Trade Surveillance Systems Market Share, Size, Trends, Industry Analysis Report, By Component; By Deployment Mode; By Organization Size; By Vertical (Banking, Capital Markets, Other Verticals); By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM2853

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

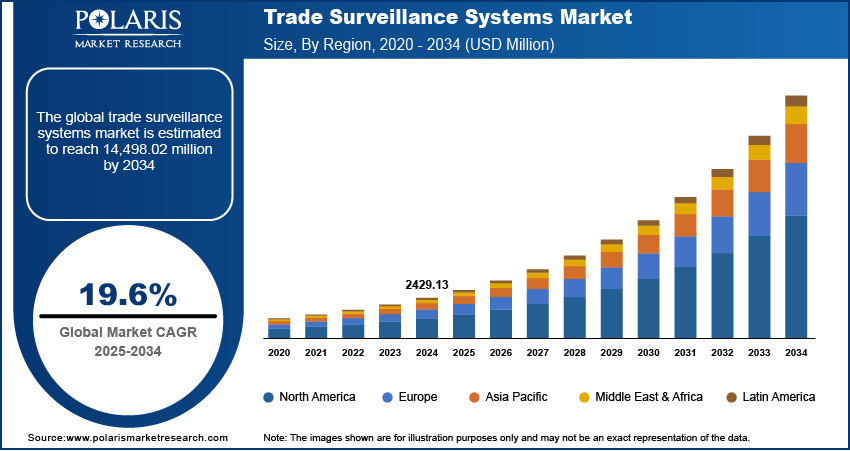

The global trade surveillance systems market was valued at USD 2026.9 million in 2023 and is expected to grow at a CAGR of 19.6% during the forecast period.The increasing instances of improper or abusive trading have made it imperative to implement trade monitoring systems to ensure regulatory compliance and prevent market fraud. The global rise in market manipulation and fraud is a key factor driving the expansion of such systems. These fraudulent activities cause significant harm to the general public, making it crucial to have pre- and post-trade monitoring in financial institutions.

To Understand More About this Research: Request a Free Sample Report

Trade surveillance involves observing and assessing an organization's trading behavior in the financial services sector. Using market abuse or manipulation techniques may lead to criminal charges, legal action, or even the company's closure. Financial institutions are now focusing on "at-risk" industries and improving their preventive skills by identifying urgent needs, forming dedicated teams, and specifying requirements.

Furthermore, trade surveillance systems market are designed to monitor clients' trading data and identify suspicious trading activities through various surveillance techniques. These systems are crucial in investigating manipulative or unlawful trading practices in the securities Market. By analyzing trading activity, trade surveillance systems help to maintain orderly markets. They use techniques such as cross-market and cross-asset analysis, market manipulation detection, trade abuse identification, an inspection of deals in suspected areas, and pre-and post-trade verification to ensure the accuracy and fairness of transactions within an organization.

The COVID-19 pandemic has impacted the global economy, including the market. The pandemic has caused disruptions in financial markets and increased market volatility, presenting new challenges for trade surveillance systems. The need for remote monitoring capabilities has become crucial, leading to a surge in demand for cloud-based surveillance systems. Furthermore, the pandemic has resulted in a rise in fraudulent activities, prompting financial institutions to implement advanced trade surveillance systems to detect and prevent such practices. The adoption of AI and ML technologies has also accelerated, as they help to automate the surveillance process, detect anomalies, and improve the accuracy and efficiency of the system. Despite the challenges posed by the pandemic, it has emphasized the significance of effective surveillance systems to ensure regulatory compliance and prevent fraudulent activities in financial markets.

For Specific Research Requirements, Speak With the Research Analyst

Industry Dynamics

Growth Drivers

The market's growth is driven by increasing regulatory compliance requirements in various industries. This includes finance, healthcare, and retail, where the need to comply with regulations related to insider trading, market manipulation, and fraud detection is creating a high demand for advanced trade surveillance systems. As rules become more complex, organizations are turning to trade surveillance systems to ensure they meet compliance requirements and mitigate risks.

The rise in financial fraud has become more sophisticated due to technological advancements, leading to a surge in financial crimes. Trade surveillance systems can help detect and prevent fraudulent activities in real-time, increasing demand for these systems. As the financial industry continues to digitize, the demand for trade surveillance systems is also expected to increase as they provide organizations with the necessary tools to monitor and prevent fraudulent activities effectively.

