Sports Nutrition Market Size, Share, Trends, Industry Analysis Report

: By Application (Pre-Workout, Post-Workout), By Product, By Consumer Group, By End User, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 116

- Format: PDF

- Report ID: PM1796

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

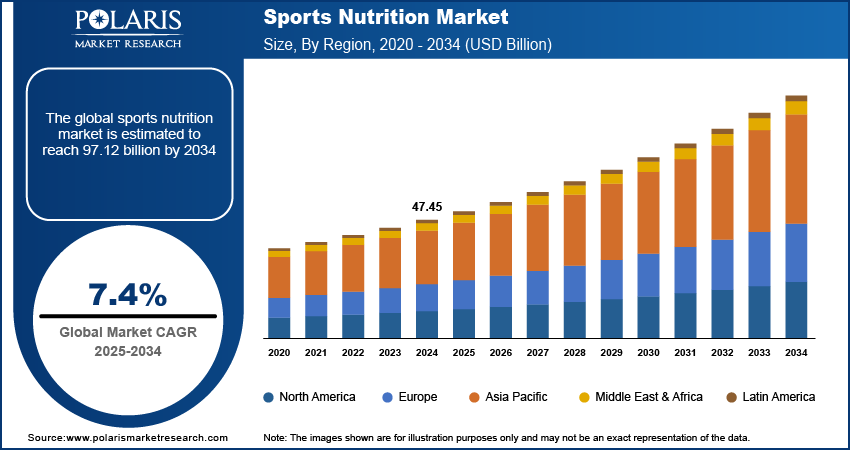

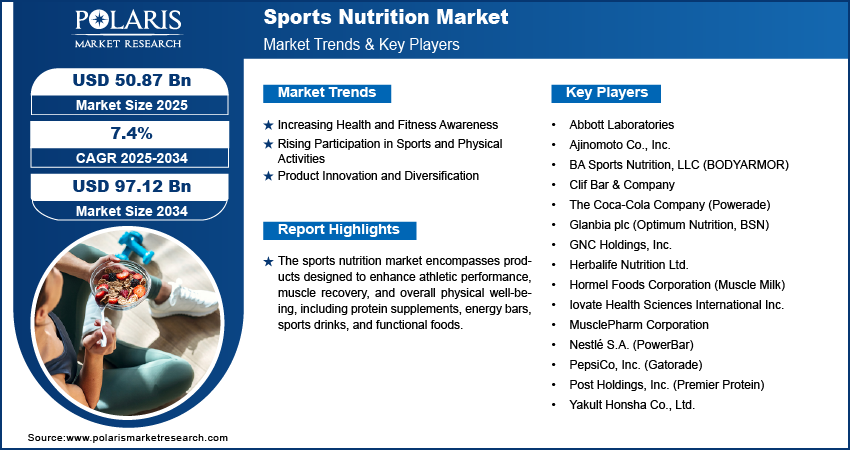

The sports nutrition market size was USD 47.45 billion in 2024, with a CAGR of 7.4% between 2025 and 2034. The market is growing as more people become aware of the benefits of fitness and demand plant-based foods and drinks, with ample room for growth through the introduction of new products and online sales.

Key Insights

- In 2024, the post-workout segment is expected to lead the market as more people become aware of its benefits for muscle recovery and growth.

- The protein powders segment is a top-performing market due to their use by bodybuilders and athletes to boost muscle recovery and growth.

- In 2024, the sports nutrition market was primarily driven by the adult segment, largely due to the high number of people in the 18- to 64-year-old age bracket engaging in physical exercise and sports activities.

- The fastest growth in the sports nutrition market is being achieved through the lifestyle users segment, as more consumers embrace active and healthy lifestyles, as well as greater awareness of the contributions of nutrition to overall health.

- North America led the sports nutrition market in 2024, driven by the expansion of the fitness culture, rising consumer expenditure on health and fitness, and the presence of established market leaders.

- Asia Pacific is experiencing a rising demand for sports nutrition, driven by increasing health consciousness and a rapidly expanding middle class with growing disposable income.

Industry Dynamics

- More people are driving the market by seeking natural, clean-label ingredients, as they desire healthier, less processed products and greater transparency.

- The growing emphasis on health and fitness is driving the sports nutrition market, as individuals increasingly recognize the importance of nutrition for optimal performance and recovery.

- Continuous product development and diversification are driving the sports nutrition market, as producers create new formulations, flavors, and forms to meet evolving customer preferences.

