Solar Powered Cold Storage Market Size, Share, Trends, & Industry Analysis Report

By Component, By Type (Photovoltaic Operated Refrigeration Cycle, Solar Mechanical Refrigeration, and Absorption Refrigeration), By Storage Capacity, By Application, By Industry Vertical, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM5804

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

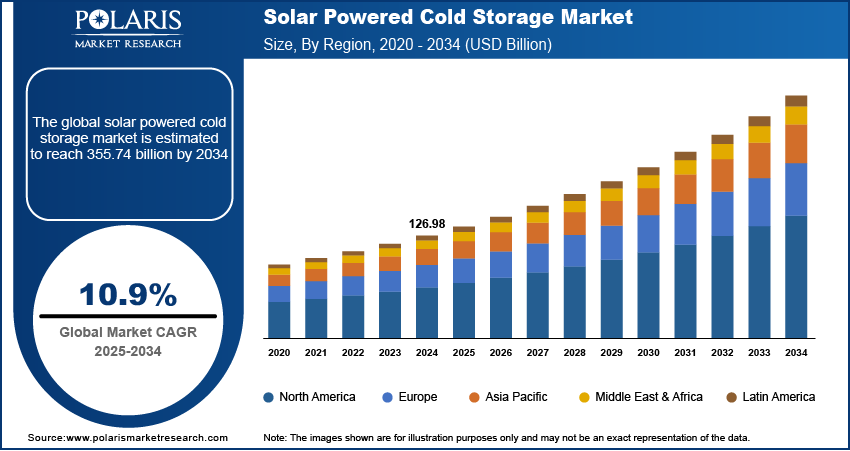

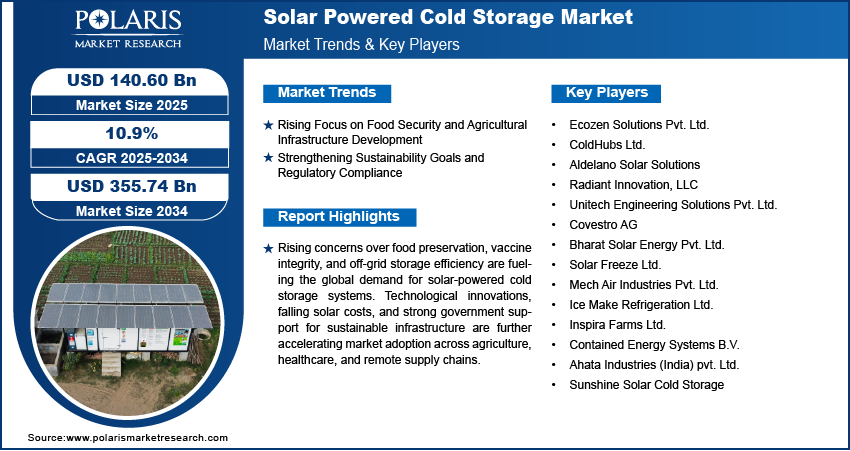

The global solar powered cold storage market size was valued at USD 126.98 billion in 2024, growing at a CAGR of 10.9% during 2025–2034. This growth is primarily driven by the increasing demand for sustainable refrigeration solutions in agriculture, food distribution, and pharmaceuticals, particularly in off-grid and energy-deficient regions.

Solar-powered cold storage systems utilize photovoltaic (PV) energy to power refrigeration units, offering an energy-efficient and environmentally responsible alternative to conventional diesel-based or grid-tied systems. These systems play a critical role in reducing post-harvest losses, preserving perishable goods, and ensuring reliable cold chain continuity in rural and remote areas with unreliable electricity supply.

The industry comprises various system types, including walk-in solar cold rooms, solar refrigerated containers, and modular units with integrated battery storage. These systems are used for storing fruits, vegetables, dairy foods, seafood, meat, and temperature-sensitive medical supplies. These units are increasingly being adopted by smallholder farmers, cooperatives, agribusinesses, and public health facilities seeking to reduce spoilage and increase profitability.

To Understand More About this Research: Request a Free Sample Report

Technological advancements are playing a key role in enhancing the performance and applicability of solar-powered cold storage systems. Innovations such as hybrid energy integration that combines solar with grid or biomass backup, enhanced thermal insulation materials, IoT-enabled remote monitoring and control, and advanced battery energy storage systems are improving the efficiency and reliability. Market players are introducing lithium-ion battery-supported systems with real-time temperature monitoring and remote diagnostics to maintain uninterrupted cooling during periods of limited sunlight or power instability.

