Global Agricultural Adjuvants Market Size, Share, & Industry Analysis Report

: By Source, By Formulation, By Crop Type, By Adoption Stage, By Function, By Application, and By Region – Market Forecast, 2025 - 2034.

- Published Date:May-2025

- Pages: 148

- Format: PDF

- Report ID: PM1184

- Base Year: 2024

- Historical Data: 2020-2023

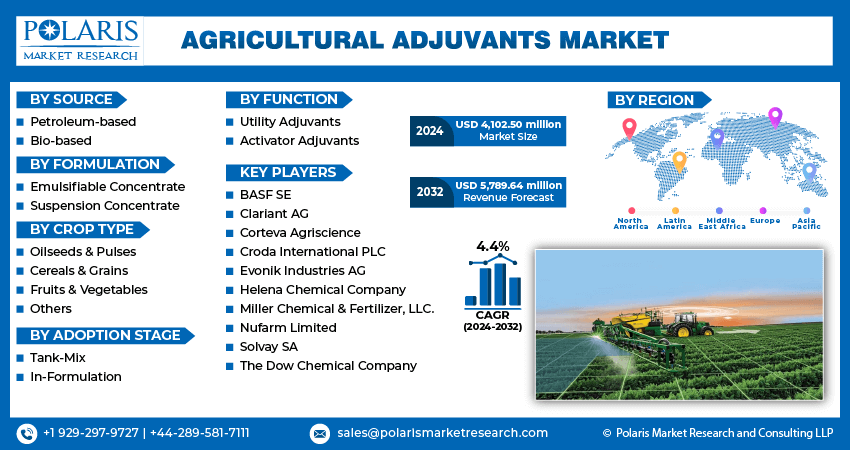

The global agricultural adjuvants market was valued at USD 4.1 billion in 2024 and is projected to grow at a CAGR of 4.78% from 2025 to 2034. The growth is attributed to the increasing need for efficient crop protection solutions and sustainable agricultural practices.

The market is further driven by the use of agricultural adjuvants involves incorporating additives that improve the effectiveness and application of crop protection chemicals. These additives modify the physical or chemical properties of spray mixes, enhancing their application qualities for herbicides, insecticides, and fungicides.

The agricultural adjuvants is experiencing robust growth driven by the increasing demand to enhance the yield of crops and the efficiency of agricultural production. Agricultural adjuvants play a crucial role in enhancing the efficiency of precision farming methods, such as aerial spraying, smart irrigation, and variable rate application. These additives improve the coverage, absorption, and penetration of agrochemicals, thus boosting growth opportunities.

To Understand More About this Research: Request a Free Sample Report

The rapid population growth has resulted in farmers increasing food grain production. Moreover, the diminishing sizes of arable lands due to population growth, urbanization, and industrialization are placing additional strain on farmers to enhance productivity on limited land.

For instance, according to the Food Agriculture Organization, in 2021, the global average cropland area per individual stood at 0.2 hectares per capita (ha/cap), an 18% decrease from the year 2000 in terms of cropland area per person.

Hence, farmers are increasingly adopting agricultural adjuvants and fertilizers to boost yields rapidly, driving expansion.

Market Dynamics

Rising Demand for Sustainable Agricultural Adjuvants

Market CAGR for agricultural adjuvants is being driven by the rising adoption and application of renewable and sustainable agricultural adjuvant alternatives. This is due to the increased awareness among consumers regarding the environmental and health hazards linked to chemically derived adjuvants.

Hence, both government agencies and adjuvant manufacturers are now emphasizing the use of sustainable adjuvants. They are also making efforts to meet rising consumer demands for sustainable adjuvants by expanding their businesses or launching new product offerings.

For instance, in November 2020, Nouryon launched a salt-free agricultural adjuvant, Adsee AMP40, which is sustainable and biodegradable. It caters to the needs of customers and provides a cost-effective solution for manufacturers in the global agricultural industry.

Increasing Use of Agrochemicals

The agricultural adjuvants market is growing rapidly, fueled by the rising demand for crop production on agricultural lands. Farmers are utilizing a variety of agrochemicals to enhance crop yields and increase productivity in response to the increasing global agricultural demands. This trend is resulting in the escalated use of advanced agrochemical solutions including pesticides, fertilizers, adjuvants, and plant growth promoters.

For instance, according to the Food and Agriculture Organization, the overall volume of pesticides used saw a 30% rise in 2020, driven by the surge in the application of pesticides for agricultural purposes. Globally, the use of pesticides grew from 4.0 to 8.7 million tons between 2019 and 2020.

The surge in the demand for agrochemicals has led to the incorporation of agricultural adjuvants, like surfactants and spreaders, into pesticides or fertilizers. These are used to improve their effectiveness and application properties by enhancing their performance, dispersal, or adherence to active ingredients property, driving the agricultural adjuvants market revenue.

