Testing, Inspection, and Certification (TIC) Market Size, Share, Trends, & Industry Analysis Report

: By Service (Certification, Inspection, and Testing), By Sourcing, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 120

- Format: PDF

- Report ID: PM4743

- Base Year: 2024

- Historical Data: 2020-2023

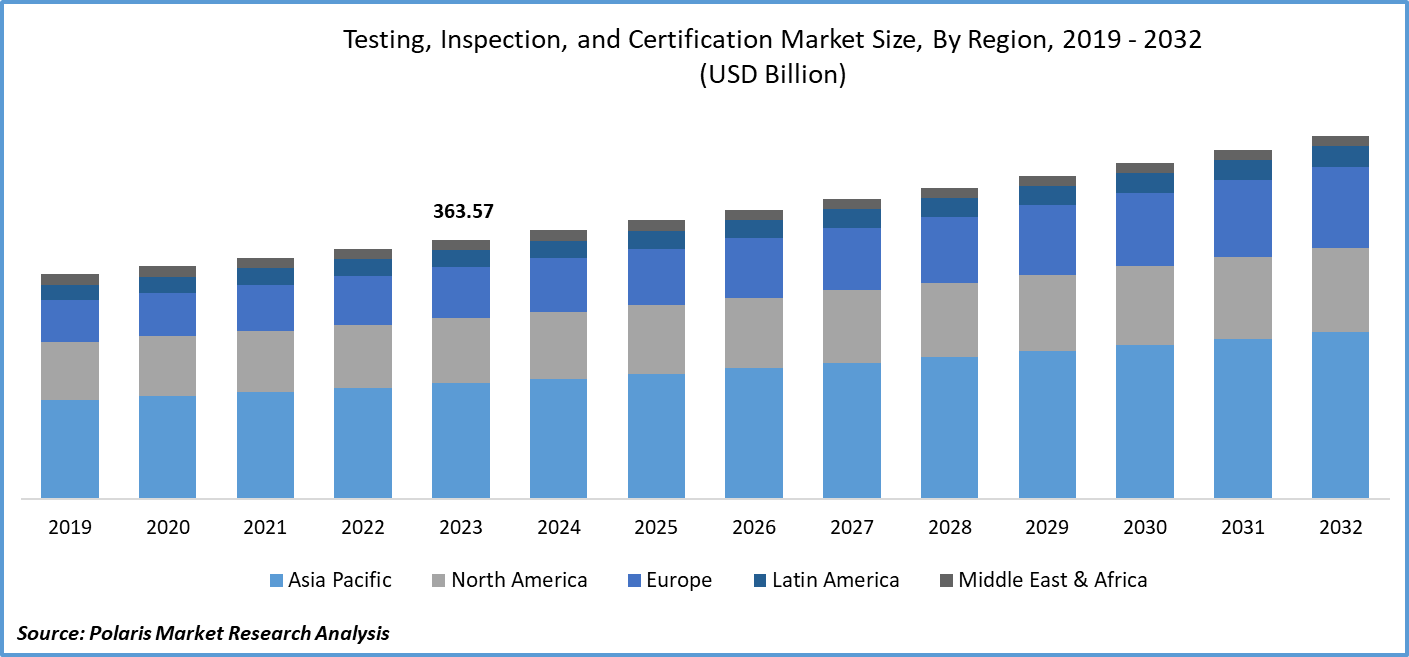

The testing, inspection, and certification (TIC) market size was valued at USD 398.11 billion in 2024. The market is projected to grow from USD 411.04 billion in 2025 to USD 560.21 billion by 2034, exhibiting a CAGR of 3.5% during 2025–2034.

The testing, inspection, and certification (TIC) market is driven by stringent regulatory standards, increasing product complexity, globalization of trade, rising demand for quality assurance, and growing focus on safety and compliance.

