U.S. Agricultural Adjuvants Market Share, Size, Trends, Industry Analysis Report

By Product (Utility Adjuvant, Activator Adjuvant); By Crop Type (Oilseeds & Pulses, Cereals & Grains); By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Apr-2024

- Pages: 117

- Format: PDF

- Report ID: PM4818

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

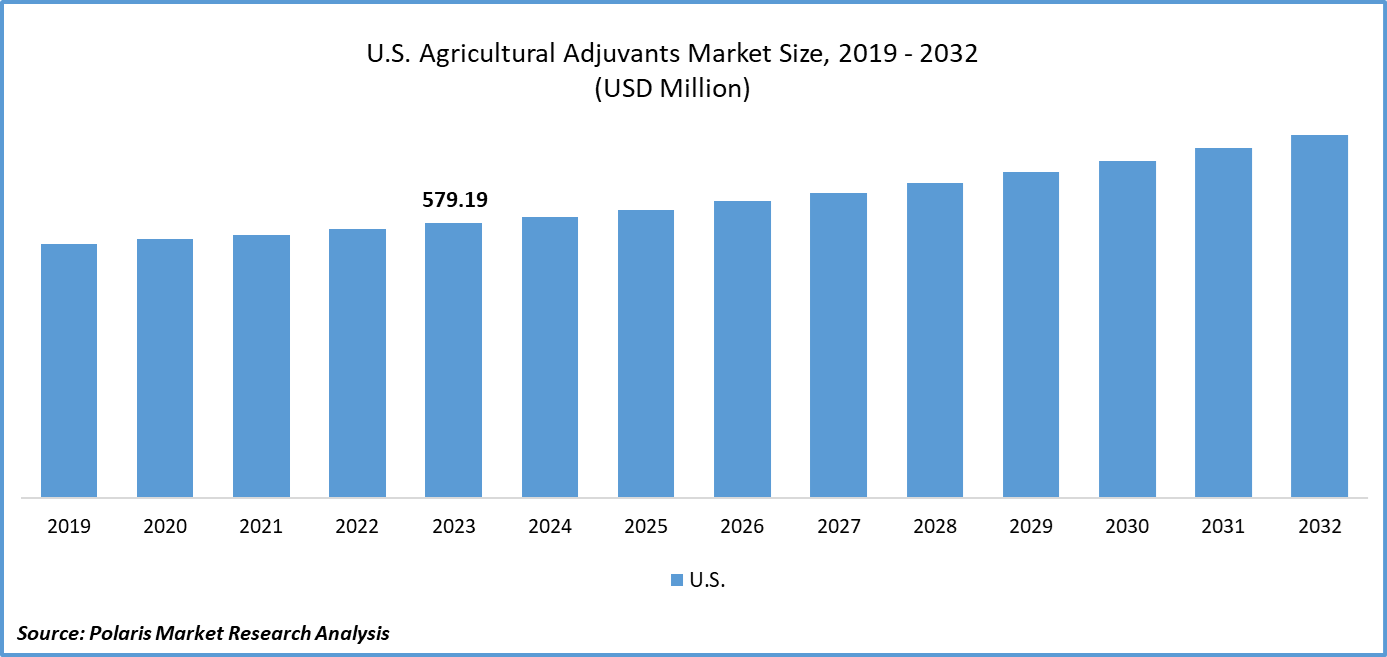

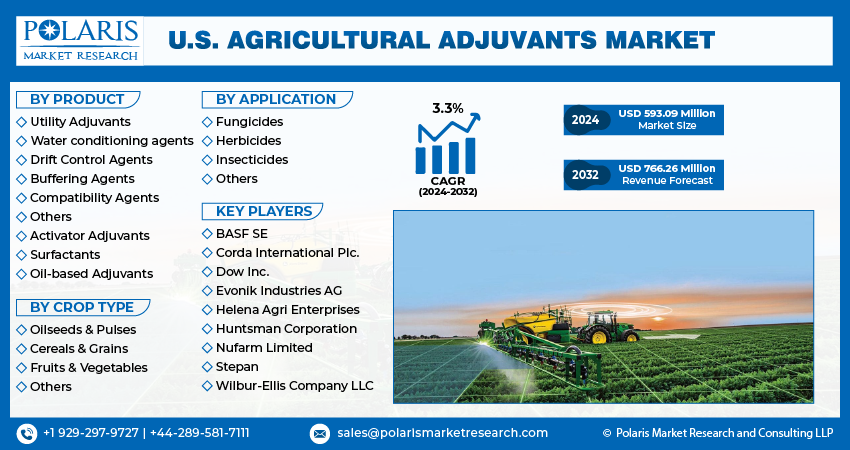

U.S. Agricultural Adjuvants Market size was valued at USD 579.19 million in 2023. The market is anticipated to grow from USD 593.09 million in 2024 to USD 766.26 million by 2032, exhibiting the CAGR of 3.3% during the forecast period

U.S. Agricultural Adjuvants Market Overview

Adjuvants, chemical compounds used in agriculture, are aimed at enhancing the effectiveness of pesticide formulations. They are added to pesticide products or spray mixtures to improve efficacy or physical properties. Adjuvants in agriculture encompass a range of substances, including crop oil concentrates, surfactants, and agents for compatibility, foaming, and wetting. They also include nitrogen fertilizers such as urea and ammonium nitrate. Given their ability to boost pesticide efficiency, adjuvants have become indispensable tools in precision and protected farming methods. Adjuvant products are regulated by the Council of Producers and Distributors of Agrotechnology (CPDA) and the American Society for Testing and Materials International (ASTM).

To Understand More About this Research:Request a Free Sample Report

For instance, in February 2024, the EPA approved BASF's Surtain Herbicide

The increasing need for higher agricultural productivity due to population growth. As the population expands, so does the demand for food, necessitating higher agricultural yields. Adjuvants play a crucial role in agriculture by enhancing pesticide effectiveness, thereby boosting crop output. Advancements in technology and farming practices drive the increasing use of adjuvants in agriculture. These additives are now a common feature in modern agricultural techniques, enhancing the efficacy of crop protection chemicals. Moreover, farmers are turning to adjuvants that improve the effectiveness of agrochemicals and reduce costs, particularly with the rising prices of premium active agrochemicals.

U.S. Agricultural Adjuvants Market Dynamics

Market Drivers

An Increase in Pest Infestation

