U.S. Desiccant Dehumidifier Market Size, Share, Trends, & Industry Analysis Report

By Product (Fixed/Mounted and Portable), By Application, By End User– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6365

- Base Year: 2024

- Historical Data: 2020-2023

Overview

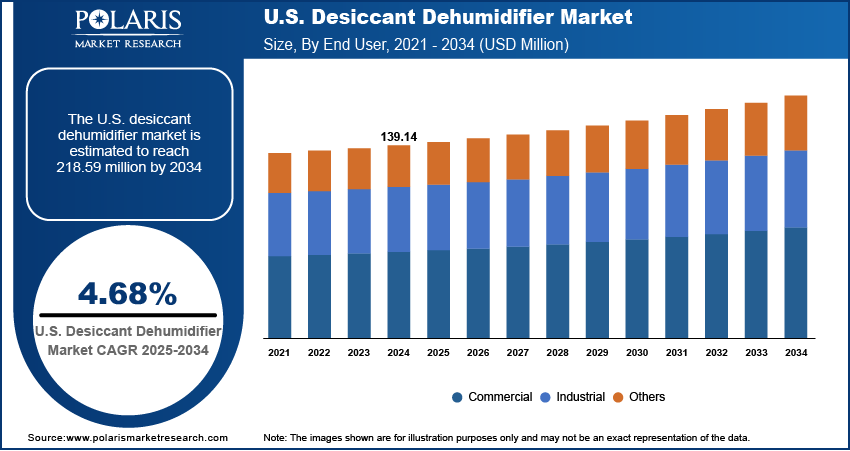

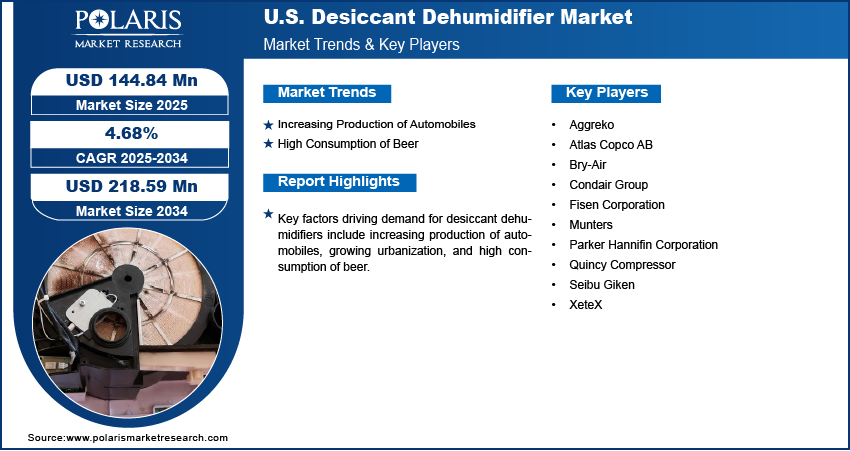

The U.S. desiccant dehumidifier market size was valued at USD 139.14 million in 2024, growing at a CAGR of 4.68% from 2025 to 2034. Key factors driving demand for desiccant dehumidifiers include increasing production of automobiles, growing urbanization, and high consumption of beer.

Key Insights

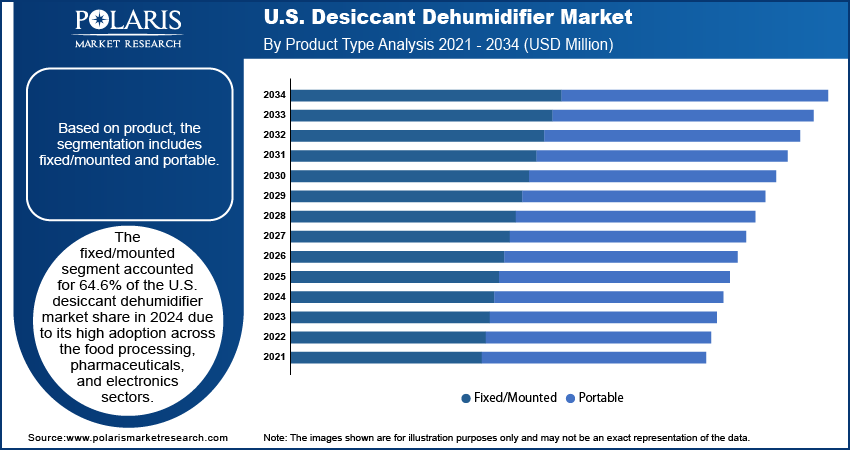

- The fixed/mounted segment accounted for 64.6% of the revenue share in 2024 due to its high adoption across the food processing and electronics sectors.

- The energy segment held 24.72% of revenue share in 2024 due to the desiccant dehumidifier's ability to maintain a stable operating environment across power plants.

Industry Dynamics

- The rising automobile production in the U.S. is boosting demand for desiccant dehumidifiers, especially during manufacturing and storage processes.

