South Korea Dietary Supplements Market Size, Share, Trends, Industry Analysis Report

By Type (Vitamins, Minerals), By Form, By Application, By Distribution Channel, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6176

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

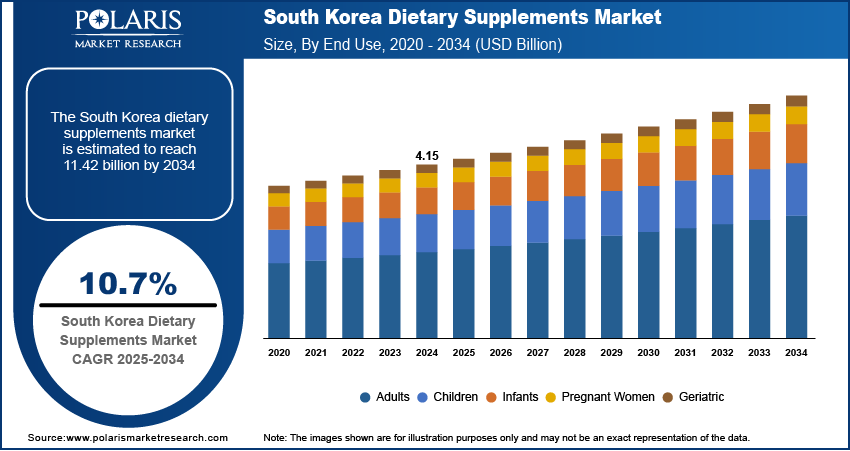

The South Korea dietary supplements market size was valued at USD 4.15 billion in 2024, growing at a CAGR of 10.7% from 2025 to 2034. The market growth is driven by the strong influence of k-beauty and inner health trends and the rising e-commerce penetration and mobile shopping.

Key Insights

- In 2024, the vitamins segment dominated with the largest share, as many consumers regularly use vitamin C, vitamin D, and multivitamins to support immunity, energy, and overall wellness.

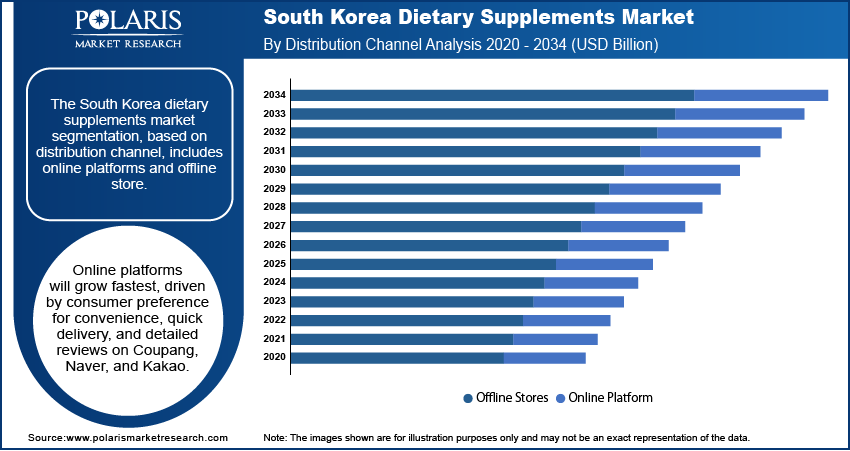

- The online platforms segment is expected to experience the fastest growth during the forecast period as consumers prefer shopping through platforms such as Coupang, Naver Shopping, and Kakao due to convenience, fast delivery, and access to detailed reviews.

Industry Dynamics

- Strong influence of k-beauty and inner health trends drives the industry growth.

- Growing e-commerce adoption and mobile shopping is fueling the industry growth by improving product accessibility.

- High regulatory scrutiny and inconsistent product quality standards restrain widespread adoption of supplements.

Market Statistics

- 2024 Market Size: USD 4.15 billion

- 2034 Projected Market Size: USD 11.42 billion

- CAGR (2025–2034): 10.7%

To Understand More About this Research: Request a Free Sample Report

Dietary supplements are products taken orally that contain nutrients such as vitamins, minerals, herbs, amino acids, or enzymes intended to supplement the diet. They are available in forms such as tablets, capsules, powders, and liquids. These supplements are not meant to replace whole foods but to support overall health or address specific nutritional gaps.

South Korea is facing a rapid increase in its elderly population, which has created a strong demand for supplements that support joint health, memory, heart function, and general vitality. Many older adults use dietary supplements to manage chronic conditions and maintain independence. Aging population increasingly uses these supplements, and healthcare professionals regularly recommend these products. Additionally, the government and public health organizations have emphasized the importance of active aging. Products containing calcium, omega-3, red ginseng, and probiotics are particularly popular, thereby driving the growth.

Traditional Korean medicine influence consumer preferences in the dietary supplements market. Herbal ingredients such as red ginseng, garlic, and ginger are widely accepted for their health benefits. Red ginseng, in particular, is deeply rooted in Korean culture and is often consumed to improve energy, immunity, and stamina. Many supplement brands incorporate traditional remedies into modern formats such as capsules, drinks, or powders. Trust in herbal ingredients makes it easier for consumers to adopt supplements as part of their daily routine. This blend of traditional and modern practices fuels demand in the country, thereby fueling the growth.

