Soft Facility Management Market Size, Share, Trends, Industry Analysis Report

By Type (Outsourced, In-house), By Soft Services, By Organization Size, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5931

- Base Year: 2024

- Historical Data: 2020-2023

Overview

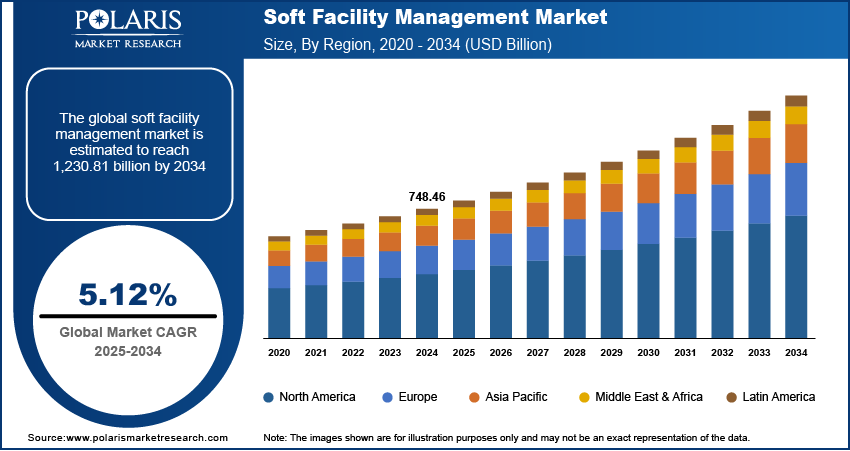

The global soft facility management market size was valued at USD 748.46 billion in 2024, growing at a CAGR of 5.12% from 2025 to 2034. Key factors driving demand for soft facility management include rising urbanization globally, growing education sector in emerging nations, expanding healthcare sector worldwide, and growing integration of technology in service delivery.

Key Insight

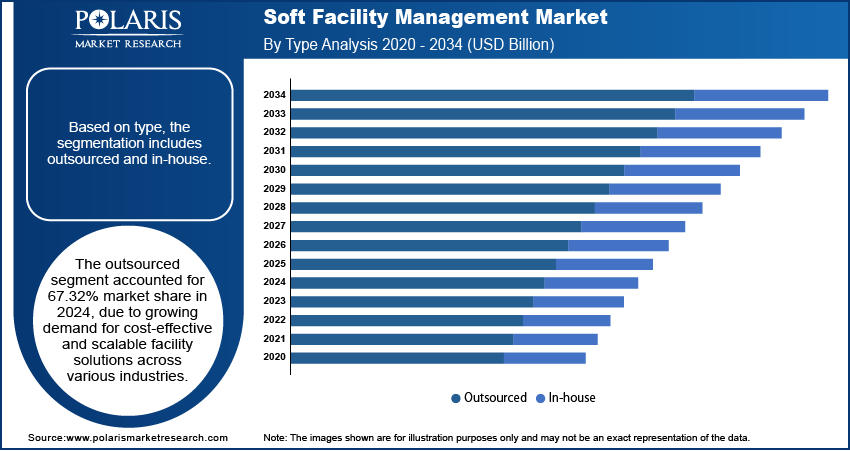

- The outsourced segment accounted for 67.32% market share in 2024.

- The in-house segment is projected to register a CAGR of 3.42% from 2025 to 2034.

- North America accounted for a 35.16% share of the global soft facility management market in 2024.

- The U.S. held a 77.79% share of the North America market in 2024.

- The market in Asia Pacific is expected to register a CAGR of 7.68% during 2025–2034.

- Countries such as China, Japan, and Australia are witnessing a surge in outsourced facility services, particularly in commercial real estate and retail.

Soft facility management refers to the range of non-technical services that support the day-to-day operations of a business or organization. These services focus on enhancing the comfort, safety, and well-being of people within a facility, rather than managing its physical infrastructure. Key components of soft facility management include cleaning, catering, waste management, security, landscaping services, mailroom services, insect pest control, concierge services, and reception management. Organizations use soft facility management to create a productive and welcoming environment for employees, customers, and visitors. These services enhance workplace efficiency by ensuring that spaces remain clean, secure, and conducive to professional activity.

The rising urbanization globally is driving the market growth. World Economic Forum, in its 2022 report, stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. This increasing urbanization is fueling the development of buildings, offices, hospitals, schools, and retail spaces, each requiring regular cleaning, waste management, landscaping, security, and front-office services to ensure smooth day-to-day operations. Businesses and property owners prioritize outsourcing these non-core services to specialized providers to maintain hygiene, safety, and customer satisfaction in increasingly dense and complex urban environments. Additionally, growing corporate hubs in urban areas are fueling the demand for soft facility management services such as cleaning, office support, and others.

To Understand More About this Research: Request a Free Sample Report

The soft facility management demand is driven by the growing education sector in emerging nations. Governments of emerging nations such as India and Brazil are investing in improving educational infrastructure to accommodate rising student populations, which is creating a need for facility management services such as cleaning, security, waste disposal, pest control, and front-desk operations. Educational institutions prioritize providing safe and hygienic environments to enhance learning experiences and comply with regulatory standards. To manage these non-core functions efficiently, administrators are increasingly relying on professional soft facility management providers who ensure smooth campus operations while allowing staff to concentrate on academic priorities.