The agriculture sector is a crucial end-use industry, driven by the need to reduce post-harvest losses, strengthen supply chain resilience, and improve the incomes of smallholder farmers. According to the Food and Agriculture Organization (FAO), approximately one-third of global food production is either lost or wasted annually. It is estimated that about 14% of food is lost during the post-harvest stages and before reaching retail, while overall losses before the food reaches consumers range between 30% and 40% of total production.

Government initiatives and public-private partnerships are accelerating installation of solar powered cold storage systems across Asia, Africa, and Latin America. Moreover, the healthcare sector is increasingly adopting solar-powered cold storage systems to ensure the safe storage of vaccines and medicines in off-grid and rural areas. With supportive environmental regulations, declining solar equipment costs, and growing global focus on emission reduction, solar-powered cold storage is poised for strong adoption worldwide, contributing to sustainable and resilient infrastructure development.

Industry Dynamics

Rising Focus on Food Security and Agricultural Infrastructure Development

The increasing global emphasis on food security and post-harvest management is driving the demand for solar-powered cold storage systems. For instance, in September 2023, U.S. Agriculture Secretary announced a USD 455 million investment that aims to enhance global food security and international capacity-building initiatives. This effort includes the deployment of over 375,000 metric tons of U.S. commodities, alongside USD 225 million in funding through the Food for Progress Program to boost agricultural productivity and promote international trade in agricultural goods. National governments, international development agencies, and private organizations are investing in decentralized agricultural infrastructure to minimize food loss, stabilize farmer incomes, and strengthen rural supply chains. In particular, solar cold storage systems are emerging as critical assets in regions with limited or unreliable electricity access, such as sub-Saharan Africa, South Asia, and parts of Latin America. These units provide reliable and energy-efficient preservation solutions for perishable produce including fruits, vegetables, dairy, and meat, thereby improving shelf life and accessibility for smallholder farmers.

Infrastructure initiatives supporting farm-to-market connectivity, agritech modernization, and rural electrification are pushing further deployment of these solar powered systems. For instance, India’s PM-KUSUM scheme targets the addition of 34,800 MW of solar capacity by March 2026, with total central financial support of approximately USD 4.13 billion. These cold storage units also help meet export standards for perishables while contributing to the international trade. The growing recognition of cold storage as a critical component of agricultural infrastructure is encouraging regional authorities and development banks to offer subsidies, concessional financing, and technical assistance for system adoption.

Strengthening Sustainability Goals and Regulatory Compliance

The solar-powered cold storage industry is witnessing growing momentum due to intensifying sustainability mandates and global decarbonization commitments. International climate frameworks and national green energy policies are prompting industries to reduce their carbon footprint and transition toward renewable energy-based infrastructure. Solar cold storage systems support this transition by eliminating reliance on diesel generators and conventional grid electricity, offering an environmentally friendly alternative for cold chain logistics. As a result, governments and non-governmental organizations are including solar cold rooms in their climate action strategies in agriculture, healthcare, and food distribution sectors.

In parallel, rising regulatory focus on pharmaceutical cold chains and food safety compliance is compelling supply chain operators to adopt solutions that ensure temperature stability and energy efficiency. Solar-powered units with advanced insulation, battery storage, AI-powered, and IoT-enabled remote monitoring are gaining preference, as they meet operational standards even in low-resource settings. In April 2025, An AI-powered, solar cold storage facility with advanced temperature and humidity controls launched at Dr. YS Parmar University of Horticulture and Forestry, Nauni, to support sustainable post-harvest practices and benefit small farmers in remote areas. The unit, developed in partnership with AgSys, GIZ India, and Cool Crops Pvt. Ltd., will first be used for scientific research before expanding to commercial and community use. Furthermore, certifications and quality standards set by bodies such as World Health Organization-PQS (Performance, Quality and Safety) and national food safety authorities are encouraging manufacturers to innovate and improve reliability, thermal performance, and life cycle efficiency. These dynamics are reinforcing the credibility and demand for solar-powered cold storage systems, positioning them as essential tools in achieving climate resilience and regulatory alignment across key industries.

