Sustainable Aviation Fuel Market Size, Share, Trends, & Industry Analysis Report

: By Fuel Type (FeV40, FeV50, FeV60, and Other), By Technology, By Aircraft Type, By Platform, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5730

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

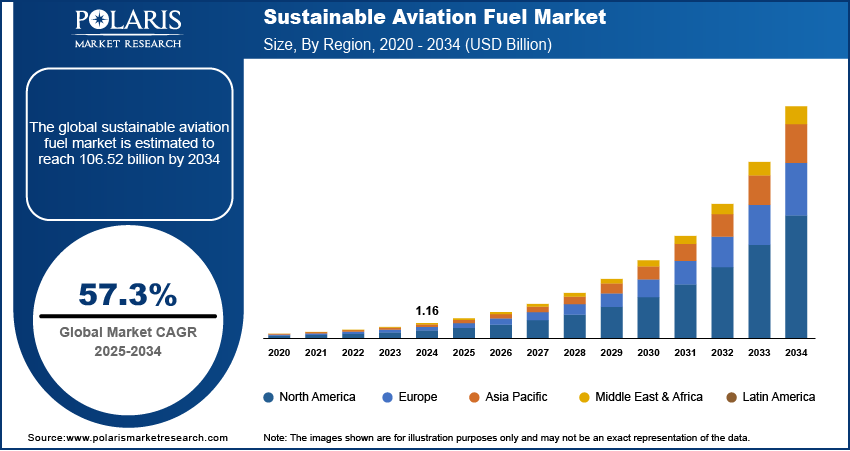

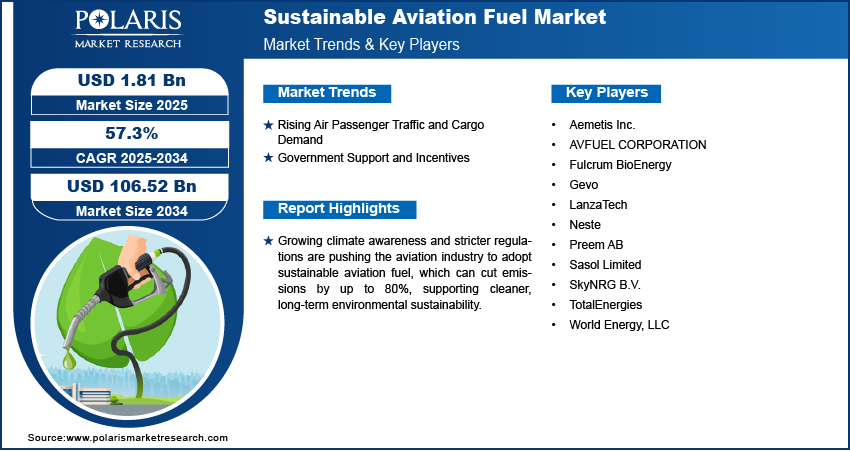

The global sustainable aviation fuel market size was valued at USD 1.16 billion in 2024, growing at a CAGR of 57.3% during 2025–2034. The growth is driven by rising focus on sustainability, government incentives, and the expansion of the aerospace industry.

Key Insights

- The biofuel segment held the largest market share in 2024 due to its maturity, proven scalability, and compatibility with existing aircraft engines, making it a practical choice for near-term emission reduction in aviation.

- The FT-SPK segment is poised for significant growth, benefiting from strong certification support and its ability to utilize a wide range of feedstocks, which makes it a versatile option for large-scale SAF production.

- The fixed-wing aircraft segment led the market in 2024, primarily due to its dominance in global air traffic for both commercial and defense applications, where the adoption of sustainable fuels is becoming increasingly prioritized.

- Military aviation is expected to grow rapidly as armed forces worldwide adopt sustainability goals and invest in alternative fuels to lower carbon emissions while ensuring operational efficiency and mission readiness.

