Stress Relief Supplements Market Share, Size, Trends, Industry Analysis Report

By Source (Ashwagandha, Chamomile, Lavender, Melatonin, Rhodiola, L-theanine); By Form; By Distribution Channel; By Region; Segment Forecast, 2023 – 2032

- Published Date:Nov-2023

- Pages: 116

- Format: PDF

- Report ID: PM3928

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

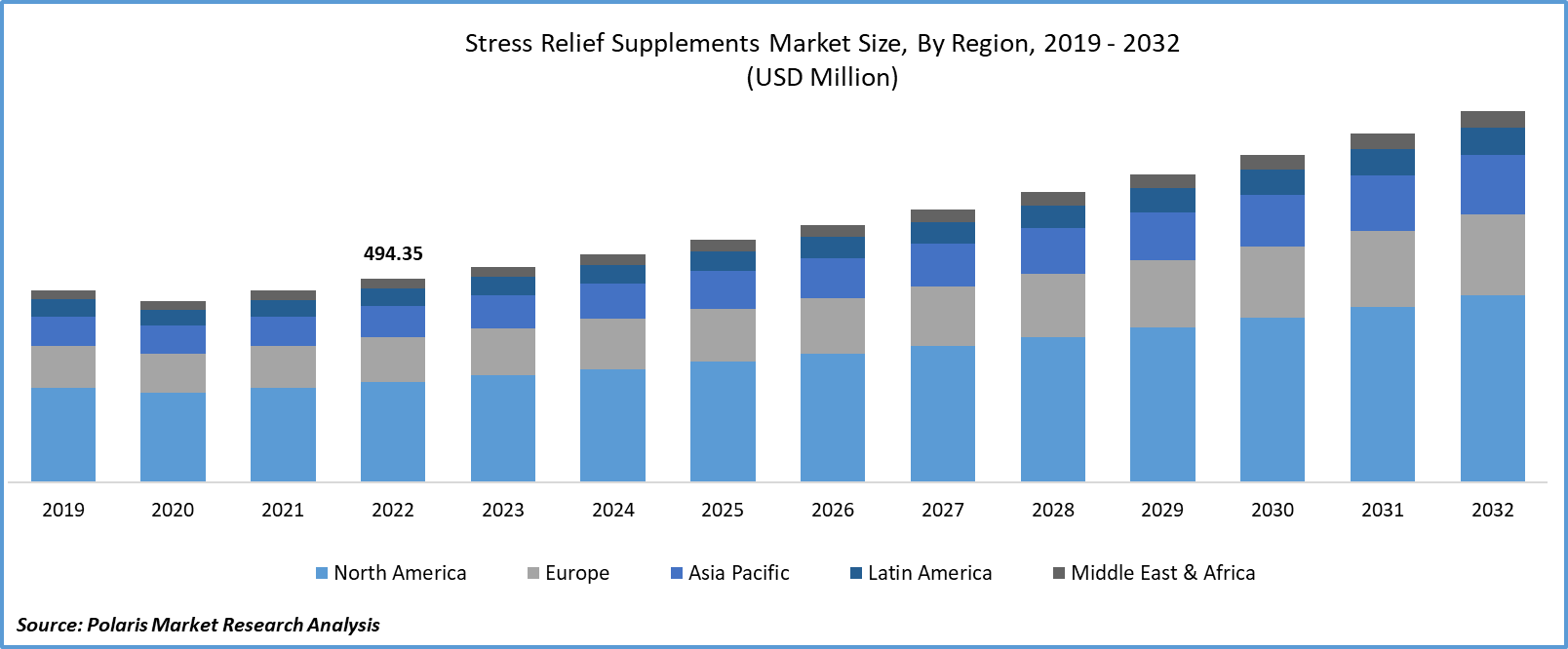

The global stress relief supplements market was valued at USD 494.35 million in 2022 and is expected to grow at a CAGR of 6.2% during the forecast period.

Growing awareness about the importance and potential benefits of stress relief supplements and the surge in the incidences of various diseases, including obesity, diabetes, malnutrition, and nutritional inadequacies that lead to worries among people, are among the primary factors boosting global market growth.

To Understand More About this Research: Request a Free Sample Report

In addition, the demand for these supplements has grown drastically in the last few years mainly due to growing preferences towards natural and holistic approaches that help in managing stress and enhancing overall well-being coupled with the rising introduction to new herbal stress relief supplements with improved characteristics, are further likely to bode well for the market growth.

- For instance, in May 2023, GNC announced the expansion of its mental wellness offering with the introduction of Innovative Preventive Nutrition & Beyond Raw supplements, which are mainly focused on providing consumers with a healthy state of mind. The new range of products helps balance mood, better manage stress, enhance relaxation, and also boost the sense of calm.

Moreover, with the growing proliferation of bioavailability enhancement all over the world, manufacturers have started exploring new and innovative techniques to enhance the bioavailability of active ingredients, ensuring that the body can absorb and utilize them more in a more effective manner, which basically includes innovations in encapsulation, delivery systems, and formulation techniques.

For Specific Research Requirements: Request for Customized Report

The coronavirus has forced countries to take necessary stringent actions like lockdown measures and trade restrictions, which led to reduced manufacturing and processing capabilities of various products, including stress relief supplements. However, there has been an increasing focus on immunity and overall well-being and changed consumer ingredient preferences; thereby, the demand for stress relief supplements has grown drastically during the pandemic.