- High prices of sports nutrition products and the presence of counterfeit or inferior-quality alternatives are significant limitations to the market's development.

Market Statistics

2024 Market Size: USD 47.45 billion

2034 Projected Market Size: USD 97.12 billion

CAGR (2025-2034): 7.4%

North America: Largest Market Share

AI Impact on Sports Nutrition Market

- Artificial intelligence-based personalization software enables the creation of customized nutrition programs tailored to an individual's specific fitness objectives, health information, and food preferences.

- Machine learning models enable manufacturers to forecast trends, streamline product formulation, and enhance production efficiency.

- Apps based on AI bring real-time monitoring of nutrition consumption, performance, and recovery, increasing consumer interaction.

- AI is enabling the creation of smarter, more precise supplementation products by analyzing large datasets on performance, nutrition, and consumer behavior.

To Understand More About this Research: Request a Free Sample Report

The sports nutrition market encompasses products designed to enhance athletic performance, muscle recovery, and overall fitness. This market includes protein supplements, energy drinks, meal replacements, and performance-enhancing products. Key drivers include the rising demand for protein-based supplements, increasing awareness of fitness and active lifestyles, and the growing number of gym-goers and professional athletes. Trends shaping the market include the shift towards plant-based protein supplements, the demand for clean-label and natural ingredients, and the rising popularity of personalized nutrition solutions. The expansion of e-commerce and digital marketing further accelerates the sports nutrition market growth by improving product accessibility.

Market Dynamics

Increasing Health and Fitness Awareness

The growing awareness of health and fitness is significantly fueling the sports nutrition market expansion. Individuals are increasingly recognizing the importance of proper nutrition in enhancing athletic performance, muscle recovery, and overall well-being. This heightened consciousness leads to a greater demand for sports nutrition products, such as protein supplements and energy bars, as people seek to optimize their fitness routines and maintain active lifestyles.

Rising Participation in Sports and Physical Activities

The surge in participation in sports and physical activities is fueling the sports nutrition market demand. For instance, according to data from the Sports and Fitness Industry Association, the participation rates in various physical activities have increased to 80%, with the number of Americans engaging in at least one form of physical activity rising from 242 million in 2023 to 247.1 million in 2024. More individuals are engaging in regular exercise, joining fitness clubs, and participating in organized sports, thereby increasing the need for nutritional products that support performance and recovery. This trend is evident across various demographics, including both amateur and professional athletes, contributing to the significant market growth.

Product Innovation and Diversification

Continuous product innovation and diversification play a crucial role in driving the sports nutrition market. Manufacturers are developing new formulations, flavors, and convenient formats to meet the evolving preferences of consumers. This includes the introduction of plant-based protein supplements, ready-to-drink protein shakes, and energy gels, providing a broader audience seeking personalized and accessible nutrition solutions.

Segment Insights

Market Assessment by Application

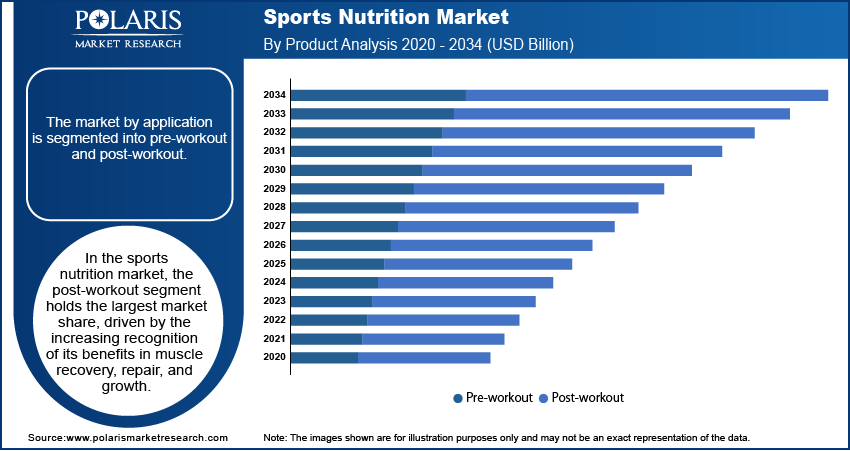

The sports nutrition market segmentation, based on application, includes pre-workout, post-workout, and others. The post-workout segment holds the largest market share in 2024, driven by the increasing recognition of its benefits in muscle recovery, repair, and growth. Post-workout supplements, such as branched-chain amino acids (BCAAs), glutamine, and casein, are gaining traction globally due to their effectiveness in enhancing muscle recovery and maintaining muscle mass. This trend is further supported by the growing awareness among fitness enthusiasts and athletes about the importance of nutrition in post-exercise recovery.

