Thermoform Packaging Market Share, Size, Trends, Industry Analysis Report

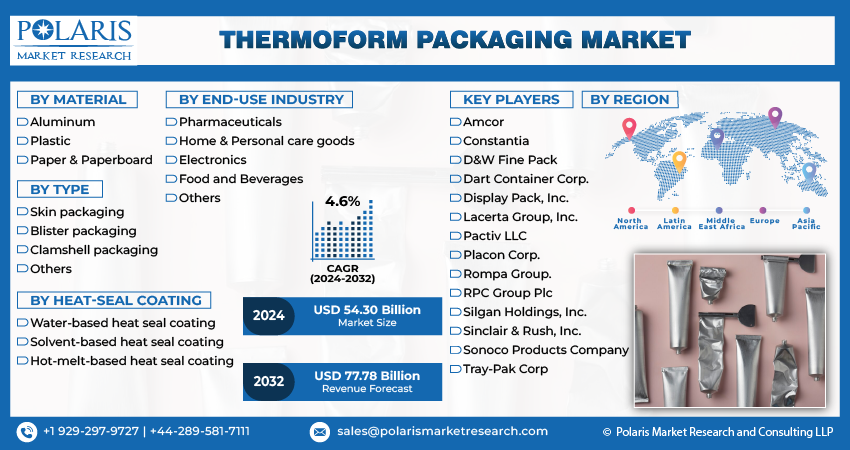

By Type (Skin packaging, Blister packaging, Clamshell Packaging, Others); By Material; By Heat-Seal Coating; By End-Use Industry; By Region; Segment Forecast, 2024- 2032

- Published Date:Mar-2024

- Pages: 115

- Format: PDF

- Report ID: PM4749

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

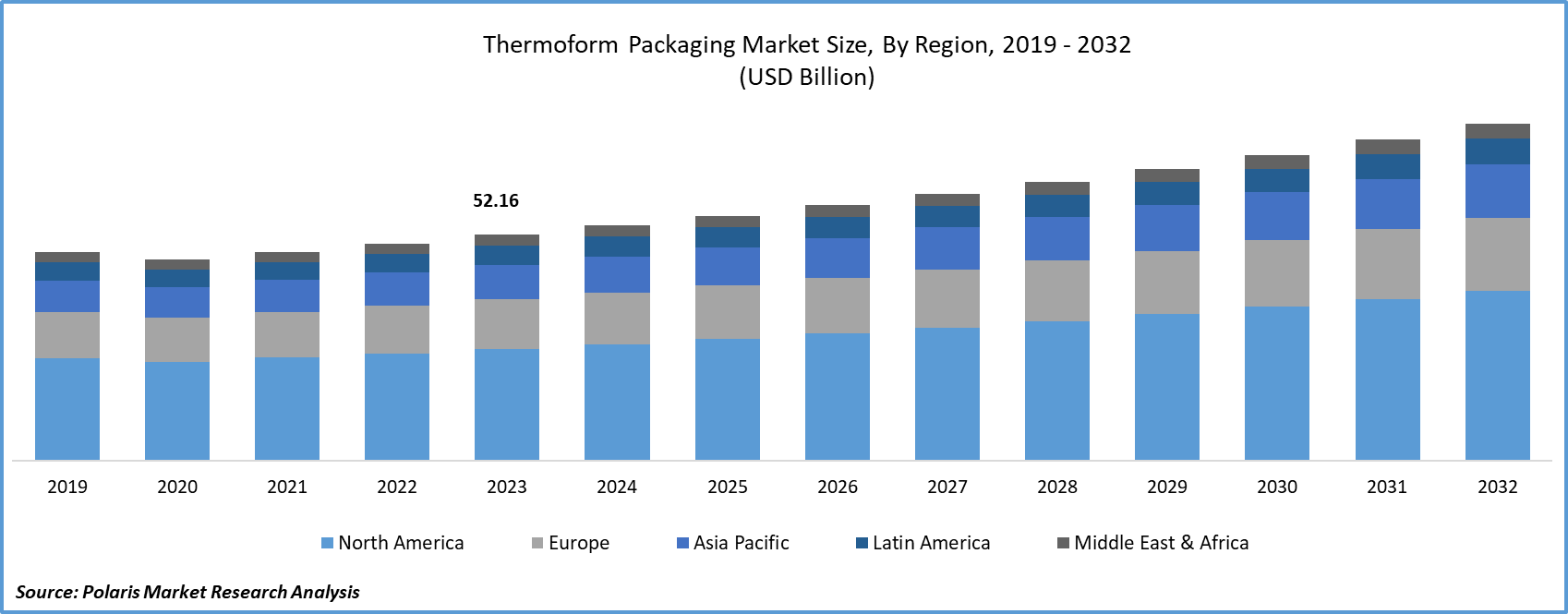

Global thermoform packaging market size was valued at USD 52.16 billion in 2023. The market is anticipated to grow from USD 54.30 billion in 2024 to USD 77.78 billion by 2032, exhibiting a CAGR of 4.6% during the forecast period