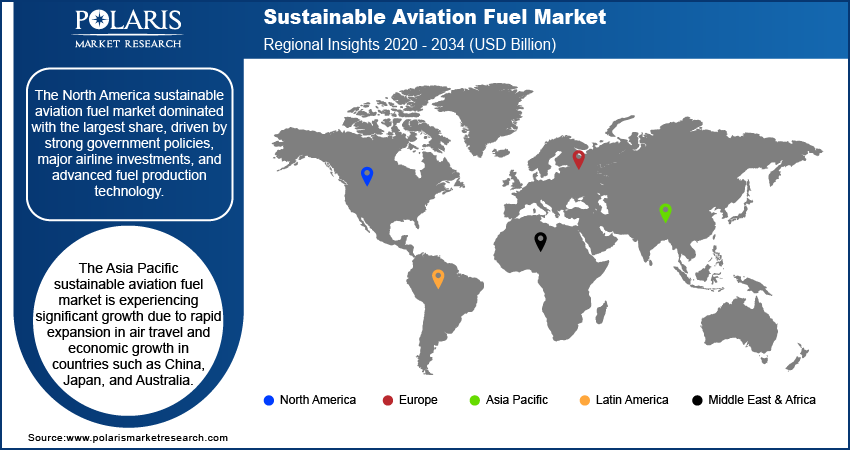

- North America led the sustainable aviation fuel market in 2024, supported by federal incentives, ambitious airline carbon-neutral targets, and the region’s technological leadership in renewable fuel processing and distribution.

Industry Dynamics

- Rising environmental concerns and strict carbon emission regulations are pushing airlines to adopt sustainable aviation fuel (SAF). Additionally, growing investments in renewable fuel production technologies are accelerating the adoption of SAF across the aviation sector.

- Increasing passenger traffic and airline commitments toward net-zero emissions by 2050 are significantly boosting demand for SAF.

- High production costs and limited global refining capacity are hindering the scalability of sustainable aviation fuel, which in turn affects its widespread commercial deployment.

- Expansion of feedstock sources and advancements in fuel conversion technologies offer strong potential for reducing costs and improving SAF availability across emerging aviation markets.

Market Statistics

- 2024 Market Size: USD 1.16 billion

- 2034 Projected Market Size: USD 106.52 billion

- CAGR (2025-2034): 57.3%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Sustainable aviation fuel (SAF) is a renewable or waste-derived fuel that can be used in existing aircraft engines to reduce greenhouse gas emissions compared to traditional jet fuel. It is produced from sustainable feedstocks such as used cooking oil, agricultural waste, or non-food crops, offering a lower-carbon alternative for the aviation industry.

The world’s increasing awareness of climate change is creating strong pressure to reduce carbon emissions across all industries, including aviation, which contributes significantly to global greenhouse gas emissions. Governments and international organizations are imposing stricter regulations and emissions targets for airlines. To meet these goals, airlines are turning to SAF as it reduces carbon emissions by up to 80% compared to traditional jet fuel. Environmental concerns and regulatory requirements are driving the aviation analytics to adopt cleaner, greener alternatives such as SAF to ensure long-term sustainability.

Technological advancements are making it easier and more cost-effective to produce SAF from a wide variety of renewable sources such as algae, used cooking oil, agricultural waste, and even carbon captured and store from the air. New methods such as Fischer-Tropsch synthesis, HEFA (Hydroprocessed Esters and Fatty Acids), and alcohol-to-jet conversion are improving fuel yield and quality. The production of SAF is becoming more efficient and scalable as technology is advancing, helping reduce costs and expand availability, thereby driving the growth of the SAF market.

Industry Dynamics

Rising Air Passenger Traffic and Cargo Demand

The global demand for air travel and air cargo is increasing, especially in emerging markets. According to the Airport Council International, the number of air travelers is projected to exceed 12 billion by 2030. More flights mean higher fuel consumption, which leads to greater emissions unless cleaner alternatives are used. This growing demand puts pressure on airlines and governments to adopt sustainable solutions. SAF provides a way to accommodate this growth while minimizing the environmental impact. Therefore, the growing aviation industry creates strong, long-term demand for SAF across industries.

Government Support and Incentives

Many governments and organizations around the world are encouraging the use of SAF by offering financial support, subsidies, tax credits, and favorable policies. These incentives help lower the high production costs of SAF and make it more competitive with traditional jet fuel. In the US, the Inflation Reduction Act includes tax credits for SAF producers. Similarly, the EU's "Fit for 55" package supports clean aviation fuels. This type of government backing is encouraging investments and expanding infrastructure. Additionally, organizations such as the International Air Transport Association (IATA) have launched "The SAF Registry" to promote transparency and supply of these fuels in emerging regions, thereby driving the industry growth.

