STI and Vaginitis PCR Testing Market Size, Share, Trends, & Industry Analysis Report

By Condition [Sexually Transmitted Infections (STIs) and Vaginal Infections], By Test Type, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5767

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

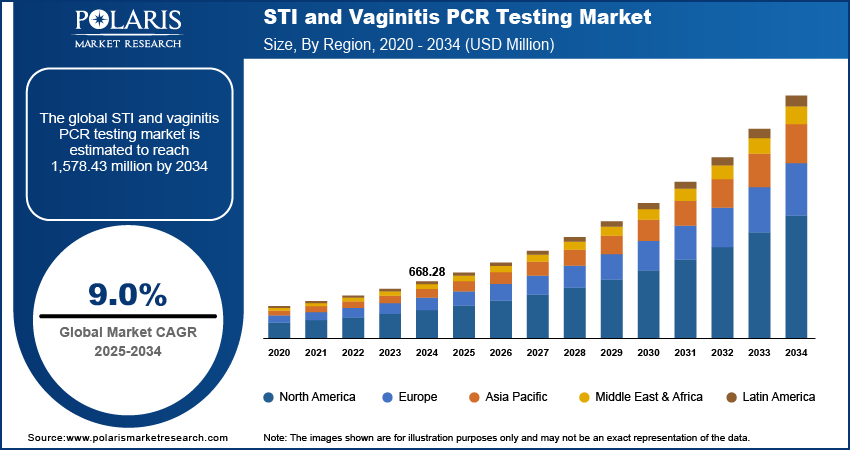

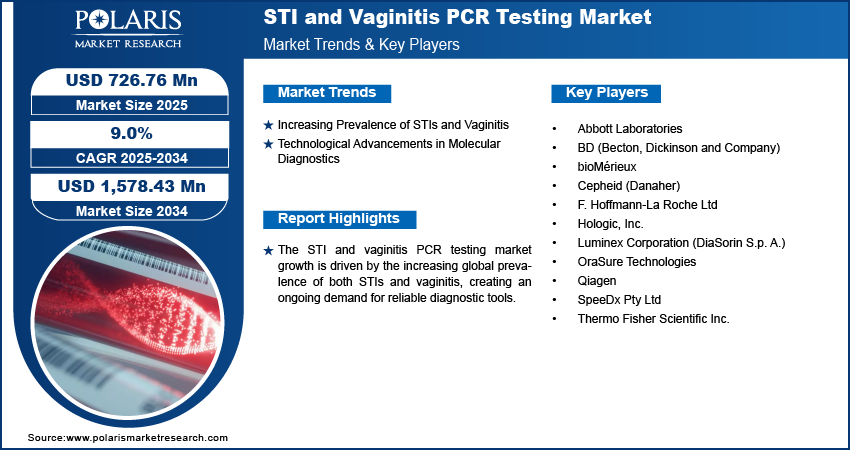

The STI and vaginitis PCR testing market size was valued at USD 668.28 million in 2024. The market is projected to grow from USD 726.76 million in 2025 to USD 1,578.43 million by 2034, exhibiting a CAGR of 9.0% during 2025–2034.

Vaginitis and STI testing entail the modern diagnostics of both sexually transmitted infections (STIs) and various forms of vaginitis, including chlamydia, gonorrhea, trichomoniasis, bacterial vaginosis, and vulvovaginal candidiasis. The conditions are diagnosed using advanced techniques such as polymerase chain reaction (PCR) testing, which has a high turnaround time. Rapid and precise identification is crucial for effective treatment and helps in reducing further transmission. The segment outlook is favorable due to concerns regarding public health, and early and accurate STD diagnosis with the assistance of medical technology.

The rise in diagnosed cases of STIs and vaginitis globally is a significant driver of growth in the STI and vaginitis PCR testing market. The increasing prevalence of these conditions, coupled with a lack of awareness and delayed medical intervention, has led to a greater demand for timely and accurate diagnostic solutions. Millions of individuals are affected by STIs and vaginitis worldwide, highlighting the urgent need for reliable and efficient testing methods. The development of multiplex PCR assays, which enable the simultaneous detection of multiple pathogens, has streamlined diagnostic processes. This advancement not only enhances testing efficiency but also increases the appeal of PCR-based solutions among healthcare providers and diagnostic laboratories, further propelling market expansion.

