U.S. Distributed Fiber Optic Sensor Market Size, Share, Trends, & Industry Analysis Report

By Fiber Type, By Operating Principle, By Scattering Process, By Application, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM6226

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

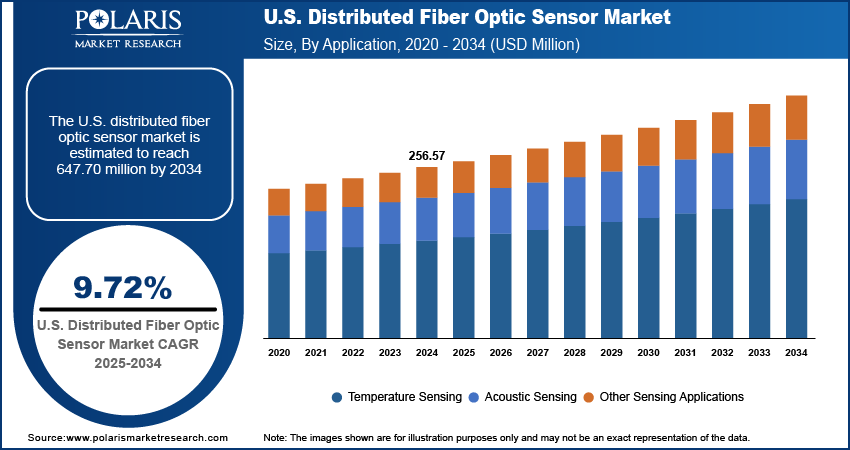

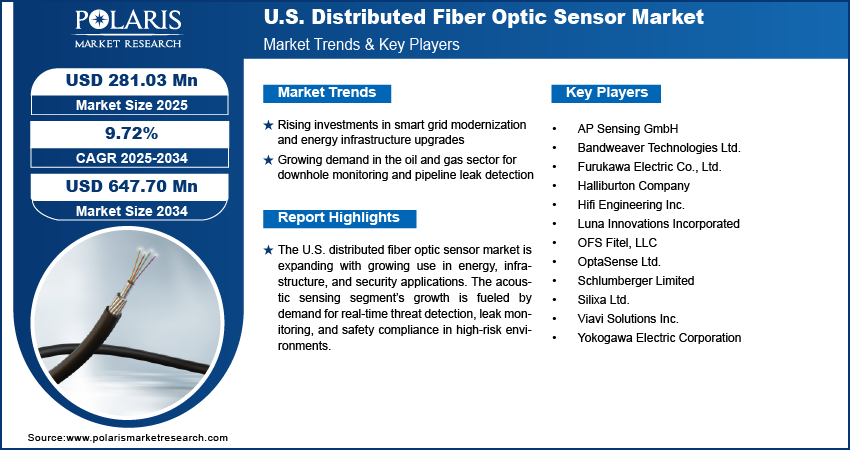

The U.S. distributed fiber optic sensor market size was valued at USD 256.57 million in 2024, growing at a CAGR of 9.72% during 2025–2034. Rising investments in smart grid modernization and energy infrastructure upgrades, coupled with growing demand in the oil and gas sector for downhole monitoring and pipeline leak detection, are driving market growth.

Key Insights

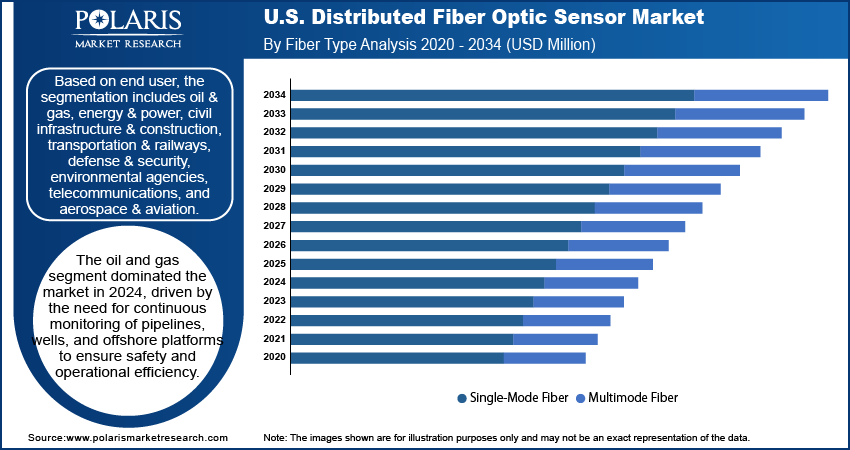

- The single-mode fiber segment dominated the distributed fiber optic sensor market share in 2024, driven by its long-distance transmission capability, low attenuation, and high precision for critical infrastructure monitoring.

- The acoustic sensing segment is projected to grow at the fastest CAGR, fueled by rising demand for real-time intrusion detection, leak monitoring, and vibration analysis across oil & gas, defense, and transportation sectors.

Industry Dynamics

- Rising investments in smart grid modernization and energy infrastructure upgrades are boosting market adoption.

