U.S. Aerospace Fasteners Market Size, Share, Trends, Industry Analysis Report

By Product (Screws, Nuts & Bolts), By Material, By Aircraft, By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5945

- Base Year: 2024

- Historical Data: 2020-2023

Overview

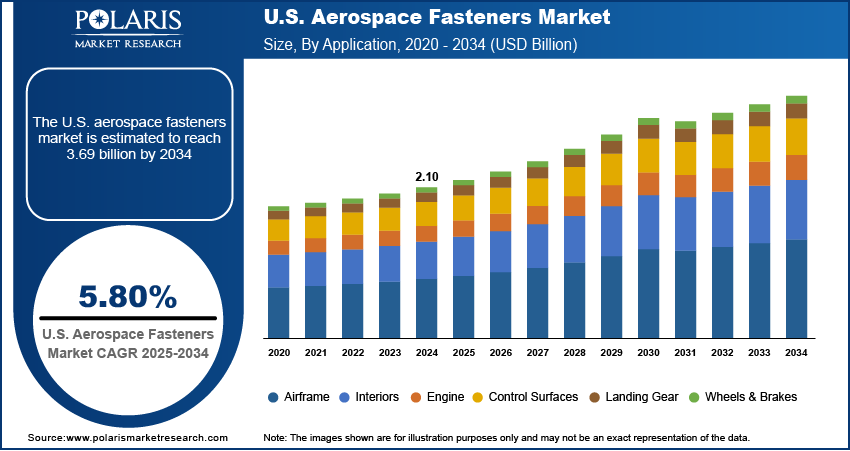

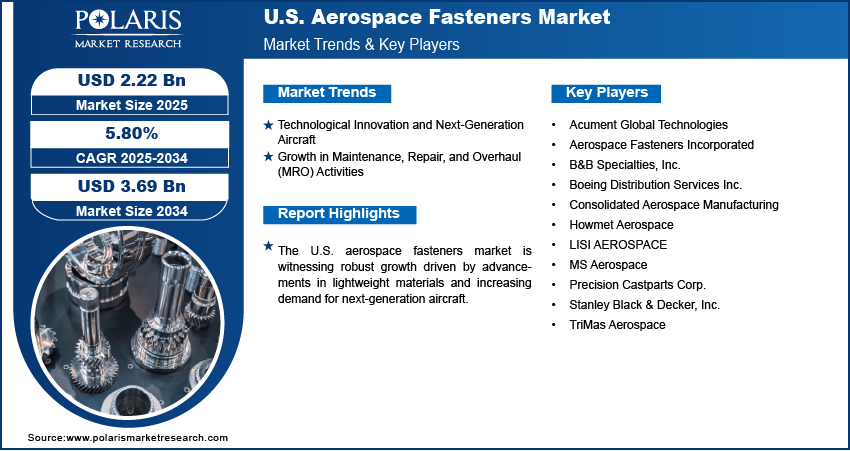

The U.S. aerospace fasteners market size was valued at USD 2.10 billion in 2024, growing at a CAGR of 5.80% from 2025 to 2034. Key factors driving demand for aerospace fasteners include rising aircraft production and fleet expansion, growing aviation sector, increasing MRO activities, and growing momentum in space exploration and satellite deployment.

Key Insights

- The narrow-body aircraft segment dominated the market in 2024.

- The nuts & bolts segment accounted for significant share in 2024

- The titanium segment is projected to grow at a rapid pace in the coming years

- The engine segment is expected to witness the fastest growth during the forecast period.

Aerospace fasteners are critical mechanical components used to join aircraft structures and systems, ensuring safety, structural integrity, and optimal performance during flight. The market is witnessing steady growth, primarily driven by rising aircraft production and fleet expansion. According to a September 2024 FAA report, U.S. commercial airlines flew 853 million passengers, covering a total of 948 billion revenue passenger miles (RPM). Manufacturers are focusing on production to meet the operational and passenger needs of both commercial and military aircraft, driven by increasing demand. This surge in aircraft output directly translates into a higher demand for fasteners, as these components are essential for assembling airframes, engines, and interior systems. Additionally, the expansion of airline fleets across the U.S. to serve to growing air travel demand is further accelerating the adoption of aerospace fasteners across various stages of aircraft manufacturing and maintenance.

