Tangential Flow Filtration Market Size, Share, Trends, Industry Analysis Report

By Product (Single-use Tangential Flow Filtration Systems, Reusable Tangential Flow Filtration Systems), By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6177

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

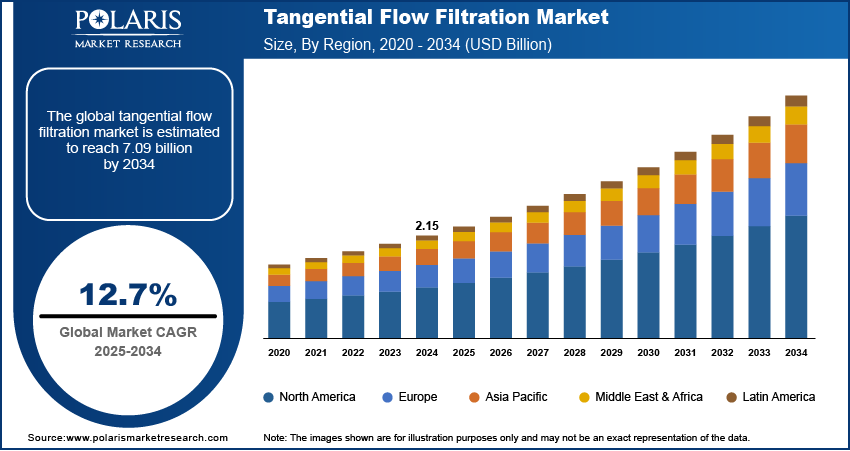

The global tangential flow filtration market size was valued at USD 2.15 billion in 2024 and is anticipated to register a CAGR of 12.7% from 2025 to 2034. The industry is growing mainly due to the rising demand for biologics and vaccines. Increasing use in research labs for protein purification and cell harvesting is also driving the industry growth.

Key Insights

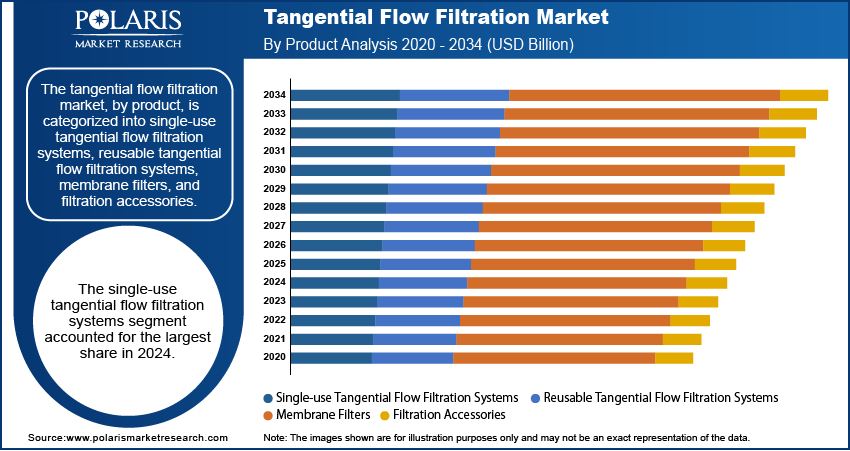

- By product, the single-use tangential flow filtration systems segment held the largest share in 2024 due to their flexibility, reduced risk of contamination, and ease of use in biopharmaceutical manufacturing. They are especially preferred in processes requiring quick changeovers and scalability, supporting efficient production workflows.

- In terms of technology, the ultrafiltration segment held the largest share in 2024 because of its wide application in concentrating and purifying large biomolecules such as proteins and viruses. Its balance of efficiency and gentle processing makes it essential for many bioprocessing steps.

- Based on application, the protein purification segment held the largest share in 2024, as it plays a critical role in isolating therapeutic proteins and enzymes. This subsegment benefits from the versatility of TFF in maintaining protein integrity and ensuring product purity in both research and commercial production.

- By end use, the pharmaceutical and biotechnology companies segment held the largest share in 2024, driven by their extensive biologics pipelines and high demand for efficient downstream processing technologies. These companies require scalable, reliable TFF systems to meet regulatory and production quality standards.