The pre-workout segment is also experiencing the highest sports nutrition market growth rate. This surge is attributed to the rising demand for products that enhance energy, focus, and endurance during exercise sessions. Pre-workout supplements often contain ingredients such as caffeine, beta-alanine, and creatine, which are known to improve workout performance. The increasing number of individuals engaging in regular physical activities and the expanding fitness industry contribute to the heightened demand for pre-workout nutrition products.

Market Evaluation by Product

The sports nutrition market is segmented by product into protein powder, ISO drink powder, capsule/tablets, supplement powder, RTD protein drinks, sports supplements, carbohydrate drinks, protein bars, carbohydrate/energy bars, and other supplements. The protein powders represent a significant segment, driven by their widespread use among athletes and fitness enthusiasts aiming to enhance muscle growth and recovery. These powders, derived from sources such as whey, casein, soy, and pea, offer a convenient method to increase protein intake and are also the best sports medicine. The demand for protein powders is further boosted by the growing consumer awareness of the importance of protein in supporting athletic performance and overall health.

Ready-to-drink (RTD) protein beverages are experiencing rapid growth within the sports nutrition sector. These pre-mixed drinks provide convenience for individuals seeking quick, on-the-go nutrition solutions. The increasing popularity of RTD protein drinks is attributed to their portability, taste variety, and the rising trend of healthy snacking among busy consumers. Manufacturers are responding to this demand by introducing innovative flavors and formulations, including plant-based options, to cater to a broader audience.

Market Outlook by Consumer Group

The sports nutrition market segmentation, based on consumer group, includes children, adult, and geriatric. The adult segment held the largest sports nutrition market share in 2024, driven by a substantial number of individuals aged 18 to 64 actively engaging in fitness and sports activities. This demographic's focus on maintaining health and enhancing performance contributes significantly to the demand for sports nutrition products. Additionally, the increasing number of working women in this age bracket further fuels the need for convenient and effective nutritional solutions to support their active lifestyles.

The geriatric segment is experiencing the highest growth rate within the sports nutrition market. As the global population ages, there is a growing emphasis on health maintenance, mobility, and overall quality of life among older adults. This has led to an increased consumption of sports nutrition products aimed at supporting muscle mass retention, joint health, and energy levels. Manufacturers are responding by developing specialized formulations tailored to the nutritional needs of the elderly, thereby contributing to the segment's rapid expansion.

Market Assessment by End Users

The market by end-users is segmented into athletes, bodybuilders, recreational users, and lifestyle users. In the sports nutrition market, the athletes segment holds the largest market share, driven by the specialized nutritional needs of individuals engaged in intense physical activities. Athletes require tailored nutrition to support muscle development, enhance performance, and expedite recovery after high intensity workouts. Sports nutrition products provide specifically to these requirements, offering optimized formulations with precise ratios of macronutrients and essential vitamins. The increasing awareness among athletes about the role of nutrition in achieving peak performance further fuels the dominance of this segment.

The lifestyle users segment is experiencing the highest growth rate within the sports nutrition market. This surge is attributed to a broader consumer base adopting active and balanced lifestyles, increasing health and wellness trends, and greater awareness of the importance of nutrition for overall health. Social media and fitness influencers often promote sports nutrition products tailored for lifestyle users, particularly in developing countries, driving product awareness and adoption among this demographic. Rather than opting for a broad range of general nutritional products, lifestyle users are increasingly favoring sports nutrition products due to their targeted, functional benefits that align with their active lifestyles.

Regional Insights

By region, the study provides sports nutrition market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest sports nutrition market share, driven by a well-established fitness culture, high consumer spending on health and wellness, and a strong presence of key market players. The region benefits from a high awareness of sports nutrition products, a growing number of gym memberships, and the increasing adoption of protein-based supplements among both professional athletes and lifestyle users. For instance, in 2023, US fitness facility memberships reached 72.9 million, accounting for 23.7% of the population aged six and older. This increase highlights a significant shift towards prioritizing health and wellness, according to the Health & Fitness Association (HFA).

The sports nutrition market in Europe is expanding due to the growing preference for clean-label, organic, and plant-based products. Consumers in the region are increasingly focusing on health and wellness, leading to higher demand for functional foods and protein supplements. The market is also influenced by stringent regulatory standards, which have encouraged the development of high-quality and scientifically backed products. Countries such as Germany, the UK, and France are key contributors to market growth, with a rising number of fitness-conscious individuals and professional athletes driving demand. E-commerce and direct-to-consumer sales are gaining traction, further boosting accessibility to sports nutrition products.