Thermoform Packaging Market Overview

Thermoforming packaging is a versatile and extensively employed technique for crafting tailored packaging solutions across diverse industries. This method entails heating a plastic sheet until it attains pliability, shaping it into the desired form through molds or dies, and subsequently cooling it to achieve the final package. Thermoformed packaging presents several advantages, including lightweight composition, cost-effectiveness, and the capability to fashion intricate shapes and designs. Its applications are prevalent in packaging various products such as consumer goods, electronics, pharmaceuticals, and food items.

The anticipated growth in the thermoform packaging market is fueled by a rising appetite for packaged food, including prepared meals, packaged meat, and seafood products. This trend is further amplified by the increasing prevalence of organized and e-retail networks on a global scale. The thermoforming process involves heating the thermoplastic sheet to its softening point, after which it is molded into the desired shape. Typically, a combination of vacuum, heat, and pressure is applied to these sheets to yield the final products.

To Understand More About this Research: Request a Free Sample Report

Thermoformed products, including cups, trays, plates, containers, and more, are extensively used in the food service industry. They serve both tabletop presentation and parcel packaging needs. The industry's expansion, driven by the increasing adoption of e-food delivery platforms and evolving lifestyles globally, is a significant catalyst for heightened product demand.

Thermoform packaging products, known for their cost-effectiveness, lightweight properties, and appealing aesthetics, are extensively employed by manufacturers in the packaged food sector. Moreover, the growing preference for Modified Atmosphere Packaging (MAP) in food products, involving the use of a controlled gaseous mixture within thermoform containers to enhance the shelf life of food items, is poised to propel thermoform packaging market size growth in the foreseeable future.

Additionally, the surge in demand for single-serve packaging, attributed to the rise in on-the-go food consumption, is expected to play a pivotal role in thermoform packaging market revenue expansion. However, the increasing emphasis on sustainable packaging practices is compelling end-use manufacturers to opt for flexible packaging, which requires fewer raw materials and facilitates efficient transportation and handling. This factor is anticipated to pose a challenge to thermoform packaging market growth throughout the forecast period.

Thermoform Packaging Market Dynamics

Market Drivers

Significant Expansion In The Food And Beverage Sector

The global food and beverage industry is experiencing remarkable growth, fueled by a surge in demand for on-the-go, processed, and ready-to-eat food products. In response to this trend, food packaging solutions are required to meet stringent standards and act as effective barriers against moisture, oxygen, tampering, physical stress, and extreme temperatures. To address these challenges, Food and Beverage manufacturers are increasingly opting for packaging solutions that boast innovative and functional designs, ensuring comprehensive protection for their products.

This heightened demand for convenient food options not only propels the growth of the Food and Beverage industry but also underscores the necessity for advanced packaging solutions. The packaging industry, equipped with the ability to enhance shelf life and provide tamper-resistant properties, along with excellent durability and sealing, is gaining substantial traction within the Food and Beverage sector. As consumer preferences continue to evolve towards more convenient and readily available food choices, the importance of innovative and effective packaging solutions becomes increasingly evident, driving the symbiotic growth of the Food and Beverage and packaging industries.

Market Restraints

Rigorous Government Regulations Regarding Plastic Utilization

The stringent government regulations surrounding plastic utilization constitute an impact on the thermoform packaging market. Governments around the world are increasingly implementing and enforcing regulations aimed at reducing the environmental impact of plastic packaging, driven by concerns over plastic pollution, waste management, and sustainability.

Restrictions on the use of certain types of plastics, especially those that are not easily recyclable or biodegradable, limit the options available to thermoform packaging manufacturers, impacting their material choices and potentially increasing costs.

Authorities are implementing more stringent recycling and waste management regulations, necessitating producers to design packaging that aligns with these requirements. Thermoform packaging may need help in meeting these regulations, particularly if the materials used are not easily recyclable. Some regions have imposed outright bans on certain single-use plastics or set ambitious reduction targets for plastic usage. This directly impacts the demand for plastic-based thermoform packaging, may require manufacturers to explore alternative materials, and may hinder market growth.