Segmental Insights

By Fuel Type Analysis

The biofuel segment dominated with the largest share in 2024. Biofuel offers a sustainable alternative to conventional jet fuel, playing a crucial role in reducing the aviation industry's carbon footprint produced from renewable sources such as used cooking oil, animal fats, and plant materials like algae. It is considered a drop-in replacement for conventional jet fuel. Biofuel can be used in existing aircraft engines without modification, making it highly attractive for airlines. Biofuels further offer significant reductions in carbon emissions, supporting airlines in meeting environmental targets. The availability of diverse and sustainable feedstocks, along with ongoing technological improvements, has helped biofuels scale to meet large fuel demand, thereby driving the segmental popularity.

By Technology Analysis

The FT-SPK (Fischer-Tropsch Synthetic Paraffinic Kerosene) segment is expected to witness significant growth during the forecast period. This method uses synthesis gas, derived from biomass, municipal waste, or other renewable carbon sources, to produce a high-quality jet fuel. FT-SPK is approved for blending with traditional aviation fuel and offers excellent performance and emissions benefits. Its ability to convert a wide range of feedstocks into clean-burning fuel makes it a flexible and scalable option. Growing investments in gasification and Fischer-Tropsch processing technologies are helping increase FT-SPK’s share, especially as demand rises for advanced, high-volume SAF production methods.

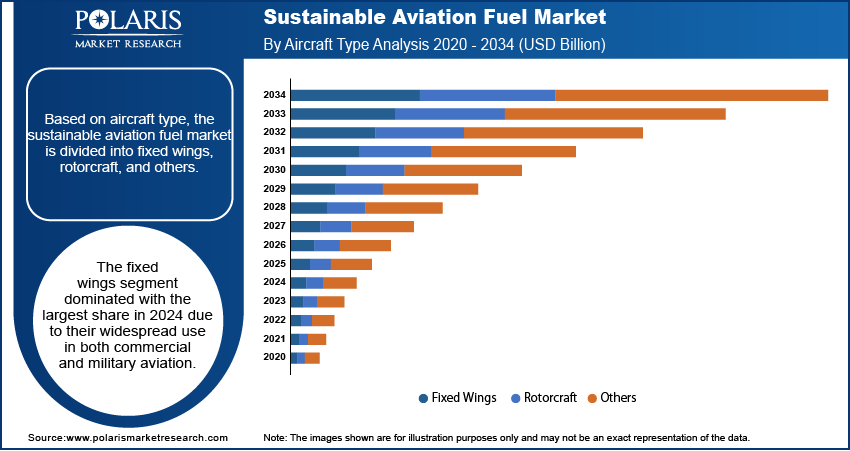

By Aircraft Type Analysis

The fixed-wing aircraft segment dominated with the largest share in 2024 due to its widespread use in both commercial and military aviation. These aircraft make up the majority of the global fleet, including passenger planes, cargo jets, and business jets. Since they consume large amounts of fuel, even small reductions in carbon emissions per flight can have a big environmental impact. SAF adoption in fixed-wing aircraft is already underway, with many airlines conducting test flights and entering long-term SAF supply agreements. The high fuel demand in fixed-wing operations is driving the segment growth.

By Platform Analysis

The military aviation segment is expected to witness significant growth as defense organizations worldwide are increasingly focused on reducing their environmental impact while maintaining operational readiness. SAF offers a strategic advantage by lowering dependence on fossil fuels and enhancing energy security. Militaries in the US, Europe, and Asia are investing in SAF research, conducting test flights, and integrating renewable fuel into their long-term planning. The durability and performance reliability of SAF make it suitable for rigorous military applications, thereby driving the segmental growth.

Regional Analysis

The North America sustainable aviation fuel market dominated with the largest share in 2024, driven by strong government policies, major airline investments, and advanced fuel production technology. The US sustainable aviation fuel market plays a major role, due to initiatives such as the Inflation Reduction Act, which offers tax incentives for SAF production. Major airlines such as United and Delta are actively partnering with SAF producers and committing to long-term usage. Canada is further increasing its support for clean aviation, thereby driving the SAF adoption in the region.