STIs are growing at an alarming rate and are a concern in public health due to their high global infection rates. Chlamydia and Gonorrhea are common examples. STIs can have a variety of symptoms or even be asymptomatic. Individuals who are infected with STIs can unknowingly transmit them, further increasing the dire need for effective PCR testing. Effective testing should be able to detect infections with minimal to no symptoms, which can control their spread. A medical study shows that a large portion of females who seem to have nonspecific vaginal symptoms or even no symptoms have a Chlamydia or Trichomoniasis infection if PCR testing is performed, thereby exposing the methods of advanced diagnostics alongside proving the existence of STIs. Healthcare systems aiming for more inclusive screening programs are facing the demand for comprehensive testing, and the increase in detection contributes directly to the number of PCR-based assays.

Industry Dynamics

Increasing Prevalence of STIs and Vaginitis

Sexually transmitted infections (STIs) and vaginitis, if left undiagnosed and untreated, can lead to severe health complications, including infertility, pelvic inflammatory disease, and increased susceptibility to HIV. The ease of transmission and often asymptomatic nature of many STIs contribute to their widespread occurrence. Global data by the World Health Organization (WHO) from 2021 indicated a high prevalence of major STIs, with approximately 128 million cases of chlamydia, 29 million of gonorrhea, 105 million of trichomoniasis, and 22.3 million of syphilis. In the US, the Centers for Disease Control and Prevention (CDC) reported over 2.4 million combined cases of chlamydia, gonorrhea, and syphilis in 2023, though an overall decrease of 1.8% from 2022 to 2023 was observed in these reported cases, as stated by the CDC in 2024. These substantial numbers underscore a persistent demand for accurate and timely diagnostic solutions such as PCR testing. The continuous increase in the prevalence of sexually transmitted infections (STIs) and vaginitis fuels the demand for advanced and rapid diagnostic methods, such as PCR testing.

Technological Advancements in Molecular Diagnostics

Significant advancements in molecular diagnostics, particularly in PCR technology, are propelling the expansion of the sexually transmitted infection and vaginitis PCR testing market. Innovations such as multiplex PCR assays allow for the simultaneous detection of multiple pathogens from a single sample, offering enhanced efficiency, reduced turnaround times, and improved diagnostic accuracy compared to traditional methods. These technologies are increasingly integrated into automated systems, streamlining laboratory workflows and enabling higher throughput. A study published in PLOS ONE in 2024 evaluated a vaginal panel real-time PCR kit, demonstrating its optimal concordance with routinely used diagnostics for vaginitis and its ability to enhance detection of Trichomonas vaginalis. Furthermore, research in Clinical and Economic Review in 2024 highlighted that syndromic multiplex RT-PCR diagnostics for vaginitis, when providing next-day results, were associated with lower outpatient costs and total healthcare costs compared to no testing. Such technological improvements boost the sensitivity and specificity of testing and contribute to more effective patient management and reduced healthcare costs, thus significantly driving the demand for PCR testing in the field of STIs and vaginitis management.

Growing Awareness and Screening Initiatives

An increasing focus on sexual health awareness and the implementation of widespread screening initiatives boost the sexually transmitted infections (STI) and vaginitis PCR testing market. Public health campaigns, educational programs, and improved access to healthcare services are encouraging more individuals to get tested, even without experiencing any symptoms. This proactive approach to diagnosis is crucial for preventing complications and reducing transmission rates. For example, a multi-center US clinical study published in Journal of Clinical Microbiology in 2024 highlighted the importance of STI testing in women seeking care for abnormal vaginal discharge and inflammation, reporting that among 1,051 women with vaginitis diagnoses, 18.5% had one or more STIs. Increased awareness of these risks and the availability of advanced diagnostic tools such as PCR are empowering individuals and healthcare providers to pursue earlier and more comprehensive testing. This enhanced awareness and proactive screening directly translates into a higher volume of tests performed, thereby contributing to the steady growth of the PCR testing segment.