Report Segmentation

The market is primarily segmented based on material, type, heat-seal coating, end-use industry, and region.

|

By Material |

By Type |

By Heat-Seal Coating |

By End-Use Industry |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Thermoform Packaging Market Segmental Analysis

By Material Analysis

- In 2023, the plastic segment accounted for the largest market share. PET dominated it, driven by the demand for its recyclable nature, lightweight properties, and high tensile strength, contributing to overall thermoform packaging market growth. PET's low water absorption ensures minimal interaction with food or beverages, making it a preferred choice for packaging consumable goods. Various PET grades, such as R-PET, A-PET, and C-PET, are employed in thermoform packaging production. A-PET, recognized for its clarity, is well-suited for crafting containers to showcase items like confectionery products. Conversely, C-PET, with its ability to withstand high temperatures, is ideal for oven-ready and frozen food packaging.

- Polyvinyl chloride (PVC) is expected to witness substantial growth at a significant CAGR throughout the analysis period, attributed to its robust barrier qualities, shatter-resistant nature, lightweight attributes, and cost-effectiveness compared to Polypropylene (PP) and High-Density Polyethylene (HDPE). PP emerges as another notable material, valued for its toughness, with high temperature tolerance suitable for microwavable food products. Furthermore, PP plays a crucial role in preserving food freshness, making it a prevalent choice in various food and beverage applications.

By End-Use Industry Analysis

- The pharmaceutical segment is expected to witness the fastest CAGR during the forecast period. The segment's growth is primarily attributed to the substantial expansion of the global pharmaceutical industry, an increasing prevalence of chronic diseases, and the rise in the geriatric population. Pharmaceutical companies particularly favor thermoformed blisters due to their efficacy in unit dose packaging.

- Furthermore, the food and beverage segment secured a significant revenue share. The heightened utilization of diverse products, including clamshells, containers, and trays, by food service outlets and packaged food manufacturers played a significant role in elevating the share of this segment. The growing preference for convenient or packaged food products, driven by changing lifestyles, is expected to enhance further the penetration of thermoform products within the Food and Beverage segment throughout the forecast period.

Thermoform Packaging Market Regional Insights

The North American region dominated the global market with the largest share in 2023

In 2023, the North American region dominated the largest market share. This was driven by the widespread presence of prominent packaged food companies and the deep penetration of organized retail. Additionally, the region's growth was facilitated by the presence of major thermoform packaging manufacturers striving to expand their market share through innovative product offerings. The thermoform packaging market in the region was further boosted by the significant consumption of frozen meat and packaged bread items.

Asia Pacific is anticipated to emerge as the fastest-growing market. Key factors propelling the regional market include the rising prevalence of nuclear households, due to a surge in demand for single-serve packaging, a growing aging population, and the expanding influence of organized retail, notably in countries like China and India. Meanwhile, Europe is expected to experience gradual growth during the forecast period, attributed to stringent regulations governing the use of plastic products and heightened awareness of sustainability. This has spurred a shift toward paper- and pulp-based packaging, posing challenges to market expansion.

Competitive Landscape

The thermoform packaging market is characterized by the presence of several key players striving for market dominance. These industry participants actively participate in strategic initiatives, such as partnerships, mergers and acquisitions, and product innovations, to strengthen their market position. The market players keenly note the emerging trends, such as the rising demand for eco-friendly and sustainable packaging solutions. They are adapting their strategies to stay competitive in this dynamic market.

Some of the major players operating in the global market include:

- Amcor

- Constantia

- D&W Fine Pack

- Dart Container Corp.

- Display Pack, Inc.

- Lacerta Group, Inc.

- Pactiv LLC

- Placon Corp.

- Rompa Group.

- RPC Group Plc

- Silgan Holdings, Inc.

- Sinclair & Rush, Inc.

- Sonoco Products Company

- Tray-Pak Corp

Recent Developments

- In August 2023, DS Smith announced its plan to acquire Bosi's doo, a renowned packaging company situated in Serbia.

- In November 2022, Amcor introduced the Amcor HealthCare OrthoSecure thermoformed trays, specifically designed for medical applications.

- In July 2021, AR Packaging announced the introduction of Ecoflex, a new type of mono-material that is ideal for use in thermoform packaging processes. This material offers excellent value while also providing enhanced performance on current filling and thermoforming equipment.

Report Coverage

The thermoform packaging market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive material, type, heat-seal coating, end-use industry, and futuristic growth opportunities.

Thermoform Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 54.30 billion |

|

Revenue Forecast in 2032 |

USD 77.78 billion |

|

CAGR |

4.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Material, By Type, By Heat-Seal Coating, By End-Use Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global Thermoform Packaging market size is expected to reach USD 77.78 billion by 2032

Key players in the market are Amcor, Constantia, D&W Fine Pack, Dart Container Corp., Display Pack, Inc., Lacerta Group, Inc

North American contribute notably towards the global Thermoform Packaging Market

Thermoform Packaging Market exhibiting a CAGR of 4.6% during the forecast period

The Thermoform Packaging Market report covering key segments are material, type, heat-seal coating, end-use industry, and region.