Surgical Helmet Market Size, Share, & Industry Analysis Report

By Product (Helmet System and Disposable Consumable), By End Use, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5789

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

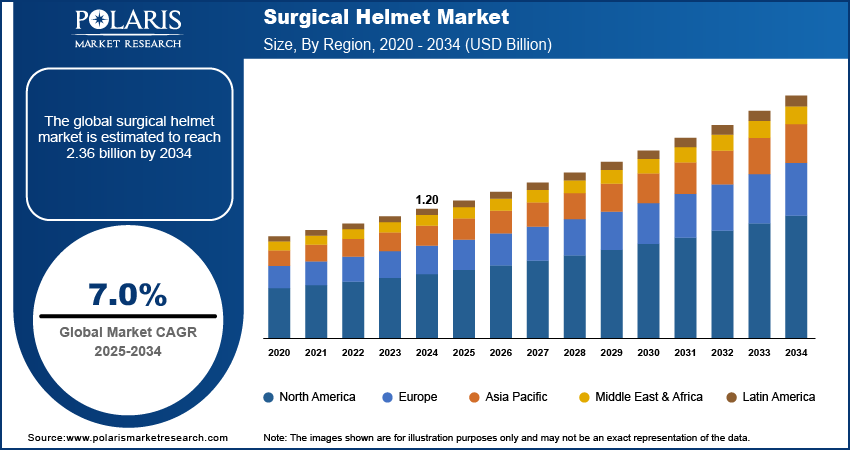

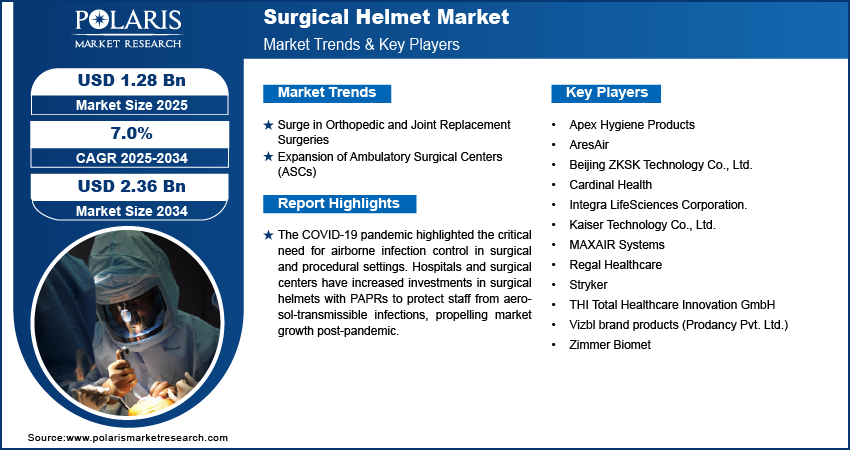

The global surgical helmet market size was valued at USD 1.20 billion in 2024 and is projected to register a CAGR of 7.0% during 2025–2034. Increasing concerns over surgical site infections led hospitals to adopt advanced infection prevention solutions. Surgical helmets, by creating a barrier against bloodborne pathogens and airborne microbes, help reduce the risk of contamination, thereby driving their demand across various surgical disciplines.

The market focuses on the production, distribution, and usage of protective headgear systems designed for surgeons and operating room staff. These helmets often include integrated face shields and powered air-purifying respirators (PAPRs) to maintain a sterile environment and protect against contaminants during surgical procedures. Surgeons face continuous exposure to biohazards and surgical smoke. Increasing awareness and regulation around occupational health and safety standards are encouraging the adoption of surgical helmets, which offer respiratory protection and reduce exposure to harmful aerosols.

Innovations such as lightweight materials, improved airflow systems, integrated communication modules, and anti-fog face shields have made surgical helmets more comfortable and efficient. These advancements are contributing to their widespread acceptance and preference among healthcare professionals. Additionally, the COVID-19 pandemic highlighted the critical need for airborne infection control in surgical and procedural settings. Hospitals and surgical centers have increased investments in surgical helmets with PAPRs to protect staff from aerosol-transmissible infections, sustaining overall growth post-pandemic.

Market Dynamics

Surge in Orthopedic and Joint Replacement Surgeries

The number of orthopedic and joint replacement surgeries is rising, due to the growing elderly population and the increasing cases of osteoarthritis and other bone-related issues. These procedures often involve prolonged surgical durations and a high risk of infection, making it necessary to maintain a highly sterile environment. Surgical helmets play a key role in protecting both patients and surgical staff from contamination. It provides full head and face coverage and helps reduce the chances of surgical site infections. Hospitals are investing more in advanced surgical helmets to improve infection control, especially in orthopedic departments where precision and cleanliness are critical.