Industry Dynamics

- The expanding healthcare sector globally is boosting demand for soft facility management as hospitals depend on soft facility services to maintain a clean, safe, and organized environment.

- The growing integration of technology in service delivery is driving the market growth by optimizing workforce allocation in real time.

- The growth of hybrid work model is projected to create a lucrative opportunity in the market in the coming years.

- The loss of direct control over service quality when organizations outsource facility management services to external providers is hampering the demand for these services.

Expanding Healthcare Sector Globally:

Patient volume is increasing rapidly worldwide due to the growing incidence of chronic diseases, obesity, road accidents, and others. This increase in patient volume is creating pressure on governments to expand the healthcare sector by developing infrastructure, such as hospitals and clinics. These infrastructures depend on soft facility services such as sanitation, waste management, security, laundry, and front-office assistance to maintain a clean, safe, and organized environment. In 2022, the healthcare industry in Germany added a gross value of USD 518,930 million. Therefore, the expanding healthcare sector globally is driving the adoption of soft facility management.

Growing Integration of Technology in Service Delivery:

The integration of technology in service delivery enables service providers to offer more efficient and customized solutions. Facilities are increasingly adopting digital tools such as IoT sensors, automation systems, mobile apps, and AI-powered platforms to monitor cleanliness levels, track maintenance schedules, and optimize workforce allocation in real time. Businesses are increasingly favoring facility management partners that utilize smart solutions to enhance service transparency, responsiveness, and cost-effectiveness. This digital transformation enhances user experience, ensures higher compliance with health and safety standards, and supports sustainability goals, prompting organizations to invest more in technologically advanced soft facility management services.

Segmental Insights

Type Analysis

Based on type, the segmentation includes outsourced and in-house. The outsourced segment accounted for 67.32% market share in 2024 due to growing demand for cost-effective and scalable facility solutions across various industries. Organizations increasingly relied on third-party service providers to manage non-core operations such as cleaning, catering, security, and landscaping to streamline resources and improve operational efficiency. Additionally, outsourced services offer access to skilled personnel, improve service quality, and ensure compliance with health and safety regulations without incurring high internal costs, which encourages their high adoption. The ability to quickly adapt to changing facility needs, particularly in the commercial, healthcare, and hospitality sectors, also contributed to the segment's dominance.

The in-house segment is projected to register a CAGR of 3.42% from 2025 to 2034, owing to the expansion of corporate office spaces, retail outlets, and coworking hubs. Businesses in the commercial sector are increasingly favoring in-house service providers to gain operational flexibility. Moreover, the growing emphasis on workplace hygiene, energy management, and customer satisfaction is fueling the reliance on in-house soft service providers.

Soft Services Analysis

In terms of soft services, the segmentation includes office support and security services, cleaning services, catering services, and others. The office support and security services segment dominated the revenue share in 2024 due to the growing need for integrated workplace solutions and rising focus on safety and regulatory compliance. Companies across commercial, industrial, and institutional sectors prioritized administrative efficiency and physical security to ensure smooth daily operations. Office support services such as reception management, mailroom operations, and document handling helped organizations streamline workflows and reduce internal administrative burdens. The rising concerns around unauthorized access, vandalism, and workplace violence further pushed businesses to invest in reliable security personnel and monitoring systems. The shift toward hybrid work models further emphasized the importance of secure access control and employee tracking, strengthening demand for professional security services.

Organization Size Analysis

In terms of organization size, the segmentation includes large enterprises and small & medium enterprises. The large enterprises segment accounted for a major market share in 2024 due to their expansive infrastructure, higher operational complexity, and greater budget allocation for non-core functions. These organizations operate across multiple locations and often manage large workforces, which creates consistent demand for professional support services such as cleaning, security, catering, and office administration. Large companies prioritize efficiency, compliance, and employee satisfaction, and they frequently outsource soft services to specialized providers to achieve standardized service quality across all sites. The ability of these enterprises to invest in long-term contracts, integrated service models, and tech-enabled facility solutions further strengthens their contribution to overall segment growth.

End Use Analysis

By end use, the segmentation includes business & corporate, healthcare, retail, education, travel & hospitality, construction & real estate, government & public sector, manufacturing, military & defense, and others. The construction & real estate segment is projected to grow at a robust pace in the coming years, owing to rapid urbanization, infrastructure development, and the increasing complexity of managing modern building ecosystems. Real estate developers, property managers, and infrastructure firms require specialized service providers to maintain newly built commercial and residential properties. Additionally, smart building technologies and green construction practices are creating opportunities for integrated, tech-driven facility solutions tailored to the real estate sector.

