Transfection Technologies Market Share, Size, Trends, Industry Analysis Report

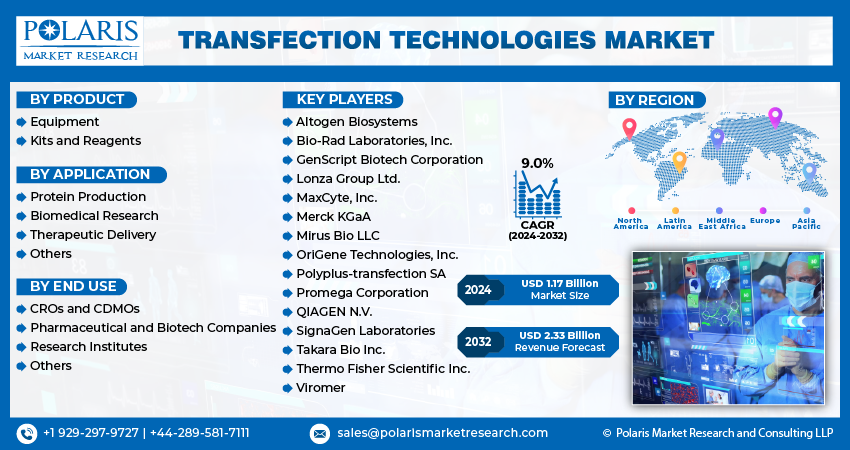

By Product (Equipment, Kits and Reagents); By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4847

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

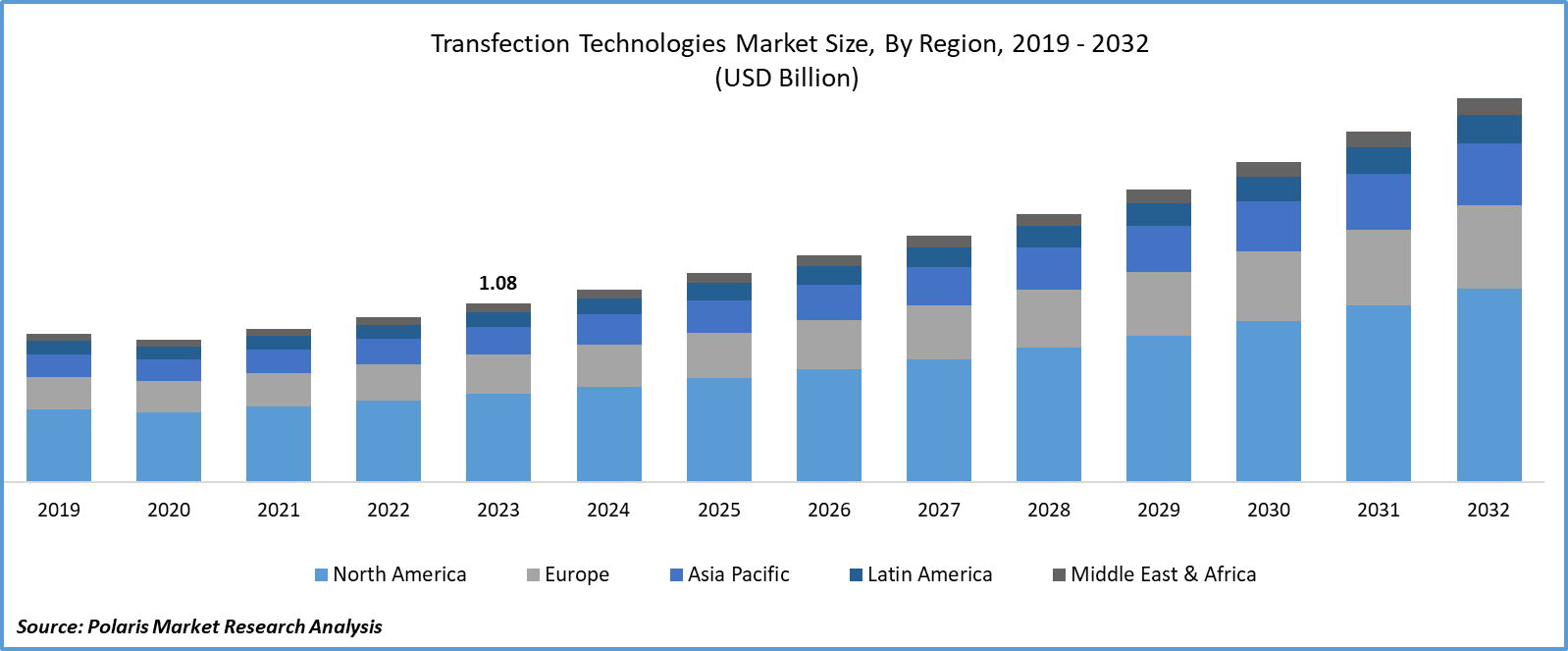

Transfection Technologies Market size was valued at USD 1.08 billion in 2023.