Expansion of Ambulatory Surgical Centers (ASCs)

Ambulatory surgical centers (ASCs) are growing in number as there is a rising demand for affordable and efficient outpatient care. These centers perform a wide range of procedures, including orthopedic, eye, and minor surgeries, outside the traditional hospital setting. To maintain a safe and sterile environment, ASCs are increasingly using surgical helmets for their staff. These helmets offer protection from blood splashes and airborne particles, ensuring both safety and compliance with infection control standards. The focus on faster recovery, reduced hospital stays, and lower healthcare costs is making ASCs more popular, and in turn, boosting the need for reliable personal protective equipment (PPE) such as surgical helmets.

Segment Insights

Market Assessment by Product

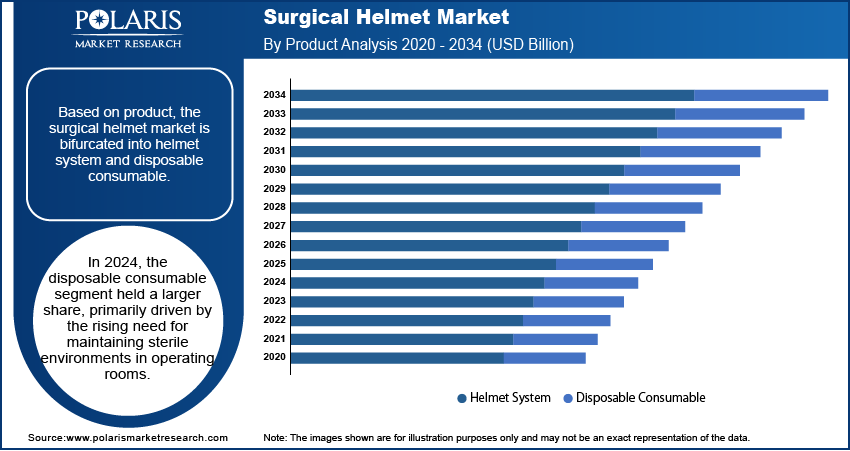

Based on product, the segmentation includes helmet system and disposable consumable. In 2024, the disposable consumable segment held a larger share, primarily driven by the rising need for maintaining sterile environments in operating rooms. Items such as disposable face shields, filters, and surgical hoods are designed for single use to prevent cross-contamination. Their continuous consumption after each procedure ensures a steady demand. Hospitals and surgical centers prefer these consumables due to strict infection control protocols, making them a recurring purchase. Surgeons also favor disposable components for their convenience and reliability during long procedures, especially in high-risk specialties such as orthopedics and trauma, where sterility is non-negotiable.

The helmet system segment is projected to register a higher CAGR during the forecast period, supported by increasing demand for advanced, reusable systems that offer integrated protection. Improvements in airflow technology, anti-fog visors, and ergonomic designs have made these helmets more efficient and comfortable during prolonged surgeries. High initial cost is offset by long-term value, especially for large hospitals with repeated surgical schedules. Surgeons are increasingly opting for systems that combine visibility, airflow, and face protection in a single setup. These systems are also evolving to support features such as powered air-purifying respirators (PAPRs), which improve safety during aerosol-generating procedures.

Market Assessment by End Use

Based on end use, the segmentation includes hospitals, ambulatory surgical centers, and specialty clinics. In 2024, the hospital segment held the largest revenue share, largely due to the high volume of complex surgeries performed in these facilities. Hospitals maintain strict infection prevention standards and have greater budgets for advanced surgical protection equipment. Specialized departments such as orthopedic surgery, trauma care, and transplant units consistently rely on surgical helmets to ensure staff safety. The ability to centralize procurement and integrate protective systems across departments helps hospitals lead in adoption. Their focus on reducing surgical site infections further reinforces the need for comprehensive protective gear, including helmet systems, across hospitals.

The ambulatory surgical centers segment is expected to grow significantly over the forecast period, driven by the increasing shift of outpatient procedures away from hospitals. ASCs focus on cost-effective, quick-turnaround surgeries while still maintaining safety standards. To meet regulatory requirements and ensure staff protection, many ASCs are investing in compact surgical helmet systems and consumables. Their growing presence in both urban and semi-urban areas, along with the rise in same-day surgeries such as arthroscopy and minor orthopedic procedures, is creating a demand for protective gear that is efficient, lightweight, and easy to use in smaller surgical environments.

