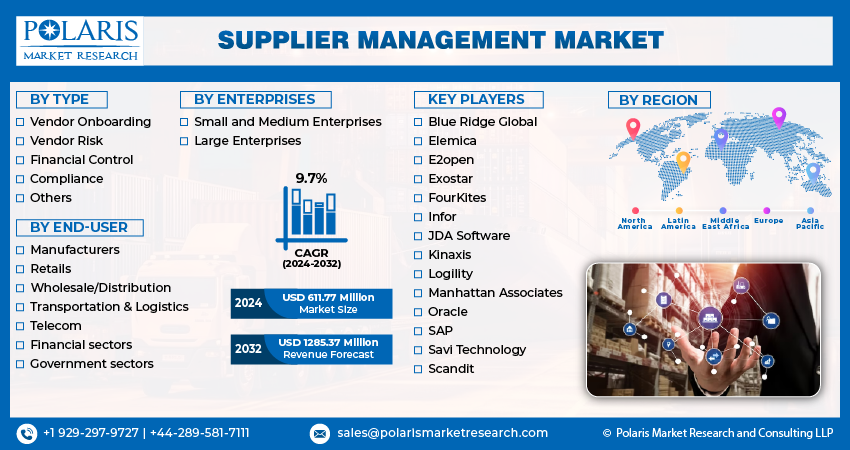

Supplier Management Market Share, Size, Trends, Industry Analysis Report

By Type (Vendor Onboarding, Vendor Risk, Financial Control, Compliance, Others); By End-user; By Enterprises; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM4176

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

The global supplier management market was valued at USD 558.69 million in 2022 and is expected to grow at a CAGR of 9.7% during the forecast period.

Supplier management plays a significant role in helping every product or service-delivering company run smooth business day-to-day operations and meet its business objectives. These solutions enable companies to monitor the flow of resources and take measures to tackle supply chain disruptions. The growing demand for various products in the marketplace is forcing various industries to boost their production operations and effective management of inventory. The rising awareness and importance of supplier management among companies is positively influencing the growth of the global market.

To Understand More About this Research: Request a Free Sample Report

- For instance, in November 2022, E2Open, a supply chain company, announced the Samsara, an expertise in connected operations cloud selection of its advanced supply chain planning and collaboration to manage demand, supply, and inventory in its operations.

Moreover, the increasing out-of-stock issues and rising concerns about inventory management and revenue growth by companies are fueling the need for supplier management solutions.

However, some organizations are likely to show unwillingness to adopt the latest supply chain technologies due to lower budgets. In the case of small and medium enterprises, rising data privacy concerns and limited knowledge about the functionality of supplier management are expected to hamper the growth of the global market.

Growth Drivers

- The growing concerns about supply chain management

The supply chain is highly influenced by supplier management, as it moderates and coordinates with the supplier's activities to enhance resource procurement at a reasonable cost and on time, contributing to their ability to provide quality goods to end users. According to a report published by the National Association of Purchasing Management, companies with strong supplier management solutions are likely to lower supplier-associated problems by 70%. This is making various disciplines adopt supplier management solutions, as no organization can operate independently without the required equipment, driving the importance of supplier management to the entire world. It is effective in supplier selection based on the company's requirements, such as quality, quantity, cost, and delivery, and also in the management of contracts, supplier monitoring, evaluation, and development.

The rising adoption of artificial intelligence and machine learning in supply chain solutions is expected to promote productivity, profitability, and competitive advantage over others. Its ability to forecast product demand is likely to stimulate the profitability of organisations by making data-driven decisions in the production of goods, enabling organisations to cut down on excess safety stock and storage space.

Report Segmentation

The market is primarily segmented based on type, end user, enterprises and region.

|

By Type |

By End-user |

By Enterprises |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Vendor risk segment is expected to witness the highest growth during the forecast period

The vendor risk segment is projected to grow at a CAGR during the projected period, mainly driven by rising supply chain disruptions. Supplier management is effective in reducing the potential risks associated with the supply chain by continuously monitoring supplier activities and their ability to meet business goals. The failure of suppliers to deliver resources on time or in the required quantity can lead to lower output, which may damage the company's reputation and its ability to withstand competition from competitors. These factors are contributing to the adoption of supplier management solutions for vendor risk management.