Market Overview:

The testing, inspection, and certification (TIC) sector encompasses conformity assessment bodies that provide a range of services. These services include auditing, inspection, testing, verification, quality assurance, and certification. The goal of the TIC market is to ensure that products, systems, and services meet regulatory standards, quality requirements, and safety guidelines. TIC services are crucial across various industries, including healthcare, manufacturing, and technology to ensure product reliability, safety, and acceptance. The TIC sector plays a vital role in facilitating global trade by ensuring products comply with international safety and quality standards.

To Understand More About this Research: Request a Free Sample Report

Increasing regulatory standards across industries like healthcare, automotive, and food certification and safety necessitate TIC services. Globalization and complex supply chains heighten the need for quality assurance and compliance. The rising demand for product safety and environmental compliance also fuels growth. Technological advancements, such as AI, IoT, and automation, are transforming the TIC, enhancing efficiency and accuracy. The expansion of industries in emerging markets and the increasing focus on sustainability further contribute to the expansion.

Industry Dynamics

Stringent Regulatory Standards Driving Market Demand

The increasing stringency of government and industry regulations across various sectors acts as a significant driver. These regulations are implemented to ensure product safety, quality, and environmental compliance, thereby necessitating the involvement of TIC services. For instance, in the European Union, the new Packaging and Packaging Waste Regulation (PPWR) was introduced in January 2025, replacing older directives to establish comprehensive rules for the entire packaging lifecycle. Similarly, new EU regulations addressing the use of bisphenol A (BPA) in food-contact materials are set to be enacted in January 2025. These evolving and stricter regulatory frameworks mandate thorough testing, inspection, and certification processes to ensure adherence, consequently fueling the demand for TIC services.

Globalization and Complex Supply Chains Fueling growth

The ongoing trend of globalization and the increasing complexity of supply chains worldwide are significant growth factors for the TIC market. As businesses expand their operations across borders and rely on intricate networks of suppliers and manufacturers, the need for independent third-party verification becomes crucial to ensure quality and compliance at every stage. The TIC sector plays a vital role in facilitating international trade by ensuring that products and processes meet diverse international standards and regulations. This is particularly evident in sectors like consumer goods and pharmaceuticals, where global sourcing requires rigorous inspection and testing to maintain consistent quality and safety across different regions. The necessity to navigate varying international standards and ensure seamless supply chain integrity significantly boosts the demand for comprehensive TIC services.

Technological Advancements Transforming TIC Processes

Technological advancements are emerging as a major trend, profoundly impacting. The integration of technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and automation is enhancing the efficiency, accuracy, and scope of TIC services. AI and machine learning algorithms are being utilized for advanced data analysis and predictive maintenance, while IoT-enabled devices facilitate real-time monitoring and remote inspection machines. The increasing adoption of connected technologies across industries necessitates thorough interoperability testing and cybersecurity assessments, further driving the demand for sophisticated TIC solutions. These technological integrations enable more streamlined and effective conformity assessments, thereby acting as a substantial driver for the evolution and expansion of the TIC market.

Segmental Insights

Market Assessment By Service

The certification subsegment holds the largest share during the forecast period. This dominance can be attributed to the widespread requirement for certifications across numerous industries to demonstrate compliance with standards, regulations, and customer expectations. Certifications assure the quality, safety, and performance of products, processes, and systems, making them an indispensable aspect of access and maintaining a competitive edge. The demand for certification services is consistently high due to the increasing emphasis on quality assurance and risk mitigation across global value chains.

The testing subsegment is anticipated to exhibit the highest growth rate over anticipated years. This rapid expansion is primarily driven by the accelerating pace of technological advancements and the introduction of more complex products and systems. The need for rigorous testing to ensure the functionality, reliability, and safety of these innovations is constantly escalating. Furthermore, the increasing focus on cybersecurity and the stringent requirements for product safety in various sectors are contributing significantly to the heightened demand for comprehensive testing services. This dynamic landscape suggests a strong growth trajectory for the testing subsegment in the foreseeable future.

