Tremfya Market Size, Share, Trends, Industry Analysis Report

By Application [Plaque Psoriasis, Psoriatic Arthritis (PsA), Others], By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5929

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

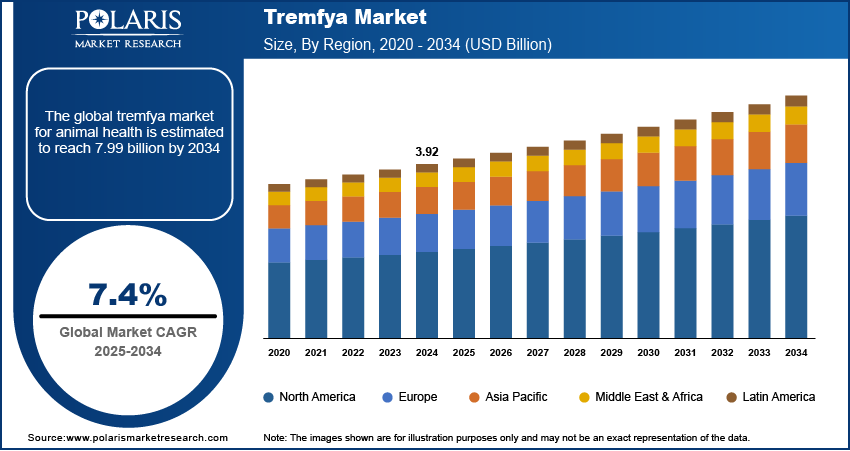

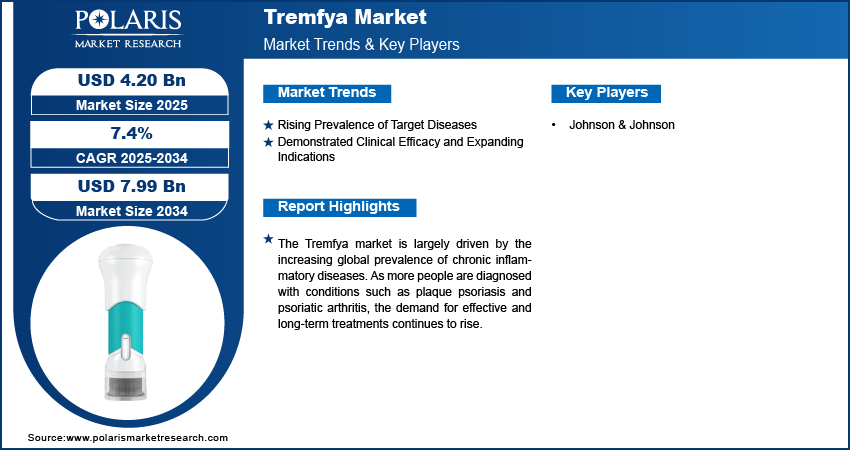

The global Tremfya market size was valued at USD 3.92 billion in 2024 and is anticipated to register a CAGR of 7.4% from 2025 to 2034. The Tremfya market is growing due to the increasing number of people affected by chronic plaque psoriasis and psoriatic arthritis, which boosts the demand for advanced biologic treatments.

The Tremfya market involves the development, production, and sale of guselkumab, a biologic medication used to treat chronic inflammatory conditions. This conditions include moderate-to-severe plaque psoriasis, active psoriatic arthritis, moderately to severely active ulcerative colitis, and moderately to severely active Crohn's disease. The industry focuses on providing advanced treatment options that target specific pathways in the immune system to reduce inflammation and improve patient outcomes.

Ongoing and significant investments in research and development by the manufacturers drive the Tremfya market expansion. This includes studies to understand the drug's long-term effectiveness and safety, as well as efforts to explore its use in new conditions and indications. With the expanding range of diseases, Tremfya solidifies its position as a versatile biologic.

The availability of comprehensive patient support and assistance programs plays a vital role in driving the Tremfya demand. As biologic therapies can be expensive, these programs help patients manage the financial burden, navigate insurance complexities, and ensure consistent access to their medication. By reducing out-of-pocket costs and providing educational resources, these initiatives improve adherence and treatment continuation.

Market Concentration & Characteristics

The Tremfya market is defined by high scientific specialization and therapeutic innovation, attributed to its biologic profile targeting the interleukin-23 (IL-23) pathway. This mechanism of action addresses key immunological drivers of chronic plaque psoriasis and psoriatic arthritis, offering targeted and sustained relief. The market is research-driven, with continuous advancements aimed at enhancing efficacy, minimizing adverse effects, and improving patient convenience through less frequent dosing schedules. Ongoing clinical trials and formulation innovations reflect the dynamic nature of the market, reinforcing the importance of research and development for differentiation and sustained competitive edge. Moreover, the presence of a robust pipeline—comprising both injectable biologics and oral IL-23 inhibitors—supports a forward-looking innovation landscape focused on meeting evolving patient needs.

Entry barriers in the Tremfya market are notably high, mainly due to the inherent complexities of biologic development. These include stringent manufacturing protocols, cold-chain logistics, and the requirement for advanced biotechnological infrastructure. Regulatory hurdles further elevate these barriers, as gaining market approval requires comprehensive preclinical and clinical data packages to demonstrate safety and efficacy. Intellectual property rights, including patents and data exclusivity, offer added protection to originator products, deterring early biosimilar competition. Furthermore, the need to build strong relationships with healthcare providers and ensure prescriber confidence presents additional challenges for new market entrants, especially in specialty therapeutic areas like immunology.

The regulatory environment exerts a significant influence on Tremfya’s market dynamics. Regulatory authorities such as the US FDA and European Medicines Agency (EMA) enforce rigorous standards for biologics, necessitating ongoing post-marketing surveillance and safety monitoring. These regulations not only affect product approvals but also extend to pricing controls, promotional practices, and market access frameworks. Shifts in healthcare policies—particularly those related to value-based care, formulary decisions, or biosimilar approvals—can impact market share and reimbursement levels. Companies operating in this space must stay agile and align with evolving compliance requirements to sustain market access and competitiveness.

Competition within the Tremfya market is strong, with multiple therapeutic alternatives available for the treatment of psoriasis and psoriatic arthritis. These include other IL-23 inhibitors (e.g., risankizumab), IL-17 inhibitors (e.g., secukinumab), TNF-alpha inhibitors (e.g., adalimumab), and small-molecule therapies such as PDE4 or JAK inhibitors. Differentiation hinges on clinical parameters like onset of action, sustained response, long-term safety, and dosing frequency. With several options in the biologics space, prescriber and patient preferences play a vital role in determining treatment choices.

Geographical expansion remains a core component of Tremfya’s growth strategy. While the product maintains strong presence in high-income markets such as North America and Europe—benefiting from mature reimbursement systems and specialist healthcare access—there is growing emphasis on penetrating emerging regions. Asia Pacific, Latin America, and parts of the Middle East present untapped opportunities, driven by increasing diagnosis rates and improving biologics access. However, local regulatory pathways, healthcare infrastructure, and pricing dynamics vary widely across these regions.

Industry Dynamics

Rising Prevalence of Target Diseases

The increasing number of people diagnosed with chronic plaque psoriasis and psoriatic arthritis drives the industry growth. These are long-term autoimmune conditions that often require ongoing and effective treatment to manage symptoms and prevent disease progression. As awareness and diagnosis rates improve, the demand for advanced therapies such as Tremfya naturally grows.

A study published in Acta Dermato-Venereologica in 2024 titled "Prevalence and Incidence of Psoriatic Arthritis among Patients with Psoriasis and Risk Factors for Psoriatic Arthritis in Republic of Korea: A Nationwide Database Cohort Study," reported a clear upward trend in the prevalence of psoriatic arthritis among psoriasis patients in Korea, with prevalence increasing from 6.17 per 1,000 patients in 2008 to 19.03 per 1,000 patients in 2020. This indicates a growing patient pool needing specialized treatments. Thus, the rising prevalence of target diseases directly fuels the demand for effective biologic treatments such as Tremfya.

Demonstrated Clinical Efficacy and Expanding Indications

Tremfya's proven clinical efficacy in treating its approved conditions, along with its expanded indications to include other inflammatory diseases, plays a crucial role in its growth. Strong clinical trial results demonstrating significant improvements in disease activity and patient quality of life build confidence among healthcare providers and patients. The expansion into new disease areas further broadens its patient base.

New data from the Phase 3b APEX study, presented in a Johnson & Johnson newsroom release on June 11, 2025, titled "New Data Show TREMFYA® (guselkumab) is the Only IL-23 Inhibitor Proven to Significantly Inhibit Progression of Joint Damage in Active Psoriatic Arthritis," showed that guselkumab significantly inhibited the progression of joint structural damage in patients having active psoriatic arthritis. Moreover, the FDA approved guselkumab for adults suffering from moderately to severely active ulcerative colitis in September 2024. FDA approved guselkumab for moderately to severely active Crohn's disease in March 2025, as stated in an article by MedCentral on April 8, 2025, titled "FDA Expands Guselkumab's Indication for Treatment of Ulcerative Colitis and Crohn's Disease."

Segmental Insights

Application Analysis

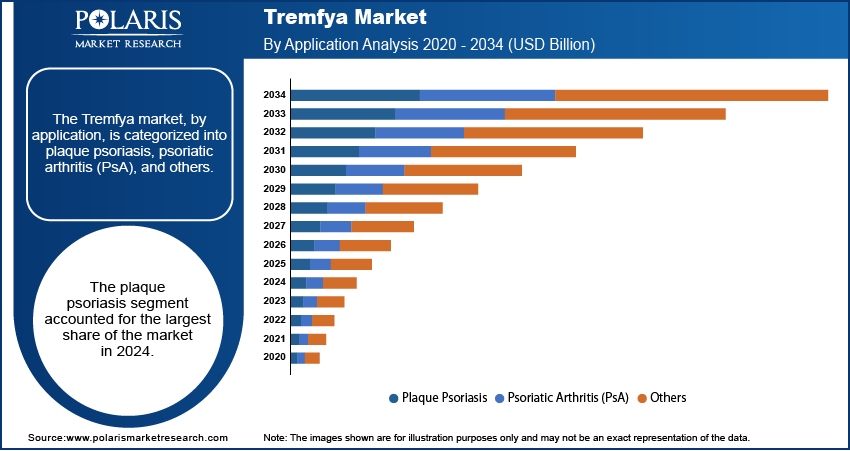

The plaque psoriasis segment held the largest share in 2024, largely due to the higher prevalence of plaque psoriasis globally compared to other indications for the drug. Plaque psoriasis is the most common form of psoriasis, affecting a significant portion of the population across the world. According to statistics from the National Psoriasis Foundation in 2023, an estimated 2% to 3% of the global population (i.e.,125 million people) are affected by psoriasis. This broad patient base, combined with Tremfya's established efficacy in clearing skin lesions, makes plaque psoriasis a dominant segment for the drug. The long-term nature of the disease also ensures a steady demand for ongoing treatment, contributing to this segment's leading position.

The psoriatic arthritis (PsA) segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by increasing awareness and diagnosis rates of psoriatic arthritis among individuals suffering from psoriasis, as well as those developing joint symptoms without prior skin manifestations. Studies are also continually reinforcing Tremfya's benefits in addressing both joint and skin symptoms in PsA. For instance, new data from the Phase 3b APEX study, as announced in a Johnson & Johnson newsroom release on June 11, 2025, highlighted that Tremfya is effective in reducing joint damage progression in active psoriatic arthritis. This expanding clinical evidence and the growing recognition of PsA as a distinct, debilitating condition are key factors driving the growth of the PsA segment.

Distribution Channel Analysis

The hospital pharmacies segment held the largest share in 2024, owing to the nature of biologic medications, which often require specialized handling, storage, and administration. Hospitals also typically house the specialists who prescribe such complex treatments for conditions such as plaque psoriasis and psoriatic arthritis, ensuring a direct pathway from diagnosis to dispensation. Furthermore, many patients initiating biologic therapies often do so in a hospital or clinic setting, allowing for initial administration and close monitoring by healthcare professionals. This structured environment, coupled with established procurement systems for high-cost drugs, solidifies the leading position of hospital pharmacies in Tremfya's distribution.

The online pharmacies segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by increasing patient preference for convenience, home delivery, and the expanding digital infrastructure that supports telehealth and remote prescription services. While biologics such as Tremfya still require careful handling, advancements in cold chain logistics and packaging are making at-home delivery more feasible and reliable. The general trend toward digital health, accelerated by recent global health events, has pushed more patients and healthcare providers to utilize online platforms for medication access. This shift, combined with the potential for cost savings and improved accessibility in underserved areas, positions online pharmacies for rapid expansion in the distribution of specialty medications such as Tremfya.