The financial control segment dominated the market, due to cost optimization. Companies are working to promote the affordability of their products to a wider audience through cost minimization and revenue maximization. One of the most effective ways to minimize costs is to maintain positive relationships with suppliers and negotiate discounts on bulk purchases of inputs. This can be done using supplier management solutions.

By End-user Analysis

- Manufacturers segment registered the largest market share in 2023

The manufacturers segment accounted for the largest share. The rapid transformation in consumer behaviour is encouraging manufacturers to innovate new products with optimized quality and supply in the market. This can be possible only with the availability of the required resources, which can be accessed from suppliers. The production of goods is highly impacted by supply chain disruptions, forcing them to adopt supplier management solutions to tackle these issues based on real-time observations of complex supply chains.

The retail segment is expected to grow at the fastest rate over the next few years on account of the rapid increase in the evolution of e-commerce platforms, stimulating retailers to adopt effective supply chain networks with a view to grabbing consumers attention by facilitating the latest products in their outlets. E-commerce platforms have effective supply chain management, which enables people to access a wide range of products at their doorsteps. By adopting supplier solutions, retailers can retain their position and compete with online e-commerce portals.

By Enterprises Analysis

- Large enterprises segment held the significant market revenue share in 2023

The large enterprises segment held a significant market share which is highly accelerated due to the need for strong supply chain networks as these enterprises engage in higher quantities of production with a diverse product portfolio, necessitating customized raw material suppliers.

Regional Insights

- North America region held the largest share of the global market in 2023

The North America region dominated the market. The presence of larger companies adopting technological innovations, including cloud computing, is expected to propel the demand for supplier management solutions. Furthermore, the prevalence of a higher number of vendors in the region, specifically the United States and Canada, is expected to boost the integration of supplier management solutions into their business operations.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period, owing to the growing presence of larger manufacturing companies in this region, accelerating the demand for resource management solutions. The countries in this region, primarily China, India, and Japan, are gaining international significance due to the presence of low-cost labourers in this region, encouraging companies to establish their manufacturing companies.

According to the 2019 United Nations Statistics Division data, 28.4% of global manufacturing output is derived from China, followed by the United States with 16.6%. The rapid expansion of manufacturing companies in the region is likely to stimulate the demand for supplier management solutions in the region as they enable control of supply disruptions.

Key Market Players & Competitive Insights

The supplier management market is fragmented and is likely to witness competition due to several players' presence. The key players are adopting technologies in their product design along with expansion activities such as strategic collaborations, partnerships, mergers, and acquisitions to increase their efficiency in providing supplier management solutions. Supplier management is gaining significant importance for companies to optimize their production processes. For instance, HVAC distributors witnessed a 40% reduction in transfers due to the adoption of Blue Ridge Supply Chain Planning Solutions.

Some of the major players operating in the global market include:

- Blue Ridge Global

- Elemica

- E2open

- Exostar

- FourKites

- Infor

- JDA Software

- Kinaxis

- Logility

- Manhattan Associates

- Oracle

- SAP

- Savi Technology

- Scandit

Recent Developments

- In September 2023, Arlington Capital Partners, an equity firm, announced its plan to acquire Exostar from Thomas Bravo, a software equity firm, to strengthen its collaboration abilities in aerospace, defence, life sciences, and health care.

- In August 2023, Emerge, a provider of freight procurement solutions, and E2open entered into a partnership. This will combine the specializations of both companies in a way that will transform the way shippers and carriers make decisions and promote their supply chain management.

Supplier Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 611.77 million |

|

Revenue forecast in 2032 |

USD 1285.37 million |

|

CAGR |

9.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End-User, By Enterprises, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The supplier management market report covering key segments are type, end user, enterprises and region.

Supplier Management Market Size Worth $1.28 Billion By 2032

The global supplier management market is expected to grow at a CAGR of 9.7% during the forecast period.

North America is leading the global market

key driving factors in supplier management market are growing concerns about supply chain management