Carbon Capture and Storage (CCS) Market Size, Share, Trends, Industry Analysis Report

By Capture Type (Pre-Combustion, Industrial Separation), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1619

- Base Year: 2024

- Historical Data: 2020-2023

Overview

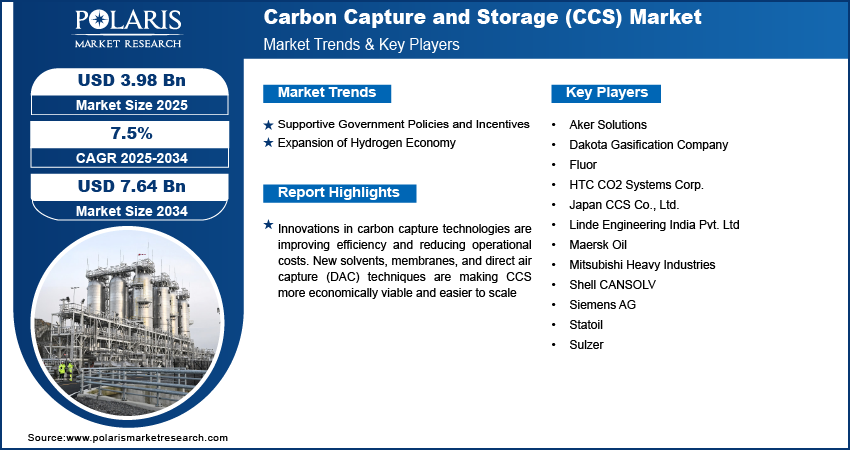

The global carbon capture and storage (CCS) market size was valued at USD 3.70 billion in 2024, growing at a CAGR of 7.5% from 2025 to 2034. The market growth is driven by supportive government policies and incentives, and expansion of hydrogen economy.

Key Insights

- In 2024, the pre-combustion segment accounted for 70.63% share in 2024, due to its high efficiency and early integration into power generation and industrial systems.

- The industrial segment is expected to experience significant growth during the forecast period, driven by increasing measures to decarbonize hard-to-abate sectors such as cement, steel, and chemical manufacturing.

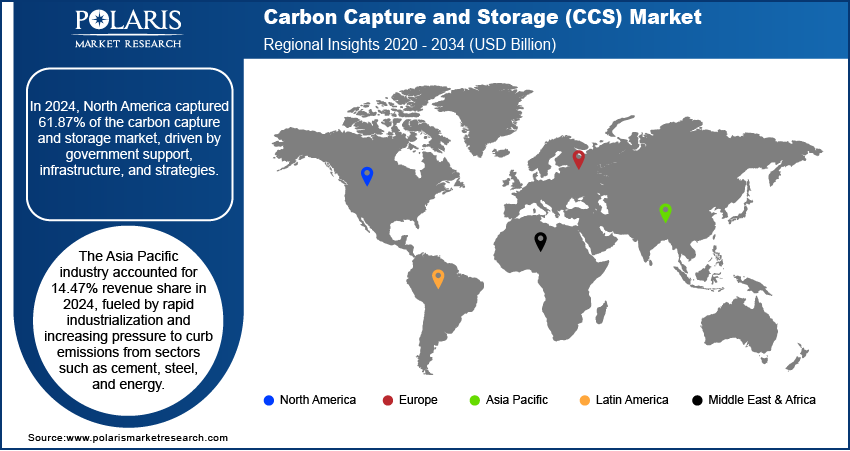

- North America accounted for 61.87% share in 2024, due to strong government support, established infrastructure, and early adoption of carbon reduction strategies.

- The industry in the U.S. is expected to register a significant CAGR during the forecast period, driven by federal incentives, energy security goals, and strong climate policies.

- The Asia Pacific industry accounted for 14.47% revenue share in 2024, fueled by rapid industrialization and increasing pressure to curb emissions from sectors like cement, steel, and energy.

Industry Dynamics

- Supportive government policies and incentives drive the demand for CCS.

- Expansion of hydrogen economy is fueling the industry growth.

- Innovations in carbon capture technologies are improving efficiency and reducing operational costs.

- High initial costs and complex infrastructure requirements restrain the growth of the industry.

Market Statistics

- 2024 Market Size: USD 3.70 billion

- 2034 Projected Market Size: USD 7.64 billion

- CAGR (2025–2034): 7.5%

- North America: Largest market in 2024

AI Impact on the Industry

- AI enhances site selection for carbon storage by analyzing geological data, reservoir characteristics, and seismic activity to identify optimal and safe storage locations.