Segmental Insights

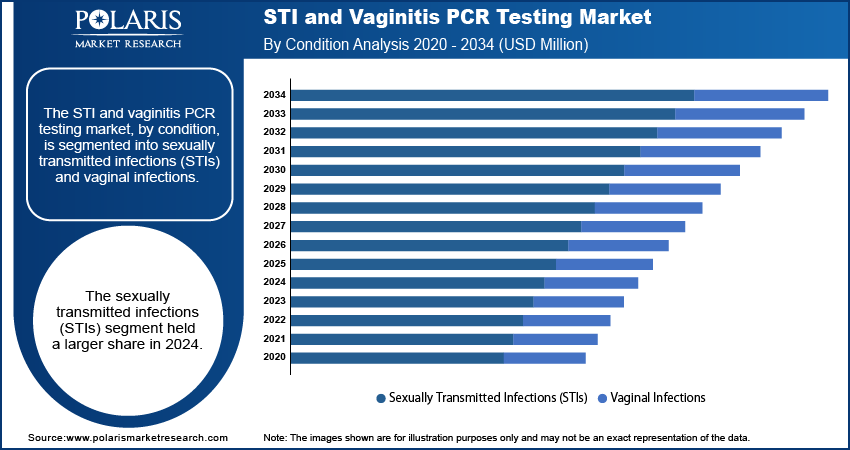

Market Assessment By Condition

The segmentation, by condition, includes sexually transmitted infections (STIs) and vaginal infections. The sexually transmitted infections (STIs) segment held a larger share in 2024. Most STIs have a high global incidence, even if they are asymptomatic, requiring complex and sensitive diagnostic instruments such as PCR. Aid campaigns and universal screening tests directed at curbing the spread of these infections increase STI PCR test demand. As per the CDC data in 2024, the US had more than 1 million recorded cases of chlamydia, gonorrhea, and syphilis in 2023, which showed the need for effective diagnostic measures. STIs are highly prevalent, and targeted STIs public health management ensures this subsegment dominates the STI and vaginitis polymerase chain reaction testing market and grows faster than other segments.

The vaginal infections segment is anticipated to exhibit a higher growth rate during the forecast period, This growth is driven by greater awareness of vaginal health among women and a widespread use of advanced molecular diagnostic techniques for bacterial vaginosis and vulvovaginal candidiasis. Compared to traditional testing methods, PCR testing for vaginal infections is much more accurate, leading to improved treatment outcomes, lower recurrence rates, and enhanced quality of life for patients. A study published in Diagnostic Microbiology and Infectious Diseases in February 2024 highlighted the superior diagnostic accuracy of real-time PCR assays for bacterial vaginosis compared to previous techniques. There is now greater reliance on more accurate testing methods, and further sensitivity to molecular diagnostic approaches, combined with new product initiatives, are greatly benefiting the growth and penetration of this subsegment.

Market Evaluation By Test Type

The segmentation, by test type, includes STI PCR panels and vaginitis PCR panels. The STI PCR panels segment held a larger share in 2024. This is primarily because there is a critical need for the sensitive and accurate detection of an extensive range of sexually transmitted infections, many of which have overlapping or asymptomatic presentations. Multiple Pathogen Detection-MLST(I) can detect multiple pathogens simultaneously, and STI treatment providers and healthcare practitioners highly appreciate its use due to its comprehensive diagnostic approach. In March 2023, BioPerfectus expanded comprehensive PCR solutions for early STI detection by launching new PCR kits for Mycoplasma Hominis and Treponema Pallidum. Such advancements, coupled with the ongoing public health initiatives aimed at controlling STIs globally, fueled the demand for STI PCR panels.

The vaginitis PCR panels segment is anticipated to exhibit a higher growth rate during the forecast period. The growth is propelled by the increasing awareness of the shortcomings of traditional methods of diagnosing vaginitis, such as microscopy, which is prone to subjectivity and inaccuracy. PCR panels tend to be more sensitive and specific than traditional diagnostic methods and thus more accurately and definitively identify bacterial vaginosis, vulvovaginal candidiasis, and trichomoniasis, even in co-infection cases. The use and accessibility of advanced PCR platforms, some of which are even usable at the point-of-care, are leading to the rapid adoption of vaginitis PCR panels and increasing their share in the growing diagnosis market.