Drivers & Opportunities

Strong Influence of K-Beauty and Inner Health Trends: South Korea’s focus on skincare and beauty has expanded into the health supplement sector, with a growing trend toward “inner beauty.” Consumers now seek supplements that support skin health, hair growth, and overall appearance from within. Collagen powders, biotin capsules, and antioxidant-rich products are popular, especially among women in their 20s to 40s. The K-beauty industry’s influence has made beauty supplements a fashionable and desirable part of daily health routines. As a result, companies are creating more products that link nutrition to appearance, fueling the growth of both the beauty and dietary supplement sectors.

Growth of E-Commerce and Mobile Shopping: Online and mobile shopping platforms have significantly boosted dietary supplement sales in South Korea. Consumers prefer the convenience of browsing, comparing, and purchasing products from home. Online retail platforms such as Coupang, Naver Shopping, and health-focused apps provide detailed product reviews and delivery options. Social media and influencer marketing further influence purchasing decisions, especially among younger shoppers. Additionally, subscription models and personalized health recommendations are attracting long-term users. The fast development of online retail, supported by advanced logistics and tech-savvy consumers, drives the growth of the industry in the country.

Segmental Insights

Type Analysis

The South Korea dietary supplements market segmentation, based on type, includes vitamins, minerals, amino acids, botanicals, probiotics, enzymes, and others. In 2024, the vitamins segment dominated with the largest share as many consumers regularly use vitamin C, vitamin D, and multivitamins to support immunity, energy, and overall wellness. Daily vitamin use increased during and after the COVID-19 pandemic, and the trend continues due to growing awareness of preventive healthcare. Korean consumers trust vitamins with clean labeling and proven benefits, especially those approved by the Ministry of Food and Drug Safety (MFDS). Moreover, widespread demand across age groups further drives the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online platforms and offline store. The online platforms segment is expected to experience the fastest growth during the forecast period as consumers prefer shopping through platforms such as Coupang, Naver Shopping, and Kakao due to convenience, fast delivery, and access to detailed reviews. Young adults and busy professionals frequently use mobile apps to compare brands, track promotions, and subscribe to regular deliveries. Many supplement brands are focusing on e-commerce, using influencers and social media to reach targeted audiences. The familiarity with digital tools and the country’s advanced logistics system continue to support the rise of online sales.

Key Players and Competitive Analysis

The South Korea dietary supplements market features intense competition among pharmaceutical giants, nutrition companies, and specialized health brands. Multinational firms such as Abbott Laboratories, Pfizer Inc., Bayer AG, and GlaxoSmithKline plc leverage their medical expertise and product reliability to appeal to health-conscious Korean consumers. Companies such as Amway Corp., Herbalife International, and Nature’s Sunshine Products maintain strong positions through direct-selling models and customer loyalty. dsm-firmenich, Glanbia Plc, and The Archer-Daniels-Midland Company contribute through ingredient innovation and science-backed solutions tailored for aging and beauty-conscious consumers. The Korean market is also influenced by high demand for functional ingredients such as red ginseng and collagen. Online platforms, strict regulatory standards, and a growing interest in personalized health are shaping competitive strategies. Success depends on trust, product transparency, and localization of global offerings to suit Korean preferences. Continuous investments in research, digital marketing, and clean-label products help top players maintain their market share.

Key Players

- Abbott Laboratories

- Amway Corp.

- Bayer AG

- dsm-firmenich

- Glanbia Plc

- GlaxoSmithKline plc

- Herbalife International of America, Inc.

- Nature’s Sunshine Products, Inc.

- Pfizer Inc.

- The Archer-Daniels-Midland Company

Dietary Supplements Industry Developments

In November 2024, dsm-firmenich, in collaboration with Rohto Pharmaceutical, launched Vision R in South Korea. This innovative multivitamin, using patented Sprinkle It Technology, addresses nutritional gaps among seniors to support healthy longevity and improve overall health.

In August 2021, The Vitamin Shoppe launched its e-commerce platform and digital storefronts in South Korea, offering nearly 300 health and wellness products. The company directly shipped from the U.S., targeting South Korea’s digitally active and health-conscious consumer base.

South Korea Dietary Supplements Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Vitamins

- Minerals

- Amino Acids

- Botanicals

- Probiotics

- Enzymes

- Others

By Form Outlook (Revenue, USD Billion; 2020–2034)

- Tablets

- Capsules

- Gummies

- Powder

- Soft Gels

- Liquids

- Others

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- General Health

- Cardia Health

- Others

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Online Platforms

- Offline Stores

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Adults

- Children

- Infants

- Pregnant Women

- Geriatric

South Korea Dietary Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.15 Billion |

|

Market Size in 2025 |

USD 4.58 Billion |

|

Revenue Forecast by 2034 |

USD 11.42 Billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.15 billion in 2024 and is projected to grow to USD 11.42 billion by 2034.

The market is projected to register a CAGR of 10.7% during the forecast period.

A few of the key players in the market are Abbott Laboratories; Glanbia Plc; The Archer-Daniels-Midland Company; dsm-firmenich: Nature’s Sunshine Products, Inc.; GlaxoSmithKline plc; Amway Corp.; Herbalife International of America, Inc.; Pfizer Inc.; and Bayer AG.

The vitamin segment dominated the market share in 2024.

The online platform segment is expected to witness the fastest growth during the forecast period.