South Korea Recycled PET Flakes Market Size, Share, Trends, Industry Analysis Report

By Product (Clear, Colored), By End Use (Fiber, Sheet & Film, Strapping) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6156

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

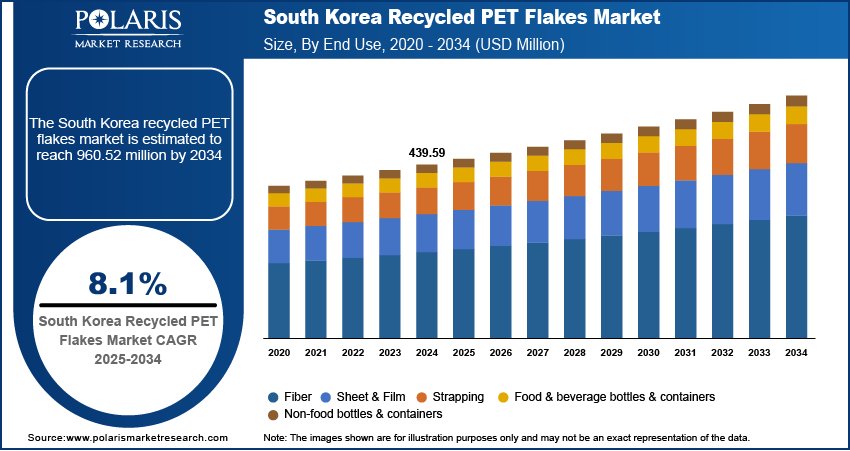

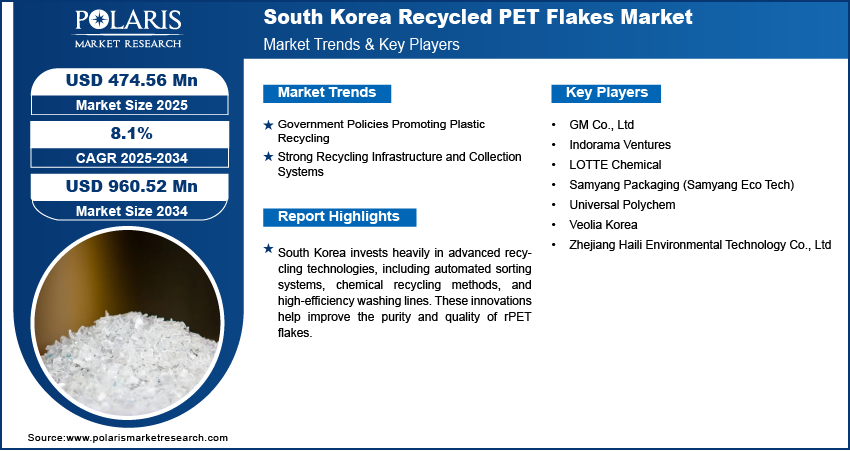

The South Korea recycled PET (rPET) flakes market was valued at USD 439.59 million in 2024 and is expected to register a CAGR of 8.1% from 2025 to 2034. The growth is driven by government policies promoting plastic recycling and strong recycling infrastructure and collection systems.

Key Insights

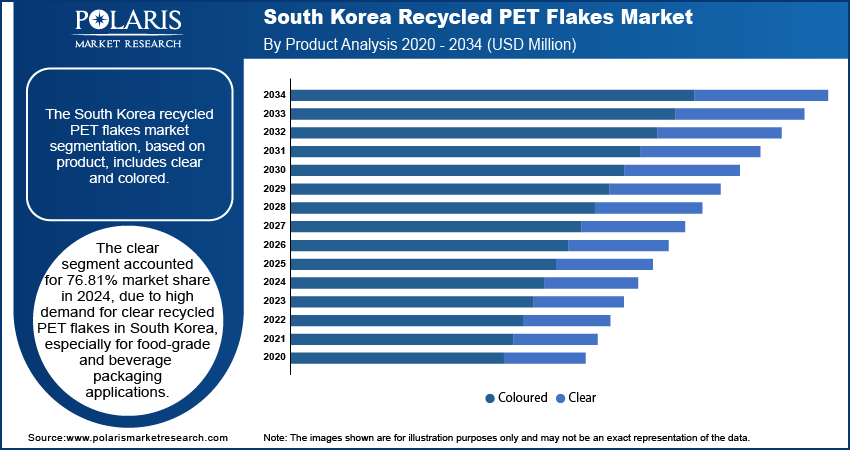

- The clear segment accounted for 76.81% market share in 2024. Clear recycled PET flakes have seen a significant uptick in demand within South Korea, particularly for applications in food-grade and beverage packaging.

- In 2024, the fiber segment captured 13.82% of the market share, driven by the substantial growth of the domestic textile and fashion sectors.

Industry Dynamics

- Government policies promoting plastic recycling are fueling the South Korea rPET flakes market growth.

- Strong recycling infrastructure and collection systems fuel its adoption.

- Rising focus on environmental sustainability is boosting the growth.

- Inconsistent quality and contamination of collected PET waste hinder efficient recycling and limit end-use applications.

Market Statistics

- 2024 Market Size: USD 439.59 million

- 2034 Projected Market Size: USD 960.52 million

- CAGR (2025–2034): 8.1%

To Understand More About this Research: Request a Free Sample Report

Recycled polyethylene terephthalate (rPET) is a plastic made by recycling used PET bottles and containers. It is processed into flakes or pellets that can be reused to manufacture new plastic products, reducing the need for virgin plastic. Using rPET helps lower environmental impact by cutting down plastic waste and conserving resources.

