South Korea Intelligent Building Automation Technologies Market Size, Share, Volume, Trends, Industry Analysis Report

By Component (Hardware, Software, Services), By End User – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6159

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

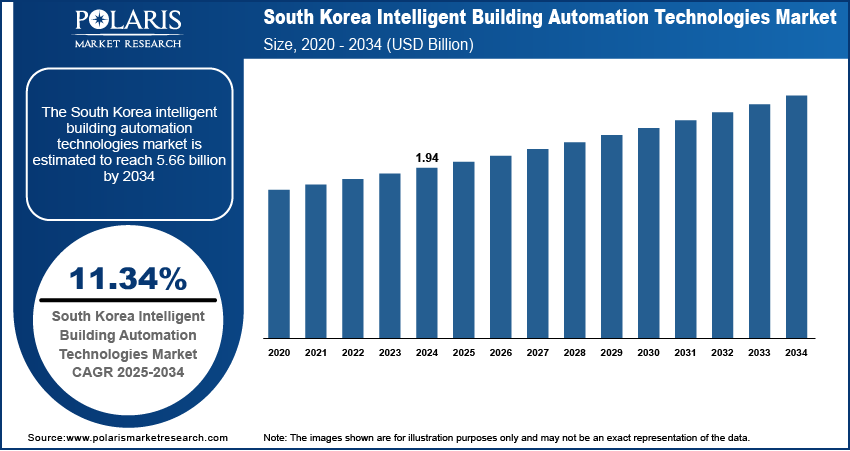

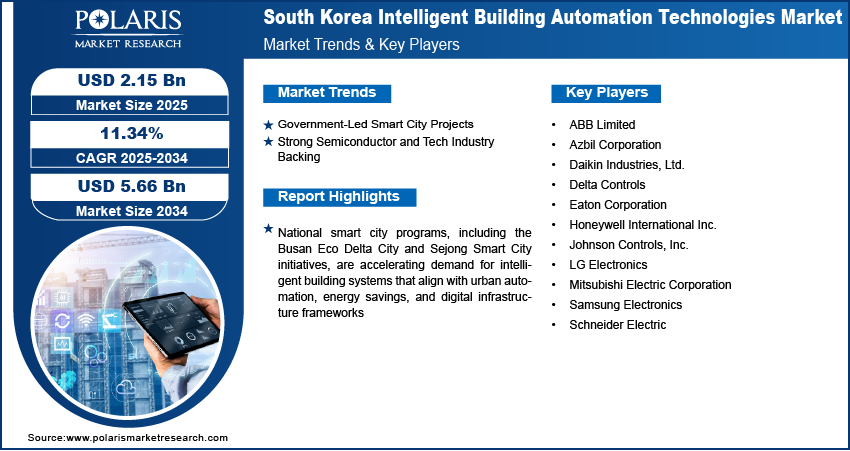

The South Korea intelligent building automation technologies market size was valued at USD 1.94 billion in 2024, growing at a CAGR of 11.34% from 2025 to 2034. National smart city programs, including the Busan Eco Delta City and Sejong Smart City initiatives, are accelerating demand for intelligent building systems that align with urban automation, energy savings, and digital infrastructure frameworks.

Key Insights

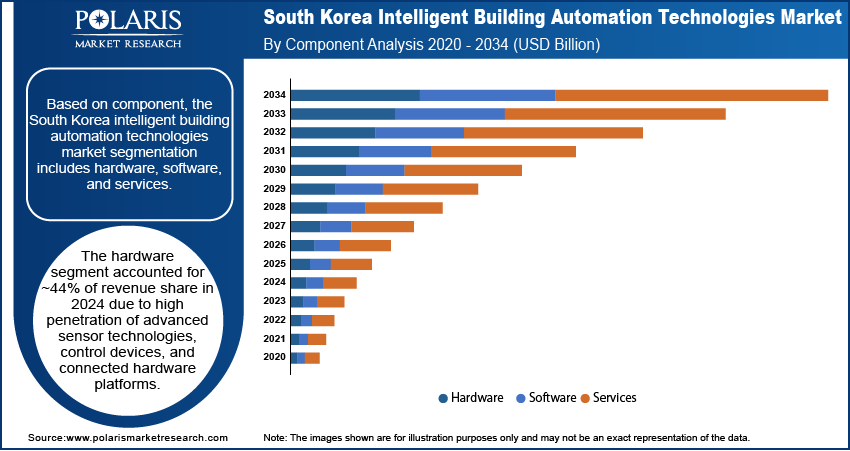

- The hardware segment accounted for ~44% of the revenue share in 2024, driven by widespread adoption of advanced sensors, control devices, and connected hardware platforms.