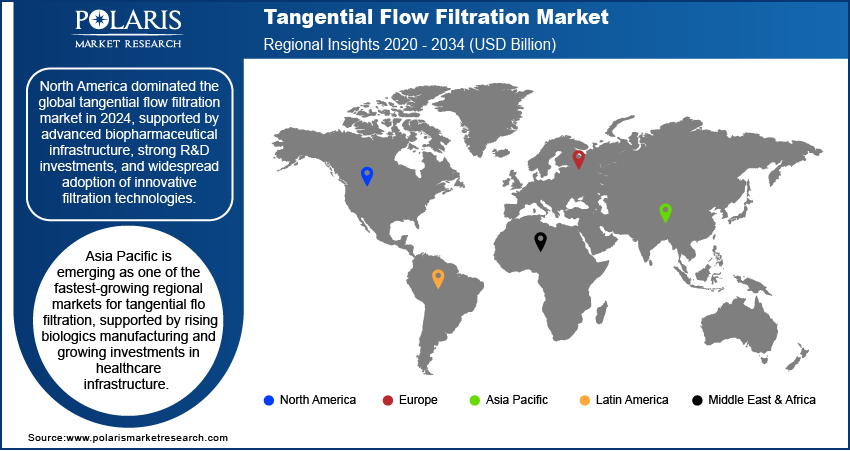

- North America dominated the global market in 2024, supported by advanced biopharmaceutical infrastructure, strong R&D investments, and widespread adoption of innovative filtration technologies.

Industry Dynamics

- The growing demand for biologics, including monoclonal antibodies and recombinant proteins, is leading to increased use of advanced filtration systems during production and purification processes.

- Rising vaccine production worldwide, especially after the COVID-19 pandemic, has encouraged wider adoption of scalable and cost-effective filtration solutions.

- Expanding investments in biopharmaceutical research and development, supported by public health agencies and government funding, are creating steady demand for filtration tools. Laboratories and production units rely on these technologies to maintain product safety, purity, and process efficiency.

Market Statistics

- 2024 Market Size: USD 2.15 billion

- 2034 Projected Market Size: USD 7.09 billion

- CAGR (2025–2034): 12.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Tangential flow filtration (TFF), also known as crossflow filtration, is a technique used to separate and purify biomolecules by passing fluids tangentially across a membrane surface. It is widely used in biopharmaceutical production, laboratory research, and diagnostics for concentrating, clarifying, and diafiltering biological samples such as proteins, enzymes, and viruses.

One of the drivers supporting growth is the rise in adoption of personalized medicine. As treatments become more targeted, smaller batch production becomes essential, which suits the flexible nature of TFF systems. These systems are efficient at handling small to mid-scale purification processes without compromising on yield or quality, making them ideal for custom therapies.

Another growing driver is the use of TFF in academic and government research institutions. As public health bodies and national labs increase their focus on infectious disease studies and genomic research, the demand for high-performance filtration systems grows. For instance, the National Institute of Health (NIH) has funded several programs focusing on protein structure analysis and vaccine design, where TFF systems are often used for sample prep and purification stages.

Drivers and Trends

Increasing Demand for Biologics and Vaccines: Biologics such as monoclonal antibodies, recombinant proteins, and cell therapies require efficient purification processes to maintain product quality and safety. Tangential flow filtration plays a critical role in these downstream processes by enabling selective separation and concentration of biomolecules while minimizing damage to delicate products. This need has intensified with the rise of complex biologics and personalized medicines, which require highly precise and scalable filtration methods. According to a 2023 study published on NCBI titled “Advances in Biologics Manufacturing Technologies”, increased production of biologics has accelerated the adoption of innovative filtration technologies such as TFF, which improve yield and reduce processing times.

Vaccine production, especially for viral vector and mRNA vaccines in vaccine contract manufacturing, relies heavily on tangential flow filtration to concentrate and purify viral particles and nucleic acids. The urgency for rapid vaccine development highlighted during recent global health crises has further pushed biomanufacturers to optimize downstream processing technologies. A 2024 article on PubMed, “Vaccine Manufacturing: Challenges and Innovations”, highlights that tangential flow filtration is a preferred method due to its ability to handle large volumes and delicate vaccine components effectively. With the rising demand for biologics and vaccines, the increasing use of TFF in biologics and vaccines production continues to boost the market growth for tangential flow filtration systems.

Technological Advancements and Adoption of Single-Use Systems: Technological advancements in membrane materials and system design have significantly contributed to the growth. Improvements in membrane selectivity, durability, and resistance to fouling have enhanced process efficiency, enabling higher throughput and better product quality. Additionally, the integration of automated and single-use TFF systems has transformed bioprocessing by reducing contamination risks and downtime associated with cleaning and sterilization. A 2024 publication on NCBI titled “Single-Use Technologies in Biomanufacturing” reports that single-use TFF systems have gained popularity due to their flexibility and cost-effectiveness, particularly in small to mid-scale production settings.

