Spear Phishing Market Size, Share, Trends, Industry Analysis Report

By Components (Solutions, Services), By Deployment, By Organization Size, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6178

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

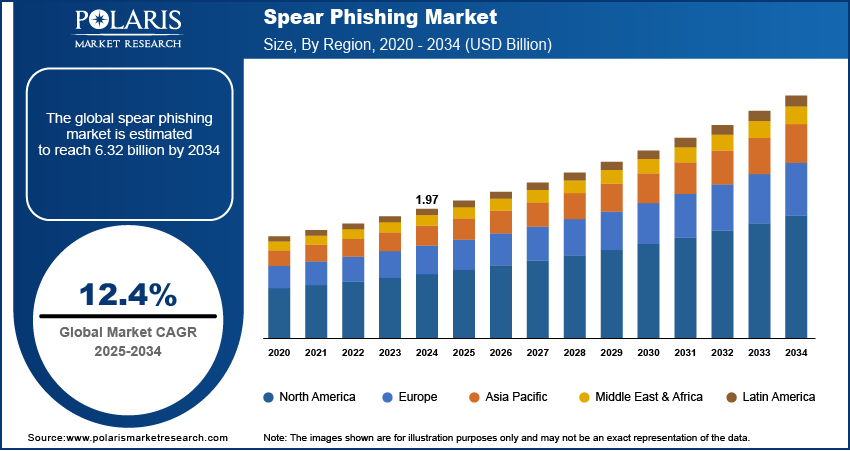

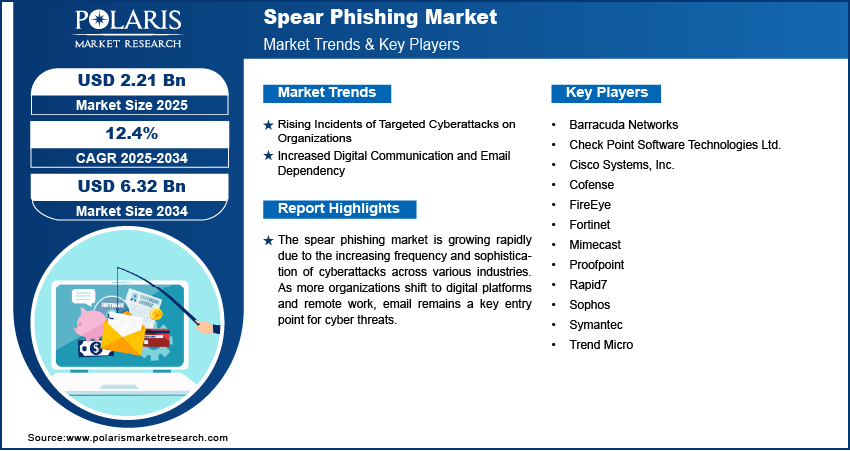

The global spear phishing market size was valued at USD 1.97 billion in 2024 and is anticipated to register a CAGR of 12.4% from 2025 to 2034. The industry is growing mainly due to the rising targeted cyberattacks on businesses and government bodies and increasing use of email communication for sensitive data sharing. Also, the shift to remote and hybrid work models has expanded potential attack surfaces.

Key Insights

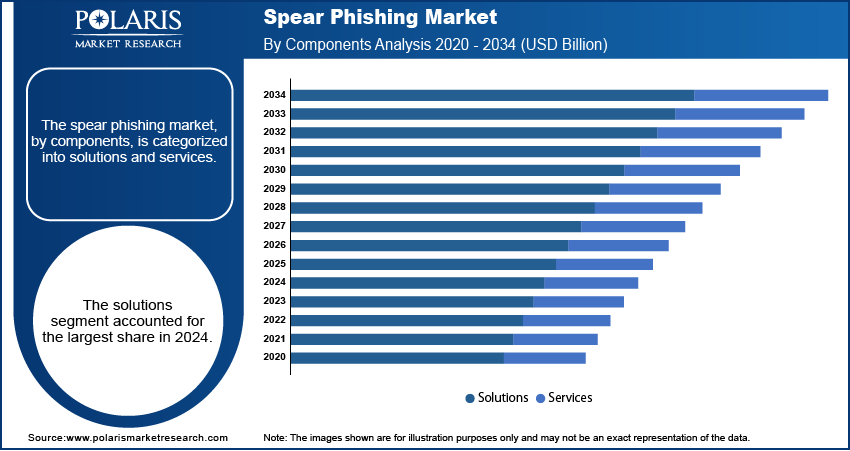

- By components, the solutions segment held the largest share in 2024 as organizations prioritize deploying advanced spear phishing detection and prevention tools. These solutions offer automated threat detection, real-time monitoring, and integration with broader cybersecurity systems, making them essential for safeguarding communications.