Market Evaluation by Distribution Channel

Based on distribution channel, the segmentation includes online and offline. In 2024, the offline segment dominated the market, fueled by established supplier relationships and the preference for direct, bulk procurement. Hospitals and surgical centers often buy equipment through distributors or sales representatives who provide on-site demonstrations, custom fitting, and post-sale support. The offline model also ensures better quality control and compliance with safety standards, as buyers can physically inspect the product. Procurement teams favor this channel when purchasing large volumes or integrating new helmet systems across departments. The added advantage of service agreements and maintenance contracts further strengthens the appeal of offline purchasing in institutional settings.

The online segment is projected to experience significant growth during the forecast period, driven by the increasing digitization of healthcare procurement and the need for convenient access to surgical gear. Smaller clinics and ASCs are turning to online platforms for faster reordering of consumables and to explore cost-effective helmet solutions. E-commerce portals allow buyers to compare features, read peer reviews, and access a wider variety of brands without relying on intermediaries. Digital catalogs and flexible delivery models are helping reach remote and under-resourced facilities, making the online segment an attractive option for facilities aiming for speed and efficiency in procurement.

Regional Analysis

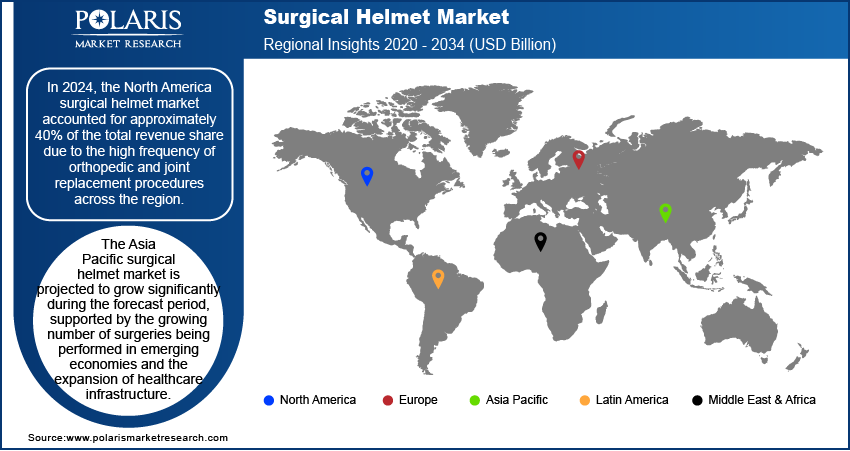

In 2024, the North America surgical helmet market accounted for approximately 40% of the total revenue share due to the high frequency of orthopedic and joint replacement procedures across the region. The presence of advanced healthcare infrastructure and strict hospital infection control policies contributes to the rising adoption of surgical helmets in routine surgical settings. Many healthcare facilities have also expanded their use of powered helmet systems in response to occupational safety concerns and to meet OSHA compliance. The region also benefits from strong reimbursement frameworks and purchasing power, enabling hospitals and surgical centers to invest in premium-grade protective equipment. Continuous innovation by local manufacturers and the rapid uptake of upgraded protective solutions have further cemented North America's leadership in the market.

US Surgical Helmet Market

The surgical helmet market in the US accounted for the largest revenue share in 2024, due to the rising prevalence of chronic diseases and high volume of complex surgeries. According to the American Heart Association, approximately 127.9 million Americans aged 20 and above, or 48.6% of the population, suffer from cardiovascular disorders (CVD), which include coronary artery disease, heart failure, stroke, and hypertension. Excluding hypertension, about 28.6 million adults (i.e., 9.9% of the population) are affected by other forms of CVD. Moreover, the rising number of joint replacement surgeries, driven by an aging population and lifestyle-related bone disorders, has boosted the need for reliable protective gear in operating rooms. The US-based hospitals and ambulatory surgical centers are early adopters of personal protective innovations and often drive the transition toward advanced equipment such as surgical helmets integrated with PAPRs. Procurement policies in the US also favor regular upgrades of surgical gear to comply with evolving infection prevention standards, which increases helmet replacement rates and demand for associated consumables, sustaining strong growth.

Asia Pacific Surgical Helmet Market

The Asia Pacific surgical helmet market is projected to grow significantly during the forecast period, supported by the growing number of surgeries being performed in emerging economies and the expansion of healthcare infrastructure. According to the International Trade Administration, the hospital market in India is currently valued at USD 99 billion and is expected to grow to USD 193 billion by 2032. Countries such as India, China, and Indonesia are witnessing a steady rise in orthopedic and trauma surgeries, creating demand for advanced surgical protection. Government-led investments in hospital modernization and the rising penetration of private surgical centers are further driving demand. Manufacturers are also offering more cost-efficient helmet models to meet the needs of price-sensitive markets, making the technology more accessible. The growing focus on healthcare worker safety and infection control is pushing adoption beyond large urban hospitals to regional centers and clinics.