The adoption of these advanced TFF systems aligns with the increasing trend toward continuous and modular bioprocessing, which demands reliable and scalable filtration technologies. An article published in 2024 on PubMed, “Trends in Continuous Bioprocessing”, notes that single-use tangential flow filtration supports faster changeovers and lowers the risk of cross-contamination, making it essential for efficient and flexible manufacturing. These technological improvements and shifts in manufacturing practices are key drivers that are propelling the tangential flow filtration forward.

Segmental Insights

Product Analysis

Based on product, the segmentation includes single-use tangential flow filtration systems, reusable tangential flow filtration systems, membrane filters, and filtration accessories. The single-use tangential flow filtration systems segment held the largest share in 2024. These systems offer clear advantages such as reduced risk of cross-contamination, minimized cleaning validation needs, and faster turnaround times between batches. Their plug-and-play setup appeals strongly to biopharmaceutical manufacturers aiming to maintain sterile conditions and boost process efficiency. Additionally, as more companies shift toward modular and flexible manufacturing setups—especially in vaccine and biologics production—single-use systems fit seamlessly into these evolving infrastructures. This has encouraged wider adoption in facilities that prioritize productivity, compliance, and cost savings over traditional setups. The growth of smaller batch sizes in personalized medicine has also reinforced demand for these systems, as they are more adaptable to variable processing volumes without incurring significant overhead costs.

The membrane filters segment is anticipated to register the highest growth rate during the forecast period. This is largely attributed to their broad use in various stages of filtration—ranging from microfiltration and ultrafiltration to nanofiltration—across applications such as protein purification, cell harvesting, and buffer exchange. Advances in membrane materials and design have enhanced their performance in terms of flow rate, retention efficiency, and resistance to fouling, making them more effective for both small-scale lab use and industrial bioprocessing. Moreover, the increased demand for high-purity biologics, including spine biologics, and the need for efficient removal of impurities have made membrane filters indispensable in modern biomanufacturing workflows. Their adaptability in different process settings and compatibility with automated systems make them a flexible and scalable solution for a range of filtration needs.

Technology Analysis

Based on technology, the segmentation includes ultrafiltration, microfiltration, nanofiltration, and others. The ultrafiltration segment held the largest share in 2024. Ultrafiltration is also commonly used for buffer exchange and concentration steps, which are essential in both clinical manufacturing and lab-scale research. As the demand for biologics, including monoclonal antibodies and cell-based therapies, continues to rise, ultrafiltration remains the go-to solution for ensuring product purity and process efficiency. Additionally, the integration of ultrafiltration systems in both single-use and reusable formats strengthens its adoption across various process scales. The balance between performance, cost-efficiency, and ease of scalability has made ultrafiltration an essential part of workflows in vaccine development, protein therapeutics, and enzyme recovery.

The nanofiltration segment is anticipated to register the highest growth rate during the forecast period. It is increasingly being used for the selective separation of molecules based on size and charge, especially in cases where traditional ultrafiltration may not be sufficient. Its ability to retain multivalent salts and small organic compounds while allowing monovalent ions to pass makes it particularly valuable in the concentration and purification of small peptides and hormones. As drug development grows more complex and targeted therapies become more common, nanofiltration is gaining attention for its precision and efficiency. In recent years, improvements in membrane chemistry and module design have expanded its use in pharmaceutical and life sciences applications, where more refined separation is needed. Moreover, its growing role in environmental and water-based pharmaceutical processing adds further momentum to its adoption.

Application Analysis

Based on application, the segmentation includes protein purification, vaccine & viral vectors, antibody purification, raw material filtration, and others. The protein purification segment held the largest share in 2024. Tangential flow filtration is widely used during various stages of protein isolation and concentration, ensuring that the end product is free from contaminants while preserving structural integrity. This application is critical in the development of therapeutic proteins, enzymes, and diagnostic reagents. The versatility of TFF in handling different protein sizes and complexities makes it a preferred technique in both small-scale research labs and large production facilities. With the growing use of recombinant proteins in therapeutics and industrial processes, protein purification continues to be a core application area. Furthermore, academic and government-funded research institutions rely heavily on this method for basic studies in biochemistry, structural biology, and drug discovery, reinforcing its strong presence.