- By deployment, the on-premises segment held the largest share in 2024, especially among enterprises with strict data privacy requirements. Many organizations prefer on-premises solutions to maintain direct control over sensitive data and customize security measures to their specific needs.

- By organization size, the large enterprises segment held the largest share in 2024 due to their extensive digital infrastructure and higher exposure to targeted attacks. Their greater resources allow them to invest significantly in sophisticated spear phishing protection technologies and comprehensive security frameworks.

- By end user, the BFSI (Banking, Financial Services, and Insurance) sector held the largest share in 2024, driven by the critical need to protect sensitive financial information. This sector’s high regulatory standards and frequent targeting by cybercriminals make spear phishing defenses a top priority.

- By region, North America is the dominant region, benefiting from early adoption of advanced cybersecurity technologies and strict regulatory environments. The region’s focus on protecting critical sectors such as finance, healthcare, and government drives strong demand for spear phishing protection solutions.

Industry Dynamics

- The growing number of targeted cyberattacks on government agencies and private organizations is pushing the need for advanced threat detection tools. These attacks often bypass traditional security systems, leading to increased investments in solutions that can identify and block personalized phishing attempts.

- With more employees working remotely or in hybrid setups, companies are facing new security challenges. The expanded digital footprint and use of unsecured personal devices make it easier for attackers to launch tailored phishing campaigns, driving demand for better security measures.

- Email remains a primary mode of business communication, often carrying sensitive or confidential information. This makes it a high-risk vector for attackers, prompting organizations to adopt solutions that can monitor and filter suspicious email activity in real time.

Market Statistics

- 2024 Market Size: USD 1.97 billion

- 2034 Projected Market Size: USD 6.32 billion

- CAGR (2025–2034): 12.4%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Spear phishing refers to a type of cyberattack where attackers send highly personalized and targeted messages, often via email, to trick individuals into revealing confidential information or downloading malicious files. Unlike generic phishing, these attacks are well-researched and appear legitimate, making them harder to detect.

The increased use of social media platforms by employees across all levels of an organization boosts the market growth. Attackers often gather personal and professional details from these platforms to craft convincing messages. This growing digital presence gives attackers more data to manipulate and enhances the success rate of spear phishing attempts.

Another factor contributing to the market is the lack of cybersecurity awareness among staff. Many employees are unaware of the signs of a spear phishing attempt, which makes organizations more vulnerable. For example, the National Institute of Health (NIH) has reported increased phishing-related threats targeting healthcare professionals during global health emergencies, showing how a lack of awareness can lead to real-world consequences. This has led to a growing need for simulation-based training and awareness programs in various industries.

Drivers and Trends

Rising Incidents of Targeted Cyberattacks on Organizations: Organizations across sectors are increasingly facing highly personalized cyber threats that exploit human behavior rather than technical vulnerabilities. These targeted attacks, particularly spear phishing, are designed to manipulate specific individuals using contextual and often confidential information. As organizations store more sensitive data and operate across multiple digital platforms, the attack surface for such threats continues to grow, creating an urgent need for proactive cybersecurity strategies. Public and private sector organizations, including critical infrastructure, are becoming prime targets due to the potential high-impact payoff for attackers.

According to a 2022 report titled “Cybersecurity and Infrastructure Security Agency (CISA) Insights: Implement Cybersecurity Measures Now to Protect Against Potential Critical Threats” published on the CISA.gov website, spear phishing was one of the most exploited methods for initial access by threat actors targeting U.S. government and infrastructure systems. The report emphasized that email-based phishing campaigns accounted for over 60% of the initial breaches observed in government-affiliated organizations. This widespread exploitation of spear phishing for targeted breaches has increased both the awareness and adoption of advanced email filtering, employee training, and real-time threat detection solutions. As a result, this growing threat landscape is significantly contributing to the expansion of the market.

