Dental Regeneration Market Size, Share, Trends, Industry Analysis Report

: By Type (Hard Tissue and Soft Tissue), By Age Group, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM2910

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

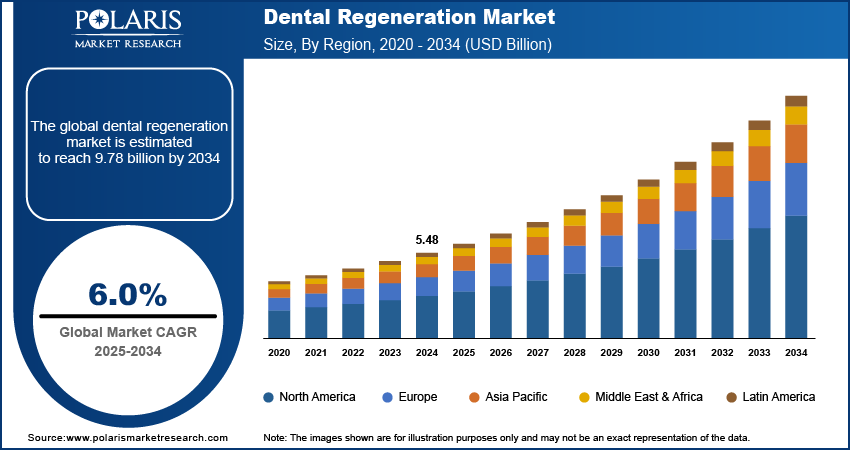

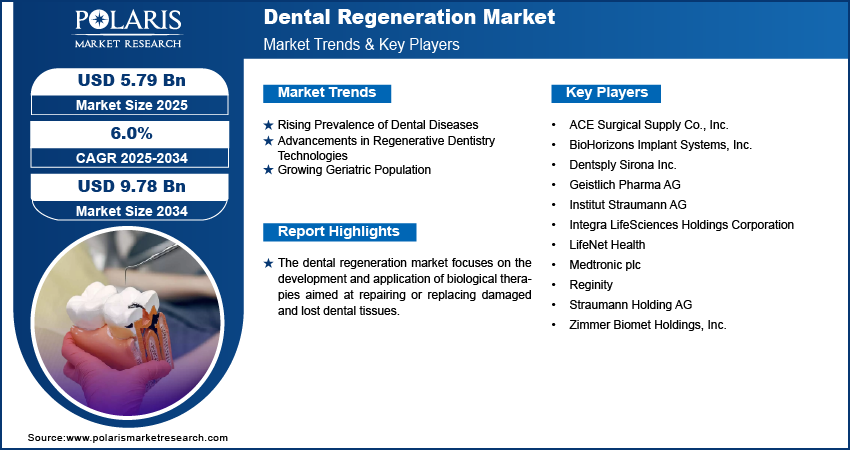

The dental regeneration market size was valued at USD 5.48 billion in 2024, growing at a CAGR of 6.0% during 2025–2034. Rising dental disease prevalence, an aging population, and advancements in regenerative technologies such as stem cells drive the market.

Key Insights

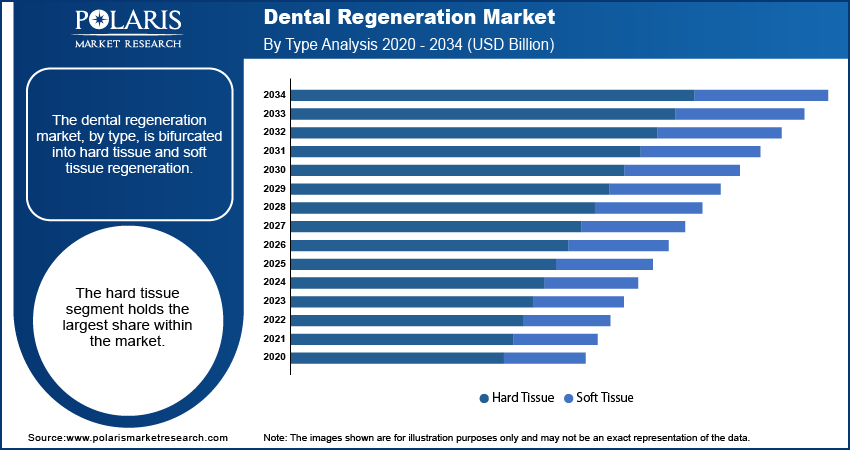

- The hard tissue segment holds the largest share due to the high incidence of caries and injuries affecting enamel, dentin, and cementum.

- The geriatric age group leads the market due to a higher prevalence of age-related dental issues such as tooth loss and gum disease.

- Dental clinics dominate the market as primary care centers for most dental treatments, including regeneration procedures, due to accessibility and infrastructure.

