Social Platforms for Commerce Market Size, Share, Trends, Industry Analysis Report

: By Platform Type (Social Networking Sites, Video Sharing Platforms, Messaging Apps, and Others), Business Model, Product Category, and Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 128

- Format: PDF

- Report ID: PM5620

- Base Year: 2024

- Historical Data: 2020-2023

Social Platforms for Commerce Market Overview

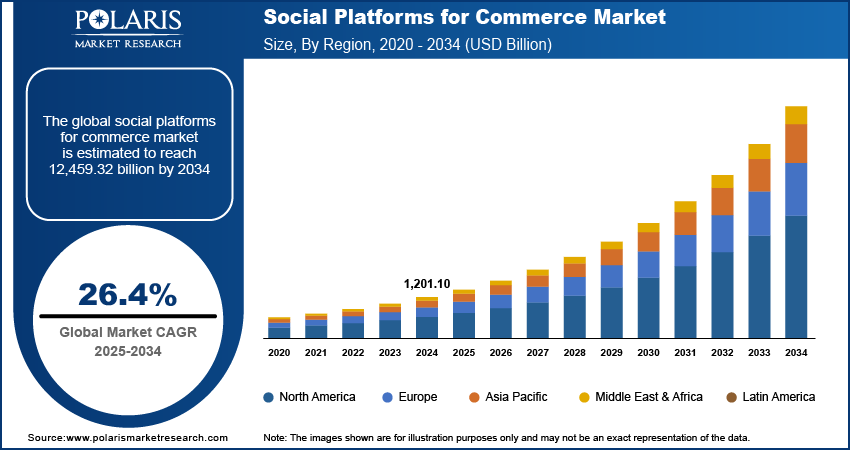

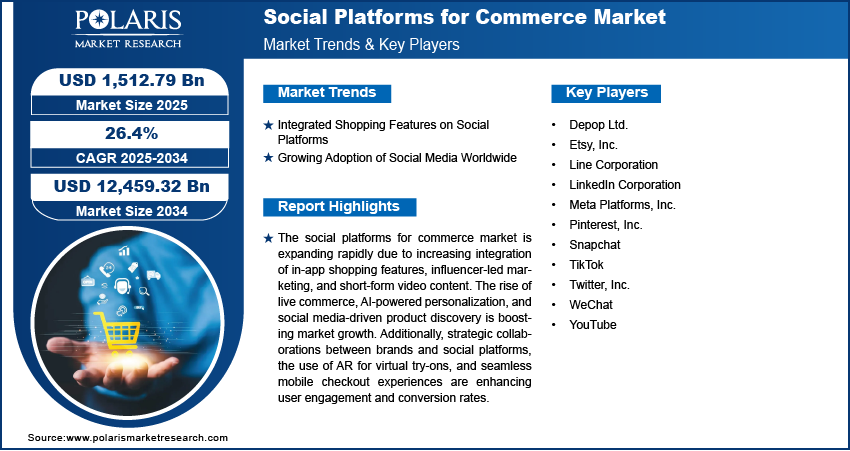

Social platforms for commerce market size was valued at USD 1,201.10 billion in 2024. The market is projected to grow from USD 1,512.79 billion in 2025 to USD 12,459.32 billion by 2034, exhibiting a CAGR of 26.4% during 2025–2034.

The market refers to the use of social media networks as platforms for buying and selling products or services. These platforms integrate shopping features such as product listings, in-app purchases, and direct messaging between buyers and sellers. They help brands to connect with consumers through interactive content, influencer promotions, and personalized recommendations. This market combines social interaction with digital retail, transforming how businesses reach and convert their audiences online.