Vaccine and viral vector processing is anticipated to register the highest growth rate during the forecast period, largely fueled by the rising development of gene therapies, mRNA vaccines, and viral-based delivery systems. TFF plays a key role in purifying and concentrating viral particles and vectors while maintaining their functional properties, which is crucial for product efficacy and safety. The ability of TFF systems to handle large volumes with high recovery rates and low shear stress makes them ideal for these sensitive biological materials. This application has gained significant traction post-COVID, as the demand for scalable and reliable purification processes for viral vectors and nucleic acid-based vaccines has surged. Additionally, as newer vaccine platforms emerge and expand globally, especially in low- and middle-income countries, efficient downstream processing technologies, including TFF, are becoming increasingly important.

End Use Analysis

Based on end use, the segmentation includes pharmaceutical & biotechnology companies, contract research organizations & contract manufacturing organizations, and academic institutes & research laboratories. The pharmaceutical & biotechnology companies segment held the largest share in 2024. These companies use TFF systems across multiple stages of the bioproduction process, including cell harvesting, protein purification, and formulation of final drug products. The need for high product quality, batch consistency, and regulatory compliance makes TFF a critical component in their downstream processing strategies. With the growing pipeline of monoclonal antibodies, vaccines, and cell and gene therapies, these organizations are expanding their in-house capabilities and investing in advanced filtration systems to improve throughput and reduce production times. The trend toward continuous bioprocessing has also contributed to wider adoption of TFF technologies, which support automated, scalable, and cost-effective operations. Additionally, global expansion of manufacturing facilities and a focus on meeting increasing demand for biologics are further reinforcing the dominant role of pharmaceutical and biotech companies.

The contract research organizations (CROs) and contract manufacturing organizations (CMOs) segment is anticipated to register the highest growth rate during the forecast period. Many small and mid-sized drug developers are partnering with CROs and CMOs to access specialized expertise and reduce operational costs, especially during clinical trials and early-stage production. These organizations are increasingly integrating tangential flow filtration systems into their workflows to provide efficient and scalable purification services for a wide range of clients. The flexibility of TFF allows them to handle various batch sizes and biologic types, making it a practical solution for rapidly changing project needs. As demand for novel therapies rises and timelines for drug development shorten, CROs and CMOs are expanding their capacity with advanced filtration technologies that ensure speed, reliability, and compliance.

Regional Analysis

The North America tangential flow filtration market accounted for the largest share in 2024, due to its strong biopharmaceutical infrastructure, robust R&D capabilities, and widespread adoption of advanced bioprocessing technologies. The region is home to a large number of biotechnology companies and pharmaceutical manufacturers actively involved in the development of biologics, biosimilars, and vaccines. Favorable regulatory frameworks and high investments in biologics manufacturing have created a solid foundation for TFF system usage. Moreover, the presence of technologically advanced manufacturing facilities and a focus on quality compliance continue to drive the integration of single-use and automated filtration systems across production lines.

U.S. Tangential Flow Filtration Market Insights

The U.S. dominates the North American market, supported by significant government funding in life sciences research and continuous innovation in bioprocessing technologies. High demand for monoclonal antibodies, personalized therapies, and advanced vaccines has pushed biomanufacturers to upgrade downstream processing, where TFF plays a key role. Additionally, the growth of cell and gene therapy production facilities, especially in regions such as California and Massachusetts, has contributed to the increased installation of TFF systems. Collaborations between academia and industry, along with rapid expansion in contract manufacturing, are further accelerating adoption across clinical and commercial stages.

Europe Tangential Flow Filtration Market Trends

In Europe, the tangential flow filtration industry is witnessing steady growth, driven by the expanding biologics sector and growing regulatory pressure for high-quality manufacturing. The region's strong focus on biosimilar development and increasing investments in biopharma infrastructure are encouraging the use of efficient purification technologies. Local initiatives to enhance vaccine self-sufficiency and strengthen healthcare systems have also added momentum to the demand for TFF solutions in both research and industrial environments. Public-private partnerships in life sciences and funding for biomanufacturing innovation are reinforcing the outlook across the region.

The Germany tangential flow filtration market plays an important role in Europe, due to its well-established pharmaceutical manufacturing base and focus on innovation in bioprocessing. The country has made consistent efforts to modernize production capabilities, including the adoption of single-use technologies and automated filtration systems. German research institutions and biotech firms are increasingly relying on TFF for protein purification, cell culture harvesting, and virus concentration, especially as demand for biologics and biosimilars grows. With government-backed support for R&D and a thriving ecosystem of biotech startups, Germany remains central to the expansion of tangential flow filtration across Europe.