Regional Analysis

The North America Tremfya market accounted for the largest share in 2024, primarily due to the high prevalence of chronic inflammatory conditions such as plaque psoriasis and psoriatic arthritis across the region. A well-developed healthcare infrastructure, including advanced diagnostic capabilities and a high adoption rate of biologic therapies, further supports the strong demand. Patients and healthcare providers in North America are more familiar with and willing to adopt innovative and high-cost biologic treatments, which contributes to the robust sales of Tremfya. The presence of leading pharmaceutical companies and substantial healthcare spending also ensure strong penetration and continued growth for advanced biologics.

U.S. Tremfya Market Insight

The U.S. is a major contributor in North America. The country benefits from a large patient population suffering from moderate-to-severe plaque psoriasis and psoriatic arthritis, coupled with a healthcare system that generally allows for rapid access to novel therapies. High awareness among dermatologists and rheumatologists regarding the efficacy of IL-23 inhibitors such as Tremfya also plays a crucial role. For example, the National Psoriasis Foundation, a leading patient advocacy organization in the U.S., actively promotes awareness and access to effective treatments for psoriasis and psoriatic arthritis, contributing to higher diagnosis and treatment rates. The competitive landscape in the U.S. encourages continuous innovation and strong marketing efforts by pharmaceutical companies, further boosting Tremfya's demand.

Europe Tremfya Market Trends

Europe represents a substantial and growing region in the global market. The region exhibits a considerable patient pool with inflammatory conditions, and there is increasing awareness and diagnosis of these diseases. Healthcare systems across European countries, while varied, generally support the use of biologic therapies, particularly for severe cases where conventional treatments have failed. The European Medicines Agency (EMA) approval of Tremfya for its various indications, including plaque psoriasis, psoriatic arthritis, and more recently ulcerative colitis and Crohn's disease in May 2025, facilitates its availability across the European Union. This widespread regulatory acceptance and rising patient numbers contribute to the steady expansion of Tremfya's adoption in Europe.

Germany Tremfya Market Assessment

Germany stands out as a key country in Europe. It possesses a robust healthcare system with significant spending on advanced medications and a large number of patients seeking effective treatments for chronic inflammatory conditions. German healthcare providers are early adopters of innovative therapies. The country's comprehensive reimbursement policies often support access to high-cost biologics. The strong emphasis on evidence-based medicine and the presence of numerous research institutions contribute to a well-informed medical community, which helps drive the adoption of clinically proven treatments such as Tremfya. This combination of factors makes Germany a significant contributor to Tremfya's European success.

Asia Pacific Tremfya Market Overview

Asia Pacific is an emerging and rapidly expanding market for Tremfya. While the prevalence of chronic inflammatory diseases may historically have been perceived as lower in some parts of this region, increasing urbanization, lifestyle changes, and improved diagnostic capabilities are leading to a rise in reported cases. Governments of several Asia Pacific countries are investing more in healthcare infrastructure and improving access to advanced medical treatments. This growing healthcare expenditure and rising awareness among patients and healthcare professionals are creating significant demand for biologic therapies such as Tremfya.

Japan Tremfya Market Analysis

Japan is a prominent country driving the market growth in Asia Pacific. The country boasts a highly advanced healthcare system and a population that is increasingly seeking effective treatments for chronic diseases. The prevalence of autoimmune conditions such as psoriasis and psoriatic arthritis is notable in Japan, and there is a strong emphasis on precision medicine and advanced therapeutic options. For example, Japan's regulatory bodies have a streamlined process for approving innovative drugs, which aids in the quicker market entry of biologics such as Tremfya. This combination of advanced healthcare, a significant patient base, and a progressive regulatory environment contributes to Japan's strong position in the regional Tremfya market.