Industry Dynamics

Growth Drivers

- Growing demand for natural supplements for stress and anxiety relief is driving the market.

The Stress Relief Supplements Market is witnessing remarkable growth due to the increasing demand for natural supplements designed to alleviate stress and anxiety. This surge in demand can be attributed to several factors.

The rising awareness of the adverse effects of chronic stress and anxiety on overall well-being has prompted consumers to seek natural, non-pharmaceutical solutions. This shift away from prescription medications has bolstered the market for stress relief supplements.

Secondly, the preference for holistic wellness and self-care practices has created a favorable environment for stress relief supplements. Consumers are increasingly turning to botanical extracts, adaptogens, and herbal remedies known for their stress-reducing properties.

Furthermore, the ongoing global pandemic has exacerbated stress levels, leading to heightened interest in stress relief solutions. As a result, the market is experiencing a boost in sales as individuals seek ways to manage their mental and emotional health.

Report Segmentation

The market is primarily segmented based on source, form, distribution channel, and region.

|

By Source |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

- Ashwagandha segment accounted for the largest market share in 2022

The ashwagandha segment accounted for a notable market share in 2022 and is likely to retain its market position over the anticipated period. The growth of the segment market is largely attributed to the significant use of ashwagandha in various traditional medicine practices like Ayurveda and growing research activities focused on exploring the efficacy of ashwagandha in reducing stress or anxiety levels. Also, the overall growth of the health and wellness industry, including greater consumption of dietary supplements, herbal remedies, and functional foods, has positively impacted the market for Ashwagandha-based stress relief supplements.

By Form Analysis

- The powder segment held a significant market share in 2022

The powder segment held the majority market share in terms of revenue in 2022, which is majorly driven by the ability of powdered-based supplements to offer higher convenience and versatility in terms of consumption, storage, and transportation compared to other product types like oil and capsules. Apart from this, powdered supplements allow users to customize their dosage easily and are also often formulated for faster absorption by the human body as compared to pills and others, which, in turn, have fueled the segment market growth in the last few years.

The capsules & tablets segment is likely to register the fastest growth rate over the next coming years on account of increasing consumer preferences for capsule supplements due to their ease of dosage control and surge in the proliferation of products due to their numerous beneficial characteristics, including longer shelf lives and portability.

By Distribution Channel Analysis

- The online channels segment is expected to witness the highest growth over the projected period.

The online channels segment is expected to grow at the highest growth rate over the next coming years, which is largely attributed to the rapid emergence of online shopping platforms all over the world and an increasing number of people shifting towards these channels due to their wide range of benefits such as easy access to a wide variety of stress relief supplements, easy availability of product related information, customer feedbacks or reviews, convenient payment option, and home delivery, among many others.

The supermarkets & hypermarkets segment led the industry with considerable revenue share in 2022, as they are easily accessible to a larger consumer base and population and offer a diverse range of products from different brands at very effective prices, making them a highly convenient choice for consumers looking for stress relief supplements.

Regional Insights

- North America region dominated the global market in 2022

The North American region dominated the global, mainly attributable to high levels of stress in countries like the United States and Canada because of several factors, including work-related issues, changes in lifestyles, and growing socio-economic pressures. Apart from this, there is a surge in the number of people in the region prioritizing their health and wellness and seeking the best preventive healthcare measures, which has led to increased demand and consumption of these supplements over the years.

The Asia Pacific region is anticipated to emerge as the fastest growing region with a significant growth rate during the projected period, owing to the presence of a large customer base and their growing awareness of the importance of health and well-being, along with the robust presence of some leading manufacturing countries of such supplements across the region.

Key Market Players & Competitive Insights

The stress relief supplements market is moderately fragmented and consolidated, mainly due to the robust presence of several large-scale companies operating in the market worldwide. The key market players are exploring new ways to expand their market and focusing on several business development strategies, including collaborations, mergers & acquisitions, partnerships, and new product launches, to cater to a wider audience globally.

Some of the major players operating in the global market include:

- ADM

- Arizona Natural Products

- Blackmores Limited

- Bristol Myers Squibb Co.

- Eli Lilly and Co.

- Jarrow Formulas Inc.

- Lundbeck

- Merck & Co. Inc.

- Naturalite Asia Co. Ltd.

- NOW Health Group

- Nutraceutical International Corporation

- Ricola

- The Himalaya Drug Company

- The Nature’s Bounty Co.

- Virtue Vilamins LLC

Recent Developments

- In November 2022, Sirio Pharma introduced new gummy supplements for sleep, immunity, and stress relief. The newly developed range of products has excellent bioavailability and better taste and also delivers a more enjoyable and improved experience while maintaining product quality.

- In August 2022, Neurohacker Collective introduced its new stress-reduction & productivity-boosting supplement to bolster its presence across the market. The new supplement enhances the overall brain’s ability to process stress by introducing cognitive processes.

Stress Relief Supplements Market Report Scope

|

Report Attributes |

Details |

|

The market size value in 2023 |

USD 523.91 Million |

|

Revenue Forecast in 2032 |

USD 902.57 Million |

|

CAGR |

6.2% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments Covered |

By Source, By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |