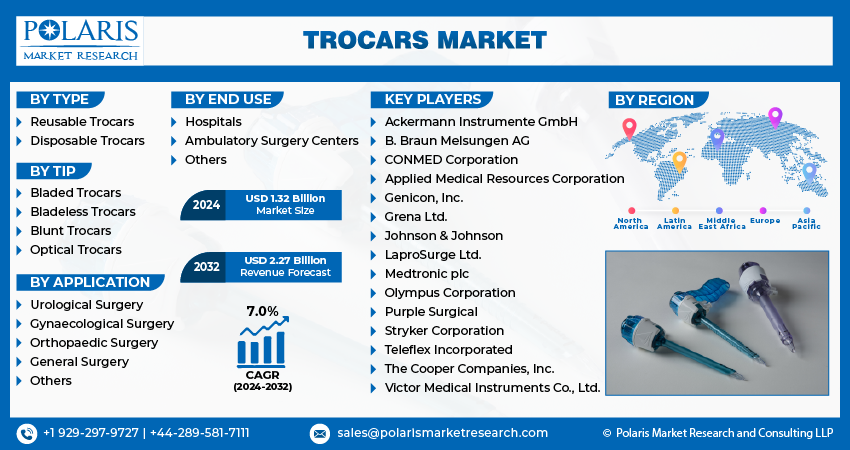

Trocars Market Size, Share, Trends, Industry Analysis Report

: By Product (Disposable Trocars and Reusable Trocars), Tip, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM4666

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The trocars market size was valued at USD 816.14 million in 2024, exhibiting a CAGR of 5.5% during 2025–2034. The market is driven by the increasing adoption of minimally invasive surgeries, technological advancements in trocar design, and the rising prevalence of chronic diseases and geriatric populations requiring surgical interventions.

Key Insights

- Disposable trocars dominate the market due to their infection control benefits, convenience, and lower reprocessing costs, making them widely adopted in healthcare settings.

- Optical trocars are anticipated to experience high growth due to their enhanced visualization, reducing tissue trauma, and improving safety in minimally invasive procedures.

- General surgery is the leading segment, driven by the high volume of laparoscopic procedures such as hernia repairs and cholecystectomies requiring trocars.

- North America holds the largest market share due to its advanced healthcare system, high adoption of minimally invasive procedures, and significant research and development efforts.

- Asia Pacific is projected to grow the fastest, driven by improving healthcare infrastructure, rising healthcare expenditure, and increasing adoption of advanced surgical technologies in countries such as China and India.

Industry Dynamics

- Increased adoption of minimally invasive surgery (MIS) and robotic-assisted procedures drives market growth by requiring advanced trocar technologies for precision and safety.

- Technological innovations in bladeless, optical, and durable trocar designs improve safety and efficiency, enhancing their demand across medical procedures.

- With rising healthcare expenditure and improving infrastructure, emerging markets present a potential avenue for expansion, driving global trocar adoption.

- High production and sterilization costs can increase device pricing, limiting access and slowing growth in cost-sensitive healthcare environments.

Market Statistics

2024 Market Size: USD 816.14 million

2034 Projected Market Size: USD 1,392.09 million

CAGR (2025–2034): 5.5%

North America: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

The trocars market encompasses the segment of medical devices utilized for creating access ports during minimally invasive surgical procedures. These devices, available in various sizes and designs, facilitate the insertion of surgical instruments into body cavities, thereby minimizing patient trauma and accelerating recovery. The market is significantly influenced by the increasing adoption of laparoscopic and robotic-assisted surgeries, which are preferred due to their reduced postoperative pain and shorter hospital stays. Furthermore, the rising incidence of chronic diseases, coupled with advancements in surgical technology, is bolstering market demand. The aging global population, which is more prone to conditions necessitating surgery, also plays a key role in driving market expansion.

Analyzing the market trends reveals a consistent focus on innovation, with manufacturers prioritizing the development of safer and more efficient trocars. Key drivers of market growth include the rising demand for single-use trocars to reduce the risk of cross-contamination and the introduction of bladeless and optical trocars that enhance precision and minimize tissue damage. The market outlook remains positive, as ongoing research and development efforts are expected to yield further improvements in trocar design and functionality. Additionally, market entry assessments show that companies are focusing on strategic collaborations and acquisitions to expand their market share and strengthen their product portfolios.