Trade surveillance systems provide real-time monitoring and analysis of trading data, enabling organizations to make informed decisions. This has become increasingly important due to the rapidly changing business environment, where organizations must quickly respond to market changes. Additionally, integrating artificial intelligence (AI) and machine learning (ML) technologies in trade surveillance systems is helping organizations automate their surveillance processes, resulting in increased efficiency and reduced costs. As organizations continue to invest in IT infrastructure, the adoption of trade surveillance systems is expected to rise as they help monitor and analyze trading data more efficiently.

Report Segmentation

The market is primarily segmented based on type, application, shape, distribution channel, and region.

|

By Component |

By Deployment Mode |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Solution segment accounted for the largest revenue share in 2022

The solutions segment holds largest revenue share of the market in 2022, as businesses face greater responsibility in creating policies and procedures to oversee trading operations amidst higher regulatory requirements and risks. Financial institutions are adopting advanced technologies like AI/ML to identify suspicious activities and market manipulation while actively monitoring their data. To respond promptly to alerts, surveillance teams must be able to connect relevant data points and assess potential hazards quickly.

Consequently, the demand for surveillance and monitoring solutions is expected to soar, driving significant revenue growth for the segment.

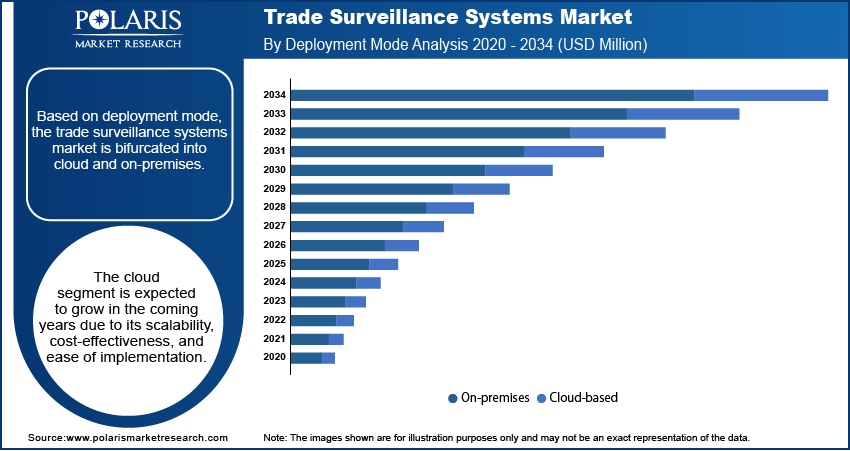

On premises segment anticipated to hold highest revenue share during the forecast period

The on premises segment is predicted to hold the highest revenue share over the forecast period. The on-premises segment of the trade surveillance market includes locally installed software and hardware solutions managed by a company's IT department, providing increased control and security over data. Although this segment is expected to grow slower than the cloud-based segment due to higher costs and the need for more resources, some organizations still prefer on-premises solutions.

Several key players in this segment offer software and hardware solutions for monitoring financial transactions and detecting illegal activities. While the on-premises segment is expected to remain important for organizations with stringent security and compliance requirements, it may face competition from advancing and more affordable cloud-based solutions in the future.

Small & medium enterprise segment expected to grow at significant CAGR during forecast

The SMEs segment is anticipated to grow at a significantly rapid CAGR over the forecast period. SMEs increasingly leverage state-of-the-art technologies to enhance their operations and gain a competitive edge. They also realize trade surveillance's importance in monitoring their trading activities and adhering to regulatory requirements.

According to the World Bank, SMEs account for 90% of all businesses worldwide and contribute up to 50% of global employment. Despite their significant economic contributions, SMEs face limited resources, lack of expertise, and regulatory compliance requirements. However, trade surveillance systems are becoming more affordable and accessible to SMEs through cloud-based solutions and Software-as-a-Service (SaaS) models. Hence, the SME segment is poised to be a vital growth driver for the trade surveillance systems market over the forecast period.

Capital markets segment holds a significant market share in 2022

The capital market segment holds a significant market share, leading to market manipulation and declining investor confidence. Trade surveillance has become a crucial element of market supervision, and regulatory bodies worldwide are implementing strict regulations and guidelines to prevent market abuse. As a result, there is an increasing demand for trade surveillance solutions.