The growing adoption of advanced lightweight materials in aircraft construction boosts the expansion opportunities in the U.S. aerospace fasteners market. Aerospace manufacturers are increasingly shifting toward composites, titanium, and aluminum alloys as the industry intensifies its focus on fuel efficiency, emission reduction, and enhanced performance. In March 2023, NASA allocated USD 184 million to HiCAM, with partners contributing an additional USD 136 million, totaling USD 320 million. The initiative supports high-performance composite aircraft manufacturing, aiding the Sustainable Flight National Partnership in advancing sustainable aviation in the U.S. These materials require specialized fasteners that are compatible with their mechanical properties and structural behavior. As a result, the demand for innovative and high-performance fastening solutions has grown. Additionally, the integration of such lightweight materials enhances aircraft efficiency, thereby increasing the need for tailored fasteners that can maintain strength while reducing overall aircraft weight, which supports the evolution of modern aviation technologies.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

- Next-gen aircraft development, such as Boeing's NGAD fighter, is driving demand for advanced fasteners that offer higher performance, durability, and lightweight properties to meet evolving aerospace design and efficiency needs.

- Growing MRO activities, supported by deals such as AAR Corp.'s acquisition of Triumph Product Support, sustain demand for aerospace fasteners as aging fleets require replacements and upgrades to maintain safety and operational efficiency.

- The increasing use of advanced composite materials in next-gen aircraft requires fasteners with specialized properties such as corrosion resistance, lightweight strength, driving up R&D and production costs for manufacturers.

- Strict FAA and defense certification processes delay fastener approvals, limiting market entry for new suppliers and slowing the adoption of innovative solutions in both commercial and military aviation.

Technological Innovation and Next-Generation Aircraft:

Technological innovation and the development of next-generation aircraft are playing a pivotal role in advancing the fasteners sector. Modern aircraft designs increasingly incorporate advanced materials, complex geometries, and advanced systems that demand equally refined fastening solutions. In March 2025, the U.S. Air Force selected Boeing for a contract to develop its next-generation fighter under the NGAD program. The aircraft aims to enhance range, survivability, and lethality, serving as the core of a future combat system. These next-generation platforms require high-performance fasteners that ensure reliability under extreme conditions while supporting lighter and more efficient structures. The need for precision-engineered fasteners capable of withstanding higher loads and environmental stress is significantly increasing as aircraft manufacturers focus on improving aerodynamics, fuel efficiency, and onboard systems, thereby fueling demand across both commercial and defense segments.

Growth in Maintenance, Repair, and Overhaul (MRO) Activities:

The steady rise in Maintenance, Repair, and Overhaul (MRO) activities is contributing to the U.S. aerospace fasteners market demand. Aging aircraft fleets and strict safety regulations necessitate routine inspections, part replacements, and structural upgrades, all of which involve the frequent use of new fasteners. In December 2023, AAR Corp. acquired Triumph Product Support from Triumph Group, a provider of MRO services, for USD 725 million in cash. The deal includes estimated USD 80 million in tax benefits, with an effective purchase multiple of 9.9x EBITDA. MRO operations rely heavily on high-quality, standardized fasteners to maintain aircraft integrity and comply with regulatory guidelines. The MRO sector continues to drive aftermarket consumption of aerospace fasteners, reinforcing their essential role throughout an aircraft’s lifecycle as airlines and defense operators aim to maximize fleet longevity and operational efficiency.

Segmental Insights

Product Analysis

Based on product, the U.S. aerospace fasteners market segmentation includes screws, nuts & bolts, rivets, pins, and other products. The nuts & bolts segment accounted for significant share in 2024 owing to its widespread use in high-load-bearing structural applications across both commercial and defense aerospace sectors. These fasteners provide exceptional strength and durability, making them essential for joining critical components such as airframes, landing gear assemblies, and engine mounts. Their compatibility with various materials, ease of inspection, and capability to endure dynamic loads contribute to their continued relevance in aircraft assembly and maintenance. Additionally, the modularity of nuts and bolts allows for efficient disassembly and replacement, which is crucial for aircraft servicing and lifecycle management.

The screws segment is projected to grow at a robust pace in the coming years, due to the growing demand for lightweight fastening solutions that offer high precision and secure installation in tight or complex geometries. Screws are increasingly favored in applications that require precise control over torque and alignment, particularly in interior cabin structures, avionics compartments, and lightweight composite panels. Advancements in thread design, material strength, and anti-corrosion coatings further enhance their performance and suitability for aerospace environments. Moreover, the increasing incorporation of composite materials and modular assembly processes in new aircraft platforms is also driving the adoption of specialty aerospace screws.