Market Dynamics

Increasing Adoption of Minimally Invasive Surgery

The rising preference for minimally invasive surgery (MIS) is a significant catalyst for the trocars market. MIS procedures, characterized by smaller incisions and reduced patient trauma, are gaining traction due to their associated benefits, including shorter hospital stays and faster recovery times. A 2023 study published in the National Center for Biotechnology Information (NCBI), titled "Trends in Minimally Invasive Surgery: A Comprehensive Review," highlighted the substantial increase in laparoscopic procedures across various surgical specialties. This trend is further supported by the growing number of robotic-assisted surgeries, which rely heavily on trocars for instrument insertion. Furthermore, a 2022 article published in PubMed, titled "Advancements in Robotic Surgery and Their Impact on Patient Outcomes," demonstrated the improved precision and reduced complications associated with MIS techniques. The demand for advanced trocars that facilitate these complex procedures directly correlates with the rise in MIS adoption. Thus, the growing adoption of MIS procedures is significantly driving market growth.

Technological Advancements in Trocars

Innovations such as bladeless and optical trocars, designed to minimize tissue damage and enhance visualization, are gaining widespread acceptance. A 2021 research paper published in NCBI, titled "Novel Developments in Surgical Trocar Technology," highlighted the improvements in trocar design that reduce the risk of complications such as port-site hernias and vascular injuries. Additionally, a 2023 PubMed study, "Optical Trocar Systems: Enhancing Surgical Precision," showed that optical trocars provide real-time visualization during insertion, improving safety and accuracy. Manufacturers are investing heavily in research and development to introduce user-friendly and safer trocar systems. These advancements align with the increasing demand for precision and safety in surgical procedures. Therefore, technological advancements in trocars are driving substantial market growth.

Rising Prevalence of Chronic Diseases and Geriatric Population

The increasing prevalence of chronic diseases, coupled with a growing geriatric population, is a substantial driver for the trocars market. Older adults are more susceptible to conditions requiring surgical intervention, such as colorectal cancer, hernia repairs, and gynecological disorders. For instance, as per WHO, chronic diseases are the leading cause of death and disability worldwide, accounting for approximately 74% of all deaths globally. The geriatric population, which is more susceptible to chronic diseases and often has multiple comorbidities, benefits significantly from the less invasive nature of MIS. Shorter hospital stays and faster recovery times associated with MIS are particularly advantageous in this patient group. The global population aged 60 years and over is projected to reach 2.1 billion by 2050.

Further, a study published in NCBI in 2022, "The Impact of Aging Population on Surgical Demands," indicated a significant rise in surgical procedures performed on elderly patients. Furthermore, according to data available on PubMed in 2021, "Epidemiological Trends in Chronic Diseases Requiring Surgical Intervention," the incidence of chronic diseases necessitating surgical treatment is steadily increasing. This surge in surgical procedures, particularly laparoscopic and robotic-assisted surgeries, directly correlates with the demand for trocars. As the global population ages and the prevalence of chronic diseases rises, the need for surgical interventions will continue to grow. Hence, the rising prevalence of chronic diseases and the growing geriatric population serve as a significant driver for the market.

Segment Insights

Assessment by Product Insights

The market, by product, is segmented into disposable trocars and reusable trocars. The disposable trocars segment holds the largest market share. This dominance can be attributed to the increasing emphasis on infection control and patient safety within healthcare settings. Single-use devices mitigate the risk of cross-contamination, aligning with stringent hygiene protocols. Furthermore, the convenience and reduced reprocessing costs associated with disposable trocars contribute to their widespread adoption in surgical procedures. This inclination towards single use products has substantially contributed to the segment’s leading market position.

The reusable trocars segment is anticipated to exhibit the highest growth rate during the forecast period. This growth is driven by advancements in sterilization technologies and the increasing focus on cost-effectiveness in healthcare. Innovations in materials and design, which enhance the durability and longevity of reusable trocars, are also contributing factors. Additionally, the growing awareness of environmental sustainability is prompting healthcare facilities to explore reusable options. This shift toward reusable devices reflects an evolving market that balances economic and ecological considerations.