China Surgical Helmet Market

The surgical helmet market in China is expected to grow significantly during the forecast period, fueled by the country’s fast-paced surgical volume growth and expanding orthopedic departments. Large investments in hospital upgrades, particularly in tier-2 and tier-3 cities, are supporting the shift toward adopting full protective systems in surgical environments. Domestic production capabilities are increasing, offering affordable helmet systems tailored to local demands. Surgeons in high-volume institutions are increasingly using disposable components for infection control, driving recurring demand. Awareness around occupational health standards is also increasing among healthcare workers, encouraging hospital administrators to invest in higher-quality personal protective equipment, including surgical helmets for routine and complex surgical procedures alike.

Europe Surgical Helmet Market

The surgical helmet market in Europe is experiencing steady growth, driven by the ongoing modernization of surgical facilities and a strong focus on health worker safety. Public health systems in countries such as Germany, France, and the UK have been integrating advanced infection control solutions into surgical workflows. Many surgical centers are adopting powered helmets to minimize exposure to aerosols and blood splatter during high-risk surgeries. The presence of leading global manufacturers in the region also ensures access to innovative products and continuous upgrades. Furthermore, regulatory frameworks around infection control in operating rooms are becoming more defined, encouraging hospitals to implement standardized PPE policies, including surgical helmets, as part of their compliance measures.

Key Players & Competitive Analysis Report

The competitive landscape of the surgical helmet market is shaped by intense industry analysis, continuous innovation, and aggressive expansion strategies. Leading players are actively pursuing mergers and acquisitions to broaden their product portfolios and strengthen their regional presence. Joint ventures and strategic alliances are being formed to leverage technological capabilities and accelerate R&D in advanced personal protective systems. Frequent product launches featuring improved airflow systems, lightweight materials, and anti-fog face shields reflect the pace of technology advancements in the industry. Companies are also focusing on post-merger integration to streamline operations and enhance supply chain efficiency. The market remains highly responsive to regulatory shifts in surgical safety standards, pushing players to invest in compliance-ready helmet systems and disposable consumables. The rising importance of infection control, powered air systems, and surgeon comfort has intensified competition, encouraging innovation and price optimization. Strategic moves in procurement partnerships and OEM collaborations further define this evolving competitive space.

List of Key Companies

- Apex Hygiene Products

- AresAir

- Beijing ZKSK Technology Co., Ltd.

- Cardinal Health

- Integra LifeSciences Corporation.

- Kaiser Technology Co., Ltd.

- MAXAIR Systems

- Regal Healthcare

- Stryker

- THI Total Healthcare Innovation GmbH

- Vizbl brand products (Prodancy Pvt. Ltd.)

- Zimmer Biomet

Surgical Helmet Industry Developments

In March 2025, Stryker launched the Steri-Shield 8 personal protection system. The system consists of a helmet with three points of contact for a customizable fit, a charging station, a sleeker battery, and three toga styles.

In February 2024, MAXAIR Systems launched the CAPR SHS Advanced Surgical Helmet System for operating room safety and efficiency. The system is designed to enhance surgical environments while maintaining affordability.

In February 2024, Zimmer Biomet Holdings, Inc. presented its latest innovations from its product portfolio at the 2024 annual meeting of the American Academy of Orthopaedic Surgeons (AAOS). The company introduced the ViVi Surgical Helmet System, an advanced tool designed to enhance surgical precision and safety in the operating room.

Surgical Helmet Market Segmentation

By Product Outlook (Revenue USD Billion, 2020–2034)

- Helmet System

- Disposable Consumable

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Distribution Channel Outlook (Revenue USD Billion, 2020–2034)

- Online

- Offline

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Surgical Helmet Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.20 billion |

|

Market Size in 2025 |

USD 1.28 billion |

|

Revenue Forecast by 2034 |

USD 2.36 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.20 billion in 2024 and is projected to grow to USD 2.36 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period.

In 2024, North America accounted for approximately 40% of the total revenue share due to the high frequency of orthopedic and joint replacement procedures across the region.

A few of the key players are Apex Hygiene Products; AresAir; Beijing ZKSK Technology Co., Ltd.; Cardinal Health; Integra LifeSciences Corporation.; Kaiser Technology Co., Ltd.; MAXAIR Systems; Regal Healthcare; Stryker; THI Total Healthcare Innovation GmbH; Vizbl brand products (Prodancy Pvt. Ltd.); and Zimmer Biomet.

In 2024, the disposable consumable segment held a larger share, primarily driven by the rising need for maintaining sterile environments in operating rooms.

In 2024, the hospital segment held the largest share, largely due to the high volume of complex surgeries performed in these facilities.