Increased Digital Communication and Email Dependency: With email remaining the primary mode of professional communication, the dependency on digital channels for data exchange has opened up new vulnerabilities. Businesses regularly transmit confidential data through email without adequate security measures. The nature of spear phishing, which relies on crafting believable, personalized messages, makes these communications an easy entry point. As digital workflows become more prevalent—especially in hybrid work models—the opportunity for attackers to exploit weak email security systems also grows.

A 2023 study published in PubMed titled "Spear Phishing Attacks and Email Security Practices in Healthcare: A Nationwide Survey of IT Professionals" highlights that over 70% of healthcare organizations reported facing at least one spear phishing attempt in the previous year 2022. The study also found that a significant portion of staff were unaware of basic email security protocols. This vulnerability is amplified in sectors such as healthcare, where digital communication is often used for sharing sensitive patient data. These findings underline the urgent need for better detection tools and employee training programs, driving investments in solutions to counter spear phishing threats and fueling market growth.

Segmental Insights

Components Analysis

Based on components, the segmentation includes solutions and services. The solutions segment held the largest share in 2024. Organizations across industries are investing in comprehensive solutions that can detect, block, and respond to spear phishing attempts in real time. These solutions often integrate machine learning algorithms and behavioral analytics to monitor communication patterns and flag anomalies before they escalate. The demand is particularly strong in industries such as finance, healthcare, and government, where data sensitivity is high and the cost of breaches is substantial. As cyberattacks become more sophisticated, companies are moving beyond basic firewalls and antivirus software, turning instead to multi-layered security tools that include email gateways, anti-spoofing features, and real-time link scanning. The dominance of this segment is also supported by the shift toward cloud-based solutions, which offer faster deployment and easier scalability. Organizations are increasingly prioritizing tools that prevent attacks and provide analytics and reporting to support ongoing threat management and compliance needs.

The services segment is anticipated to register the highest growth rate during the forecast period, driven by the rising demand for specialized security services such as threat assessment, security audits, managed detection and response (MDR), and training programs. Many small to mid-sized companies lack the in-house expertise to manage advanced cyber threats, making outsourced services an essential part of their security strategy. Service providers offer continuous monitoring, rapid incident response, and expert analysis that help reduce the burden on internal teams. In addition, phishing simulation and awareness training services are gaining popularity as organizations aim to strengthen the human element of cybersecurity. These programs are often tailored by industry and role, helping employees recognize and respond to targeted attacks more effectively. Growth in this segment is further supported by the increasing number of regulations requiring companies to demonstrate proactive risk management and employee preparedness.

Deployment Analysis

Based on deployment, the segmentation includes on-premises, cloud-based, and hybrid. The on-premises segment held the largest share in 2024. Organizations often handle highly sensitive and confidential data that requires tighter control, customization, and compliance with internal security policies. On-premises solutions allow businesses to retain full control over their infrastructure, data, and security protocols without relying on external vendors. This deployment model is especially preferred in sectors such as defense, finance, and healthcare, where regulatory demands and risk tolerance are significantly higher. Many companies in these sectors opt for in-house security environments to minimize third-party access and ensure complete visibility over data traffic and threat activity. Additionally, organizations with established IT infrastructure and skilled internal teams are more inclined to maintain on-premises systems, especially when legacy integration is necessary. These factors have made on-premises solutions a reliable choice for enterprises seeking long-term control, stability, and adherence to strict cybersecurity standards.

The cloud-based deployment segment is anticipated to register the highest growth rate during the forecast period. The shift toward remote and hybrid work models has accelerated cloud adoption, as companies need to secure a dispersed workforce operating across different networks and devices. Cloud-based spear phishing defense tools offer flexible deployment, real-time updates, and easier integration with third-party applications, making them highly attractive to small and medium-sized businesses. They also reduce the need for complex infrastructure management and allow faster implementation, which appeals to organizations seeking agility and operational efficiency. Additionally, ongoing improvements in cloud security and compliance capabilities have helped address concerns about data protection and reliability.

Organization Size Analysis

Based on organization size, the segmentation includes large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment held the largest share in 2024. Large organizations often operate across multiple regions, manage vast volumes of sensitive data, and rely heavily on email and digital communication for daily operations, making them prime targets for spear phishing attacks. To mitigate risks, large enterprises invest in comprehensive security ecosystems that include advanced threat detection, incident response, behavioral analytics, and staff training. Many of them also implement custom solutions that align with their internal security policies and regulatory requirements. The presence of dedicated IT and cybersecurity teams further supports the adoption of sophisticated anti-phishing tools and strategies. Given the scale and complexity of their digital environments, these enterprises consistently prioritize proactive threat management, making them the largest contributors to the demand for spear phishing protection solutions and services.