The market demand is growing rapidly due to the increasing integration of e-commerce tools within social media platforms and the rising use of smartphones globally. Platforms such as Instagram, TikTok, and Facebook are introducing shopping features, allowing users to discover and purchase products directly without leaving the app. This seamless experience is boosting the market expansion. Additionally, the widespread use of mobile devices makes it easy for people to browse and shop on social platforms anytime, which is contributing to the market growth. These factors are driving brands to invest more in social commerce strategies, helping reach to broader audience.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Integrated Shopping Features on Social Platforms

Integrated shopping features allow users to browse, interact, and purchase products directly within social media platforms. This innovation is a key driver of the global market growth, as it removes the need to switch between multiple apps or websites during the buying process.

Platforms such as Instagram, TikTok, Facebook, and YouTube have added tools such as in-app checkouts, product tagging, and live shopping. These tools allow users to discover and buy products without leaving the app. This seamless experience reduces friction and encourages faster purchase decisions. As per the data published by Cube Asia, a leading e-commerce company, in first year of TikTok launched, TikTok Shop GMV reached millions of dollars in total merchandise volume, and helped small businesses reach millions of users instantly, thus boosting sales and visibility. These features also give brands deeper insights into customer behavior, helping them optimize content and increase their market share. With rising user engagement, transaction volumes are increasing, directly impacting the market size.

Growing Adoption of Social Media Worldwide

Millions of users are actively engaged on social media platforms such as Instagram, Facebook, TikTok, Pinterest, and YouTube for communication, entertainment, and shopping. According to the recent statistics published by Exploding Topics is a Trademark of Semrush Inc, in 2024, the typical internet user has spent about 6 hours and 40 minutes online each day. This is a slight increase from the 6 hours and 31 minutes recorded in 2023. A large part of this time is spent on social media platforms. Among them, Instagram was the most favored, with 16.5% of internet users aged 16 to 64 considering it their preferred platform, surpassing WhatsApp, which stands at 16.1%. This data underscores the growing adoption of social media into daily life and its expanding role in global commerce.

Owing to the increasing penetration of social media platforms, both consumers and businesses embrace social media as a key shopping channel. In August 2021, Shopify and TikTok partnered and allowed small businesses to create shoppable videos. Thus, the rising adoption of social media is boosting the market demand.

Segment Insights

Market Breakdown by Platform Type Insights

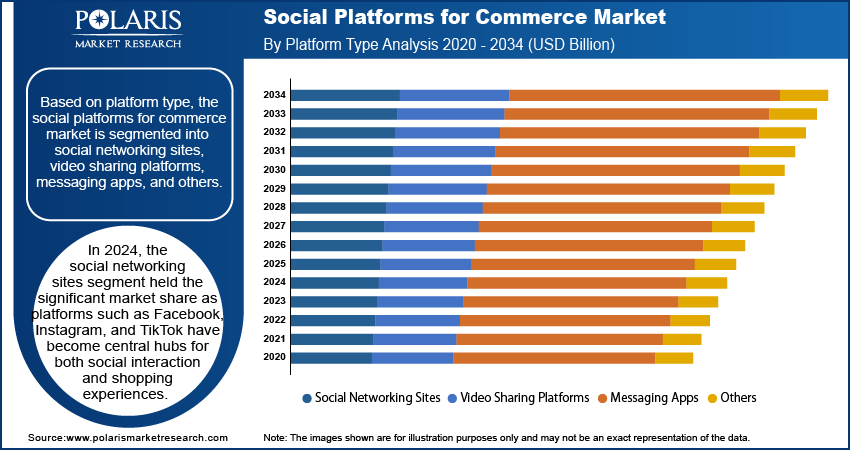

In terms of platform type, the market is segmented into social networking sites, video sharing platforms, messaging apps, and others. In 2024, the social networking sites segment held the significant market share within the global market. This is due to the platforms such as Facebook, Instagram, and TikTok have become central hubs for both social interaction and shopping experiences. These platforms offer seamless integration of shopping features, making it easy for users to discover and buy products without leaving the app. For instance, Instagram’s "Shop" feature, allows businesses to showcase their products directly on their profiles and in users’ feeds. This reflects a major shift in social platforms for commerce market trends, where consumers prefer convenience and personalized recommendations. Also, social networking sites have the highest number of active users globally, which boosts visibility and trust in products. Therefore, social networking is seen as the most promising segment in the market for businesses aiming to grow their digital sales.