- The high consumption of beer in the U.S. is fueling the adoption of desiccant dehumidifiers as breweries use them during the fermentation, storage, and packaging stages to maintain beer quality and prevent contamination.

- Rising demand for frozen food in the U.S. is creating a lucrative market opportunity.

- The high cost of desiccant dehumidifiers is projected to hamper the market growth.

Market Statistics

- 2024 Market Size: USD 139.14 Million

- 2034 Projected Market Size: USD 218.59 Million

- CAGR (2025-2034): 4.68%

AI Impact on U.S. Desiccant Dehumidifier Market

- AI is enhancing the U.S. desiccant dehumidifier market by enabling smart humidity control through real-time data analytics and machine learning.

- It optimizes energy efficiency by predicting usage patterns and adjusting operations accordingly.

- AI-powered IoT integration allows remote monitoring and predictive maintenance, reducing downtime and costs.

- Additionally, AI supports demand forecasting for manufacturers, improving supply chain and inventory management.

A desiccant dehumidifier is a device that removes excess moisture from the air using a desiccant material, such as silica gel or zeolite, which absorbs water vapor. Desiccant models work efficiently in low-temperature and low-humidity environments, making them ideal for industrial, commercial, and residential spaces. They help prevent mold growth, protect equipment, and maintain optimal air quality in storage facilities, warehouses, pharmaceuticals, and food processing units. The ability of these devices to operate in colder climates and provide consistent humidity control makes them a reliable solution where precise environmental conditions are critical.

The U.S. desiccant dehumidifier market is growing rapidly due to rising demand across industries that require strict humidity control, including food processing, pharmaceuticals, electronics, and warehouses. Harsh winters in many states are increasing the adoption of desiccant systems, as they perform well in low-temperature environments where refrigerant models often fail. Additionally, regulatory emphasis on product safety and energy efficiency has pushed industries to adopt advanced dehumidification technologies. Growing investment in infrastructure, coupled with the need to preserve perishable goods and sensitive equipment, further fuels adoption. U.S. manufacturers are also focusing on developing portable and energy-efficient systems, supporting broader market penetration.

The demand for desiccant dehumidifiers in the U.S. is driven by the growing urbanization. According to the World Bank Group, the urban population in the U.S. reached 84% in 2024 from 83% in 2022. This pushed builders and facility managers to invest in advanced dehumidification solutions such as desiccant dehumidifiers to protect infrastructure, electronics, and indoor air quality. Moreover, the high concentration of data centers, hospitals, and cold chains in urban areas is fueling the adoption of desiccant dehumidifiers as these infrastructures require precise humidity control to ensure equipment longevity and product safety. Therefore, the growing urbanization is propelling the adoption of desiccant dehumidifiers in the U.S.

Drivers & Opportunities/Trends

Increasing Production of Automobiles: The rising automobile production in the U.S. is boosting demand for desiccant dehumidifiers, especially during manufacturing and storage processes. United States Motor Vehicle Production was reported at 10,611,555.000 units in Dec 2023. This records an increase from the previous number of 10,052,958.000 units for Dec 2022. Automakers use desiccant dehumidifiers in assembly plants, paint shops, and warehouses to maintain optimal humidity levels, preventing rust, paint defects, and electrical failures. The expansion of electric vehicle (EV) production is further amplifying the demand, as lithium-ion batteries and sensitive electronic systems require strict moisture control to ensure performance and safety. Additionally, automotive parts and finished vehicles often need protection during storage and transportation, especially in humid climates or overseas shipping, where desiccant dehumidifiers help prevent condensation and damage. Therefore, as automobile output rises in the country, manufacturers and logistics providers invest more in these dehumidifiers to safeguard quality, reduce waste, and meet stringent industry standards.

High Consumption of Beer: Breweries require precise humidity control equipment, such as desiccant dehumidifiers, during the fermentation, storage, and packaging stages to maintain beer quality and prevent contamination. Additionally, large-scale storage and distribution centers for bottled or canned beer use desiccant dehumidifiers to avoid condensation, which can cause rust on equipment and compromise packaging integrity. Hence, the high consumption of beer in the U.S. is driving both small and large beer producers to invest in humidity control solutions to ensure consistency in their products. For instance, according to a beer consumption report by World Population Review, the U.S. consumed 23,761,000 tons of beer in 2022, the second most by any country in the world.

Segmental Insights

Product Analysis

Based on product, the segmentation includes fixed/mounted and portable. The fixed/mounted segment accounted for 64.6% of the U.S. desiccant dehumidifier market share in 2024 due to its high adoption across the food processing, pharmaceuticals, and electronics sectors. Manufacturers in these sectors installed fixed systems in large-scale production and storage facilities to prevent moisture-related damage, corrosion, and microbial growth. The ability of fixed units to operate continuously with high efficiency and handle large volumes of air made them a preferred choice for industrial and commercial applications. Growing concerns about maintaining product quality, extending shelf life, and ensuring regulatory compliance further drove businesses to invest in these fixed/mounted systems.

