Vaccine Contract Manufacturing Market Share, Size, Trends, Industry Analysis Report

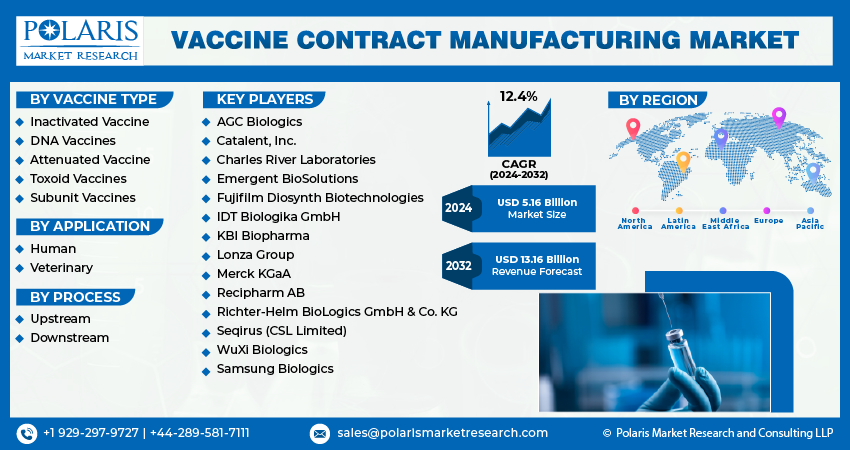

By Vaccine Type (Inactivated Vaccine, DNA Vaccines, Attenuated Vaccine, Toxoid Vaccines, Subunit Vaccines); By Application; By Process; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4069

- Base Year: 2023

- Historical Data: 2019-2021

Report Outlook

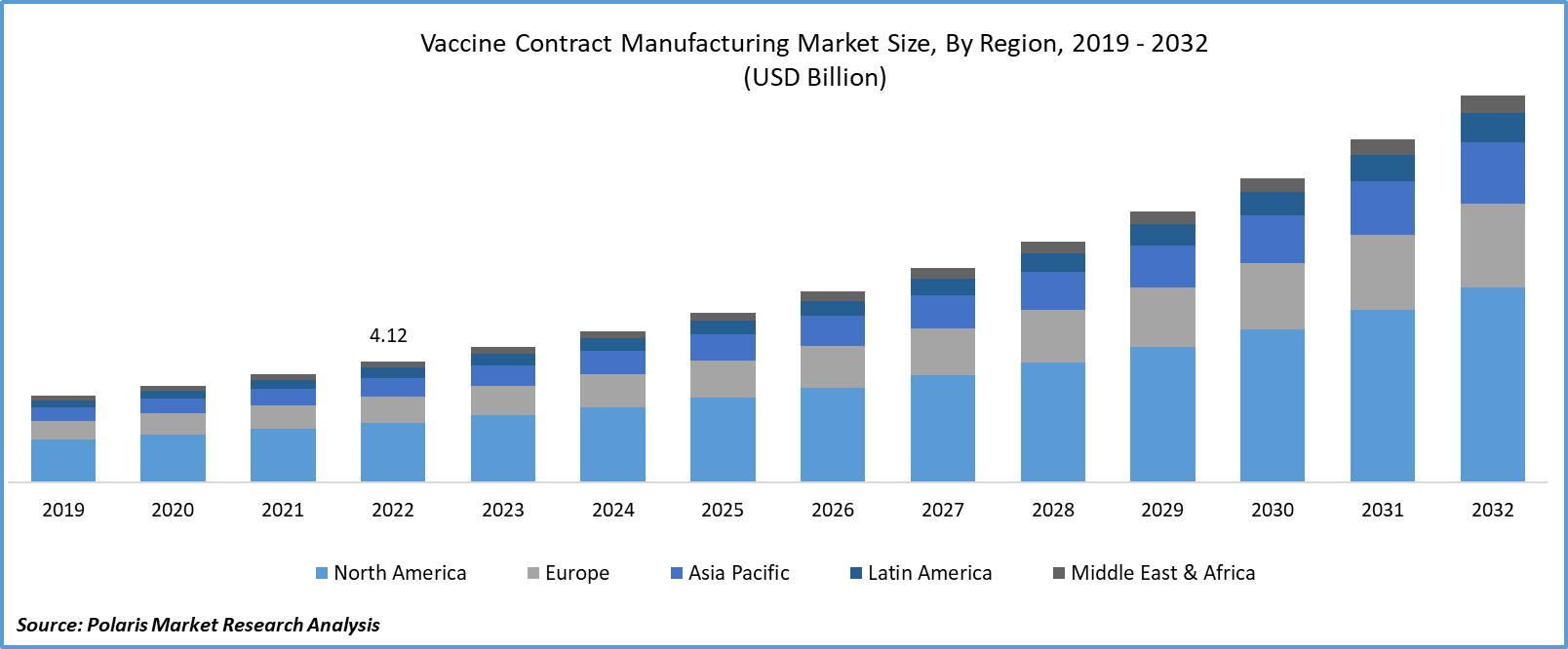

The global vaccine contract manufacturing market was valued at USD 4.61 billion in 2023 and is expected to grow at a CAGR of 12.4% during the forecast period.