The small and medium-sized enterprises (SMEs) segment is anticipated to register the highest growth rate during the forecast period due to the increasing frequency and impact of targeted attacks on smaller businesses. While they may not hold the same volume of sensitive data as large corporations, SMEs are often seen as easier targets by attackers due to limited security infrastructure and lack of awareness. With rising digitalization and adoption of remote work practices, these businesses are recognizing the need to upgrade their cybersecurity defenses. Many are turning to cloud-based and managed service options that offer robust protection without the burden of heavy upfront investment. Additionally, growing regulatory pressures and customer demands for secure data handling are pushing SMEs to adopt spear phishing protection tools and training programs.

End User Analysis

Based on end user, the segmentation includes IT & telecommunication, BFSI, government & defense, healthcare, retail, manufacturing, media & entertainment, and others. The BFSI segment held the largest share in 2024. Financial institutions are frequent targets of spear phishing attacks aimed at gaining unauthorized access to customer accounts, confidential transactions, or internal systems. As digital banking and online financial services continue to grow, these risks have become more complex and widespread. To safeguard against such threats, BFSI organizations are heavily investing in advanced email security tools, real-time threat intelligence systems, and staff awareness programs. The integration of artificial intelligence and behavioral analytics is also becoming more common, helping institutions detect even subtle anomalies in user behavior. Furthermore, compliance with regulations related to data privacy and cybersecurity requires banks and insurers to maintain a robust defense strategy, further driving the demand for targeted phishing protection. This continued investments in prevention and risk management makes the BFSI sector a major contributor.

The healthcare segment is anticipated to register the highest growth rate during the forecast period, mainly due to the rapid digital transformation of healthcare systems and the increasing volume of electronic health records being shared and stored online. Healthcare organizations, including hospitals, clinics, and research institutions, often operate with limited cybersecurity budgets while managing extremely sensitive patient data. This combination makes them an attractive target for cybercriminals deploying spear phishing campaigns. The growing use of telehealth platforms, electronic prescriptions, and remote patient monitoring tools further expands the risk surface. In recent years, there has been a noticeable rise in phishing attacks exploiting public health emergencies and posing as communications from trusted institutions. In response, healthcare providers are now investing more in awareness training, endpoint protection, and cloud-based email security tools that are easier to deploy and maintain.

Regional Analysis

The North America spear phishing market accounted for the largest share in 2024, driven by the early adoption of advanced cybersecurity infrastructure and a high awareness of cyber threats across industries. Enterprises in this region, especially within critical sectors such as finance, defense, and healthcare, are frequently targeted by sophisticated spear phishing attacks. The region benefits from strong regulatory frameworks, including mandatory data protection policies and breach notification laws, which push organizations to implement robust email security and threat detection systems. Ongoing investments in cloud-based technologies and AI-driven cybersecurity tools are also supporting market expansion, as companies aim to prevent targeted attacks that traditional tools often fail to detect.

U.S. Spear Phishing Market Insights

The U.S. holds the largest portion of demand within North America due to its dense concentration of high-value targets, including multinational corporations, government bodies, and research institutions. The rise in spear phishing campaigns targeting political entities, healthcare organizations, and tech companies has driven widespread investments in multi-layered security systems and workforce training. Additionally, regulatory efforts such as HIPAA for healthcare and the GLBA for financial services create added pressure to prevent data breaches caused by phishing. Frequent public disclosures of phishing-related incidents in the U.S. have also heightened executive-level focus on proactive threat management, fueling growth in both solutions and services across sectors.

Europe Spear Phishing Market Trends

Europe is seeing steady growth in the adoption of spear phishing protection solutions, supported by strong data privacy regulations such as the GDPR. Organizations are becoming more aware of the legal and financial consequences of data breaches, prompting increased cybersecurity spending. Industries such as banking, manufacturing, and public services are investing in tools that combine real-time threat detection, email monitoring, and user behavior analytics. The shift toward cloud-based work environments across European businesses has also raised concerns around email-based threats, making spear phishing protection a top priority.