Asia Pacific is experiencing rapid growth in the sports nutrition market, driven by increasing awareness of fitness and a rising middle-class population with higher disposable income. Countries such as China, India, and Japan are key growth hubs, supported by urbanization, an expanding gym culture, and growing interest in protein-based diets. The demand for ready-to-drink protein beverages, plant-based supplements, and energy-boosting products is increasing as consumers prioritize convenience and overall well-being. International brands are expanding their presence in the region, while local players are introducing region-specific formulations to cater to diverse consumer preferences.

Key Players and Competitive Insights

In the sports nutrition market, several companies have established a significant presence with their diverse product offerings. Glanbia plc, an Ireland-based global nutrition company, operates brands such as Optimum Nutrition and BSN, providing a range of protein powders and supplements. Abbott Laboratories offers products such as Ensure and EAS Myoplex, catering to both general consumers and athletes. PepsiCo, Inc. owns the Gatorade brand, which includes sports drinks and protein products designed to support hydration and recovery. The Coca-Cola Company markets Powerade, a sports beverage formulated to replenish electrolytes during physical activity. Clif Bar & Company produces energy bars and snacks aimed at fueling athletic performance. MusclePharm Corporation develops a variety of supplements targeting muscle growth and recovery. Nestlé S.A. offers products such as PowerBar, focusing on energy and nutrition for athletes. Hormel Foods Corporation owns the Muscle Milk brand, providing protein shakes and powders. Yakult Honsha Co., Ltd. produces probiotic beverages that support digestive health, beneficial for active individuals. Ajinomoto Co., Inc.

These companies compete by continually innovating their product lines to meet evolving consumer preferences, such as the demand for plant-based proteins and clean-label ingredients. They leverage extensive distribution networks, including e-commerce platforms and brick-and-mortar retail partnerships, to reach a broad customer base. Marketing strategies often involve endorsements from athletes and fitness influencers to enhance brand credibility and appeal. Research and development investments are significant, aiming to create products that improve performance, aid recovery, and support overall health. The market is dynamic, with companies striving to differentiate themselves through unique formulations, flavors, and functional benefits.

Despite the competitive landscape, opportunities for growth remain abundant, particularly in emerging markets where health and fitness trends are gaining momentum. Companies adapt to regional tastes, comply with local regulations, and effectively communicate the benefits of their products are well-positioned to expand their market share. Additionally, the increasing consumer focus on holistic wellness presents avenues for product diversification into areas such as mental well-being and personalized nutrition.

Glanbia plc, headquartered in Kilkenny, Ireland, is a global nutrition company that specializes in performance and lifestyle nutrition products. Its portfolio includes well-known brands such as Optimum Nutrition, SlimFast, and Isopure, catering to consumers seeking to enhance their health and fitness. The company's focus on innovation and quality has established it as a prominent entity in the sports nutrition industry.

Abbott Laboratories, based in Illinois, US, is a diversified healthcare company with a significant presence in the nutrition sector. Through its Abbott Nutrition division, the company offers products like Ensure, designed to support overall health and wellness. Abbott's commitment to science-based nutrition solutions has made it a trusted name among consumers who aim to maintain or improve their health.

List of Key Companies

- Abbott Laboratories

- Ajinomoto Co., Inc.

- BA Sports Nutrition, LLC (BODYARMOR)

- Clif Bar & Company

- The Coca-Cola Company (Powerade)

- Glanbia plc (Optimum Nutrition, BSN)

- GNC Holdings, Inc.

- Herbalife Nutrition Ltd.

- Hormel Foods Corporation (Muscle Milk)

- Iovate Health Sciences International Inc. (MuscleTech, Hydroxycut)

- MusclePharm Corporation

- Nestlé S.A. (PowerBar)

- PepsiCo, Inc. (Gatorade)

- Post Holdings, Inc. (Premier Protein)

- Yakult Honsha Co., Ltd.

Sports Nutrition Industry Developments

- March 2025: Hostess Brands, a subsidiary of The J.M. Smucker Co., entered a multi-year partnership with sports nutrition company REDCON1 to introduce Hostess flavors into protein powders and ready-to-drink shakes.

- August 2024: Denzour Nutrition, a well-known Indian brand recognized for its focus on natural and effective sports supplements, announced its expansion into organic nutraceuticals. This new product line is designed to serve both athletes and the general population looking to enhance their health and fitness with high-quality natural ingredients.

