Transformer Oil Market Share, Size, Trends, Industry Analysis Report

By Product (Mineral-based Oils, Silicone-based Oils, and Bio-based Oils); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM2967

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

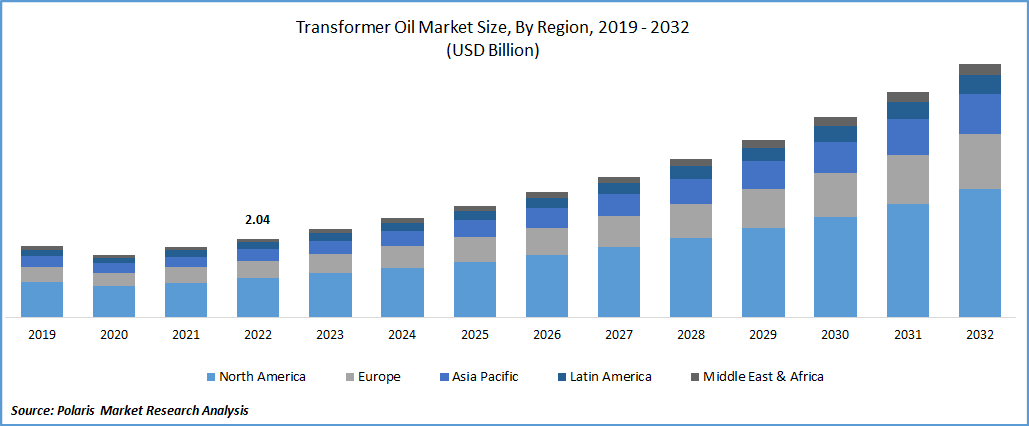

The global transformer oil market was valued at USD 2.28 billion in 2023 and is expected to grow at a CAGR of 12.4% during the forecast period.

The increasing focus by various power utilities on the upgradation of performance and safety of new as well as existing transformers and growing demand for bio-based oils across the world, as bio-based products are completely non-toxic and free from PCBs that provide reliable and cleaner product results are major key factors driving the growth of the global market.

Know more about this report: Request for sample pages

In addition, rapid industrialization, high rate of urbanization, introduction to innovative oils, and surge in investments in grid networks especially in emerging economies such as India, Brazil, China, and Indonesia, are likely to accommodate a significant increase in the demand and growth of the transformer oil market.

For instance, in June 2021, Nynas announced that the company has received the United States Department of Agriculture Certified Bio-based Product Label for its new NYTRO BIO 300X transformer oil. It’s a very crucial step to contribute to sustainable development that offers the same performance at a lower CO2 footprint than other transformer oils.

In recent years, transformer oil has gained high popularity as a barrier between the insulation and the atmospheric oxygen, thereby ensures minimize oxidation and avoiding direct contact. Transformer oil is highly used in transformers to preserve the transformer’s core and windings as well as widely utilized in power transmission plants.

The outbreak of the COVID-19 pandemic has had a mixed impact on the growth of the transformer oil market. The decline in the prices of crude oil across the globe has helped manufacturers and suppliers of transformer oil to achieve reduced costs of raw materials. However, due to the emergence of the deadly coronavirus, many countries had to impose lockdowns and various other restrictions on trade and movement activities, which resulted in the temporary closure of manufacturing facilities and high disruptions in the supply chain, hence the demand for transformer oil declined slightly.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising usage of transformer oil in the power generation sector and rapidly growing production and consumption of electricity across the globe to fulfill consumer requirements, which increases the need and demand for the installation of transformers are major factors expected to boost the growth of the global market during the anticipated period. For instance, according to the International Energy Agency, the volume of power generation in China increased by over 8.1% in 2021 to 8,112.2 terra-watt hours with a significant increase of about 11% from 2019. And, the demand for power in the country is projected to grow at a rate of over 4.5% from the period of 2022-2024.

Furthermore, increasing prevalence and demand for bio-based transformer oil around the world, as it is eco-friendly and have a wide range of beneficial features as compared to other products available in the market is further anticipated to propel the market growth over the next coming years. In addition, the growing focus of several manufacturers of transformer oil on research & development activities to develop more enhanced and effective products along with the investigation of nanofluids for the use in transformers and which could be used as additives for the electrical sector and thermal stability of the oil, which is likely to create high market growth opportunities.