The Germany spear phishing market stands out as a key country in the regional market, with its industrial and financial sectors facing an increasing volume of targeted phishing campaigns. The country has implemented national strategies and frameworks to strengthen cyber resilience across its critical infrastructure. As digital transformation continues across German enterprises, the demand for tailored spear phishing solutions, such as employee awareness training and incident response services, is growing rapidly. Government-driven initiatives to support digital security for small and mid-sized businesses are also helping push adoption, making Germany a focal point in Europe’s cybersecurity landscape.

Asia Pacific Spear Phishing Market Overview

Asia Pacific is emerging as a key region for market growth, fueled by increasing digitalization and the rising frequency of targeted cyberattacks. Rapid technology adoption across sectors such as finance, healthcare, education, and e-commerce has introduced new vulnerabilities, prompting businesses to invest in cybersecurity tools. The growing use of email-based communication in the region’s expanding digital workforce is a primary entry point for attackers. Organizations are responding by deploying cloud-based security solutions and investing in user training programs to improve defenses. Regional governments are also becoming more active in implementing data protection policies that support this upward trend in cybersecurity awareness and investment.

India Spear Phishing Market Outlook

India, in particular, is witnessing strong growth in spear phishing prevention efforts due to a surge in cyberattacks on its banking, IT, and public service sectors. Many Indian organizations are transitioning to hybrid work models, which has increased exposure to spear phishing risks. The country’s cybersecurity ecosystem is rapidly evolving, supported by national initiatives that promote secure digital infrastructure and mandate stronger compliance measures. Local businesses are embracing scalable, cost-effective tools such as managed security services, phishing simulation platforms, and advanced threat monitoring, driving notable momentum.

Key Players and Competitive Insights

The market includes several key players that are actively developing and offering spear phishing protection solutions and services. Major companies such as Proofpoint, Barracuda Networks, Mimecast, Cisco (Cisco Systems, Inc.), Trend Micro, FireEye (now Trellix after merging with McAfee Enterprise), and Symantec (Broadcom Inc.) are leading the competitive landscape. These players focus on enhancing their product portfolios through innovation, partnerships, and strategic acquisitions to address evolving cyber threats. The competition revolves around offering comprehensive, real-time threat detection, user training programs, and integration capabilities with broader cybersecurity ecosystems.

A few prominent companies in the industry include Proofpoint, Barracuda Networks, Mimecast, Cisco Systems, Inc., Trend Micro, FireEye, Broadcom Inc., Cofense, Sophos, Fortinet, Check Point Software Technologies Ltd., and Rapid7.

Key Players

- Barracuda Networks

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Cofense

- FireEye

- Fortinet

- Mimecast

- Proofpoint

- Rapid7

- Sophos

- Symantec

- Trend Micro

Spear Phishing Industry Developments

May 2025: Proofpoint announced its intent to acquire Hornetsecurity Group, a European email security provider. This strategic move aims to expand Proofpoint's reach beyond large enterprises to small and mid-sized businesses globally, particularly through managed service providers.

May 2025: Barracuda Networks announced enhancements to its threat protection capabilities by integrating multimodal AI technology into its purpose-built sandbox engine.

Spear Phishing Market Segmentation

By Components Outlook (Revenue – USD Billion, 2020–2034)

- Solutions

- Email Security Solutions

- Advanced Threat Protection (ATP)

- Data Loss Prevention (DLP)

- Endpoint Detection & Response (EDR)

- Identity & Access Management (IAM)

- Others

- Services

- Professional Services

- Managed Services

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-Premises

- Cloud-Based

- Hybrid

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By End User Outlook (Revenue – USD Billion, 2020–2034)

- IT & Telecommunication

- BFSI

- Government & Defense

- Healthcare

- Retail

- Manufacturing

- Media & Entertainment

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Spear Phishing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.97 billion |

|

Market Size in 2025 |

USD 2.21 billion |

|

Revenue Forecast by 2034 |

USD 6.32 billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.97 billion in 2024 and is projected to grow to USD 6.32 billion by 2034.

The global market is projected to register a CAGR of 12.4% during the forecast period.

North America dominated the share in 2024.

A few key players include Proofpoint, Barracuda Networks, Mimecast, Cisco Systems, Inc., Trend Micro, FireEye, Broadcom Inc., Cofense, Sophos, Fortinet, Check Point Software Technologies Ltd., and Rapid7.

The solutions segment accounted for the largest share in 2024.

The cloud-based segment is expected to witness the fastest growth during the forecast period.