The global demand for vaccines is increasing due to the need for preventive healthcare and the ongoing development of new vaccines for emerging diseases. This growth in the vaccine market directly extends the scope of vaccine contract manufacturing. Vaccines are developed for a wide range of diseases, including infectious diseases, cancer, and autoimmune disorders. The diverse types of vaccines require specialized expertise and manufacturing capabilities, expanding the scope for contract manufacturers. Advancements in biopharmaceutical manufacturing techniques, such as cell culture and recombinant DNA technology, have made vaccine production more complex. Contract manufacturers with expertise in biologics are well-positioned to meet this demand.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Vaccine Contract Manufacturing Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

In spite of the market supremacy of vaccine manufacturers established in high- and middle-income nations, there are several motives why a low-income country or regional assembly of nations might want to begin their vaccine supply. This involves supply safety, regulation over production organizing and viability, regulation of prices, socioeconomic advancement, and speedy response to regional outbreaks involving surfacing contagious illnesses.

Notable alterations in manufacturing procedures, such as contemporary spaces, mass-producing instruments, or alterations in raw materials, will usually set off contemporary administrative needs involving clinical trials. The vaccine contract manufacturing market demand is on the rise. These needs will prove that the vaccine is yet productive and equivalent to the commodity rendered by the primary vaccine procedures and researched in primary clinical studies.

To Understand More About this Research: Request a Free Sample Report

The vaccine contract manufacturing market has observed significant growth and change in recent years, driven by the unprecedented demand for vaccines worldwide. Contract manufacturing organizations (CMOs) play a pivotal role in the production of vaccines, offering expertise, capacity, and flexibility to pharmaceutical companies and governmental organizations.

The rise of new and intricate diseases, coupled with the imperative for streamlined and extensive vaccine production, has propelled pharmaceutical companies towards a heightened reliance on contract manufacturing collaborators. These specialized Contract Manufacturing Organizations (CMOs) excel in the production, packaging, and distribution of vaccines, enabling pharmaceutical companies to channel their efforts towards research, development, and regulatory matters.

- For instance, in September 2023, SK Bioscience, headquartered in South Korea, revealed that Prime Minister Ana Brnabic of the Republic of Serbia paid a visit to their facilities. During her visit, a Memorandum of Understanding (MoU) was inked, solidifying a strategic collaboration between the two nations in the realms of vaccine development and production.

However, the market is not immune to supply chain challenges, which the COVID-19 pandemic has exacerbated. Issues such as raw material shortages, transportation delays, and border restrictions can impact production timelines.

Moreover, the surge in demand for vaccines, particularly during pandemics, can strain the manufacturing capacity of CMOs. It highlights the need for continuous investment in expanding production capabilities.

Industry Dynamics

Growth Drivers

- Increased demand for vaccines is projected to spur product demand.

The global population's growing awareness of the importance of vaccination, coupled with the emergence of new diseases, has led to an increased demand for vaccines worldwide. This imperative has been further underscored by events such as the COVID-19 pandemic, which have illuminated the necessity for swift and scalable vaccine development capabilities. Technological strides in biotechnology and vaccine manufacturing have significantly enhanced the efficiency and scalability of production processes, rendering contract manufacturing an alluring solution for pharmaceutical enterprises.

Moreover, the financial aspect also plays a pivotal role, as contract manufacturing affords companies the opportunity to curtail capital expenditures and operational costs while mitigating risks associated with in-house production. Moreover, contract manufacturers often bring specialized expertise to the table, ensuring adherence to rigorous quality and compliance standards.

Regulatory proficiency is yet another driving force, with established contract manufacturing organizations adept at navigating the intricate landscape of regulatory requirements. As vaccine supply chains globalize, diversification across regions has become imperative to safeguard against disruptions, further fueling the demand for contract manufacturing services. In tandem with these market dynamics, government initiatives and collaborations, alongside a growing emphasis on global health, continue to amplify the pivotal role played by vaccine contract manufacturing in safeguarding public health.

Report Segmentation

The market is primarily segmented based on vaccine type, application, process, and region.

|

By Vaccine Type |

By Application |

By Process |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Vaccine Type Analysis

- The Inactivated Vaccine segment is expected to witness the fastest CAGR during the forecast period.

The inactivated vaccine segment is expected to witness the fastest CAGR during the forecast period. DNA vaccines, currently undergoing clinical research in multiple product lines, are poised for a robust growth trajectory. In terms of prospects, they exhibit tremendous potential in mitigating various diseases.

The subunit category is projected to experience consistent growth throughout the forecast period, driven by continuous research endeavors aimed at creating recombinant subunit vaccines targeting the Hepatitis C virus.