Global warming can lead to extreme weather changes, including longer droughts, increased rainfall, shorter winters, and more frequent storms. Such erratic weather patterns can affect plant development and exacerbate pest infestations. Rising temperatures can accelerate insect reproduction and promote uncontrolled weed growth. Additionally, areas with erratic climates are more prone to crop and plant diseases. For instance, the spread of needle blight is linked to higher precipitation levels, as plants can contract the fungus causing this disease. Adjuvant-based insecticides are essential for managing both pest infestations and infections like needle blight.

Advancements in Farming Practices and Growing Awareness Among Farmers

The increased use of adjuvants in agriculture is due to advancements in technology and farming practices. These additives are now a common feature in modern agricultural techniques, enhancing the effectiveness of crop protection chemicals. Moreover, farmers are increasingly turning to adjuvants that improve the effectiveness of agrochemicals and reduce costs, particularly with the rising prices of premium active agrochemicals. The U.S. agricultural adjuvants market opportunity is growing due to farmers' growing awareness of their benefits, such as improving spray droplet retention on leaves and reducing pesticide runoff. However, obstacles like small-scale farmers' lack of knowledge about the risks of synthetic adjuvants and stringent environmental regulations could hinder this growth. Despite these challenges, the agricultural adjuvants market in the United States is expected to show positive growth during the U.S agricultural adjuvants market forecast period.

Market Restraints

Laws Governing the Application of Agricultural Adjuvants

The U.S. Environmental Protection Agency (EPA) plays a crucial role in regulating adjuvant formulations used in agriculture. The EPA evaluates the safety and effectiveness of adjuvants to ensure they meet strict standards before they can be approved for use. This regulatory oversight is important for protecting human health and the environment from potentially harmful chemicals. However, the regulatory landscape for agricultural adjuvants is complex, with different countries and regions having their own regulations and requirements. This can create challenges for companies looking to market their adjuvants globally. Differences in regulatory standards can lead to delays in product approvals, increased compliance costs, and difficulties in navigating the regulatory process in different jurisdictions.

