. QLED features a full array of local dimming, quantum dot color, and Dolby vision, and atmos technologies to provide exceptional visuals, smooth performance, and premium audio quality.

Global Smart TV Market, Segmental Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Smart TV Market Breakdown by Regional Insights

By region, the study provides the market insights into North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Smart TV market in Europe is expected to register a significant CAGR over the forecast period, mainly attributed to the infrastructure developments in broadband internet and telecommunications that have facilitated the adoption of streaming services and smart TV functionalities.

For instance, in June 2024, NetRange, a German provider of smart TV solutions, incorporated OKAST's collection of FAST Channels. OKAST aims to broaden its selection of channels in order to offer customized content to viewers, highlighting the diverse European programming that resonates with their cultural background.

Smart TV partnerships are also driving the United Kingdom smart TV market by enhancing content diversity, technological integration, and consumer engagement. Partnerships between smart TV manufacturers and content providers, such as streaming platforms and app developers, enable seamless integration of popular apps and services directly into smart TV interfaces, improving user experience.

For instance, in September 2019, Amazon partnered with Dixons Carphone in the U.K. to distribute Fire TV Edition smart TVs under the JVC brand. The JVC products were available in three models, with features such as HDR10 and Dolby Vision support.

Global Smart TV Market, Regional Coverage, 2019 - 2032 (USD billion)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

The Asia Pacific smart TV market dominated the market in 2023 due to a significant portion of the global population, providing a large consumer base. The rapid urbanization and rising disposable incomes in countries like China, India, and South Korea have spurred demand for smart TVs in this region.

The key market players are acquiring, expanding, and collaborating to strengthen their market presence and to serve better offerings in Asia Pacific, further driving the market during the forecast period.

For instance, in March 2024, Kodak expanded its range of smart TVs in the Indian market by introducing three new HD LED TVs as part of the SE series. The company unveiled three different models, including 24-inch, 32-inch, and 43-inch options, with affordable pricing to cater to the Asian consumer base.

Moreover, China’s smart TV market held the largest market share in 2023, driven by the development of advanced technologies and high-performing smart TVs. For instance, in February 2024, Skyworth introduced its latest A4E series of 4K TVs in China, budget-friendly, high-quality smart TVs.

Smart TV Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the smart TV market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the smart TV industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global smart TV industry to benefit clients and increase the market sector. In recent years, the smart TV industry has offered some technological advancements. Major players in the smart TV market, including Haier Inc., Hisense International, Intex Technologies, Koninklijke Philips N.V., LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co. Ltd, Sansui Electric Co. Ltd, Sony Corporation, and TCL Electronics Holdings Limited.

Sansui Electric Co., Ltd. is a Japanese consumer electronics company that manufactures a wide range of products, including TVs, home theater systems, audio equipment, home appliances, and more. The company has branches and R&D centers in over 80 countries and a sales market in more than 100 countries across Southeast Asia, Europe, Oceania, and other regions. Sansui was founded in 1944. In August 2022, Sansui launched a new series of Android TVs, including a 43-inch UHD TV, a 50-inch UHD TV, a 43-inch FHD TV, a 55-inch UHD TV, a 32-inch HD TV, and a 40-inch FHD TV available starting at Rs. 16,590 in India.

TCL Electronics Holdings Limited is a global consumer electronics company. The company’s product portfolio includes televisions, mobile devices, home appliances, and other smart technology products. TLC also provides smart TV ecosystem services and home internet services. The company has manufacturing facilities in Mexico, China, and Vietnam and a sales network spanning over 160 countries. In May 2024, TCL Electronics introduced a new range of products, including QD-Mini LED TV and smart home appliances across different categories designed specifically for the African and Middle East markets during the launch event held in Turkey.

List of Key Companies in Smart TV Market

- Haier Inc.

- Hisense International

- Intex Technologies

- Koninklijke Philips N.V.

- LG Electronics Inc.

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sansui Electric Co. Ltd

- Sony Corporation

- TCL Electronics Holdings Limited

Smart TV Industry Developments

- June 2024: Freely, the streaming service from UK broadcasters collaborated with four smart TV manufacturers, Toshiba, Sharp, Panasonic, and Metz, allowed users to access the connected TV app on the latest smart TV models.

- June 2024: Panasonic collaborated with Amazon Fire TV to offer customized, high-quality images and sound for enhanced experiential value for smart TVs.

- June 2023: Xiaomi India introduced the Smart TV A-series, equipped with Dolby Audio, DTS: Virtual X, and Vivid Picture Engine, enhancing the overall entertainment experience by broadening its range of smart TVs.

Smart TV Market Segmentation

Smart TV Operating System Outlook

- Android TV

- WebOS

- Roku

- Tizen

- Others

Smart TV Technology Outlook

- QLED

- LED

- OLED

- Others

Smart TV Resolution Outlook

- 4K UHD TV

- 8K TV

- HDTV

- Full HD TV

Smart TV Screen Shape Outlook

- Curved

- Flat

Smart TV Screen Size Outlook

- Above 65 inches

- 56 to 65 inches

- 46 to 55 inches

- 32 to 45 inches

- Below 32 inches

Smart TV Distribution Channel Outlook

- Offline

- Online

Smart TV Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Smart TV Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 207.40 billion |

|

Market size value in 2024 |

USD 227.87 billion |

|

Revenue Forecast in 2032 |

USD 495.06 billion |

|

CAGR |

10.2% from 2024 – 2032 |

|

Base Year |

2023 |

|

Historical Data |

2019 – 2022 |

|

Forecast Period |

2024 – 2032 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global smart TV market size was valued at USD 207.40 billion in 2023 and is projected to be valued at USD 495.06 billion in 2032

The global market is projected to grow at a CAGR of 10.2% during the forecast period, 2024-2032

Asia-Pacific held the largest share of the global market

• The key players in the market are Haier Inc., Hisense International, Intex Technologies, Koninklijke Philips N.V., LG Electronics Inc., Panasonic Corporation, Samsung Electronics Co. Ltd, Sansui Electric Co. Ltd, Sony Corporation, and TCL Electronics Holdings Limited.

The roku category is expected to grow at the highest CAGR in the global market

The QLED held the largest share in the global market.