Segmental Insights

By Component Analysis

The global segmentation, based on component includes, solar panels, battery storage systems, cooling unit & compressor, and controller & monitoring system. The solar panels segment is projected to witness substantial growth by 2034 driven by declining photovoltaic (PV) module costs, higher solar conversion efficiencies, and favorable regulatory incentives across developing economies. These panels serve as the primary power generation source for cold storage units and are increasingly manufactured using monocrystalline and bifacial technologies that enhance performance in diverse climatic conditions. Additionally, bulk procurement through government-led rural electrification schemes and agritech subsidies is reinforcing adoption. For instance, in March 2025, the USDA announced to allocate up to USD 10 billion via the Emergency Commodity Assistance Program (ECAP) for the 2024 crop year, delivering direct economic aid to farmers to counter rising input costs and declining commodity prices.

The battery storage systems segment is projected to grow at a robust pace in the coming years, owing to the advancements in lithium-ion and solid-state battery technologies that provide longer operational life, faster charging, and better temperature regulation. Battery systems are crucial for maintaining uninterrupted cooling during nighttime or cloudy conditions, making them indispensable in regions with unreliable grid access. The integration of intelligent battery management systems (BMS) and IoT-enabled diagnostics is further boosting segment adoption across agriculture and healthcare verticals.

By Type Analysis

The global segmentation, based on type includes, photovoltaic operated refrigeration cycle, solar mechanical refrigeration, and absorption refrigeration. The photovoltaic operated refrigeration cycle segment accounted for largest market share in 2024, due to its widespread deployment in standalone solar-powered systems. These units offer direct integration with PV arrays and utilize conventional vapor compression cycles powered by solar-generated electricity, making them suitable for modular, off-grid applications in remote areas. Their ease of maintenance and scalability make them a preferred option for smallholder farmers and regional cold chain operators.

The absorption refrigeration segment is projected to grow at a significant pace during the forecast period. This system type uses solar thermal energy instead of electricity to drive the cooling cycle, providing a viable solution in energy-scarce regions. Its low operational cost, minimal maintenance, and chemical-free refrigeration process make it particularly appealing for eco-sensitive applications, especially in regions with high solar insolation and low electrification levels.

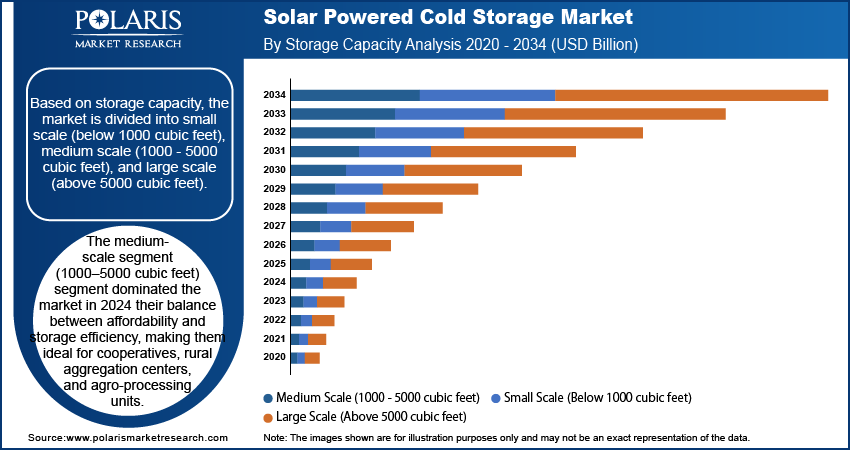

By Storage Capacity Analysis

The global segmentation, based on storage capacity includes, small scale (below 1000 cubic feet), medium scale (1000 - 5000 cubic feet), and large scale (above 5000 cubic feet). The medium-scale segment (1000–5000 cubic feet) segment dominated the market in 2024 their balance between affordability and storage efficiency, making them ideal for cooperatives, rural aggregation centers, and agro-processing units. Their widespread deployment across South Asia and sub-Saharan Africa is supported by donor-funded projects, agricultural extension programs, and institutional buyers in horticulture and dairy sectors. As per the Bullvine LLC, Asia emerged as the world’s dairy powerhouse, producing nearly half (≈458 Mt) of the global output of 979 Mt in 2023, an increase of 1.4%. China and India are the primary drivers, with China up 4.8% to 45.5 Mt and India up 2.8% to 242.9 Mt, supported by economic growth, rising demand, modernization, and supportive policies.

The large-scale (above 5000 cubic feet) segment is gaining prominence in commercial agriculture, food processing, and pharmaceutical supply chains. These systems are designed for multi-product storage and extended backup support, often integrating hybrid energy solutions to ensure uninterrupted operations. Their scalability and compatibility with logistics hubs and warehouses make them essential for industrial cold chain management in both developed and emerging economies.