Sports Nutrition Market Segmentation

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Pre-workout

- Post-workout

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Protein Powder

- Iso Drink Powder

- Capsule/Tablets

- Supplement Powder

- RTD Protein Drinks

- Sports supplements

- Carbohydrate Drinks

- Protein Bars

- Carbohydrate/Energy Bars

- Other Supplements

By Consumer Group Outlook (Revenue-USD Billion, 2020–2034)

- Children

- Adult

- Geriatric

By End User Outlook (Revenue-USD Billion, 2020–2034)

- Athletes

- Bodybuilders

- Recreational Users

- Lifestyle Users

By Distribution Channel Outlook (Revenue-USD Billion, 2020–2034)

- Large Retail and Mass Merchandisers

- Small Retail

- Drug and Specialty Stores

- Fitness Institutions

- Online

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Sports Nutrition Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 47.45 billion |

|

Market Size Value in 2025 |

USD 50.87 billion |

|

Revenue Forecast by 2034 |

USD 97.12 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The sports nutrition market has been segmented into detailed segments of application, product, consumer group, end user, and distribution channel. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the sports nutrition market focus on product innovation, digital marketing, and strategic partnerships to expand their consumer base. They invest in research and development to introduce formulations with clean-label ingredients, plant-based proteins, and functional benefits. E-commerce platforms and direct-to-consumer channels are key drivers, allowing brands to reach a wider audience. Athlete endorsements, fitness influencers, and social media campaigns play a crucial role in brand positioning. Additionally, companies expand their market presence through acquisitions, collaborations, and regional product adaptations to cater to diverse consumer preferences.

FAQ's

The sports nutrition market size was valued at USD 47.45 billion in 2024 and is projected to grow to USD 97.12 billion by 2034.

The market is projected to register a CAGR of 7.4% during the forecast period, 2024-2034.

North America had the largest share of the market driven by a well-established fitness culture, high consumer spending on health and wellness, and a strong presence of key market players.

Key players in the sports nutrition market include Abbott Laboratories, Ajinomoto Co., Inc.; BA Sports Nutrition, LLC (BODYARMOR), Clif Bar & Company, The Coca-Cola Company (Powerade), Glanbia plc (Optimum Nutrition, BSN), GNC Holdings, Inc.; Herbalife Nutrition Ltd.; and Hormel Foods Corporation.

The post-workout segment accounted for the larger market share in 2024 driven by the increasing recognition of its benefits in muscle recovery, repair, and growth.

The athletes segment accounted for the larger share of the market in 2024 driven by the specialized nutritional needs of individuals engaged in intense physical activities.

Sports nutrition refers to the practice of consuming specific nutrients to enhance athletic performance, endurance, recovery, and overall physical health. It includes dietary supplements, protein powders, energy bars, sports drinks, and other products formulated to support muscle growth, hydration, and energy levels. The field focuses on optimizing macronutrient intake, including proteins, carbohydrates, and fats, along with micronutrients like vitamins and minerals, to meet the demands of different physical activities. Sports nutrition is widely used by athletes, bodybuilders, fitness enthusiasts, and individuals seeking to improve their exercise outcomes and general well-being.

A few key trends in the market are described below: Rising Demand for Plant-Based Products – Increasing consumer preference for plant-based protein powders, bars, and supplements due to health and sustainability concerns. Growth of Clean-Label and Natural Ingredients – Consumers are seeking products free from artificial additives, preservatives, and synthetic ingredients. Expansion of E-Commerce and Direct-to-Consumer Sales – Online retail platforms are becoming primary distribution channels, offering convenience and personalized recommendations. Personalized Nutrition Solutions – Brands are integrating AI and data analytics to provide customized sports nutrition plans based on individual needs.

A new company entering the sports nutrition market can focus on plant-based and clean-label products, as consumer demand for natural and sustainable ingredients is increasing. Investing in personalized nutrition using AI-driven recommendations can provide a competitive edge by catering to individual dietary and fitness needs. Establishing a strong digital presence through e-commerce and direct-to-consumer sales, along with influencer partnerships, can enhance brand visibility. Developing innovative formulations such as functional hydration drinks, RTD protein beverages, and recovery-focused supplements can attract diverse consumer segments. Additionally, expanding into emerging markets with localized product offerings can create growth opportunities.

Companies manufacturing, distributing, or purchasing Sports Nutrition and related products, and other consulting firms must buy the report.