Evaluation by Tip Insights

The market, by tip, is segmented into bladeless trocars, optical trocars, blunt trocars, and bladed trocars. The bladed trocars segment holds the largest market share. This dominance stems from their long-established use and familiarity among surgeons, who often rely on their proven efficacy in creating precise entry points. The consistent demand for traditional surgical techniques, coupled with the availability of a wide range of bladed trocar designs, has contributed to their widespread adoption.

The optical trocars segment is projected to experience the highest growth rate. This expansion is driven by the increasing emphasis on enhanced visualization and safety during minimally invasive procedures. Optical trocars, which provide real-time visual feedback during insertion, are gaining traction due to their ability to minimize tissue trauma and reduce the risk of complications. The rising demand for precision and patient safety in surgical interventions, coupled with advancements in imaging technology, is fueling the rapid adoption of optical trocars.

Assessment by Application Insights

The market, by application, is segmented into general surgery, gynecological surgery, urological surgery, pediatric surgery, and other surgeries. The general surgery segment holds the largest market share. This can be attributed to the broad range of procedures performed within general surgery, which frequently necessitate the use of trocars. The high volume of laparoscopic procedures, including hernia repairs and cholecystectomies, contributes significantly to the demand for these devices. The widespread application of trocars in common surgical interventions has established this segment as a dominant force.

The urological surgery segment is anticipated to exhibit the highest growth rate. This growth is driven by the increasing adoption of minimally invasive techniques for treating urological conditions, such as prostate cancer and kidney stones. Advancements in robotic-assisted urological surgeries, which rely heavily on precise trocar placement, are also contributing to this expansion. The rising prevalence of urological disorders and the continuous innovation in surgical technologies are expected to further propel the growth of this segment.

Regional Analysis

Regional analysis of the trocars market reveals a diverse landscape, with varying levels of adoption and growth across different geographic areas. North America and Europe have established themselves as significant markets, driven by advanced healthcare infrastructure and high adoption rates of minimally invasive surgical procedures. Asia Pacific is emerging as a high-growth market, fueled by increasing healthcare expenditure and a rising patient population. Latin America and the Middle East & Africa are also witnessing growth, albeit at a relatively slower pace, due to improving healthcare access and infrastructure.

North America holds the largest market share. This dominance is primarily attributed to the region's well-established healthcare system, which facilitates the widespread adoption of advanced surgical technologies. The presence of major market players and robust research and development activities further contribute to the region's strong market position. Additionally, the high prevalence of chronic diseases and the increasing demand for minimally invasive procedures in North America act as significant growth drivers. The established reimbursement policies and favorable regulatory environment also play a crucial role in maintaining the region’s market leadership.

Asia Pacific is projected to experience the highest growth rate. This growth is driven by the rapidly improving healthcare infrastructure, increasing healthcare expenditure, and a large patient pool. The rising awareness of minimally invasive surgery and the growing number of skilled surgeons in the region are also contributing factors. Furthermore, the increasing adoption of advanced surgical technologies, particularly in countries like China and India, is fueling market expansion. The rising medical tourism in these countries also adds to the growing market, as patients from other regions seek out more affordable yet high-quality medical care.

Key Players and Competitive Insights

Key players actively participating in the trocars market include CONMED Corporation, Applied Medical Resources Corporation, B. Braun SE, Medtronic plc, Johnson & Johnson (Ethicon Inc.), Karl Storz SE & Co. KG, Teleflex Incorporated, Olympus Corporation, Purple Surgical Manufacturing Limited, and Richard Wolf GmbH. These companies offer a wide range of trocar products, catering to diverse surgical needs and contributing significantly to the market dynamics.

Competitive analysis of the market reveals a landscape characterized by continuous innovation and strategic collaborations. Companies are focusing on developing advanced trocar systems that enhance surgical precision and patient safety. The competitive environment is also influenced by the increasing demand for single-use trocars and the growing adoption of minimally invasive surgical techniques. Companies are investing in research and development to introduce user-friendly and cost-effective solutions. Furthermore, strategic mergers and acquisitions, along with regional expansion efforts, are shaping the competitive landscape.