By Application Analysis

The global segmentation, based on application includes, fruits and vegetables, dairy and meat products, and pharmaceuticals and vaccines. The fruits and vegetables segment is projected to grow at a substantial CAGR during the forecast period owing to high spoilage rates and significant post-harvest losses in perishable produce across Asia, Africa, and Latin America. Solar-powered cold storage systems are proving instrumental in reducing food waste, improving quality retention, and extending shelf life in agricultural supply chains. The dairy and meat products segment is also witnessing steady growth, particularly in livestock-intensive regions where cold chains are essential for processing, packaging, and safe distribution.

The pharmaceuticals and vaccines segment is estimated to hold a significant market share during the forecast period. Growing immunization campaigns, temperature-sensitive medicine logistics, and healthcare expansion in underserved regions are creating strong demand for reliable, off-grid refrigeration solutions. As an example, in April 2024, the World Bank Group unveiled a bold initiative aimed at helping countries provide quality and affordable healthcare services to 1.5 billion people by 2030. Solar-powered cold rooms offer an effective means of maintaining cold chain integrity for vaccines, especially in regions with limited electricity access and high ambient temperatures.

By Industry Vertical Analysis

The global segmentation, based on industry vertical includes, agriculture, food & beverage, pharmaceuticals, and chemicals. The agriculture segment is growing as cold storage becomes a critical enabler of farm-to-market linkages, food quality assurance, and farmer income stability. Government initiatives, public-private partnerships, and international development programs are investing in solar-powered solutions to support smallholder farmers and reduce rural post-harvest losses. For instance, in January 2025, Government of Jamaica announced to invest USD 100 million to develop a modern cold storage facility and refurbish existing sites, aiming to reduce post-harvest losses and stabilize food prices. Additionally, 30 solar-powered cold units will be deployed nationwide by 2025 through public–private partnerships to enhance food security. The food and beverage industry is also a major contributor, adopting solar-powered systems to ensure freshness, comply with safety standards, and meet sustainability targets in warehousing and distribution.

The pharmaceuticals segment is projected to register fastest CAGR during the forecast period. This growth is driven by the demand for reliable, off-grid cold storage surged with the expansion of vaccine distribution networks, particularly in underserved regions. Cold chain continuity is critical in maintaining drug efficacy, and solar solutions offer a cost-effective and sustainable alternative in low-resource environments. This trend is gaining momentum as healthcare systems adopt more decentralized and mobile service delivery models across developing nations.

Regional Analysis

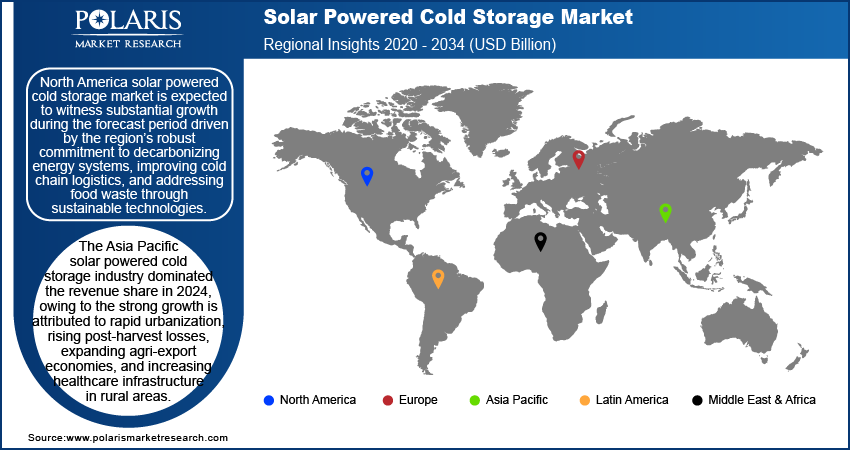

North America solar powered cold storage market is expected to witness substantial growth during the forecast period driven by the region’s robust commitment to decarbonizing energy systems, improving cold chain logistics, and addressing food waste through sustainable technologies. Recently, the National Renewable Energy Laboratory (NREL) projected that the US can achieve 100% clean electricity by 2035 through multiple feasible pathways, primarily driven by wind and solar contributing 60–80% of total generation. Achieving this target would require a tripling of current power capacity and an estimated investment of USD 330–740 billion. The United States and Canada are witnessing growing adoption of solar refrigeration systems across agriculture, pharmaceuticals, and food distribution sectors, fueled by incentives under renewable energy and food security programs. The U.S. Department of Agriculture (USDA) and Department of Energy (DOE) supported pilot projects that integrate solar cold storage in rural farming cooperatives and vaccine storage networks.

