Sulfate-Free Shampoo Market Share, Size, Trends, Industry Analysis Report

By Form (Solid, Liquid, and Others); By Packaging Type; By Application; By Distribution Channel; By Region; Segment Forecast, 2023- 2032

- Published Date:Jun-2023

- Pages: 112

- Format: PDF

- Report ID: PM3427

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

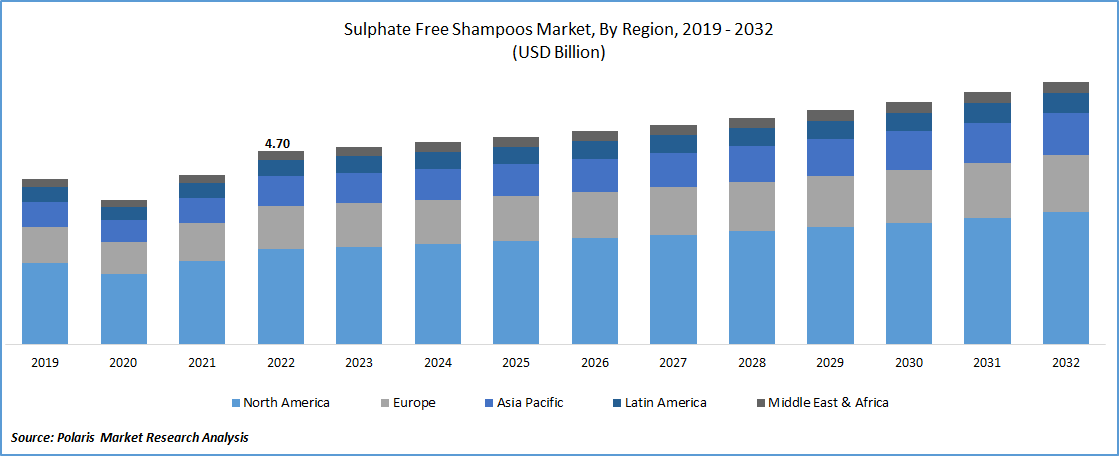

The global sulfate-free shampoo market was valued at USD 4.70 billion in 2022 and is expected to grow at a CAGR of 3.19% during the forecast period. Growing prevalence among the urbanized people for new and innovative chemical-free products and rise in their expenditure over green and environment-friendly products coupled with the drastic growth in the cosmetics & personal care industry worldwide, are among the factors augmenting the global market growth. In addition, the continuously augmenting social media marketing for salons & hair care products and developments in product manufacturing techniques that could lead to enhancements in product characteristics and quality, is further likely to foster the market in the near future. For instance, in December 2022, OUAI, introduced its anti-dandruff shampoo, company’s 1st FDA approved OTC ingredient, which is clinically proven to reduce the dandruff symptoms of irritation & flaking.

To Understand More About this Research: Request a Free Sample Report

Customization is becoming an important and emerging trend in the beauty industry and some sulfate-free shampoo brands are offering personalized formulations to meet individual hair and scalp needs. These customized shampoos are formulated with specific active ingredients based on the customer's hair type, concerns, and preferences, that is gaining significant traction globally.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the sulfate-free shampoo market. The emergence of pandemic has disrupted supply chains and causing shortages and delays in product availability, that might have affected the production and distribution of sulfate-free shampoos, leading to temporary shortages or price increases. However, the pandemic has increased awareness about personal hygiene and health, and consumers are looking for products that promote health and wellness, which have boosted the demand for these products globally.

Industry Dynamics

Growth Drivers

There is a growing trend among consumers towards natural and organic products, driven by concerns regarding the environment and personal health. As, sulfate-free shampoos often contain natural and organic ingredients that does not harm human body, is becoming popular among health-conscious and eco-friendly consumers. These shampoos are gentler on the scalp and less likely to cause irritation, which resulting in higher adoption among people with sensitive skin, thereby boosting the growth of the global market. Furthermore, sulfates are harsh detergents commonly found in shampoos that can strip the natural oils from the hair and scalp, leading to dryness, irritation, and even hair loss, since consumers across the world are preferring for sulfate-free shampoos for lower chance of skin and eye irritation or contact allergy, which in turn, is likely to have a positive impact on the demand and growth of the market.

Report Segmentation

The market is primarily segmented based on form, packaging type, application, distribution channel, and region.

|

By Form |

By Packaging Type |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Liquid segment is projected to witness highest growth in 2022

The liquid segment is projected to grow at a highest CAGR during the study period, owing to popularity among consumers as it is easy to apply and produce more lather than other forms available in the market. The ability of liquid shampoos to easily clean sebum, dandruff, dust, and others from the hair because of its better formulation and advances in manufacturing techniques that are being adopted by major manufacturers across the globe.

The dry segment led the industry market with significant market share in 2022, mainly due to numerous benefits including lightweight, requiring less space during the transport, and are much better for the environment, as they are packaged free and generate a lower carbon footprint. Moreover, it eliminates the need for bottle packaging and avoid pills and many other relevant issues, that has significantly helped them gaining widespread acceptability across the globe.