- Integration of artificial Intelligence enables real-time monitoring of CO₂ injection and storage, improving safety, leakage detection, and long-term performance assessment.

- AI-driven predictive maintenance supports efficient operation of CCS equipment by identifying potential failures before they occur, minimizing downtime and repair costs.

- AI optimizes carbon capture processes by dynamically adjusting parameters such as temperature, pressure, and solvent usage, thereby increasing capture efficiency and reducing energy consumption.

Carbon capture and storage is defined as the process that traps the carbon dioxide gas at the emission source, and then transports it to a storage location, isolating it. The storage location in most cases is underground. The process guarantees greener energy by capturing the excess carbon dioxide (CO2). They can be employed on coal-based sources, on natural gas, and other industrial sources. CCS is an integrated technology with each process complementing the other. It is a well-proven and established technology and achieves an efficiency of as high as 90% when deployed. It can capture CO2 fossil fuel emissions, thus preventing the harmful gas from escaping to the atmosphere.

The global push toward clean energy and decarbonization is a major driver of the CCS market. Countries need to manage emissions from existing infrastructure as countries transition from fossil fuels to renewable sources. CCS bridges this gap by allowing continued use of current energy systems while reducing emissions. It is especially useful for hard-to-abate sectors such as chemical manufacturing and heavy industry. The integration of CCS into national energy strategies and net-zero roadmaps is creating strong demand and positioning it as a critical technology for the future energy mix, thereby driving the growth.

Innovations in carbon capture technologies are improving efficiency and reducing operational costs. New solvents, membranes, and direct air capture (DAC) techniques are making CCS more economically viable and easier to scale. Digital tools and automation are further streamlining the monitoring, storage, and transportation of captured CO₂. The cost barrier for CCS adoption is gradually decreasing as technology matures, making it accessible to smaller emitters. These advancements are boosting confidence among investors and operators and enabling pilot projects to transition into full-scale commercial operations, thereby fueling the growth.

Drivers & Opportunities

Supportive Government Policies and Incentives: Government regulations and policy frameworks across various regions are significantly promoting CCS development. Incentives such as tax credits, funding programs, and carbon pricing mechanisms are motivating industries to invest in carbon capture. In countries like the U.S., the 45Q tax credit reward companies for each ton of carbon captured and stored. These financial incentives lower the initial investment burden and encourage innovation. Regulatory support, including mandates for emissions reductions, is further pushing industries to adopt CCS as a compliance strategy, further accelerating growth and encouraging new CCS projects.

Expansion of Hydrogen Economy: The rapid growth of the hydrogen economy, especially blue hydrogen, is fueling demand for CCS technologies. Blue hydrogen is considered a low-carbon energy source when combined with CCS, making it attractive for industrial and transport applications. CCS becomes essential to ensure sustainability as governments and industries aim to scale hydrogen generation. Countries such as Japan, South Korea, and Germany are investing heavily in hydrogen projects, with CCS as a core component. According to the FCHEA, in 2024, 23 hydrogen projects in Germany received EUR 4.6 billion or USD 5 billion worth of investment. This alignment of hydrogen and CCS markets opens up new investment opportunities and long-term potential.

Segmental Insights

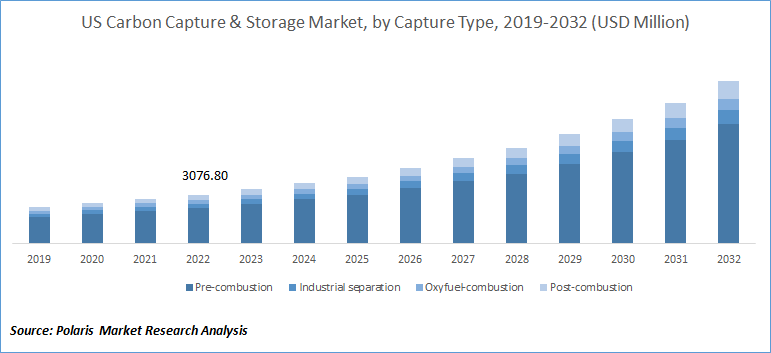

Capture Type Analysis

The segmentation, based on capture type, includes pre-combustion, industrial separation, oxyfuel-combustion, and post-combustion. In 2024, the pre-combustion segment accounted for 70.63% share in 2024 due to its high efficiency and early integration into power generation and industrial systems. This method allows carbon dioxide to be captured before fuel is burned, making it particularly effective in integrated gasification combined cycle (IGCC) plants. The technology is mature and widely adopted in hydrogen production and chemical processes, where CO₂ is a byproduct. Its ability to capture large volumes of carbon at relatively lower costs compared to other methods has made it the preferred choice for large-scale CCS applications, thus fueling segment growth.