Material Analysis

In terms of material, the U.S. aerospace fasteners market segmentation includes aluminum, steel, titanium, and super alloys. The super alloys segment captured a substantial share of the market in 2024 due to their exceptional mechanical strength, resistance to high temperatures, and superior fatigue and corrosion performance. These properties make them essential in fastening applications within jet engines, turbine assemblies, and structural areas exposed to extreme thermal and mechanical stress. Their use is especially dominant in military and high-performance commercial aircraft, where durability and reliability under extreme conditions are essential. Additionally, the ongoing advancements in propulsion systems and the demand for long-term performance in harsh operating environments are boosting the preference for super alloy-based fasteners.

The titanium segment is projected to grow at a rapid pace in the coming years, owing to its excellent strength-to-weight ratio, corrosion resistance, and compatibility with carbon fiber-reinforced composites. These characteristics make titanium fasteners highly suitable for next-generation aircraft, where weight reduction is crucial for improving fuel efficiency and reducing emissions. Titanium's ability to maintain structural integrity under high thermal stress conditions makes it ideal for both airframe and engine applications. Moreover, the push toward light weighting strategies across the aerospace sector, particularly in narrow-body and electric aircraft, continues to drive demand for titanium-based fastening systems.

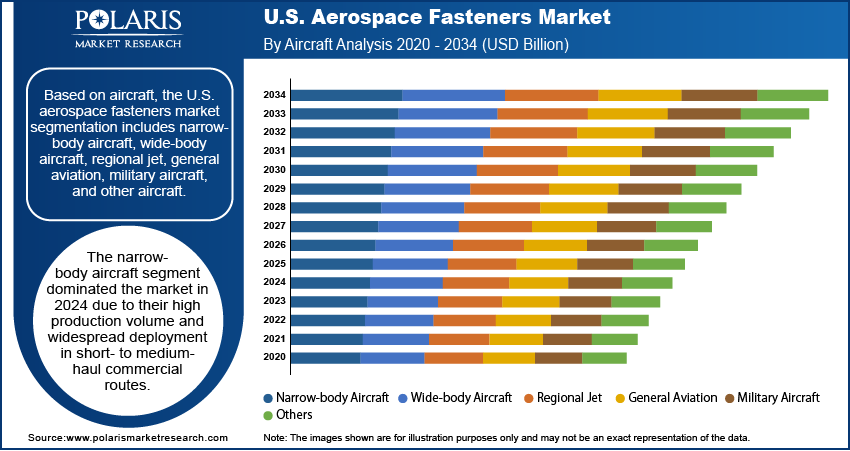

Aircraft Analysis

Based on aircraft, the U.S. aerospace fasteners market segmentation includes narrow-body aircraft, wide-body aircraft, regional jet, general aviation, military aircraft, and other aircraft. The narrow-body aircraft segment dominated the market in 2024, due to their high production volume and widespread deployment on short- to medium-haul commercial routes. These aircraft rely heavily on a high density of fasteners across various subsystems, such as fuselage, wings, and interior structures, to ensure structural stability and ease of maintenance. The segment benefits from increasing airline demand for fuel-efficient and cost-effective aircraft, which accelerates the need for advanced fastening solutions. Additionally, frequent upgrades, retrofitting activities, and maintenance schedules in the narrow-body fleet further support consistent demand for high-performance aerospace fasteners.

The military aircraft segment is expected to witness robust growth during the forecast period, owing to increased investments in defense aviation and the modernization of air fleets. Military aircraft demand fasteners with enhanced tensile strength, fatigue resistance, and tolerance to harsh operational environments. The need for reliable and high-specification fasteners has risen, especially with the deployment of advanced fighter jets, surveillance aircraft, and unmanned aerial systems. Furthermore, national defense strategies highlighting increasing production and fleet expansion are expected to accelerate the manufacturing and procurement of aerospace-grade fasteners for military applications.

Application Analysis

In terms of application, the U.S. aerospace fasteners market segmentation includes airframe, interiors, engine, control surfaces, landing gear, and wheels & brakes. The airframe segment is projected to capture a significant share by 2034 due to the sheer volume of fasteners required in primary structural assemblies. Fasteners are crucial in joining fuselage sections, wing structures, and empennages, thereby ensuring the overall integrity and safety of the aircraft. The increasing use of composite materials in airframe design demands advanced fastening solutions with high strength and compatibility, further fueling segment growth. Additionally, the focus on modular design and ease of maintenance underscores the crucial role of fasteners in contemporary airframe architecture across commercial, military, and private aviation.