Advanced technologies such as AI, ML, and Big Data analytics have enabled financial institutions to improve the detection of market manipulation and trade anomalies. This segment's revenue growth is expected to continue over the forecast period due to the adoption of innovative surveillance solutions and increased regulatory pressure. A report by the International Organization of Securities Commissions (IOSCO) shows that trade surveillance is essential in detecting and investigating market abuse, making it critical to the financial sector.

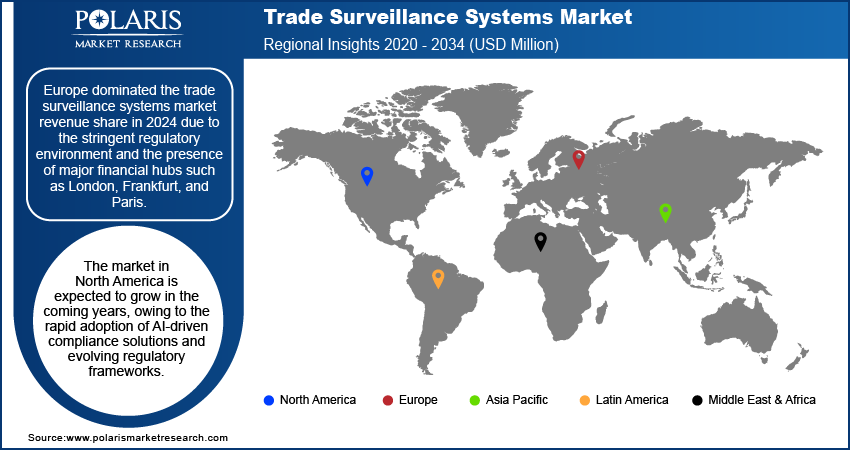

Europe holds the largest market share in 2022

Europe holds the largest share of the market in 2022. The European market provides services and solutions for detecting and preventing illegal or unethical activities in financial transactions, including insider trading, market manipulation, and money laundering. The market is expected to grow due to increasing regulatory compliance requirements and the adoption of advanced technologies like artificial intelligence and machine learning. Key players offer various solutions for market surveillance, trade reconstruction, communication monitoring, and compliance reporting. Regulatory bodies like the FCA in the UK and BaFin in Germany oversee and enforce trade surveillance regulations.

Competitive Insight

Some of the major players operating in the global market include Nasdaq, FIS (Fidelity National Information Services, NICE, OneMarketData, ACA Compliance, IPC, SIA, Aquis Technologies, Software AG, and BAE systems.

Recent Developments

- In October 2022, ACA Group, the top governance, risk, and compliance (GRC) expert in the financial services industry, introduced several new capabilities to ComplianceAlpha, the company's comprehensive RegTech solutions platform.

- In September 2022, NICE Actimize released Compliancentral, a cloud-based platform for financial services companies that monitors end-to-end communications and transaction compliance.

- In July 2022, BXS, the industry's top provider of trade analytics and compliance reporting, announced the introduction of its new Trade Surveillance Platform. In addition to Investigation, integrating Alerts, and Case Management into one system to meet and surpass the regulators' expectations, BXS also designed this platform to meet and exceed the expectations of its clients

Trade Surveillance Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2419.3 million |

|

Revenue forecast in 2032 |

USD 10,161.9 million |

|

CAGR |

19.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Component, By Deployment Mode, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Nasdaq, FIS (Fidelity National Information Services, NICE, OneMarketData, ACA Compliance, IPC, SIA, Aquis Technologies, Software AG, and BAE systems. |

FAQ's

Key Companies in the Trade Surveillance Systems Market Nasdaq, FIS (Fidelity National Information Services, NICE, OneMarketData, ACA Compliance.

The global trade surveillance systems market expected to grow at a CAGR of 19.6% during the forecast period.

The Trade Surveillance Systems Market report covering key segments are component, deployment Mode, organization Size, vertical, and region.

key driving factors in Trade Surveillance Systems Market are Rise in need for safety and security of trading activities in financial institutes.

The global Trade Surveillance Systems market size is expected to reach USD 10,161.9 million by 2032.