Market Breakdown by Product Category Insights

On the basis of product category, the market has been segmented into fashion & apparel, beauty & personal care, home décor & furniture, electronics & gadgets, food & beverage, health & wellness, and others. In 2024, the fashion & apparel segment held the significant market share. This dominance is attributed to high engagement levels on platforms such as Instagram, TikTok, and Facebook, where visual content plays a big role in influencing shopping decisions. These platforms have become ideal for showcasing clothing, styling ideas, and influencer-led promotions. The fashion & apparel segment has gained massive traction due to its strong reliance on visual storytelling and influencer marketing, which strongly appeal to Gen Z and millennials.

Brands such as Zara and Shein used TikTok’s live shopping features to boost visibility and sales during seasonal campaigns. Also, fashion brands benefit the most from user-generated content and peer recommendations. Therefore, this segment contributed significantly to the overall market revenue.

Regional Insights

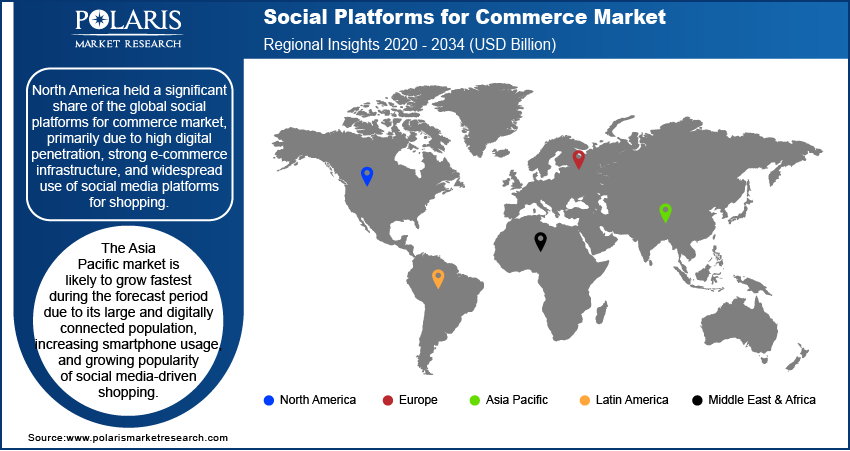

By region, the study provide insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In 2024, North America held a significant share of the global market revenue, primarily due to high digital penetration, strong e-commerce infrastructure, and widespread use of social media platforms for shopping. Consumers in the US and Canada are early adopters of new technologies and actively engage with brands through features such as in-app purchases, live shopping, and shoppable posts. The presence of leading platforms such as Meta and Pinterest, which continuously enhance commerce features, has further driven regional growth. Retailers increasingly use Instagram Shops and Facebook Marketplace to convert social engagement into direct sales. In May 2024, Nike expanded its digital strategy by leveraging Instagram Shops to showcase limited-edition products and exclusive drops directly on the platform. By integrating shoppable tags into influencer content and using Instagram’s in-app checkout feature, Nike was able to drive direct sales without requiring users to leave the app.

The Asia Pacific held a significant market share and is likely to grow fastest during the forecast period due to its large and digitally connected population, increasing smartphone usage, and growing popularity of social media-driven shopping. Countries such as China, India, and Indonesia are witnessing a surge in social commerce adoption as users spend more time on platforms such as WeChat, TikTok, and LINE. In 2024, Indian beauty brand Sugar Cosmetics used TikTok and YouTube Shorts to launch product tutorials linked to instant purchase options, thus driving its sales. This reflects strong social platforms for commerce market opportunities in the region.