Segmental Insights

By Function Outlook

The global agricultural adjuvants market segmentation, based on function, includes activator adjuvants and utility adjuvants. The utility adjuvants segment is expected to grow at the fastest CAGR in the market. This is mainly attributed to their ability to alter the physical or chemical characteristics of spraying solutions in order to enhance the effectiveness and ability to adhere to plant surfaces. The addition of utility adjuvants to agrochemicals helps boost the application of the product to the intended plant target.

For instance, in April 2022, Clariant introduced Synergen DT, an antidrift agent for drone spraying. Synergen DT effectively manages the drift and volatility of fine droplets, enhancing the coverage and penetration of active ingredients on leaves. Further, it boosts biological performance and promotes sustainability in drone spraying operations.

By Application Outlook

The global agricultural adjuvants market segmentation, based on application, includes herbicides, fungicides, insecticides, and others. In 2024, the herbicides category dominated the market owing to the extensive utilization of herbicides such as glyphosate and glufosinate in global crop cultivation to effectively manage weeds in a wide range of crops.

Farmers utilize broad-spectrum herbicides with a unique mechanism of action, allowing for strategic rotation with different herbicides to address weed resistance. For instance, in 2021-2022, according to the USDA National Agricultural Statistics Service, 84% of glyphosate application by volume was done on crops like soybeans, corn, or cotton annually in the United States.

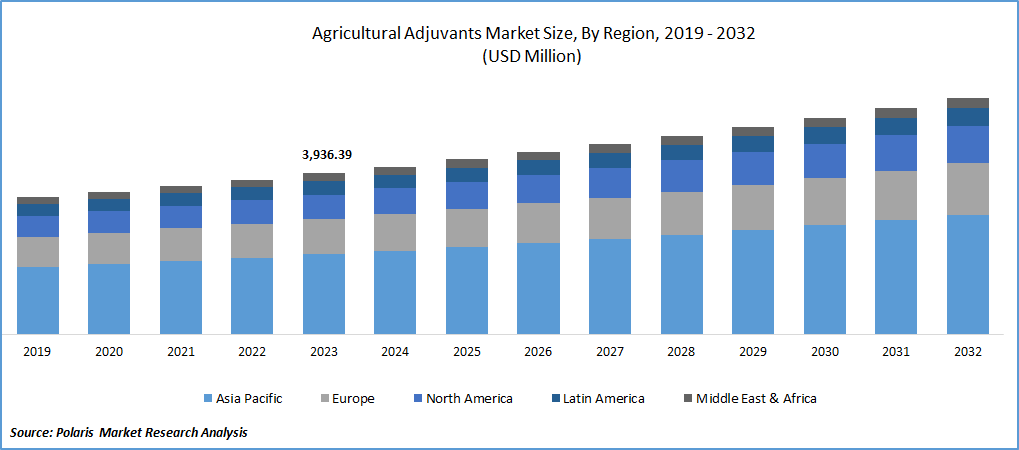

Global Agricultural Adjuvants Market, Segmental Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

By Regional Analysis

By region, the study provides market insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The North America agricultural adjuvants market is expected to grow at the fastest CAGR during the forecast period owing to the rising need for crops such as grains, fruits, corn, and oils in countries such as the United States and Canada. The increased crop production due to expanding agricultural land is driving the demand for agricultural adjuvants in this region.

Technology-integrated herbicides for improved functionality, like compatibility with specific pesticides or better targeting, are introduced to enhance the efficiency of crop protection products in this region.

For instance, in August 2023, BASF introduced Liberty ULTRA Herbicide, featuring Glu-L Technology, to efficiently manage grasses and broadleaf weeds in glufosinate-tolerant soybeans, cotton, canola, and corn crops.

Further, the major countries studied in the market report are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Europe agricultural adjuvants market accounted for the significant market share due to the increased demand from farmers to enhance crop yield and production efficiency. Furthermore, the agricultural field in Europe is shifting towards cultivating high-value crops such as fruits, vegetables, and specialty crops. These crops require greater protection from pests and diseases, thus creating a growing demand for adjuvants that can enhance the efficacy of crop protection agrochemicals while also promoting sustainability by reducing chemical runoff and environmental impact.

The adoption and integration of sustainable agricultural practices are being encouraged by both the UK government and numerous farmers. For instance, in April 2024, Rovensa Next collaborated with the Biocontrol Coalition to enhance farmers' availability of sustainable crop protection options and influence EU Biocontrol regulatory changes.

The Asia-Pacific region dominated the agricultural adjuvants market in 2024 due to the presence of countries like India and China as key exporters, consumers, and producers of pesticide chemicals.