The market is anticipated to grow from USD 1.17 billion in 2024 to USD 2.33 billion by 2032, exhibiting the CAGR of 9.0% during the forecast period.

Market Introduction

The transfection technologies market is driven by the increasing demand for protein production. Proteins are vital for various biological processes, making them essential for research, drug development, and therapeutic applications. Transfection, crucial for introducing nucleic acids into cells, enables the expression of recombinant proteins. With rising demand for recombinant proteins in biopharmaceuticals, vaccines, and diagnostics, efficient transfection technologies are essential. Advancements in biotechnology and the complexity of protein-based therapeutics further drive the need for innovative transfection methods offering high efficiency and scalability.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in August 2021, Mirus Bio LLC unveiled the TransIT VirusGEN GMP product series. This extension to the current TransIT VirusGEN line adheres to good manufacturing practice (GMP) standards for viral vector production, aiding in cell and gene therapy research and facilitating process activities up to GMP commercial scale.

To Understand More About this Research: Request a Free Sample Report

Technological advancements in transfection methods are propelling growth in the transfection technologies market. Progress in techniques like viral and non-viral methods, electroporation, and lipid-based transfection has improved efficiency, specificity, and safety. These advancements allow for precise control over gene delivery and expression in target cells. Innovative delivery vehicles such as nanoparticles and cell-penetrating peptides have broadened transfection technology applications in gene therapy, drug discovery, and biopharmaceutical production. Ongoing research and development efforts aim to enhance transfection methods, overcoming limitations and offering new opportunities for therapeutic development.

Industry Growth Drivers

Rise in Gene Therapy and Cell-based Therapies is Projected to Spur the Product Demand

The transfection technologies market sees growth fueled by the surge in gene therapy and cell-based therapies. Gene therapy, involving genetic engineering for disease treatment, and cell-based therapies like stem cell and CAR-T cell therapy are gaining traction. These therapies rely on transfection technologies to deliver nucleic acids into target cells, facilitating gene expression or editing. With promising clinical outcomes and increased investment in biotechnology research, demand for these therapies rises. Consequently, the transfection technologies market is poised for expansion, catering to the evolving needs of the healthcare sector.

Expansion of Biopharmaceutical Research is Expected to Drive Transfection Technologies Market Growth

The transfection technologies market experiences growth due to the expansion of biopharmaceutical research. With increasing demand for biopharmaceuticals and advancements in gene therapy and vaccine development, efficient transfection technologies are essential. Transfection, crucial for introducing nucleic acids into cells, is vital for gene editing and protein production. The focus on developing novel therapies for diseases drives demand for innovative transfection technologies offering high efficiency and scalability. Additionally, the rise of genome editing technologies like CRISPR/Cas9 further boosts the need for precise transfection reagents and instruments.

Industry Challenges

Transfection Efficiency and Variability are Likely to Impede Market Growth

Transfection efficiency and variability constrain the transfection technologies market. Efficiency denotes the successful transfer of nucleic acids into cells, crucial for gene delivery and expression. Meanwhile, variability causes inconsistent outcomes across experiments or cell types, compromising reproducibility. These limitations arise from factors like transfection method, cell type, and reagent quality. Poor efficiency and variability lead to inaccurate findings and higher costs. To mitigate these challenges, ongoing research focuses on developing new methods, optimizing protocols, and enhancing reagent performance.

Report Segmentation

The transfection technologies market analysis is primarily segmented based on product, application, end use, and region.

|

By Product |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Kits and Reagents Segment Held Significant Revenue Share in 2023

The kits and reagents segment held significant revenue share in 2023 owing to their convenience, consistency, and versatility. These ready-to-use solutions simplify the transfection process with pre-optimized protocols, saving researchers time and effort. Standardized formulations ensure consistent and reproducible results across experiments and laboratories, enhancing data reliability. With compatibility across various cell types and formats, these products cater to a wide range of transfection applications, including DNA and CRISPR-based techniques. Additionally, customization options allow researchers to tailor protocols to their specific needs. Moreover, their accessibility and affordability make them indispensable tools for molecular biology, cell biology, and drug discovery research, appealing to both academic institutions and biotechnology companies.