Social Platforms for Commerce Market – Key Players & Competitive Insights

The market is highly competitive, fueled by major retail brands, direct-to-consumer startups, and tech-savvy digital marketers. Companies are constantly adopting innovative strategies such as integrating in-app shopping features, influencer collaborations, and AI-driven personalization to boost user engagement. Key competitive strategies include strategic brand partnerships, platform-exclusive product launches, seamless integration with mobile wallets, and enhanced user experiences through AR try-ons and chat-based customer service. These efforts contribute to market expansion and increased customer loyalty across digital channels. A few major players in the market include Meta Platforms, Inc.; TikTok; Pinterest, Inc.; YouTube; Snapchat; Twitter, Inc.; WeChat; Line Corporation; LinkedIn Corporation; Depop Ltd.; and Etsy, Inc.

Meta Platforms, Inc. is a leading American technology company headquartered in Menlo Park, California. Formerly known as Facebook, Inc., Meta rebranded in 2021 to reflect its broader focus on building the metaverse, a shared virtual environment. The company operates major social media platforms, including Facebook, Instagram, WhatsApp, and Messenger, serving billions of users worldwide. Meta is a dominant player in the market, leveraging features such as Facebook Shops and Instagram Checkout to integrate shopping experiences directly into social interactions. The company invests heavily in artificial intelligence, virtual reality, and augmented reality to enhance user engagement and enable immersive commerce experiences, contributing to its long-term growth and innovation strategy.

TikTok is a short-form video platform that has rapidly grown into one of the most influential social media apps globally. Launched internationally in 2018, TikTok allows users to create, share, and discover short videos set to music, trends, and challenges. It has gained massive popularity, especially among Gen Z and millennials, and plays a major role in shaping digital trends. TikTok is a key player in the social platforms for commerce market, with features like TikTok Shop and in-video product links enabling seamless shopping experiences. Its algorithm-driven content discovery and influencer collaborations drive high engagement and brand visibility across various industries.

List of Key Companies in Social Platforms for Commerce Market

- Depop Ltd.

- Etsy, Inc.

- Line Corporation

- LinkedIn Corporation

- Meta Platforms, Inc.

- Pinterest, Inc.

- Snapchat

- TikTok

- Twitter, Inc.

- YouTube

Social Platforms for Commerce Industry Developments

March 2025: TikTok officially launched its e-commerce platform, TikTok Shop, in France, Germany, and Italy, further expanding its presence in Europe. TikTok Shop's live shopping and short video-based commerce allow consumers to purchase items directly while watching content and receive recommendations from trusted creators.

April 2024: Meta’s free artificial intelligence assistant, Meta AI, rolled out across its social media platforms such as WhatsApp, Instagram, Facebook, and Messenger to enhance personalized product recommendations and improve conversational commerce.

September 2024: Pinterest launched a feature called Collages, allowing users to create shoppable mood boards and buy items directly from pins, strengthening its commerce capabilities.

Social Platforms for Commerce Market Segmentation

By Platform Type Outlook (Revenue, USD Billion, 2020–2034)

- Social Networking Sites

- Video Sharing Platforms

- Messaging Apps

- Others

By Business Models Outlook (Revenue, USD Billion, 2020–2034)

- B2C (Business-to-Consumer)

- C2C (Consumer-to-Consumer)

- B2B (Business-to-Business)

By Product Category Outlook (Revenue, USD Billion, 2020–2034)

- Fashion & Apparel

- Beauty & Personal Care

- Home Décor & Furniture

- Electronics & Gadgets

- Food & Beverage

- Health & Wellness

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Social Platforms for Commerce Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,201.10 Billion |

|

Market Size Value in 2025 |

USD 1,512.79 Billion |

|

Revenue Forecast by 2034 |

USD 12,459.32 Billion |

|

CAGR |

26.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2024–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,201.10 billion in 2024 and is projected to grow to USD 12,459.32 billion by 2034.

The global market is expected to register a CAGR of 26.4% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

A few key players in the market are Meta Platforms, Inc.; TikTok; Pinterest, Inc.; YouTube; Snapchat; Twitter, Inc.; WeChat; Line Corporation; LinkedIn Corporation; Depop Ltd.; and Etsy, Inc.

The social networking sites segment dominated the market in 2024.