Regional Analysis

The North America soft facility management market accounted for 35.16% share of the global market in 2024. This dominance is attributed to growing emphasis on employee well-being, workplace experience, and sustainability. Multinational companies in the region increasingly outsource non-core services such as cleaning, security, landscaping, and catering to enhance operational efficiency. The rise of hybrid work models in the region has also led to a greater need for flexible and adaptive facility management solutions. Additionally, stringent health and safety regulations in North America accelerated demand for specialized soft facility management services that ensure hygienic and safe work environments.

U.S. Soft Facility Management Market Insight

The U.S. held a 77.79% share of the North America market in 2024 due to the corporate sector’s focus on productivity and employee satisfaction. Large enterprises and tech firms in the country invested heavily in integrated workplace management systems (IWMS) to streamline services such as janitorial, pest control, and concierge services. The growth of smart buildings and IoT-enabled facilities further pushed demand for tech-driven soft facility management solutions. Additionally, the expanding healthcare and education sectors in the U.S. drove demand for soft facility management solutions as these sectors are major consumers due to their need for high hygiene standards and support services.

Asia Pacific Soft Facility Management Market Trends

The industry in Asia Pacific is expected to register a CAGR of 7.68% from 2025 to 2034, owing to urbanization, expanding corporate sectors, and increasing foreign investments. Countries such as China, Japan, and Australia are witnessing a surge in outsourced facility services, particularly in commercial real estate and retail. The adoption of green building certifications is also driving demand for sustainable cleaning and waste management services. Moreover, the growing focus on workplace hygiene in the region is fueling the need for specialized disinfection and sanitation services.

India Soft Facility Management Market Overview

In India, the soft facility management industry is growing due to the booming IT sector, rapid infrastructure development, and increasing corporate outsourcing. The IT sector accounted for 7.5% of India's GDP as of FY23 and is projected to reach 10% by FY25. The rise of co-working spaces, shopping malls, and smart cities is creating a strong demand for cleaning, security, and hospitality services. Additionally, government initiatives such as Swachh Bharat are highlighting the awareness about hygiene standards, boosting demand for professional soft facility management services.

Europe Soft Facility Management Market

The industry in Europe is expected to record a CAGR of 4.26% from 2025 to 2034, owing to strict regulatory standards, sustainability goals, and the need for cost optimization. The EU’s Green Deal and circular economy policies are pushing companies to adopt eco-friendly cleaning and waste management solutions. Countries such as the UK, Germany, and France have a mature facility management industry, where businesses prioritize employee well-being and invest in soft services within facility management.

Key Players and Competitive Analysis

The global soft facility management industry is highly competitive, characterized by the presence of established multinational players, regional specialists, and emerging technology-driven providers. Key industry leaders, such as Sodexo, ISS World Services, CBRE Group, and Compass Group, dominate the industry, leveraging their extensive service portfolios, global reach, and strong client relationships. These companies offer integrated soft facility management solutions, including cleaning, security, catering, landscaping, and workplace services. The industry is witnessing increasing competition from niche and regional players specializing in specific soft facility management segments, such as Aramark, which focus on delivering high-quality, tailored services.

A few major market players include AHI Facility Services Inc., Aramark, CBRE Group Inc., Compass Group, Cushman & Wakefield plc, Equans, Guardian Service Industries Inc., ISS A/S, SMI Facility Services, Sodexo Inc., and Tenon Group.

Key Players

- AHI Facility Services Inc.

- Aramark

- CBRE Group Inc.

- Compass Group

- Cushman & Wakefield plc

- Equans

- Guardian Service Industries Inc.

- ISS A/S

- SIERRA

- SMI Facility Services

- Sodexo Inc.

- Tenon Group

Industry Developments

March 2025: SIERRA announced the launch of its eFACiLiTY, the enterprise facilities management system in India, to cover the areas of maintenance management.

February 2025: Equans announced that it has extended its partnership with the Portsmouth Hospitals University Trust, which will see soft facilities management services continue to be delivered at Queen Alexandra Hospital until 2029.

Soft Facility Management Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Outsourced

- In-house

By Soft Services Outlook (Revenue, USD Billion, 2020–2034)

- Office Support and Security Services

- Cleaning Services

- Catering Services

- Other

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small & Medium Enterprises

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Business & Corporate

- Healthcare

- Retail

- Education

- Travel & Hospitality

- Construction & Real Estate

- Government & Public Sector

- Manufacturing

- Military & Defense

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Soft Facility Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 748.46 Billion |

|

Market Size in 2025 |

USD 785.28 Billion |

|

Revenue Forecast by 2034 |

USD 1,230.81 Billion |

|

CAGR |

5.12% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 748.46 billion in 2024 and is projected to grow to USD 1,230.81 billion by 2034.

The global market is projected to register a CAGR of 5.12% during the forecast period.

North America dominated the market in 2024, holding 35.16% share.

A few of the key players in the market are AHI Facility Services Inc., Aramark, CBRE Group Inc., Compass Group, Cushman & Wakefield plc, Equans, Guardian Service Industries Inc., ISS A/S, SMI Facility Services, Sodexo Inc., and Tenon Group.

The outsourced segment dominated the market in 2024, holding 67.32% share.

The construction & real estate segment is expected to witness the fastest growth during the forecast period.