The Asia Pacific sustainable aviation fuel market is expected to witness significant growth during the forecast period due to rapid expansion in air travel and economic growth in countries such as China, Japan, and Australia. Governments in the region are beginning to adopt environmental policies that promote cleaner fuels and reduce aviation emissions. Airlines are exploring SAF partnerships and trial flights to meet sustainability goals. The region's increasing focus on reducing dependence on imported fossil fuels also supports SAF adoption, thereby driving the regional market expansion.

The India sustainable aviation fuel market is attributed to rapid aviation growth and increasing environmental awareness. The Indian government is promoting biofuels and sustainable practices across industries, including aviation. Domestic airlines are exploring SAF trials and partnerships, and discussions around policy incentives are gaining momentum. India's large feedstock availability, such as agricultural and municipal waste, provides an opportunity for localized SAF production. Therefore, India’s combination of policy support, feedstock potential, and growing air travel demand is driving the market growth in the country.

The Europe sustainable aviation fuel market is expected to grow significantly during the forecast period, driven by strong environmental regulations and climate targets. The European Union's "Fit for 55" initiative and the ReFuelEU Aviation proposal mandate increasing levels of SAF use in commercial flights. Airlines such as Lufthansa, Air France, and British Airways are actively integrating SAF into their operations. The region also benefits from significant investments in SAF production facilities and innovation. Europe remains at the forefront of sustainable aviation and is setting a global example in decarbonizing air travel with strict policies, public awareness, and industry collaboration.

Key Players & Competitive Analysis Report

The sustainable aviation fuel (SAF) market features a dynamic competitive landscape with key players driving innovation and scale. TotalEnergies, Neste, and World Energy lead in commercial SAF production and global supply networks. Gevo, Fulcrum BioEnergy, and LanzaTech are pioneering novel feedstock and conversion technologies, including alcohol-to-jet and waste-to-fuel pathways. Aemetis Inc. and Preem AB focus on renewable fuel integration into existing refineries. AVFUEL Corporation and SkyNRG B.V. act as crucial SAF distributors, linking producers with aviation clients. Sasol Limited adds synthetic fuel expertise. Strategic partnerships, feedstock sourcing, and regulatory alignment define the competitive edge in this rapidly evolving market.

Key Players

- Aemetis Inc.

- AVFUEL CORPORATION

- Fulcrum BioEnergy

- Gevo

- LanzaTech

- Neste

- Preem AB

- Sasol Limited

- SkyNRG B.V.

- TotalEnergies

- World Energy, LLC

Industry Developments

In April 2025, Bangchak launched Thailand’s first 100% Neat SAF production unit at its Phra Khanong Refinery, marking a major milestone in renewable aviation fuel innovation and reinforcing the company’s leadership in clean energy initiatives.

In February 2024, Airbus and TotalEnergies signed a strategic partnership to advance sustainable aviation fuel, aiming to reduce aviation CO₂ emissions. TotalEnergies is committed to supplying SAF and co-developing 100% sustainable fuel solutions with Airbus.

Sustainable Aviation Fuel Market Segmentation

By Fuel Type Outlook (Volume, Million Liters, Revenue, USD Billion, 2020–2034)

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

By Technology Outlook (Volume, Million Liters, Revenue, USD Billion, 2020–2034)

- HEFA-SPK

- FT-SPK

- HFS-SIP

- ATJ-SPK

By Aircraft Type Outlook (Volume, Million Liters, Revenue, USD Billion, 2020–2034)

- Fixed Wings

- Rotorcraft

- Others

By Platform Outlook (Volume, Million Liters, Revenue, USD Billion, 2020–2034)

- Commercial

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

By Regional Outlook (Volume, Million Liters, Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Sustainable Aviation Fuel Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.16 Billion |

|

Market Size Value in 2025 |

USD 1.81 Billion |

|

Revenue Forecast by 2034 |

USD 106.52 Billion |

|

CAGR |

57.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Million Liters, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.16 billion in 2024 and is projected to grow to USD 106.52 billion by 2034.

The global market is projected to register a CAGR of 57.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Aemetis Inc.; AVFUEL CORPORATION; Fulcrum BioEnergy; Gevo; TotalEnergies; LanzaTech; Neste; Preem AB; Sasol Limited; SkyNRG B.V.; and World Energy, LLC.

The fixed wings segment dominated the market share in 2024

The military segment is expected to witness the significant growth during the forecast period.