Asia Pacific Tangential Flow Filtration Market Overview

Asia Pacific is emerging as one of the fastest-growing regions in the tangential flow filtration, supported by rising biologics manufacturing and growing investments in healthcare infrastructure. The region is becoming a preferred hub for contract manufacturing, with an increasing number of local and international companies setting up production facilities. Demand for cost-effective and scalable bioprocessing technologies is pushing manufacturers to adopt TFF systems for improving production efficiency and compliance with international quality standards. In addition, growing awareness about advanced filtration methods and rising R&D activities in the life sciences sector are contributing to wider adoption across the region.

China Tangential Flow Filtration Market Analysis

China is playing a key role in driving growth in Asia Pacific due to its expanding pharmaceutical and biotechnology industries. The country has made major investments in biopharma innovation, especially in the areas of biosimilars, vaccines, and gene therapies. Local companies are rapidly integrating modern filtration technologies, including TFF systems, into their production pipelines to meet both domestic and global demand. Government-led initiatives to promote biomanufacturing and improve healthcare outcomes have created a favorable environment for technological upgrades in downstream processing. As a result, China continues to strengthen its position as a strategic center for TFF adoption in the region.

Key Players and Competitive Insights

The tangential flow filtration market includes several key players actively developing and supplying advanced filtration systems. A few of the major companies in the landscape are Cytiva, Merck KGaA, Pall Corporation, Sartorius AG, Repligen Corporation, Danaher Corporation, and GE Healthcare Life Sciences. These players compete by offering innovative products that focus on improving filtration efficiency, scalability, and user convenience. They invest in research and development to introduce new membrane technologies, single-use systems, and integrated filtration solutions to meet evolving industry needs.

A few prominent companies in the industry include Cytiva, Merck KGaA, Danaher Corporation, Sartorius AG, Repligen Corporation, GE Healthcare, Thermo Fisher Scientific, Merck KGaA, Asahi Kasei Corporation, NovaMem Technologies, Parker Hannifin Corporation, and BIA Separations.

Key Players

- Asahi Kasei Corporation

- BIA Separations

- Cytiva

- Danaher Corporation

- GE Healthcare Life Sciences

- Merck KGaA

- NovaMem Technologies

- Parker Hannifin Corporation

- Repligen Corporation

- Sartorius AG

- Thermo Fisher Scientific

Tangential Flow Filtration Industry Developments

June 2025: Cytiva announced its plans to install new filtration manufacturing lines at its Pensacola, Florida, facility by August 2025. This expansion aims to increase production capacity for filter membranes in North America by 20%, supporting the growing demand for biopharmaceutical manufacturing.

September 2024: Sartorius introduced the Vivaflow® SU, a next-generation tangential flow filtration cassette designed for laboratory-scale applications.

Tangential Flow Filtration Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Single-use Tangential Flow Filtration Systems

- Reusable Tangential Flow Filtration Systems

- Membrane Filters

- Polyethersulfone (PES)

- Polyvinylidene Difluoride (PVDF)

- Polytetrafluoroethylene (PTFE)

- Mixed Cellulose Ester & Cellulose Acetate

- Polycarbonate Tracked Etched (PCTE)

- Regenerated Cellulose

- Others

- Filtration Accessories

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Protein Purification

- Vaccine & Viral Vectors

- Antibody Purification

- Raw Material Filtration

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations & Contract Manufacturing Organizations

- Academic Institutes & Research Laboratories

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tangential Flow Filtration Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.15 billion |

|

Market Size in 2025 |

USD 2.42 billion |

|

Revenue Forecast by 2034 |

USD 7.09 billion |

|

CAGR |

12.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.15 billion in 2024 and is projected to grow to USD 7.09 billion by 2034.

The global market is projected to register a CAGR of 12.7% during the forecast period.

North America dominated the share in 2024.

A few key players include Cytiva, Merck KGaA, Danaher Corporation, Sartorius AG, Repligen Corporation, GE Healthcare, Thermo Fisher Scientific, Merck KGaA, Asahi Kasei Corporation, NovaMem Technologies, Parker Hannifin Corporation, and BIA Separations.

The single-use tangential flow filtration systems segment accounted for the largest share of the market in 2024.

The nanofiltration segment is expected to witness the fastest growth during the forecast period.