The engine segment is expected to witness the fastest growth during the forecast period as aircraft engine components require precision fasteners that can withstand high temperatures, pressure variations, and mechanical loads. The need for high-performance, heat-resistant fasteners is increasing with advancements in jet propulsion technologies and the development of more efficient engines. Engine manufacturers are also integrating lightweight materials and innovative designs, which necessitate compatible fastening solutions. Furthermore, this trend is particularly noticeable in newer generation engines with stricter performance and durability standards, driving fastener innovation and increasing demand within this segment.

Key Players and Competitive Analysis

The U.S. aerospace fasteners sector faces intense competition, with major players leveraging strategic investments and technological advancements to strengthen their position. Established suppliers dominate developed markets, focusing on revenue growth through high-performance solutions for next-gen aircraft, while small and medium-sized businesses target niche segments with specialized offerings. Competitive intelligence reveals that disruptions and trends, such as lightweight composites and additive manufacturing, are reshaping industry trends, forcing vendors to adapt to future development strategies. Revenue opportunities lie in addressing latent demand from defense programs such as NGAD and expanding MRO activities, though economic and geopolitical shifts pose risks. Vendor strategies emphasize sustainable value chains and partnerships to mitigate supply chain disruptions. Meanwhile, emerging market segments, such as urban air mobility, present expansion opportunities for agile suppliers. To maintain competitive positioning, companies must align with industry-leading competitive intelligence, optimize pricing insights, and invest in business transformation to capitalize on growth projections. Expert insights suggest that differentiation through innovation and regional footprint optimization will be critical in this evolving landscape.

A few major companies operating in the U.S. aerospace fasteners industry include Acument Global Technologies; Aerospace Fasteners Incorporated; B&B Specialties, Inc.; Boeing Distribution Services Inc.; Consolidated Aerospace Manufacturing; Howmet Aerospace; LISI AEROSPACE; MS Aerospace; Precision Castparts Corp.; Stanley Black & Decker, Inc.; and TriMas Aerospace.

Key Players

- Acument Global Technologies

- Aerospace Fasteners Incorporated

- B&B Specialties, Inc.

- Boeing Distribution Services Inc.

- Consolidated Aerospace Manufacturing

- Howmet Aerospace

- LISI AEROSPACE

- MS Aerospace

- Precision Castparts Corp.

- Stanley Black & Decker, Inc.

- TriMas Aerospace

Industry Developments

- February 2024: TriMas Aerospace secured a multi-year global contract with Airbus, covering its Monogram, Allfast, and Mac Fasteners brands. The expanded agreement broadens TriMas' supply scope across Airbus operations, reinforcing its role in the aircraft manufacturer's global fastener supply chain.

- August 2024: Skybolt launched the SK203 and SK245 adjustable fastener receivers, reducing multiple stud sizes into one. The toolless, stainless-steel/composite design allows panel thickness adjustments without tools, preventing FOD. The system supports endless readjustments, improving efficiency in aerospace panel fastening.

U.S. Aerospace Fasteners Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Screws

- Nuts & Bolts

- Rivets

- Pins

- Other Products

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Aluminum

- Steel

- Titanium

- Super alloys

By Aircraft Outlook (Revenue, USD Billion, 2020–2034)

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jet

- General Aviation

- Military Aircraft

- Other Aircrafts

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Airframe

- Interiors

- Engine

- Control Surfaces

- Landing Gear

- Wheels & Brakes

U.S. Aerospace Fasteners Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.10 Billion |

|

Market Size in 2025 |

USD 2.22 Billion |

|

Revenue Forecast by 2034 |

USD 3.69 Billion |

|

CAGR |

5.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 2.10 billion in 2024 and is projected to grow to USD 3.69 billion by 2034.

The U.S. market is projected to register a CAGR of 5.80% during the forecast period.

A few of the key players in the market are Acument Global Technologies; Aerospace Fasteners Incorporated; B&B Specialties, Inc.; Boeing Distribution Services Inc.; Consolidated Aerospace Manufacturing; Howmet Aerospace; LISI AEROSPACE; MS Aerospace; Precision Castparts Corp.; Stanley Black & Decker, Inc.; and TriMas Aerospace.

The narrow-body aircraft segment dominated the market share in 2024.

The engine segment is expected to witness fastest growth during the forecast period.