- The commercial end user segment is projected to register a CAGR of 12.18% from 2025 to 2034, fueled by rising demand for energy-efficient, secure, and digitally integrated workspaces in South Korea.

Industry Dynamics

- Rising urbanization and demand for smart cities are driving the adoption of intelligent building systems in commercial and residential infrastructure.

- Government initiatives promoting energy efficiency and green buildings are accelerating investments in automated HVAC, lighting, and security systems.

- Integration of AI and IoT enables real-time monitoring and predictive maintenance in building management systems across major urban centers.

- High initial costs and fragmented standards hinder widespread adoption, especially in small and medium-sized buildings and legacy facilities.

Market Statistics

- 2024 Market Size: USD 1.94 billion

- 2034 Projected Market Size: USD 5.66 billion

- CAGR (2025-2034): 11.34%

To Understand More About this Research: Request a Free Sample Report

The intelligent building automation technologies (IBAT) market refers to the integration of advanced systems and technologies such as sensors, controllers, software platforms, and communication networks to automate and optimize building operations. These systems enable real-time monitoring and control of lighting, HVAC, security, energy management, and other core infrastructure components to enhance energy efficiency, occupant comfort, and operational performance. IBAT plays a key role in smart buildings and contributes to sustainability, safety, and digital transformation across residential, commercial, and industrial settings. South Korea's AI infrastructure and high IoT adoption enable seamless implementation of interconnected building management systems, improving automation and remote control capabilities.

Increased focus on employee wellness, hybrid work models, and productivity is driving investment in intelligent lighting, air quality monitoring, and occupancy sensing within office buildings. Moreover, urban renewal efforts across Seoul, Incheon, and other cities are creating opportunities for the integration of smart building technologies in new residential, mixed-use, and commercial developments.

Drivers & Opportunities

Government-Led Smart City Projects: Ongoing investments in large-scale smart city programs are positively influencing the South Korea intelligent building automation technologies market growth. Projects such as Busan Eco Delta City and Sejong Smart City are structured around integrating next-generation digital infrastructure, including AI-driven urban systems, energy-efficient buildings, and intelligent mobility. These developments require seamless building automation to support goals around sustainability, real-time monitoring, and centralized control. Developers and local authorities are increasingly specifying smart automation solutions in new commercial and residential infrastructure. These efforts enhance energy optimization and security and support South Korea’s vision of becoming a global leader in connected, sustainable urban ecosystems.

Strong Semiconductor and Tech Industry Backing: A well-established semiconductor and electronics manufacturing sector plays a crucial role in accelerating the intelligent building automation market in South Korea. In May 2024, the South Korean government launched a comprehensive "Semiconductor Ecosystem Support Package," which allocates state funding of ~USD 19 billion. This initiative aims to support the domestic semiconductor industry by enhancing research and development capabilities, supporting manufacturing infrastructure, and encouraging innovation within the supply chain. Leading tech companies are leveraging their R&D capabilities to develop advanced sensors, controllers, and integrated platforms tailored for building management. These innovations contribute to cost reduction, performance improvements, and customization across various building environments. The close alignment between hardware production and software development enables faster commercialization and scalability of building automation solutions. Industry players also collaborate with construction and infrastructure firms to pilot automation in large real estate and urban projects. This synergy continues to strengthen South Korea’s position in the global smart building technology landscape.

Segmental Insights

Component Analysis

Based on component, the South Korea intelligent building automation technologies market segmentation includes hardware, software, and services. The hardware segment accounted for ~44% of revenue share in 2024 due to high penetration of advanced sensor technologies, control devices, and connected hardware platforms. The country’s robust manufacturing ecosystem and innovation in smart electronics are enabling the quick integration of energy meters, HVAC controllers, lighting sensors, and building security components. Government-backed infrastructure modernization projects and the replacement of legacy systems across office complexes and public buildings are further propelling hardware adoption. Companies are prioritizing real-time data collection and edge processing, which makes hardware investment critical for enabling intelligent, automated decision-making in smart buildings.