- North America leads the market due to strong healthcare infrastructure, patient awareness, R&D activities, and favorable reimbursement systems.

- Asia Pacific is expected to grow at the highest rate, driven by a large patient base, better infrastructure, and rising dental tourism and income.

Industry Dynamics

- The increasing prevalence of dental caries and periodontal disease is creating high demand for regenerative treatments over traditional dental restorations.

- The rising geriatric population with age-related tooth loss boosts the need for advanced, long-lasting dental regeneration therapies and solutions.

- Technological advancements in stem cell therapy and tissue engineering open new possibilities for more effective and natural dental tissue restoration.

- Growing demand for aesthetic and minimally invasive procedures is encouraging the adoption of regenerative techniques across the cosmetic and general dentistry sectors.

- High treatment costs and limited insurance coverage in many regions restrict access to advanced regenerative dental care for many people.

Market Statistics

2024 Market Size: USD 5.48 billion

2034 Projected Market Size: USD 9.78 billion

CAGR (2025–2034): 6.0%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The dental regeneration market focuses on restoring damaged or lost dental tissues such as enamel, dentin, and pulp through advanced biological methods, aiming to stimulate the body's natural healing processes. This approach contrasts with traditional dentistry, which primarily uses synthetic materials for replacements. The market development is being significantly influenced by a rising global prevalence of dental diseases such as tooth decay and periodontal disease, leading to a greater demand for innovative and long-lasting treatment options. Furthermore, increasing awareness regarding oral health and the desire for aesthetically pleasing dental solutions are pushing the adoption of dental regeneration procedures.

Technological advancements in regenerative dentistry, including stem cell therapy, tissue engineering, cosmetic dentistry, and the development of advanced biomaterials, are creating new possibilities for effective treatments. The growing geriatric population, which is more susceptible to dental issues and tooth loss, is driving the dental regeneration market growth. Moreover, the increasing popularity of dental tourism, especially in regions offering cost-effective advanced dental care, is expanding the demand for dental regeneration procedures. The market outlook is positive, with ongoing research and development efforts focused on enhancing treatment outcomes and broadening the applicability of dental regeneration techniques.

Market Dynamics

Rising Prevalence of Dental Diseases

The increasing prevalence of dental diseases worldwide is a significant driver for the adoption of dental regeneration procedures. Conditions such as dental caries (tooth decay) and periodontal disease are highly prevalent and can lead to substantial tooth damage and loss, thereby escalating the demand for effective regenerative treatments. The National Institutes of Health (NIH) published data in 2022 indicating that ∼42% of adults aged 20–64 in the US have experienced dental caries in their permanent teeth. For instance, a study published in the Journal of Periodontology in 2021 by researchers at the National Center for Biotechnology Information (NCBI) highlighted that nearly 47.2% of adults aged 30 years and above in the US have some form of periodontal disease. This high prevalence of dental issues necessitates advanced treatment options beyond traditional fillings and prosthetics, thus fueling the dental regeneration market expansion by creating a substantial patient pool seeking restorative solutions.

Advancements in Regenerative Dentistry Technologies

Innovations such as stem cell therapy, tissue engineering, and the development of sophisticated biomaterials are offering novel approaches to regenerating damaged dental tissues. Research published in the journal Stem Cells Translational Medicine in 2023 by scientists at the NIH demonstrated the potential of mesenchymal stem cells in regenerating dental pulp tissue in animal models. These technological breakthroughs provide clinicians with more effective tools for treating complex dental issues and are expanding the possibilities for dental regeneration. Hence, advancements in regenerative dentistry technologies are consequently driving the market development.

Growing Geriatric Population

Geriatric population is more prone to various dental problems, including tooth loss due to aging, chronic diseases, and medication side effects. Data from the Administration for Community Living, part of the U.S. Department of Health & Human Services, indicated in a 2024 report that the number of adults aged 65 and above is projected to significantly increase in the coming decades, leading to a greater need for advanced dental care. This demographic trend is significantly contributing to the demand for dental regeneration therapies, as this population seeks long-lasting and functional solutions for age-related dental issues.

Segment Insights

Market Assessment by Type

By type, the dental regeneration market is segmented into hard tissue and soft tissue regeneration. The hard tissue segment holds a larger share. This dominance is attributed to the high incidence of conditions affecting hard dental tissues, such as dental caries and traumatic injuries. The substantial demand for effective treatments that can restore lost or damaged enamel, dentin, and cementum contributes significantly to the leading position of the segment. Ongoing advancements in biomaterials and surgical techniques aimed at regenerating these hard tissues further support their dominating position. The dental laboratory and clinical necessity for addressing widespread issues related to hard tissue damage contribute to the segment growth.