Key Players and Competitive Insights

Johnson & Johnson Services, Inc. continues to dominate the Tremfya market through its extensive experience in immunology, strong commercialization capabilities, and established relationships with healthcare providers worldwide. The company’s focus on expanding label indications, investing in real-world evidence, and maintaining high manufacturing standards has reinforced its market leadership. Additionally, Johnson & Johnson’s emphasis on physician education and patient support services enhances product uptake and treatment adherence. Meanwhile, emerging biopharmaceutical companies such as Bio-Thera Solutions (China), Alvotech (Iceland), and Samsung Bioepis (South Korea) are making strategic moves into the IL-23 inhibitor space, with an eye on biosimilar development as patent expiry nears. These firms are investing in R&D, cost-efficient production models, and global partnerships to challenge branded biologics. As pricing pressures rise and market access strategies evolve, the competitive landscape surrounding Tremfya is likely to become increasingly dynamic

Key Players

Pipeline Analysis

Tremfya (guselkumab), developed by Johnson & Johnson, is a monoclonal antibody that selectively targets the p19 subunit of interleukin-23 (IL-23), and has become a key player in the treatment of immune-mediated inflammatory diseases. Initially approved by the FDA for moderate-to-severe plaque psoriasis in 2017, its label was extended to include active psoriatic arthritis in 2020. Building on its success in dermatology and rheumatology, the drug has expanded into the gastroenterology space, with FDA approval for ulcerative colitis in 2024 and EMA approval for Crohn’s disease in 2025, both supported by strong Phase 3 data demonstrating sustained clinical remission and mucosal healing.

Tremfya’s continued expansion into adjacent inflammatory conditions reflects Johnson & Johnson’s broader immunology strategy, which emphasizes durable efficacy, differentiated safety, and convenient dosing. The QUASAR and GALAXI Phase 3 trials have provided compelling evidence of Tremfya’s efficacy in inflammatory bowel disease, positioning it as a potential anchor therapy across multiple autoimmune indications.

Meanwhile, Johnson & Johnson is strategically advancing its immunology pipeline to build on Tremfya’s foundation. The most prominent pipeline asset is JNJ-2113, an oral IL-23 receptor antagonist currently in Phase 3 for plaque psoriasis, which has shown strong skin clearance rates in the Phase 2b FRONTIER study. Its oral formulation makes it a promising follow-on candidate targeting patients seeking alternatives to injectable biologics. In addition, TLL-018, a dual TYK2/JAK1 inhibitor licensed from Suzhou Connect Biopharma, is being explored in Phase 2 trials for various immune conditions and may serve as a complementary option within the J&J immunology portfolio.

Together, these developments reflect a dual approach: expanding Tremfya’s reach across immunology while preparing next-generation agents to address shifting patient preferences and market dynamics.

Impact of Tremfya Access Programs on Uninsured and Underinsured Patients

Johnson & Johnson has implemented comprehensive Tremfya access programs aimed at improving treatment affordability for uninsured and underinsured patients in the United States. Through the Janssen CarePath support services, eligible patients can receive copay assistance, reimbursement support, and information on alternate funding options. For those without insurance, the Johnson & Johnson Patient Assistance Foundation offers Tremfya at no cost, provided certain income and residency criteria are met. These programs have played a critical role in enhancing treatment access and adherence among socioeconomically disadvantaged populations, helping to reduce disparities in care and ensuring that financial barriers do not prevent eligible patients from receiving consistent and effective therapy.

Industry Developments

May 2025: Johnson & Johnson announced new data from the Phase 3 ICONIC-TOTAL- Icotrokinra. It demonstrated substantial skin clearance in patients having challenging-to-treat scalp and genital psoriasis. By Week 16, 66% of scalp psoriasis patients and 77% of genital psoriasis patients achieved site-specific clear or nearly clear skin with the investigational treatment.

March 2025: Johnson & Johnson reported that the FDA approved Tremfya as the first IL-23 inhibitor available in subcutaneous and intravenous formulations for adults having moderate to severely active Crohn’s disease. This approval introduces more flexible treatment options and extends Tremfya’s indication beyond psoriasis and arthritis to include Crohn’s disease.

Tremfya Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Plaque Psoriasis

- Psoriatic Arthritis (PsA)

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Tremfya Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.92 billion |

|

Market Size in 2025 |

USD 4.20 billion |

|

Revenue Forecast by 2034 |

USD 7.99 billion |

|

CAGR |

7.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.92 billion in 2024 and is projected to grow to USD 7.99 billion by 2034.

The global market is projected to register a CAGR of 7.4% during the forecast period.

North America dominated the market share in 2024.

Johnson & Johnson remains the key player in the market.

The plaque psoriasis segment accounted for the largest share of the market in 2024.

The online pharmacies segment is expected to witness the fastest growth during the forecast period.