Market Evaluation By Sourcing

The in-house sourcing subsegment accounted for the largest share in 2024. This substantial share is due to the fact that many large organizations, particularly in highly regulated industries, maintain their own dedicated TIC departments to ensure greater control over quality assurance and compliance processes. Having in-house capabilities allows for immediate response to testing and inspection needs, facilitates seamless integration with internal processes, and can be perceived as offering a higher degree of confidentiality and customization. This preference for direct oversight contributes significantly to the dominant share of the in-house sourcing segment.

The outsourced sourcing subsegment is expected to demonstrate the highest growth rate during the forecast period. This increasing reliance on external TIC providers is driven by several factors, including the growing complexity of regulations and the need for specialized expertise that may not be readily available internally. Outsourcing TIC services can offer benefits such as cost-effectiveness, access to advanced technologies and methodologies, and scalability to meet fluctuating demands. Furthermore, smaller and medium-sized enterprises often prefer outsourcing due to the high investment required to establish and maintain in-house TIC capabilities. This trend toward leveraging external expertise and resources is propelling rapid growth.

Market Assessment By Application

The manufacturing application segment holds the largest share in the upcoming years. This significant share is attributed to the extensive and diverse quality control and compliance requirements inherent in manufacturing processes across various industries. From raw materials to finished products, stringent testing, inspection, and certification are essential to ensure product safety, performance, and adherence to both regulatory standards and consumer expectations. The sheer volume of manufacturing activities globally and the complexity of modern production necessitate substantial TIC services, solidifying this segment's leading position.

The healthcare application segment is anticipated to experience the highest growth rate over the anticipated years. The increasing focus on patient safety drives this rapid growth, as the stringent regulatory landscape governing medical devices and pharmaceuticals and the rising complexity of healthcare technologies. The need for thorough testing, inspection, and certification to ensure the efficacy and safety of medical products and healthcare services is paramount. Furthermore, the growing adoption of advanced medical equipment and the increasing emphasis on quality healthcare delivery worldwide is fueling the demand for comprehensive TIC services within the healthcare sector. This dynamic environment positions healthcare as a high-growth application area.

Regional Analysis

North America holds the largest share during the forecast period. This dominance can be attributed to the region's mature industrial base, stringent regulatory frameworks across key sectors, and a strong culture of quality and safety compliance. The presence of numerous established industries, including aerospace, automotive, and healthcare, coupled with rigorous government regulations and active participation of industry-specific standardization bodies, drives significant demand for comprehensive TIC services. Furthermore, the high level of awareness among consumers and businesses regarding product quality and safety contributes to the sustained leadership of North America.

The Asia Pacific region is projected to exhibit the highest growth rate over the upcoming years. This rapid expansion is fueled by robust economic growth, rapid industrialization, and increasing investments in manufacturing and infrastructure development across countries like China, India, and Southeast Asian nations. The rising awareness regarding product quality and safety standards, coupled with evolving regulatory landscapes and increasing international trade activities, is creating substantial demand for TIC services in this region. The growing middle-class population and the expansion of both domestic and international businesses within Asia Pacific are further contributing to its emergence as the fastest-growing for TIC services globally.

Key Players and Competitive Insights

Some of the major players operating in the Testing, Inspection, and Certification (TIC) market include SGS S.A., Bureau Veritas S.A., Intertek Group plc, TÜV SÜD AG, DEKRA SE, DNV AS, Lloyd's Register Group Limited, Eurofins Scientific SE, Applus Services, S.A., and UL LLC.

The competitive landscape is characterized by a mix of large multinational corporations and smaller niche players. Competition among these entities is based on factors such as service portfolio breadth, geographical reach, technical expertise, turnaround time, and pricing. Key insights reveal a growing emphasis on specialization within specific industries and service types, as well as increasing adoption of digital technologies to enhance service delivery and efficiency. Strategic collaborations, acquisitions, and expansions into emerging are common strategies employed by companies to strengthen their position and cater to evolving client needs.

List of Key Companies in Testing, Inspection, and Certification (TIC) Industry:

- Applus Services, S.A.