The soft tissue regeneration segment is anticipated to exhibit a faster growth rate, driven by the increasing focus on periodontal health and the aesthetic demands for optimal soft tissue contours around natural teeth and dental implants. The rising prevalence of periodontal diseases, which affect the gums and supporting bone structures, necessitates advanced regenerative therapies. Furthermore, the growing adoption of dental implant procedures, where adequate soft tissue volume and architecture are crucial for long-term success and aesthetic outcomes, is fueling the demand for innovative soft tissue regeneration techniques. This increasing emphasis on periodontal health and implant aesthetics positions the soft tissue regeneration segment for significant future growth.

Market Evaluation by Age Group

The market, by age group, is segmented into pediatric, adult, and geriatric. The geriatric segment constitutes the largest market share. This can be primarily attributed to the higher prevalence of dental issues, including tooth loss and periodontal diseases, among the older population. The cumulative effect of age-related dental problems and the growing number of older individuals requiring dental interventions contributed to the dominant position of the geriatric segment.

The pediatric segment is anticipated to exhibit a higher growth rate during the forecast period. This increasing growth is driven by a rising awareness of the importance of early intervention in dental health and the development of innovative, minimally invasive regenerative treatments suitable for younger patients. The focus on preventing and treating dental issues in children and adolescents, such as enamel defects and pulp damage, through regenerative approaches is gaining momentum. Furthermore, the potential for long-term benefits from early regenerative interventions in this age group is expected to fuel a higher adoption rate of these therapies, thus positioning the pediatric segment for the fastest growth.

Market Assessment by End User

The market, by end user, is segmented into hospitals, dental clinics, and others. The dental clinics segment represents the largest market share. This dominance is primarily due to the fact that dental clinics are the primary point of care for the majority of dental procedures, including both routine and advanced treatments such as dental regeneration. The accessibility and widespread presence of dental clinics, coupled with the increasing number of specialized dental practitioners offering regenerative therapies, contribute significantly to the substantial revenue share. The established infrastructure and patient flow within dental clinics make them the central hub for the delivery of dental regeneration procedures.

The hospitals segment is anticipated to exhibit the highest growth rate during the forecast period. The growth is being driven by an increasing integration of advanced medical treatments within hospital settings, including specialized dental and maxillofacial procedures that often involve regenerative techniques. The presence of sophisticated infrastructure, multidisciplinary healthcare teams, and the ability to handle complex cases contribute to the rising adoption of dental regeneration therapies in hospitals. Furthermore, collaborations between dental and medical specialists within hospitals are expanding the application of regenerative approaches, driving the hospital segment growth at the highest rate.

Regional Outlook

By region, the dental regeneration market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounts for the largest market share, owing to the region's well-established healthcare infrastructure, high patient awareness regarding advanced dental treatments, and the presence of key players and technological advancements in regenerative dentistry. Furthermore, the favorable reimbursement policies and the strong emphasis on research and development activities in the region contributed to the widespread adoption of dental regeneration therapies, contributing to North America's leading position.

The Asia Pacific market is anticipated to register the highest growth rate over the forecast period. This rapid expansion is fueled by a confluence of factors, including a large patient pool, increasing healthcare expenditure, rising awareness about oral health, and growing disposable incomes. Additionally, the improving healthcare infrastructure and the increasing adoption of advanced dental technologies in countries within this region are creating significant opportunities for the regional market. The rising trend of medical tourism and the growing focus on aesthetics further contribute to the rapid growth of the Asia Pacific market.

Key Players and Competitive Analysis

A few key participants actively contributing to the dental regeneration market include Integra LifeSciences Holdings Corporation; Geistlich Pharma AG; Zimmer Biomet Holdings, Inc.; Straumann Holding AG; Dentsply Sirona Inc.; Institut Straumann AG (part of Straumann Holding AG); BioHorizons Implant Systems, Inc. (part of Henry Schein, Inc.); ACE Surgical Supply Co., Inc.; LifeNet Health; and Medtronic plc. These companies are involved in the development, manufacturing, and distribution of various products and technologies aimed at regenerating dental tissues.

The competitive landscape of the industry is characterized by a mix of well-established players and emerging companies, all striving to innovate and capture a larger share of the market. Competition is based on factors such as product innovation, the breadth of product offerings, the efficacy of regenerative solutions, pricing strategies, and geographical reach. Companies are heavily investing in research and development to introduce advanced biomaterials, growth factors, and cell-based therapies for dental tissue regeneration. Strategic collaborations, partnerships, and acquisitions are also observed as companies aim to expand their product portfolios and industry penetration. The increasing focus on minimally invasive procedures and patient-specific treatments is further intensifying the competitive dynamics within the industry.