Furthermore, both companies and researchers in academia are actively engaged in advancing research and development efforts for inactivated vaccine candidates across various medical conditions, with some gaining approval from health authorities. Consequently, this dynamic is poised to drive growth in the inactivated vaccine segment. Notably, in April 2022, the WHO approved ten COVID-19 vaccines, wherein three vaccines belong to the inactivated category, including Sinopharm, CoronaVac and COVAXIN (Bharat Biotech).

By Application Analysis

- The veterinary segment held a significant revenue share in 2022

The veterinary segment held a significant share in revenue share in 2022. The pivotal role of vaccination in enhancing veterinary health and preventing diseases in animals has been duly noted. It is poised to be a substantial catalyst for the increased utilization of Contract Manufacturing Organizations (CMOs) in the production of animal vaccinations. Vaccination not only diminishes the necessity for antibiotics in animal treatment but also aligns with the surge in demand for animal-derived food driven by a growing global population. Consequently, the significance of vaccination within the meat-production sector is slated to experience an upward trajectory. These intertwined factors are anticipated to fuel notable growth within this segment.

By Process Analysis

- The downstream segment held the largest market share in 2022

In 2022, the downstream segment held the largest market share, primarily drives the need for robust and advanced equipment in downstream processing.

Given that downstream processing encompasses crucial steps like product recovery and purification, it necessitates substantial investment and meticulous attention. Consequently, there is a substantial demand for improved biotechnological tools, significant capital, and a skilled workforce dedicated to ensuring the successful recovery of the vaccine as the ultimate product. This factor has emerged as a key driver for the notable growth witnessed in this segment in recent years.

Regional Insights

- North America region held the largest market share in 2022

In 2022, the North American region held the largest market share. The practice of vaccine contract manufacturing in North America has brought about a myriad of positive effects on public health, economic stability, and the pharmaceutical sector.

Foremost, it has greatly fortified the region's readiness and responsiveness in the face of pandemics. Leveraging its advanced biopharmaceutical infrastructure and a multitude of specialized contract manufacturing organizations (CMOs), North America demonstrated remarkable agility in producing vaccines during health emergencies. It was vividly demonstrated in the swift development and wide-scale distribution of COVID-19 vaccines during the recent pandemic, where North American CMOs played a pivotal role.

Moreover, the North American market exhibits a strong demand for vaccines, not only for infectious diseases but also for a wide range of other conditions, including cancer and autoimmune disorders. This diversified demand fosters a dynamic environment for contract manufacturing organizations to expand their offerings.

The Asia-Pacific region is expected to be the fastest-growing region during the forecast period. Asia Pacific offers a cost-effective manufacturing environment, with lower labor and operational costs compared to many Western countries. This cost advantage attracts pharmaceutical companies to outsource vaccine production to the region, resulting in increased contract manufacturing activities.

Also, the region has a well-educated and skilled workforce, particularly in biotechnology and pharmaceutical sciences. This expertise, combined with a strong focus on research and development, makes Asia-Pacific an attractive destination for vaccine manufacturing.

Key Market Players & Competitive Insights

The vaccine contract manufacturing market is anticipated to witness competition due to various players' existence. Prominent service providers in the market are continuously boosting their technologies to stay ahead of the competitors and to ensure integrity, efficiency, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- AGC Biologics

- Catalent, Inc.

- Charles River Laboratories

- Emergent BioSolutions

- Fujifilm Diosynth Biotechnologies

- IDT Biologika GmbH

- KBI Biopharma

- Lonza Group

- Merck KGaA

- Recipharm AB

- Richter-Helm BioLogics GmbH & Co. KG

- Seqirus (CSL Limited)

- WuXi Biologics

- Samsung Biologics

Recent Developments

- In August 2022, Moderna entered into a partnership with the Canadian government to establish a manufacturing facility for messenger RNA vaccines in Canada, with the exact location yet to be determined. According to the biotechnology company, this collaboration aims to provide Canadians with locally produced mRNA vaccines designed to combat respiratory viruses, including SARS-CoV-2, influenza, and respiratory syncytial virus.

Vaccine Contract Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 5.16 billion |

|

Revenue forecast in 2032 |

USD 13.16 billion |

|

CAGR |

12.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Vaccine Type, By Application, By Process, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Download Sample Report

Want to check out the Vaccine Contract Manufacturing Market report before buying it? Then, our sample report has got you covered. It includes key market data points, ranging from trend analyses to industry estimates and forecasts. See for yourself by downloading the sample report.

Browse Our Top Selling Reports

Amniotic Products Market Size, Share 2024 Research Report

Protein Characterization And Identification Market Size, Share 2024 Research Report

Wearable Breast Pumps Market Size, Share 2024 Research Report

Actinic Keratosis Treatment Market Size, Share 2024 Research Report

Magnetic Beads Market Size, Share 2024 Research Report