For instance, according to the Food and Agriculture Organization, in 2020, the pesticide consumption for agriculture applications by China and India was 273 kilotons and 61 kilotons, respectively.

Agricultural adjuvants are used in combination with pesticides to enhance the effectiveness of crop protection. Thus, key players are entering specific markets to broaden their market reach and expand their product offerings.

For instance, in March 2022, BASF launched a new Herbicide called Vesnit in the Indian crop protection market, providing effective and broad-spectrum control of weeds in sugarcane and corn. The formulation is convenient for long-duration control and ensures excellent crop safety.

Global Agricultural Adjuvants Market Share, Regional Coverage, 2019 - 2032 (USD million)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Key Market Players & Competitive Analysis

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, this industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global industry to benefit clients and increase the market sector. In recent years, the agricultural adjuvants industry has witnessed some technological advancements. Major players in the market include BASF, Clariant AG, Corteva Agriscience, Croda International PLC., Evonik Industries AG, Helena Chemical Company, Miller Chemical & Fertilizer, LLC., Nufarm Limited, Solvay SA and The Dow Chemical Company.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Surface technologies provides automotive OEM services and chemical solutions to the automotive and chemical sectors. In May 2024, BASF launched adjuvants called Agnique BioHance, designed to enhance the performance of biological pesticides by improving the efficiency and properties of biological solutions.

Evonik Industries AG is a specialty chemicals company. Evonik's product portfolio includes consumer specialties, advanced intermediates, inorganic materials, coatings & additives, health & nutrition, and performance polymers. Evonik's subsidiaries include Evonik Degussa GmbH and Evonik Steag GmbH. The company is headquartered in Germany. In April 2023, Evonik created two new adjuvants, BREAK-THRU MSO MAX 522 and TEGO XP 11134. These adjuvants are formulated using a unique combination of polyether-trisiloxanes and other ingredients in order to improve effectiveness and minimize drift for drone-based agricultural input applications.

List of Key Companies in the Agricultural Adjuvants Market

- BASF SE

- Clariant AG

- Corteva Agriscience

- Croda International PLC

- Evonik Industries AG

- Helena Chemical Company

- Miller Chemical & Fertilizer, LLC.

- Nufarm Limited

- Solvay SA

- The Dow Chemical Company

Agricultural Adjuvants Industry Developments

March 2025: Sell Agro Launched The first new product Oleum Sell, a high-purity mineral oil free of sulfur, aromatics, and naphtha.

September 2023: Croda introduced its latest product Atlo BS-50, which is a distribution system designed to cater to the expanding biopesticide industry.

April 2022: Lamberti SPA completed the acquisition of Turftech International to enable Lamberti to enhance its product range and increase its agricultural adjuvants presence in the European region.

June 2021: Attune Agriculture introduced fresh crop offerings in collaboration with Commodit AG to distribute Accomplice, a comprehensive agricultural adjuvant specifically created for use on row crops.

Agricultural Adjuvants Market Segmentation:

By Source Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Petroleum-based

- Bio-based

By Formulation Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Emulsifiable Concentrate

- Suspension Concentrate

By Crop Type Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Oilseeds & Pulses

- Soyabean

- Others

- Cereals & Grains

- Rice

- Wheat

- Corn

- Others

- Fruits & Vegetables

- Others

By Adoption Stage Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Tank-Mix

- In-Formulation

By Function Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Utility Adjuvants

- Buffers/Acidifiers

- Water conditioners

- Compatibility agents

- Antidrift agents

- Antifoam agents

- Others

- Activator Adjuvants

- Oil-based Adjuvants

- Surfactants

By Application Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- Herbicides

- Fungicides

- Insecticides

- Others

By Regional Outlook (Revenue, Volume Tons; USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Agricultural Adjuvants Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 4.1 billion |

|

Market Size Value in 2025 |

USD 4.3 billion |

|

Revenue Forecast in 2034 |

USD 6.51 billion |

|

CAGR |

4.78% from 2025 – 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020 – 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD billion, Volume in tons, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global agricultural adjuvants market size was valued at USD 4.1 billion in 2024 and is projected to be valued at USD 6.51 billion in 2034

The global market is projected to grow at a CAGR of 4.78% during the forecast period, 2025-2034.

Asia-Pacific held the largest share of the global market.

The key players in the market are BASF, Clariant AG, Corteva Agriscience, Croda International PLC., Evonik Industries AG, Helena Chemical Company, Miller Chemical & Fertilizer, LLC., Nufarm Limited, Solvay SA and The Dow Chemical Company.

The utility adjuvants category is expected to grow with the fastest CAGR in the market in 2024.

The herbicides category held the largest share in the global market.