Report Segmentation

The market is primarily segmented based on product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Mineral-based oils segment accounted for the highest market share

The mineral-based oils segment accounted for a significant global market share in 2022 and is likely to grow at a significant growth rate during the anticipated period. A wide range of applications of these types of transformer oil such as circuit breakers and capacitors along with the high prevalence for use in shielding transformers, switchgear, boilers, and conditioning, are key factors propelling the growth of the segment market. Moreover, they are highly preferred for the purpose of thermal transfer and improving the safety of interior field winding of transformers, which results in the rapid surge in demand and adoption across the globe and impacts the market positively.

Furthermore, the bio-based oils segment is expected to grow fastest at a CAGR throughout the anticipated period, as it does not consist of halogens, petroleum hydrocarbons, and silicone and is non-toxic in nature. In addition, a large range of products is being produced from bio-based transformer oil owing to various advantages and beneficial features including low cost, high efficiency, better thermal cooling capacity, and environmentally friendliness, which is influencing consumers to opt for these oils and boosting the segment market.

Large-scale transformers are likely to witness fastest growth

The large-scale transformers are anticipated to register the highest growth of CAGR over the projected period owing to rapid growth in the industrial sector and extensive rise in the production and consumption of eco-friendly transformers, especially in emerging economies like China, India, and South Korea. Large-scale transformers are widely utilized in various sectors including power generation, power utility, railways, and many more to distribute and transmit electricity to the end-user from the originating point. Additionally, with the growing consumer base for electricity consumption across the globe, the need and demand for power generation have significantly increased, and in turn, the adoption of transformer oils is also likely to grow rapidly.

However, the small-scale transformers held the largest market revenue share in 2022 due to rapid growth in the usage of these transformers to fulfill the demand and need for electricity in small localities and rural areas. Moreover, the increase in urbanization and emerging trend of electrification in developing countries, having a large presence in rural areas including India and Africa are projected to fuel the growth of the market in the coming years.

The Asia Pacific region dominated the global market in 2021

Asia Pacific region dominated the transformer oil market in 2021 with a holding of the majority market revenue share and is expected to maintain its dominance throughout the anticipated period. The growth of the regional market can be attributed to high growth in renewable energy capacity and heavily investing in the power generation sector in countries like India and China along with the presence of strong electricity manufacturers and suppliers in the region.

For instance, according to India Brand Equity Foundation, in October 2022, India’s total installed renewable energy capacity stood at about 169.94 GW, which represents 40.6% of the overall power capacity installed in the country.

Furthermore, the North America region is projected to register significant growth over the coming years on account of continuously growing manufacturing and industrial sectors, which needs electricity in high amount to operate their functions and operations. Additionally, modernization in existing transformers and technical upgradation of transformers are further likely to have a positive impact on the market.

Competitive Insight

Some of the major players operating in the global market include Sinopec Lubricant, Valvoline, Cargill, Ergon International, PetroChina Lubricant, Apar Industries, Engen Petroleum, Hydrodec Group, Calumet Specialty Products, Nynas, Savita Oil Technologies, Chevron Corporation, Gandhar Oil, Sasol, Hydrax Oil, Exxon Mobil Corporation, & Royal Dutch Shell.

Recent Developments

In September 2022, Nynas AB announced the launch of its new refined transformer oil by using recycled fluids to have a small and low greenhouse gas footprint. It is at the least rare for virgin base oil plants, which are mainly used for refining. With this new product launch, the company will expand its market, and consolidate its position as a market leader in Sweden.

In December 2021, Cargill Inc. announced the opening of its first FR3 natural ester production facility in Guangdong province, China. The new FR3 fluid is basically derived from 100% natural vegetable oils and performance-improving additives and is readily biodegradable.

Transformer Oil Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.28 billion |

|

Revenue forecast in 2032 |

USD 6.56 billion |

|

CAGR |

12.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Sinopec Lubricant Company, Valvoline, Cargill Inc., Ergon International Inc., PetroChina Lubricant Company, Apar Industries Ltd., Engen Petroleum Ltd., Hydrodec Group plc, Calumet Specialty Products, Nynas AB, Savita Oil Technologies, Chevron Corporation, Gandhar Oil, Sasol, Hydrax Oil, Exxon Mobil Corporation, and Royal Dutch Shell. |

FAQ's

The global transformer oil market size is expected to reach USD 6.56 billion by 2032.

key players are Sinopec Lubricant, Valvoline, Cargill, Ergon International, PetroChina Lubricant, Apar Industries, Engen Petroleum, Hydrodec Group, Calumet Specialty Products, Nynas, Savita Oil Technologies.

Asia Pacific contribute notably towards the global transformer oil market.

The global transformer oil market expected to grow at a CAGR of 12.4% during the forecast period.

key segments are product, application, and region.