By Application Analysis

Therapeutic Delivery Segment Held Significant Revenue Share in 2023

The therapeutic delivery segment held significant revenue share in 2023. Gene therapy's increasing demand for delivering therapeutic genes, along with advancements in drug delivery for cancer therapy and regenerative medicine, contributes to this growth. Additionally, the rise of RNA-based therapeutics like mRNA vaccines and RNAi therapies drives the need for efficient transfection technologies. These technologies also play a crucial role in cell-based therapies such as CAR-T cell therapy and stem cell therapy. Moreover, growing investments in biopharmaceutical research and development, particularly in personalized medicine, further propel the demand for advanced transfection methods in therapeutic delivery applications.

By End Use Analysis

Pharmaceutical and Biotech Companies Segment Held Significant Revenue Share in 2023

The pharmaceutical and biotech companies segment held significant revenue share in 2023 due to its crucial role in drug discovery, biologics production, and gene therapy research. These firms extensively utilize transfection for introducing therapeutic genes or RNA molecules into cells for target validation, biologics manufacturing, and gene therapy development. Additionally, transfection enables cell-based assays and high-throughput screening, aiding in drug candidate identification and evaluation. Compliance with stringent regulatory standards further drives their preference for transfection technologies offering reproducibility and scalability.

Regional Insights

North America Region Accounted for a Significant Market Share in 2023

In 2023, North America region accounted for a significant market share. Its robust biotechnology and pharmaceutical industry, advanced healthcare infrastructure, and substantial research and development spending contribute to this dominance. Moreover, strategic partnerships and collaborations between academic institutions, biotech companies, and pharmaceutical firms drive innovation and adoption of transfection technologies. The region's early embrace of novel technologies further accelerates the uptake of advanced transfection methods in research laboratories and biopharmaceutical companies.

Asia-Pacific is expected to experience significant growth during the forecast period due to expanding biopharmaceutical research, growing biotechnology and life sciences sectors, and rising demand for personalized medicine. Government support, investments, and the emergence of contract research organizations further fuel market growth. Additionally, rapid healthcare infrastructure development, including research institutes and specialized facilities, creates opportunities for transfection technology adoption. This region, encompassing countries like China, India, Japan, and South Korea, is witnessing a surge in investments, research collaborations, and favorable regulatory policies.

Key Market Players & Competitive Insights

The transfection technologies market comprises a variety of participants, and the imminent entry of new competitors is set to heighten competition. Established frontrunners consistently refine their technologies to sustain a competitive edge, with a focus on efficacy, dependability, and safety. These companies prioritize strategic initiatives like forging partnerships, enhancing product offerings, and engaging in cooperative ventures. Their objective is to surpass rivals in the sector, securing a notable transfection technologies market share.

Some of the major players operating in the global transfection technologies market include:

- Altogen Biosystems

- Bio-Rad Laboratories, Inc.

- GenScript Biotech Corporation

- Lonza Group Ltd.

- MaxCyte, Inc.

- Merck KGaA

- Mirus Bio LLC

- OriGene Technologies, Inc.

- Polyplus-transfection SA

- Promega Corporation

- QIAGEN N.V.

- SignaGen Laboratories

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- Viromer

Recent Developments

- In March 2023, Sartorius, operating under its French subsidiary Sartorius Stedim Biotech, entered into a contract to purchase Polyplus. Polyplus specializes in the development and manufacture of transfection agents, along with other high-quality DNA/RNA delivery reagents and GMP-grade plasmid DNA.

- In May 2021, Gamma Biosciences disclosed its intention to secure a controlling stake in Mirus Bio, a company located in Wisconsin, known for its pioneering work in biomimetic lipid-polymer nanocomplexes (LPNCs) tailored for nucleic acid delivery, which adapt to cellular environments.

Report Coverage

The transfection technologies market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, applications, end uses, and their futuristic growth opportunities.

Transfection Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.17 billion |

|

Revenue forecast in 2032 |

USD 2.33 billion |

|

CAGR |

9.0% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Transfection Technologies Market are Bio-Rad Laboratories, Inc., GenScript Biotech Corporation, Lonza Group Ltd., Merck KGaA, Mirus Bio LLC

Transfection Technologies Market exhibiting the CAGR of 9.0% during the forecast period.

The Transfection Technologies Market report covering key segments are product, application, end use, and region.

key driving factors in Transfection Technologies Market are Rise in gene therapy and cell-based therapies

The global Transfection Technologies market size is expected to reach USD 2.33 billion by 2032