The post-combustion segment accounted significant revenue in 2024 due to its flexibility and compatibility with existing fossil fuel-based infrastructure. This method allows CO₂ to be captured after fuel combustion, making it suitable for retrofitting old coal- and gas-fired power plants and industrial boilers. Post-combustion solutions offer a practical, cost-effective option as many countries aim to decarbonize without immediately replacing infrastructure. Growing environmental regulations and government support for emission reduction in legacy systems are further encouraging the adoption of post-combustion technologies, especially in regions like North America and Europe, thereby driving segment expansion.

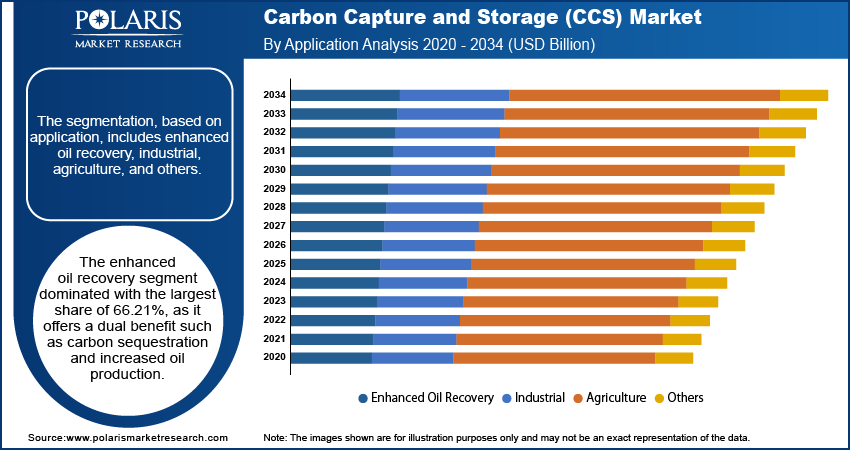

Application Analysis

The segmentation, based on application, includes enhanced oil recovery, industrial, agriculture, and others. The enhanced oil recovery segment dominated with the largest share, accounting 66.21%. It offers a dual benefit such as carbon sequestration and increased oil production. In this method, captured CO₂ is injected into aging oil fields to boost output, making it economically appealing. The oil and gas industry has widely adopted EOR to maximize resource extraction while reducing environmental impact. The commercial viability of this process, supported by favorable policies and carbon credit systems, has driven its widespread use. The ability to monetize stored CO₂ makes EOR an attractive and scalable, thereby driving the segment growth.

The industrial segment is expected to experience significant growth driven by increasing measures to decarbonize hard-to-abate sectors such as cement, steel, and chemical manufacturing. These industries are among the largest emitters of CO₂ and face growing regulatory and investor demands for sustainability. CCS is emerging as a critical solution as renewable energy adoption alone can't fully address industrial emissions. Technological advancements and decreasing costs of capture equipment are making it feasible for industries to integrate CCS into their operations. Furthermore, collaborations between governments and industrial players are accelerating deployment, thereby fueling the growth.

Regional Analysis

North America Carbon Capture and Storage Market Trends

The market in North America accounted for 61.87% share in 2024, due to strong government support, established infrastructure, and early adoption of carbon reduction strategies. The presence of major CCS facilities, particularly in the U.S. and Canada, along with generous tax incentives such as the U.S. 45Q tax credit, has significantly encouraged investments in CCS technologies. Additionally, North America’s large number of oil and gas fields makes it ideal for carbon storage and enhanced oil recovery (EOR) applications. Public-private partnerships, innovation funding, and climate-focused policies drive regional demand, driving the industry growth.

U.S. Carbon Capture and Storage Market Insights

The industry in the U.S. is expected to register a significant CAGR during the forecast period, driven by federal incentives, energy security goals, and strong climate policies. The 45Q tax credit has been a major driver, offering financial returns for every ton of CO₂ captured and stored. Major U.S. energy companies and tech innovators are investing in CCS across power plants, industrial facilities, and EOR projects. The Department of Energy’s support for pilot projects and large-scale deployment has further accelerated progress. Moreover, its vast storage capacity and strong industrial base further fuel the growth.

Asia Pacific Carbon Capture and Storage Market Analysis

The Asia Pacific industry is accounted for 14.47% revenue share in 2024, fueled by rapid industrialization and increasing pressure to curb emissions from sectors like cement, steel, and energy. Governments across the region, especially in countries such as Japan, Australia, and South Korea, are including CCS in their net-zero roadmaps. Regional collaborations and funding for clean technology are helping overcome infrastructure challenges. Additionally, the expansion of hydrogen and ammonia production is boosting demand for carbon capture in energy-intensive processes, thereby boosting the growth.