CONMED Corporation, headquartered in Utica, New York, offers a comprehensive portfolio of surgical equipment, including a variety of trocars designed for laparoscopic and robotic-assisted procedures. Their products emphasize safety and ease of use, addressing the evolving needs of surgeons and patients. The company's focus on innovation and quality has contributed to its established presence in the market for trocars.

Medtronic plc, with its operational headquarters in Dublin, Ireland, provides a broad spectrum of medical technologies and services, including advanced trocar systems. Their offerings cater to various surgical specialties, incorporating features that enhance visualization and minimize tissue trauma. Medtronic's extensive distribution network and strong brand recognition support its significant role in the trocars market.

List of Key Companies

- Applied Medical Resources Corporation

- B. Braun SE

- CONMED Corporation

- Ethicon Inc. (Johnson & Johnson)

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Purple Surgical Manufacturing Limited

- Richard Wolf GmbH

- Teleflex Incorporated

Trocars Industry Developments

- February 2024: Johnson & Johnson MedTech initiated direct operations in Saudi Arabia to advance healthcare delivery by providing advanced medical and surgical technologies, including laparoscopic instruments.

- December 2023: Xpan obtained FDA 510(k) clearance for its universal trocar system—a radially expandable device capable of adjusting to 5mm or 12mm, offering enhanced flexibility in surgical procedures.

Trocars Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Disposable Trocars

- Reusable Trocars

By Tip Outlook (Revenue – USD Million, 2020–2034)

- Bladeless Trocars

- Optical Trocars

- Blunt Trocars

- Bladed Trocars

By Application Outlook (Revenue – USD Million, 2020–2034)

- General Surgery

- Gynecological Surgery

- Urological Surgery

- Pediatric Surgery

- Other Surgeries

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Trocars Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 816.14 million |

|

Market Size Value in 2025 |

USD 859.07 million |

|

Revenue Forecast by 2034 |

USD 1,392.09 million |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The trocars market has been segmented into detailed segments of product, tip, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth strategies within the trocars market are centered on innovation and expansion. Companies are prioritizing research and development to introduce advanced trocar systems that enhance surgical precision and patient safety. Strategic collaborations and acquisitions are employed to broaden product portfolios and expand market reach. Increasing market penetration in emerging economies, particularly within Asia Pacific, is a key focus. Furthermore, targeted marketing efforts emphasize the benefits of minimally invasive surgery and the advantages of advanced trocar technologies to healthcare professionals, ultimately driving market growth.

FAQ's

The market size was valued at USD 816.14 million in 2024 and is projected to grow to USD 1,392.09 million by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

North America had the largest share of the market in 2024.

Key players actively involved in the trocars market include CONMED Corporation, Applied Medical Resources Corporation, B. Braun SE, Medtronic plc, Johnson & Johnson (Ethicon Inc.), Karl Storz SE & Co. KG, Teleflex Incorporated, Olympus Corporation, Purple Surgical Manufacturing Limited, and Richard Wolf GmbH.

The disposable trocars segment accounted for the larger share of the market in 2024.

Following are some of the key market trends: ? Increasing Adoption of Minimally Invasive Surgery (MIS): The growing preference for MIS procedures, driven by benefits like reduced recovery time and less postoperative pain, is a major trend. ? Technological Advancements in Trocar Design: Innovations such as bladeless and optical trocars, which enhance precision and minimize tissue trauma, are gaining traction. ? Rising Demand for Disposable Trocars: Emphasis on infection control and patient safety is driving the adoption of single-use trocars.

A trocar is a medical device essential for minimally invasive surgeries, functioning as a tool to create an access port through the body wall. It typically consists of a sharp-pointed obturator, which punctures the tissue, and a cannula, which is a hollow tube that remains in place to allow the insertion of surgical instruments like cameras and graspers. This instrument enables surgeons to perform complex procedures with smaller incisions, reducing patient trauma and accelerating recovery. Often, trocars also include seals to prevent the leakage of fluids or gases, ensuring a controlled surgical environment. Thus, trocars are vital for modern surgical techniques, facilitating procedures that minimize patient discomfort and improve outcomes.