Report Segmentation

The market is primarily segmented based on product, crop type, application, and region.

|

By Product |

By Crop Type |

By Application |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

U.S. Agricultural Adjuvants Market Segmental Analysis

By Product Analysis

The utility adjuvants segment is projected to grow at a significant CAGR during the projected period. To enhance the foam-reducing capabilities and uniformity of spray solutions, pesticide formulations are supplemented with utility adjuvants. These additives not only help reduce evaporation rates but also improve the effectiveness of pesticides. The industry has experienced growth due to farmers' growing awareness of the benefits of utility adjuvants in enhancing crop yields and the greater demand for more efficient pesticide use. As the agriculture industry continues to advance, the demand for innovative and practical solutions like these is expected to increase.

The activator adjuvants segment led the industry market with a substantial revenue share in 2023. Their dominance in the U.S. agricultural adjuvants market development can be attributed to their ability to enhance the efficacy of pesticides, thereby increasing agricultural productivity and quality. Adjuvants are designed to improve the physical characteristics of spray droplets, including spreading, wetting, and penetration. The growth of these activator adjuvants can be attributed to the increasing demand for improved pest control, sustainable agricultural practices, and higher food consumption rates.

By Crop Type Analysis

The cereal & grains segment accounted for the largest market share in 2023 and is likely to retain its position throughout the U.S. agricultural adjuvants market forecast period. This can be attributed to the widespread cultivation of cereal and grain crops, such as corn, wheat, and rice, in the United States. Adjuvants are employed in these crops to enhance the effectiveness of insecticides, thereby improving crop quality and yield.

The food & vegetables segment is expected to grow at the fastest CAGR over the U.S. agricultural adjuvants market forecast period. This segment's growth can be attributed to the increasing demand for fruits and vegetables and the necessity for efficient pest management techniques in these crops. Adjuvants play a vital role in enhancing the effectiveness of pesticides utilized in fruit and vegetable production, thereby driving the market's expansion.

By Application Analysis

Based on application analysis, the market has been segmented into fungicides, herbicides, insecticides, and others. The herbicides segment held a dominant revenue share in 2023. Adjuvants play a significant role in enhancing the effectiveness of herbicides, which are employed to control unwanted vegetation, especially in agricultural environments. The dominance of this sector can be attributed to the substantial use of herbicides in the U.S. agriculture industry, one of the largest in the world.

The insecticides segment is anticipated to grow at the fastest CAGR during the U.S. agricultural adjuvants market forecast period. This expansion is driven by the growing threat of pests and crop diseases, which has heightened the demand for insecticides. Adjuvants play a crucial role in pest management strategies by enhancing the effectiveness of insecticides.

Competitive Landscape

The U.S. Agricultural Adjuvants market is fragmented and is anticipated to witness competition due to several players' presence. Major agricultural adjuvants providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BASF SE

- Corda International Plc.

- Dow Inc.

- Evonik Industries AG

- Helena Agri Enterprises

- Huntsman Corporation

- Nufarm Limited

- Stepan

- Wilbur-Ellis Company LLC

Recent Developments

- In November 2023, Nufarm introduced a new herbicide technology designed to assist farmers in combating difficult weeds in cereal crops.

- In April 2022, Clariant AG introduced DropForward, a precision application approach involving adjuvants and co-formulants.

Report Coverage

The U.S. agricultural adjuvants market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, crop type, application and their futuristic growth opportunities.

U.S. Agricultural Adjuvants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 593.09 million |

|

Revenue forecast in 2032 |

USD 766.26 million |

|

CAGR |

3.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Crop Type, By Application, By Region |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

U.S. Agricultural Adjuvants Market report covering key segments are product, crop type, application and region.

U.S. Agricultural Adjuvants Market Size Worth $ 766.26 Million By 2032

U.S. Agricultural Adjuvants Market exhibiting the CAGR of 3.3% during the forecast period

The key driving factors in U.S. Agricultural Adjuvants Market an increase in pest infestation