Market Evaluation By End Use

The segmentation, by end use, includes hospitals & clinics, diagnostic laboratories, homecare/at-home testing, and others. The diagnostic laboratories segment held the largest share in 2024. This dominance is driven by their sophisticated infrastructure, tremendous throughput, and skilled personnel needed to carry out less intricate molecular infectious disease diagnostic tests, such as PCR. Diagnostic laboratories receive samples from a variety of health service providers, including hospitals and clinics, as well as through home collection kits. Their capacity to process numerous tests in an accurate and timely manner makes them essential for both screening and confirmatory diagnosis. A study published in Microbiology Spectrum in August 2023 comparing DNA probe-based and PCR-based molecular vaginitis testing monitoring showcased the volume of orders that laboratories receive. Along with high volumes of test requests, the requirements for other specialized equipment and qualified staff guarantee that laboratories will remain the dominant setting.

The homecare/at-home testing segment is projected to exhibit the highest growth rate during the forecast period. This growth is attributed to the increased demand for private and convenient healthcare access. Testing kits for STIs and vaginitis allow sample collection by the subject, sending the sample to the lab, thereby eliminating many barriers associated with clinics, such as stigma, distance, and booking diaries. The ease associated with self-collection is a major factor for increased testing, especially among youngsters and those in underrepresented regions. An NIH review published in October 2024 examining home-based screening strategies suggested that home-testers are more likely to utilize screening than clinic-testers.

Regional Analysis

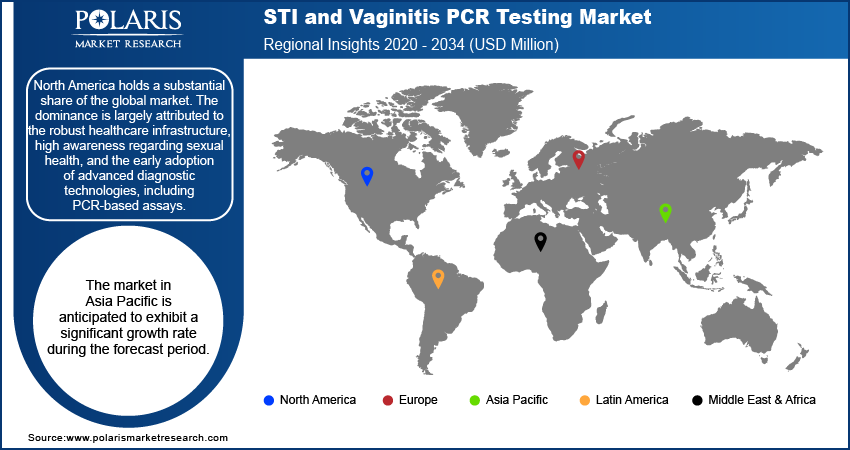

The STI and vaginitis polymerase chain reaction (PCR) testing market report demonstrates varying dynamics across different geographical regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region has its own landscape considering the dominance of specific diseases, the level of medical care, health policies, and modern diagnostic tool use. Currently, North America and Europe account for a substantial share of the total revenue, while Asia Pacific is likely to experience considerable growth. The growth of these regions is fueled by the global emphasis on early detection and prevention, along with the advancements in molecular testing.

The North America STI and vaginitis PCR testing market dominated with a substantial share in 2024, due to the developed healthcare systems, increasing awareness pertaining to sexual hygiene, and the rising use of sophisticated diagnostic methods, such as PCR assays. In the case of US citizens, there is a notable focus on complete surveillance programs and prompt detection to take control of the widespread occurrence of STIs and common vaginal infections. The subsidization of these diagnostics by the government and reasonable policies for remissions also contribute to the negative attitude toward the use of PCR testing. The dominance of major suppliers in the market, along with ongoing R&D focused on improving the precision and ease of testing, strengthens North America's lead position in the diagnosis technologies worldwide.

The Asia Pacific STI and vaginitis PCR testing market is anticipated to exhibit a significant growth rate during the forecast period. The growth is mainly attributed to improvements in the healthcare industry, increased spending capacities, and better awareness of reproductive health in the Government of India and the PRC. Relatively higher burden of STIs and vaginal infections, together with increasing access to diagnostic services, necessitates the need for precise and timely PCR testing. Several governments and NGOs across Asia Pacific are focusing on public health initiatives and promoting STI screening, which will foster the growth of molecular diagnostics. The South and East Pacific areas will benefit from the broad population and current modernization of healthcare services offered to the public.