China Carbon Capture and Storage Market Insights

The China industry is projected to witness substantial growth during the forecast period as the country pushes toward its carbon neutrality goal by 2060. The government has prioritized CCS in national development plans, especially for reducing emissions from coal-based power and heavy industries like cement and steel. China is investing heavily in pilot CCS projects and research to support scalable deployment. Its growing hydrogen industry further presents strong opportunities for pre-combustion carbon capture. Moreover, state-owned enterprises leading initiatives and favorable policy support are fueling the growth in China.

Europe Carbon Capture and Storage Market Insights

The industry in Europe is expected to experience significant growth in the future, due to its strict climate policies, commitment to net-zero emissions by 2050, and robust regulatory support. The European Union has funded numerous CCS projects through its Innovation Fund and Horizon programs. Countries such as Norway, the UK, and the Netherlands are actively developing large-scale storage and transport networks, such as the Northern Lights project. Moreover, Europe's focus on decarbonizing hard-to-abate sectors such as cement, steel, and chemicals is increasing CCS demand. The integration of CCS into the EU Green Deal further accelerates its role in achieving Europe’s ambitious climate targets.

France Carbon Capture and Storage Market Outlook

The market in France is expected to experience rapid growth as France is actively supporting the growth of the Carbon Capture and Storage (CCS) demand as part of its national climate strategy to achieve carbon neutrality by 2050. The government has prioritized decarbonizing heavy industries such as cement, steel, and chemicals. Public and private investments are increasing in R&D and pilot CCS projects. France is further collaborating with other European countries on cross-border CO₂ storage and transport infrastructure. Support from the EU Green Deal and national low-carbon roadmaps is encouraging industrial players to adopt CCS technologies, fueling the growth of the country.

Key Players and Competitive Analysis

The competitive landscape in the CCS market features a blend of global energy giants, engineering leaders, and specialized technology providers. Aker Solutions, Fluor, Mitsubishi Heavy Industries, and Siemens AG have been at the forefront of large-scale carbon capture projects, leveraging strong engineering capabilities and proven deployment experience. Shell CANSOLV, Dakota Gasification Company, and Linde Engineering India have played key roles in refining capture technologies and integrating them into existing industrial systems. Companies like Maersk Oil, Japan CCS Co., Ltd., and HTC CO₂ Systems Corp. have focused on storage and regional implementation, particularly in offshore and pilot-scale initiatives. The market has seen increasing competition driven by tightening climate regulations, rising demand for decarbonization solutions, and technological advancements. Strategic partnerships, innovation in cost-effective capture methods, and geographic expansion have remained the primary strategies for market players to strengthen their position in this evolving landscape.

Key Players

- Aker Solutions

- Dakota Gasification Company

- Fluor

- HTC CO2 Systems Corp.

- Japan CCS Co., Ltd.

- Linde Engineering India Pvt. Ltd

- Maersk Oil

- Mitsubishi Heavy Industries

- Shell CANSOLV

- Siemens AG

- Statoil

- Sulzer

Carbon Capture and Storage Industry Developments

In July 2025, Carbon Clean inaugurated its Global Innovation Centre in Navi Mumbai, India. The center aims to accelerate next-generation carbon capture technologies and strengthen UK-India collaboration in clean tech innovation.

In May 2025, Wärtsilä launched its carbon capture solution for the maritime industry following the successful full-scale installation on Solvang ASA’s Clipper Eris, enabling up to 70% CO₂ reduction and marking a major step forward in marine decarbonization efforts.

Carbon Capture and Storage Market Segmentation

By Capture Type Outlook (Revenue, USD Billion, 2020–2034)

- Pre-Combustion

- Industrial Separation

- Oxyfuel-Combustion

- Post-Combustion

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Enhanced Oil Recovery

- Industrial

- Agriculture

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Carbon Capture and Storage Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.70 Billion |

|

Market Size in 2025 |

USD 3.98 Billion |

|

Revenue Forecast by 2034 |

USD 7.64 Billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.70 billion in 2024 and is projected to grow to USD 7.64 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Aker Solutions; Dakota Gasification Company; Fluor; HTC CO2 Systems Corp.; Japan CCS Co., Ltd.; Linde Engineering India Pvt. Ltd; Maersk Oil; Mitsubishi Heavy Industries; Shell CANSOLV; Siemens AG; Statoil; and Sulzer.

The pre-combustion segment dominated the market share in 2024.

The Industrial segment is expected to witness the significant growth during the forecast period.