South Korean consumers are becoming increasingly aware of environmental issues and actively prefer eco-friendly products. This shift drives brands and retailers to use more recycled content in packaging to meet consumer expectations. Companies respond by integrating rPET flakes in food packaging, bottles, and textiles as people seek sustainable options. Public awareness campaigns and media coverage about plastic pollution reinforce this trend. This growing consumer demand for sustainable products is fueling the South Korea rPET flakes market growth.

South Korea invests heavily in advanced recycling technologies, including automated sorting systems, chemical recycling methods, and high-efficiency washing lines. These innovations help improve the purity and quality of rPET flakes, enabling their use in more sensitive applications such as food packaging and textiles. Technological advancements further reduce production costs and environmental impact. Consequently, South Korea’s recycling industry can supply competitive, high-grade rPET flakes, fostering growth in domestic and export market.

Drivers & Opportunities

Government Policies Promoting Plastic Recycling: South Korea’s government has implemented strict policies and regulations to reduce plastic waste and promote recycling. The Extended Producer Responsibility (EPR) system requires manufacturers and importers to take responsibility for collecting and recycling plastic packaging, including PET bottles. This has encouraged industries to increase the use of recycled PET flakes in packaging and other products. Additionally, government targets to reduce landfill and marine pollution further boost recycling infrastructure and investments. These policies create a stable demand and supply environment for rPET flakes, thereby driving the growth.

Strong Recycling Infrastructure and Collection Systems: South Korea has one of the world’s most efficient recycling and waste collection systems. The country’s advanced sorting and collection technology ensures high-quality PET bottle recovery, which supplies feedstock for rPET flake production. Public participation in separate waste collection and deposit return schemes helps maintain a steady supply of recyclable PET materials. This well-established infrastructure reduces contamination and improves the quality of recycled flakes, further driving the growth.

Segmental Insights

Product Analysis

The clear segment accounted for 76.81% regional share in 2024. Clear recycled PET flakes are in high demand in South Korea, especially for food-grade and beverage packaging applications. These flakes are sourced from transparent PET bottles collected through the country’s highly efficient recycling system. Clear rPET flakes are preferred by major beverage brands and packaging manufacturers as they offer greater flexibility and can be easily processed into new bottles and containers. Clear rPET is widely used in closed-loop systems with growing regulations and consumer pressure for eco-friendly packaging. This segment is further driven by South Korea's clean and advanced sorting processes, ensuring consistent supply and high product quality.

By End Use Analysis

The fiber segment accounted for 13.82% regional market share in 2024, driven by the country’s large textile and fashion industries. Recycled PET flakes are used to produce polyester fibers for clothing, home textiles, and industrial applications. Major Korean brands are integrating recycled plastic materials into their products to meet rising sustainability standards and appeal to eco-conscious consumers. Additionally, fiber production from rPET helps reduce dependence on petroleum-based virgin polyester. Moreover, the strong government support and increasing demand for green fashion and performance fabrics fuel the growth of the segment.

Key Players & Competitive Analysis

The South Korea recycled PET flakes market is shaped by a mix of domestic and global players, each contributing to the country's circular economy goals. GM Co., Ltd and Samyang Packaging (Samyang Eco Tech) are key local companies actively producing high-quality rPET flakes, especially for food-grade and fiber applications. LOTTE Chemical and Indorama Ventures, both with strong regional presence, are investing in advanced recycling technologies and integrated systems to increase rPET production. Veolia Korea, a branch of the global waste management leader, brings international expertise to Korea’s recycling infrastructure. Universal Polychem supports local supply with PET recycling services, while Zhejiang Haili Environmental Technology Co., Ltd strengthens cross-border cooperation by supplying recycling equipment and solutions. These companies are leveraging South Korea’s advanced collection systems, strong government policies, and growing demand for sustainable materials to innovate and scale operations, making the market increasingly competitive and technology-driven.

Key Players

- GM Co., Ltd

- Indorama Ventures

- LOTTE Chemical

- Samyang Packaging (Samyang Eco Tech)

- Universal Polychem

- Veolia Korea

- Zhejiang Haili Environmental Technology Co., Ltd

South Korea Recycled PET Flakes Industry Developments

January 2023: South Korea approved its first physically recycled PET containers for food and beverages, marking a major step toward carbon neutrality and enforcing strict safety and recycling standards under its updated Packaging and Food Sanitation laws.

South Korea Recycled PET Flakes Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Clear

- Colored

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Fiber

- Sheet & Film

- Strapping

- Food & Beverage Bottles & Containers

- Non-food Bottles & Containers

- Other

South Korea Recycled PET Flakes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 439.59 Million |

|

Market Size in 2025 |

USD 474.56 Million |

|

Revenue Forecast by 2034 |

USD 960.52 Million |

|

CAGR |

8.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 439.59 million in 2024 and is projected to grow to USD 960.52 million by 2034.

The global market is projected to register a CAGR of 8.1% during the forecast period.

A few of the key players in the market are GM Co., Ltd; Indorama Ventures; LOTTE Chemical; Samyang Packaging (Samyang Eco Tech); Universal Polychem; Veolia Korea; and Zhejiang Haili Environmental Technology Co., Ltd.

The clear segment dominated the market share in 2024.

The fiber segment is expected to witness the fastest growth during the forecast period.