The portable segment is projected to grow at a CAGR of 5.78% from 2025 to 2034, owing to its flexibility and cost-effectiveness. Households, warehouses, and data centers are increasingly adopting portable units due to their easy installation, energy efficiency, and ability to be relocated as needed. Rising awareness about indoor air quality and moisture control in residential and commercial spaces is further fueling their demand. Additionally, advancements in compact designs, smart controls, and lower maintenance requirements are making portable systems more attractive to consumers seeking practical solutions.

Application Analysis

In terms of application, the segmentation includes energy, chemical, construction, electronics, and food & pharmaceuticals. The energy segment held 24.72% of revenue share in 2024 due to the desiccant dehumidifier's ability to maintain a stable operating environment across power plants, refineries, and renewable energy facilities. Equipment such as turbines, generators, and switchgear is highly sensitive to moisture, which encouraged operators to invest in desiccant dehumidifiers to prevent corrosion, electrical failures, and costly downtime. The rising demand for uninterrupted power supply and the expansion of renewable energy infrastructure in the country further accelerated adoption. Utilities prioritized these systems to extend equipment lifespan, reduce maintenance costs, and ensure operational efficiency, which strengthened the dominance of the energy segment.

End User Analysis

In terms of end user, the segmentation includes commercial, industrial, and others. The industrial segment accounted for 60.55% of the U.S. desiccant dehumidifier market share in 2024 due to the desiccant dehumidifier's ability to safeguard equipment, raw materials, and finished products from moisture damage. Facilities handling power generation equipment, precision electronics, and chemical compounds required strict humidity control to prevent corrosion, contamination, and production delays. Companies in this sector prioritized dehumidification to reduce downtime, comply with regulatory standards, and extend asset lifespans. The growing scale of industrial operations, coupled with the modernization of energy and manufacturing infrastructure, further contributed to the strong adoption of desiccant dehumidifier systems in industrial spaces.

The commercial segment is growing at a CAGR of 3.53%, owing to the rising construction of commercial complexes, expansion of e-commerce storage facilities, and increasing focus on energy-efficient indoor climate management. Commercial property managers are using dehumidifiers to maintain indoor comfort, protect infrastructure, and improve air quality. Data centers, in particular, rely on effective dehumidification to prevent equipment failures caused by excess moisture, while warehouses require controlled environments to preserve stored goods.

Key Players & Competitive Analysis Report

The U.S. desiccant dehumidifier industry is competitive, with both large and smaller companies competing for market share. Munters, Aggreko, and Atlas Copco AB are some of the most important companies that offer sophisticated, energy-efficient solutions for industrial and commercial use. Companies like Bry-Air and Condair Group focus on specific markets and offer custom systems for medicines, food processing, and HVAC integration. Parker Hannifin Corporation and Quincy Compressor excel in engineering and utilize their other industrial products to enhance the reliability of their own products. At the same time, foreign companies such as Seibu Giken and XeteX are coming up with new rotor technologies to gain revenue share. To stand out from the competition and take advantage of new opportunities in a wide range of industries, companies are putting more money into research and development and forming strategic alliances.

Major companies operating in the U.S. desiccant dehumidifier industry include Aggreko, Atlas Copco AB, Bry-Air, Condair Group, Fisen Corporation, Munters, Parker Hannifin Corporation, Quincy Compressor, Seibu Giken, and XeteX.

Key Companies

- Aggreko

- Atlas Copco AB

- Bry-Air

- Condair Group

- Fisen Corporation

- Munters

- Parker Hannifin Corporation

- Quincy Compressor

- Seibu Giken

- XeteX

Industry Developments

May 2025, Atlas Copco launched a new range of portable desiccant air dehumidifiers for air treatment in industries working in the toughest conditions.

July 2024, Munter expanded its digital solutions by signing an agreement to acquire the majority share in Automated Environments (AEI), a US-based company specializing in automated control systems for the layer industry.

U.S. Desiccant Dehumidifier Market Segmentation

By Product Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Fixed/Mounted

- Portable

By Application Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Energy

- EV Battery Manufacturing

- Power Plants and Wind Turbines

- Chemical

- Construction

- Electronics

- Food & Pharmaceuticals

By End User Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Commercial

- Industrial

- Others

U.S. Desiccant Dehumidifier Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 139.14 Million |

|

Market Size in 2025 |

USD 144.84 Million |

|

Revenue Forecast by 2034 |

USD 218.59 Million |

|

CAGR |

4.68% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume Thousand Units, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 139.14 million in 2024 and is projected to grow to USD 218.59 million by 2034.

The market is projected to register a CAGR of 4.68% during the forecast period.

A few of the key players in the market are Aggreko, Atlas Copco AB, Bry-Air, Condair Group, Fisen Corporation, Munters, Parker Hannifin Corporation, Quincy Compressor, Seibu Giken, and XeteX.

The fixed/mounted segment dominated the market revenue share in 2024.

The commercial segment is projected to witness the fastest growth during the forecast period.