Sachet segment accounted for the largest market share in 2022

Sachet segment garnered maximum revenue share in 2022, that can be highly attributable to its cost-effectiveness that the conventional packaging methods due to less expensive and low cost of material used as compared to the tube and bottle packaging. They are also customizable and can be easily created in various sizes as per the need and requirements of consumers, which provides more flexibility in packaging and resulting in higher growth.

The bottles segment is expected to register significant growth rate over the next coming years, on account of high convenient it offers in terms of usage and can also be stored in a variety of ways including on shelves or in shower caddies. Consumers are constantly becoming more conscious about the environmental impact of their purchases, hence sulfate-free shampoo brands offer bottles made from recycled materials or with refillable options, which makes them an attractive option for eco-conscious consumers.

Homecare segment held the significant market revenue share in 2022

The homecare segment held the significant market revenue share in terms of revenue in 2022, which is mainly driven by its widespread adoption and utilization across homes to wash the impurities from hair and rising number of consumers who are being aware regarding the negative impacts of sulfates and other chemicals, thereby opting for sulfate-free products. These shampoos are becoming more widely available and affordable, which makes them accessible to a larger consumer base along with the rise in consume disposable income levels, that results in higher spending on personal care products.

E-commerce platforms segment is anticipated to expand at rapid growth rate in projected timeframe

The e-commerce platforms segment is expected to grow at a healthy CAGR during the forecasted period, on account of wide range of benefits offered by online sales channels or platforms including allowing consumers to shop from anywhere or any time, availability of wide range of products, and easy payments methods and convenient delivery. Additionally, the significant rise in the number of online shoppers and growing smartphone penetration especially in emerging economies like China, India, and Indonesia along with the growing efforts by online channels to promote their products through attractive ads, are also likely to have positive impact on the market growth.

For instance, according to a report published in 2022, approx. 180-190 million Indian shopped online at least once in 2021 and the number of online shoppers in the country is likely to reach 400-450 million by 2027, and India might replace US, as the country with second-largest online shopper base.

North America region dominated the global market in 2022

The North-America region dominated the global market for sulfate-free shampoo in 2022, and is anticipated to maintain its dominance over the projected period. The regional market growth can be largely attributed to rising consumer preference for sulfate-free and organic hair cleansers and surge in the demand for mid shampoo for chemically processed and colored hair, that helps in restoring hair natural shine. The US and Canada is home to large number of SLS-free shampoo manufacturers, who are focusing on influencing consumer penetration across the region coupled with the growth in saloon and beauty parlors industry, has been propelling the market growth.

The Asia Pacific region is anticipated to be the fastest growing region with a substantial growth rate over the coming years, owing to rising concerns among consumers regarding the hair and scalp health and continuous surge in the demand for wide range of chemical-free cleansers coupled with the rapid rate of urbanization and industrialization in countries like India and China, that is boosting consumer spending on these products.

Competitive Insight

Some of the major players operating in the global market include Procter & Gamble, Hindustan Unilever., Johnson & Johnson, Shiseido, Natural Supply., Honasa Consumer, California Baby, Avlon Industries, Sephora, Coty Inc., Loreal, MamaEarth, Babo Botanicals, Devacurl, AG Hair, Giovanni Cosmetics, Himalaya Herbals, Estee Lauder, Henkel, and Aveeno.

Recent Developments

- In March 2021, E-Ventures., announced that they have successfully acquired the lifestyle care product company ‘Coccoon’. With this acquisition, the company is focusing on scaling up and strengthening the operations of Subline Life, and a crucial right step for the company that will inlock strong collaborations between the brands and will further drive Coccoon’s growth.

- In August 2021, Tresemme, introduced Pro pure in the UK, that will be available in the shampoo & conditioner pairings. The product range has been specifically developed to provide a chemical-free and natural hair care range to shoppers, containing zero sulfates, silicones or dyes without compromising with results.

Sulfate-Free Shampoo Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 4.70 billion |

|

Revenue forecast in 2032 |

USD 6.36 billion |

|

CAGR |

3.1% from 2023– 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2021 |

|

Forecast period |

2022 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Form, By Packaging Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Procter & Gamble, Hindustan Unilever Ltd., Johnson & Johnson Services Inc., Shiseido Co. Ltd., Natural Supply Co., Honasa Consumer Pvt. Ltd., California Baby, Avlon Industries, Sephora USA Inc., Coty Inc., Loreal S.A., MamaEarth, Babo Botanicals, Devacurl, AG Hair, Giovanni Cosmetics Inc., Himalaya Herbals, Estee Lauder, Henkel, and Aveeno. |

FAQ's

The global sulfate-free shampoo market size is expected to reach USD 6.36 billion by 2032.

Top market players in the Sulfate-Free Shampoo Market are Procter & Gamble, Hindustan Unilever., Johnson & Johnson, Shiseido, Natural Supply., Honasa Consumer.

North America contribute notably towards the global Sulfate-Free Shampoo Market.

The global sulfate-free shampoo market expected to grow at a CAGR of 3.19% during the forecast period.

The Sulfate-Free Shampoo Market report covering key are form, packaging type, application, distribution channel, and region.