Key Players and Competitive Insights

The STI and vaginitis PCR testing market includes several prominent players that are actively contributing to its growth and innovation. A few companies include Hologic, Inc.; BD (Becton, Dickinson and Company); bioMérieux; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Abbott Laboratories; Qiagen; OraSure Technologies; and SpeeDx Pty Ltd. Additionally, some key entities operate under larger parent organizations, such as Cepheid (Danaher) and Luminex Corporation (DiaSorin S.p.A.). These organizations consistently offer a range of products and services crucial for the diagnosis of sexually transmitted infections and various forms of vaginitis using advanced PCR technology.

The competition pivots around developing more advanced technology, enhancing product lines, and forming new partnerships. Companies are continually funding R&D to develop more sensitive, specific, and rapid PCR assays, including multiplex panels that detect several pathogens at once. There is also a significant focus on creating automated systems and other solutions for point-of-care and at-home testing to improve accessibility and turnaround time. Moreover, companies differentiate themselves by the number of pathogens included in a single test, the ease of use of their platforms, and their global distribution reach, more so than customer service-friendly interfaces. Their partnerships with healthcare providers and diagnostic laboratories also become vital in widening the product’s reach and seamlessly integrating their diagnostics into care pathways.

List of Key Companies

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- bioMérieux

- Cepheid (Danaher)

- F. Hoffmann-La Roche Ltd

- Hologic, Inc.

- Luminex Corporation (DiaSorin S.p.A.)

- OraSure Technologies

- Qiagen

- SpeeDx Pty Ltd

- Thermo Fisher Scientific Inc.

Industry Developments

- January 2025: Hologic, Inc. announced the completion of its acquisition of Gynesonics, Inc. This acquisition expands Hologic's portfolio within women's health, specifically in the area of uterine fibroid treatment.

- January 2025: bioMérieux announced that it had entered into an agreement to acquire SpinChip Diagnostics ASA, a privately held Norwegian diagnostics company. This acquisition strengthens bioMérieux's presence in point-of-care (POC) diagnostics with a focus on immunoassay technology.

STI and Vaginitis PCR Testing Market Segmentation

By Condition Outlook (Revenue – USD Million, 2020–2034)

- Sexually Transmitted Infections (STIs)

- Chlamydia

- Gonorrhea

- Trichomoniasis

- Herpes Simplex Virus (HSV-1 & HSV-2)

- Human Papillomavirus (HPV)

- Syphilis

- Other

- Vaginal Infections

- Bacterial Vaginosis

- Vulvovaginal Candidiasis

- Other

By Test Type Outlook (Revenue – USD Million, 2020–2034)

- STI PCR Panels

- Vaginitis PCR Panels

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals & Clinics

- Diagnostic Laboratories

- Homecare/At-home Testing

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

STI and Vaginitis PCR Testing Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 668.28 billion |

|

Market Size in 2025 |

USD 726.76 billion |

|

Revenue Forecast by 2034 |

USD 1,578.43 billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 668.28 billion in 2024 and is projected to grow to USD 1,578.43 billion by 2034

The global market is projected to register a CAGR of 9.0% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Hologic, Inc.; BD (Becton, Dickinson and Company); bioMérieux; F. Hoffmann-La Roche Ltd; Thermo Fisher Scientific Inc.; Abbott Laboratories; Qiagen; OraSure Technologies; and SpeeDx Pty Ltd. Additionally, some key entities operate under larger parent organizations, such as Cepheid (Danaher) and Luminex Corporation (DiaSorin S.p.A.).

The sexually transmitted infections (STIs) segment accounted for a larger share of the market in 2024.

Following are a few of the market trends: ? Increase in demand for multiplexing: The diagnostic industry is gradually shifting toward tests that offer multi-target detection from single-specimen sampling. This improvement adds value by enhancing accuracy and reliability by diminishing the time required to obtain results for STIs and vaginitis and enabling more specific treatment. ? Broadened access to point-of-care (POC) and at-home testing: There is an increase in the development and use of POC and home-based PCR testing solutions as a result of the desire for speed, privacy, and convenience. These developments are aimed at improving access to testing for many who are unable to visit clinics due to various constraints.