Integra LifeSciences Holdings Corporation, located in Princeton, New Jersey, US, offers a range of biomaterials that are relevant to the dental regeneration sector. Their product portfolio includes collagen-based solutions and resorbable materials that are utilized in guided dental bone graft substitutes and regeneration and soft tissue repair procedures in dentistry. These offerings support the regeneration of bone and gum tissues, addressing the needs of both hard and soft tissue regeneration in dental applications.

Geistlich Pharma AG, headquartered in Wolhusen, Switzerland, specializes in the development and manufacturing of biomaterials for the regeneration of bone, cartilage, and soft tissues. Their product line includes bone graft materials, collagen membranes, and other regenerative solutions widely used in dental implantology, periodontology, and maxillofacial surgery. These products facilitate the regeneration of alveolar bone and support soft tissue healing, making them pertinent to various dental regeneration procedures.

List of Key Companies in Dental Regeneration Market

- BioHorizons Implant Systems, Inc.

- Dentsply Sirona Inc.

- Geistlich Pharma AG

- Institut Straumann AG

- Integra LifeSciences Holdings Corporation

- LifeNet Health

- Medtronic plc

- Regenity

- Straumann Holding AG

- TBS Dental

- Zimmer Biomet Holdings, Inc.

Dental Regeneration Industry Developments

- February 2025: Geistlich Pharma AG announced a strategic investment in ReOss Ltd., a company known for its patient-specific solutions incorporating digital technologies. This investment signifies Geistlich's commitment to further strengthen its portfolio with the latest regenerative solutions.

- June 2024: TBS Dental, a pioneer in innovative dental instrumentation and solutions, announced the launch of its latest product line, REGEN, to set new standards in regenerative procedures in dentistry.

Dental Regeneration Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Hard Tissue

- Soft Tissue

By Age Group Outlook (Revenue – USD Billion, 2020–2034)

- Pediatric

- Adult

- Geriatric

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Dental Clinics

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Dental Regeneration Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.48 billion |

|

Market Size Value in 2025 |

USD 5.79 billion |

|

Revenue Forecast by 2034 |

USD 9.78 billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The dental regeneration market has been segmented into detailed segments of type, age group, and end user. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies: A successful dental regeneration market growth strategy necessitates a multifaceted approach focusing on technological advancement, strategic collaborations, and effective market penetration. Companies should prioritize research and development to introduce innovative regenerative solutions with enhanced efficacy and patient outcomes. Establishing partnerships with dental professionals, research institutions, and distributors can facilitate wider adoption and market reach. Educational initiatives and awareness campaigns targeting dentists and patients are crucial for driving market demand. Furthermore, exploring opportunities in emerging economies with increasing healthcare investments and a growing focus on advanced dental care can unlock significant industry potential. Tailoring marketing efforts to highlight the long-term benefits and aesthetic advantages of dental regeneration over traditional methods will be key to industry growth.

FAQ's

The market size was valued at USD 5.48 billion in 2024 and is projected to grow to USD 9.78 billion by 2034.

The market is projected to register a CAGR of 6.0% during the forecast period.

North America had the largest share of the market in 2024.

A few key players in the market include Integra LifeSciences Holdings Corporation; Geistlich Pharma AG; Zimmer Biomet Holdings, Inc.; Straumann Holding AG; Dentsply Sirona Inc.; Institut Straumann AG (part of Straumann Holding AG); BioHorizons Implant Systems, Inc. (part of Henry Schein, Inc.); ACE Surgical Supply Co., Inc.; LifeNet Health; and Medtronic plc.

The hard tissue segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Advancements in Stem Cell Therapy: Ongoing research and development in stem cell technology are leading to more effective and predictable methods for regenerating dental tissues such as pulp, dentin, and even potentially entire teeth. ? Development of Advanced Biomaterials as Dental Equipment: Innovations in biomaterials, including bioactive scaffolds and growth factor-releasing materials, are enhancing the regeneration process and improving treatment outcomes. ? Integration of Digital Dentistry: The use of digital technologies such as CAD/CAM systems and 3D printing is increasing the precision and efficiency of dental regeneration procedures, from diagnostics to the creation of customized scaffolds.

Dental regeneration is a field within dentistry and regenerative medicine focused on restoring damaged or lost dental tissues. Unlike traditional methods that primarily use artificial materials for replacement, dental regeneration aims to stimulate the body's natural healing capabilities to regrow tissues such as enamel, dentin, pulp, and the supporting structures of the teeth. This can involve various biological approaches, including stem cell therapy, tissue engineering, and the use of growth factors and biomaterials to encourage tissue repair and regeneration. The ultimate goal is to achieve functional and natural-looking restoration of dental structures.