End User Analysis

In terms of end user, the South Korea intelligent building automation technologies market segmentation includes commercial, residential, and industrial. The commercial segment is projected to register a CAGR of 12.18% from 2025 to 2034 as growing demand for energy-efficient, secure, and digitally managed workspaces is fueling rapid adoption of intelligent automation across South Korea’s commercial sector. Real estate developers and property managers are focusing on long-term operational cost savings, sustainability compliance, and enhanced tenant experience, which is leading to the integration of building management systems in offices, retail centers, and mixed-use complexes. National smart city initiatives are also incentivizing the automation of public commercial spaces. Increasing interest in smart work environments, coupled with ESG-driven investments, is reinforcing adoption in the commercial segment, positioning it for the fastest growth among all end-use categories through 2034.

Key Players and Competitive Analysis

The competitive landscape of the South Korea intelligent building automation technologies market is evolving rapidly through industry analysis, regional integration, and a sharp focus on digital transformation. Companies are pursuing market expansion strategies through strategic alliances with domestic tech firms and international players to enhance solution portfolios and broaden geographic reach.

Mergers and acquisitions are reshaping the competitive terrain, enabling participants to consolidate resources and accelerate deployment of integrated automation platforms. Joint ventures with semiconductor and electronics manufacturers are facilitating hardware-software interoperability, while post-merger integration efforts are streamlining operations and innovation pipelines. Technology advancements in IoT, AI, and cloud-based analytics are fueling the development of scalable, real-time automation systems tailored to energy efficiency, security, and occupant comfort. Vendors are customizing solutions for both legacy infrastructure retrofits and newly constructed smart buildings. The market’s dynamic is further strengthened by increased collaboration between public agencies and private firms to align with South Korea’s smart city and green building goals.

Key Players

- ABB Limited

- Azbil Corporation

- Daikin Industries, Ltd.

- Delta Controls

- Eaton Corporation

- Honeywell International Inc.

- Johnson Controls, Inc.

- LG Electronics

- Mitsubishi Electric Corporation

- Samsung Electronics

- Schneider Electric

South Korea Intelligent Building Automation Technologies Industry Development

June 2025: Honeywell launched Honeywell Connected Solutions, an AI-driven platform that integrates key building management software into a single interface for improved operational efficiency.

South Korea Intelligent Building Automation Technologies Market Segmentation

By Component Outlook (Volume, Million Units; Revenue, USD Billion; 2020–2034)

- Hardware

- Sensors

- Controllers

- Actuators

- Networking Devices

- Others

- Software

- Building Management Systems (BMS)

- Energy Management Software

- Lighting Control Software

- HVAC Control Software

- Fire, Life & Safety and Security

- Others

- Services

- Professional Services

- Managed Services

By End User Outlook (Volume, Million Units; Revenue, USD Billion; 2020–2034)

- Commercial

- Residential

- Industrial

South Korea Intelligent Building Automation Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.94 billion |

|

Market Size in 2025 |

USD 2.15 billion |

|

Revenue Forecast by 2034 |

USD 5.66 billion |

|

CAGR |

11.34% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Units; Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The South Korea market size was valued at USD 1.94 billion in 2024 and is projected to grow to USD 5.66 billion by 2034.

The South Korea market is projected to register a CAGR of 11.34% during the forecast period.

A few of the key players in the market are ABB Limited; Azbil Corporation; Daikin Industries, Ltd.; Delta Controls; Eaton Corporation; Honeywell International Inc.; Johnson Controls, Inc.; LG Electronics; Mitsubishi Electric Corporation; Samsung Electronics; and Schneider Electric.

The hardware segment accounted for ~44% of revenue share in 2024 due to high penetration of advanced sensor technologies, control devices, and connected hardware platforms.

The commercial segment is projected to register a CAGR of 12.18% from 2025 to 2034 due to the growing demand for energy-efficient, secure, and digitally managed workspaces is fueling rapid adoption of intelligent automation across South Korea’s commercial sector.