US Solar Powered Cold Storage Market Insight

The US solar powered cold storage market growth is supported by public-private collaborations, favorable tax credits under the Inflation Reduction Act (IRA), and strategic investments in clean infrastructure. The need to support last-mile cold chains in underserved and disaster-prone areas is also encouraging adoption among non-profits, health agencies, and community health providers. Additionally, the country’s advanced research ecosystem is contributing to the development of lithium-ion battery-integrated and IoT-enabled cold storage systems, reinforcing the region’s leadership in product innovation and reliability. In May 2025, Electrovaya secured a USD 4.2 million repeat order from a U.S. cold-storage logistics operator to supply lithium-ion batteries for electric material-handling vehicles across six facilities. This follows over USD 13 million in previous sales and underscores growing demand for its Infinity Battery Technology in frigid warehouse environments.

Europe Solar Powered Cold Storage Market

The Europe solar powered cold storage market growth is supported by the region’s strong regulatory push toward carbon neutrality and sustainable infrastructure. For instance, the European Union is targeting carbon neutrality by 2050, with interim goals of cutting net greenhouse gas emissions by at least 55% by 2030 and 90% by 2040, relative to 1990 levels. Achieving these milestones involves accelerating the adoption of renewable energy, enhancing energy efficiency, and significantly curbing fossil fuel usage. Countries such as Germany, France, the Netherlands, and the Nordic nations are prioritizing green logistics solutions, particularly in food security and pharmaceutical resilience. The European Union’s Green Deal and funding mechanisms such as the Horizon Europe program are promoting renewable-powered technologies, including solar cold chains, as part of climate adaptation and circular economy strategies.

Germany solar powered cold storage market committed significant resources toward decentralized solar energy adoption in agriculture and municipal services. Pilot programs integrating solar refrigeration in food banks, community healthcare, and vaccine distribution networks are being actively scaled. The increasing demand for temperature-controlled storage in urban food systems, e-commerce, and biopharma logistics is creating a supportive environment for innovation. As per the ECDB GmbH, Germany’s B2C e-commerce sector was valued at approximately USD 110.9 billion in 2024, reflecting modest year-over-year growth of up to 5%, with projections indicating a 5% to 10% increase in 2025. Europe’s well-established quality standards, advanced R&D capabilities, and emphasis on energy-efficient infrastructure are expected to continue driving steady growth and early technology maturity in the solar powered cold storage sector.

Asia Pacific Solar Powered Cold Storage Market Overview

The Asia Pacific solar powered cold storage industry dominated the revenue share in 2024, owing to the strong growth is attributed to rapid urbanization, rising post-harvest losses, expanding agri-export economies, and increasing healthcare infrastructure in rural areas. Countries such as India, China, Bangladesh, and Indonesia are witnessing significant deployment of solar-based cold rooms to serve farmers, fisheries, and primary healthcare centers. Government-led initiatives under schemes such as India’s PM-KUSUM, along with international funding from organizations including the Asian Development Bank and the World Bank, are accelerating its penetration across underserved rural landscapes.

Asia’s growing population and projected increase of over 1.2 billion urban dwellers by 2050, as noted by the United Nations, underscore the urgency for reliable and energy-efficient cold chains. Solar-powered systems are playing a critical role in stabilizing temperature-sensitive supply chains, especially where conventional electricity infrastructure is lacking or unreliable. Additionally, regional manufacturers are scaling up localized production of solar PV modules, compressors, and battery units, making the technology more affordable. Enhanced awareness among agricultural cooperatives, vaccine delivery networks, and local governments is expected to further propel demand across the Asia Pacific industry.

Key Players & Competitive Analysis Report

The global solar-powered cold storage industry is moderately competitive and characterized by an increasing number of players focused on technological innovation, regional expansion, and cross-sector collaboration. Leading manufacturers are actively engaged in the development of integrated cold storage systems that combine solar generation, battery storage, and advanced thermal insulation to address diverse storage needs across agriculture, pharmaceuticals, and food logistics. Market participants are also forming strategic alliances with agritech startups, non-governmental organizations, and governmental bodies to enhance deployment in underserved and off-grid regions.