- Bureau Veritas S.A.

- DEKRA SE

- DNV AS

- Eurofins Scientific SE

- Intertek Group plc

- Lloyd's Register Group Limited

- SGS S.A.

- TÜV SÜD AG

- UL LLC

Testing, Inspection, and Certification (TIC) Industry Developments

- January 2025: SGS S.A. and Bureau Veritas S.A. announced that their discussions regarding a potential business combination had ended without an agreement. While the merger of two of the industry's largest players would have significantly reshaped the dynamics, the decision to discontinue talks means both companies will continue to pursue their independent growth strategies.

- October 2024: Bureau Veritas announced the acquisition of Aligned Incentives, a company specializing in AI-powered enterprise sustainability planning solutions. This acquisition aims to enhance Bureau Veritas's global sustainability services by integrating Aligned Incentives' expertise in life cycle assessment and ESG data management.

Testing, Inspection, and Certification (TIC) Market Segmentation

By Service Outlook (Revenue – USD Billion, 2020–2034)

- Certification

- Inspection

- Testing

By Sourcing Outlook (Revenue – USD Billion, 2020–2034)

- In-house

- Outsourced

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace & Defense

- Agriculture & Food

- Automotive

- Chemicals

- Consumer Goods & Retail

- Education

- Energy & Power

- Government

- Healthcare

- Infrastructure

- Manufacturing

- Mining

- Oil, Gas & Petroleum

- Public Sector

- Supply Chain & Logistics

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Testing, Inspection, and Certification (TIC) Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 398.11 billion |

|

Market Size Value in 2025 |

USD 411.04 billion |

|

Revenue Forecast by 2034 |

USD 560.21 billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The testing, inspection, and certification (TIC) market has been segmented into detailed segments of service, sourcing, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: Growth strategies in the Testing, Inspection, and Certification (TIC) market often revolve around expanding service portfolios to cater to evolving industry needs and regulatory changes. Penetration in emerging economies, where industrial growth is significant, represents another key strategy. Embracing digital transformation to offer more efficient and data-driven services is also crucial. Furthermore, strategic acquisitions and collaborations allow companies to enhance their geographical reach and technical expertise. A strong marketing strategy emphasizes building trust and credibility through accreditations and highlighting sector-specific knowledge to attract and retain clients seeking reliable conformity assessment services.

FAQ's

The global market size was valued at USD 398.11 billion in 2024 and is projected to grow to USD 560.21 billion by 2034.

The market is projected to register a CAGR of 3.5% during the forecast period, 2024-2034.

North America had the largest share of the market.

Some of the major players include SGS S.A., Bureau Veritas S.A., Intertek Group plc, TÜV SÜD AG, DEKRA SE, DNV AS, Lloyd's Register Group Limited, Eurofins Scientific SE, Applus Services, S.A., and UL LLC.

The certification segment accounted for the larger share of the market in 2024.

Following are some of the trends including that of battery TIC: ? Increasing Regulatory Complexity: Stricter and more diverse regulations across industries drive the need for comprehensive TIC services to ensure compliance. ? Growing Focus on Sustainability: Environmental regulations and a rising emphasis on sustainable practices are increasing the demand for green certifications and environmental testing. ? Digital Transformation: The adoption of technologies like AI, IoT, and blockchain is enhancing the efficiency, accuracy, and transparency of TIC processes through remote inspections, predictive maintenance, and secure data management.

Testing, Inspection, and Certification (TIC) refers to a range of services provided by independent organizations to assess the conformity of products, services, processes, and systems with relevant standards, regulations, and specifications. These services include activities like product testing to ensure safety and performance, inspecting facilities and processes for compliance, and certifying that management systems or products meet specific criteria. The primary goal of the TIC sector is to provide assurance to stakeholders – including consumers, businesses, and regulatory bodies – regarding quality, safety, and compliance, thereby facilitating trade, enhancing trust, and protecting the public safety and security and the environment.