Product innovation is a central area of competition, with companies prioritizing the development of cold storage units equipped with lithium-ion battery backup, real-time temperature monitoring, and hybrid power compatibility. Efforts are being made to optimize energy efficiency through advanced refrigeration cycles, smart charge controllers, and IoT-based diagnostics. In addition, players are increasingly incorporating recyclable materials and modular designs to meet rising sustainability demands and reduce carbon footprints. The integration of mobile cold storage units and portable solar kits is further intensifying the competitive landscape, particularly in emerging markets where logistical adaptability is crucial.

Prominent companies operating in the solar-powered cold storage market include Ecozen Solutions Pvt. Ltd.; ColdHubs Ltd.; Aldelano Solar Solutions; Radiant Innovation, LLC; Unitech Engineering Solutions Pvt. Ltd.; Covestro AG; Bharat Solar Energy Pvt. Ltd.; Solar Freeze Ltd.; Mech Air Industries Pvt. Ltd.; Ice Make Refrigeration Ltd.; Inspira Farms Ltd.; Contained Energy Systems B.V.; Ahata Industries (India) Pvt. Ltd.; and Sunshine Solar Cold Storage. These players are leveraging government subsidies, donor-funded programs, and international development initiatives to scale operations and deliver accessible, clean energy-based cold chain infrastructure.

Key Players

- Ecozen Solutions Pvt. Ltd.

- ColdHubs Ltd.

- Aldelano Solar Solutions

- Radiant Innovation, LLC

- Unitech Engineering Solutions Pvt. Ltd.

- Covestro AG

- Bharat Solar Energy Pvt. Ltd.

- Solar Freeze Ltd.

- Mech Air Industries Pvt. Ltd.

- Ice Make Refrigeration Ltd.

- Inspira Farms Ltd.

- Contained Energy Systems B.V.

- Ahata Industries (India) pvt. Ltd.

- Sunshine Solar Cold Storage

Industry Developments

February 2025: Indian startup Enhanced Innovations unveiled “Phloton,” a solar-powered cold storage unit for last-mile vaccine transport with AI-enabled temperature control. The unit offers 14-hour battery backup, real-time monitoring, and targets India's growing cold-chain market.

January 2025: Jimi IoT unveiled its "Attach-and-Go" cold chain solution at CES 2025, integrating 4G trackers and solar-powered modules for real-time monitoring. The system addresses cold chain issues such as data gaps and temperature deviations with instant alerts and offline storage.

August 2023: ColdHubs launched two solar-powered cold storage rooms in Southwest Nigeria to reduce post-harvest losses and support local farmers. The pay-as-you-store model offers affordable preservation, extending produce shelf life up to 21 days.

Solar Powered Cold Storage Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solar Panels

- Battery Storage Systems

- Cooling Unit & Compressor

- Controller & Monitoring System

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Photovoltaic Operated Refrigeration Cycle

- Solar Mechanical Refrigeration

- Absorption Refrigeration

By Storage Capacity Outlook (Revenue, USD Billion, 2020–2034)

- Small Scale (Below 1000 cubic feet)

- Medium Scale (1000 - 5000 cubic feet)

- Large Scale (Above 5000 cubic feet)

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Fruits and Vegetables

- Dairy and Meat Products

- Pharmaceuticals and Vaccines

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Agriculture

- Food & Beverage

- Pharmaceuticals

- Chemicals

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Solar Powered Cold Storage Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 126.98 Billion |

|

Market Size in 2025 |

USD 140.60 Billion |

|

Revenue Forecast by 2034 |

USD 355.74 Billion |

|

CAGR |

10.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 126.98 billion in 2024 and is projected to grow to USD 355.74 billion by 2034.

The global market is projected to register a CAGR of 10.9% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Ecozen Solutions Pvt. Ltd.; ColdHubs Ltd.; Aldelano Solar Solutions; Radiant Innovation, LLC; Unitech Engineering Solutions Pvt. Ltd.; Covestro AG; Bharat Solar Energy Pvt. Ltd.; Solar Freeze Ltd.; Mech Air Industries Pvt. Ltd.; Ice Make Refrigeration Ltd.; Inspira Farms Ltd.; Contained Energy Systems B.V.; Ahata Industries (India) Pvt. Ltd.; and Sunshine Solar Cold Storage

The medium-scale (1000–5000 cubic feet) segment dominated the market share in 2024.

The absorption refrigeration segment is expected to witness the fastest growth during the forecast period.