- Growing demand in the oil and gas sector for downhole monitoring and pipeline leak detection is further driving market growth.

- Expansion in renewable energy monitoring in wind farms and solar power plants creates an opportunity for the market in the coming years.

- High initial deployment and integration costs compared to conventional monitoring technologies are hindering the growth of the DFOS industry.

Market Statistics

- 2024 Market Size: USD 256.57 Million

- 2034 Projected Market Size: USD 647.70 Million

- CAGR (2025–2034): 9.72%

AI Impact on U.S. Distributed Fiber Optic Sensor Market

- AI enables real-time monitoring of pipelines and infrastructure, instantly detecting leaks or structural issues to prevent failures and improve safety.

- Machine learning predicts equipment maintenance needs, reducing downtime and repair costs by identifying problems before they disrupt operations.

- Advanced analytics enhance security monitoring, accurately distinguishing intrusions from false alarms along borders and critical assets.

- AI processes vast sensor data efficiently, enabling scalable, cost-effective monitoring networks across large industrial and urban areas.

Distributed fiber optic sensor technology in the U.S. is valued for its ability to provide continuous, real-time monitoring across long distances with high accuracy and reliability. Utilizing optical fibers as both the sensing element and transmission medium, these systems offer immunity to electromagnetic interference, long operational life and minimal maintenance requirements. They are widely applied in industries such as oil and gas, power and utilities, transportation and infrastructure monitoring. For instance, in October 2024, Luna Innovation presented its integrated optical sensing portfolio, including Silixa, OptaSense, and LIOS technologies, for real-time monitoring of wells, pipelines, and reservoirs at ADIPEC 2024 in Abu Dhabi. Manufacturers are investing in advanced interrogation units, enhanced sensing algorithms, and automated calibration processes to improve measurement resolution, reduce signal loss, and optimize system performance. Energy-efficient manufacturing and recyclable components are adopted to meet sustainability targets and comply with environmental standards.

Rising applications of distributed fiber optic sensors are observed in pipeline monitoring, perimeter security, structural health assessment, and downhole well monitoring, driven by their ability to detect temperature, strain, and acoustic changes along the entire length of the fiber. Customized sensing configurations are enhancing performance in high-temperature, high-pressure, and hazardous environments, which are expanding their adoption in offshore energy, rail networks and large-scale industrial facilities. Integration with digital platforms, AI-based data analytics and cloud-based monitoring tools is enabling predictive maintenance and operational efficiency while controlling operational costs.

Infrastructure development projects and increasing investments in energy and transportation sectors in the U.S. are fueling demand for distributed fiber optic sensors. Federal initiatives, such as allocations under the Bipartisan Infrastructure Law (BIL) are promoting technology adoption in smart grid modernization, railway safety upgrades and pipeline integrity programs. Project planners are incorporating DFOS systems into critical infrastructure to improve safety compliance, reduce downtime and extend asset life. Growing focus on sustainable operations is driving the use of low-energy interrogation systems, fiber recycling programs and waste-reducing installation practices. In addition, compliance with safety regulations and the need for cost-effective, high-performance sensing solutions are positioning DFOS technology as a preferred choice for projects requiring accurate, real-time, and long-range monitoring capabilities.

Drivers & Opportunities

Rising investments in smart grid modernization and energy infrastructure upgrades

Rising significant investments in modernizing the U.S. power grid and upgrading energy infrastructure are driving the adoption of distributed fiber optic sensor technology. According to the International Energy Agency (IEA), by late 2023 the Infrastructure Investment and Jobs Act allocated nearly USD 75 billion to clean energy, covering grid upgrades, projects, efficiency programs, and manufacturing. DFOS systems enable continuous, real-time monitoring of transmission lines, substations and underground cables, ensuring early detection of faults and minimizing downtime. Utilities are rapidly integrating DFOS solutions to improve asset management, enhance operational efficiency and meet regulatory compliance for safety and reliability. Federal initiatives, including funding under the Bipartisan Infrastructure Law are accelerating technology deployment in large-scale projects. The shift toward digitalized and resilient energy networks positions DFOS as a critical component of next-generation infrastructure monitoring.

Growing demand in the oil and gas sector for downhole monitoring and pipeline leak detection

The oil and gas industry in the U.S. is adopting distributed fiber optic sensors for advanced downhole monitoring, flow profiling and leak detection to enhance operational safety and efficiency. According to the U.S. Energy Information Administration (EIA), the U.S. crude oil production is expected to fall from about 13.5 million barrels per day in April 2025 to 13.3 million barrels per day by the end of 2026. DFOS technology offers the ability to monitor temperature, strain and acoustic signals along the entire length of a pipeline or wellbore in real time. This capability is essential for preventing environmental hazards, reducing production losses and extending the operational life of assets. Increasing regulatory scrutiny on pipeline integrity and offshore safety is pushing companies to invest in DFOS systems. These sensors provide a cost-effective, accurate and long-range solution for maintaining energy infrastructure reliability.

Segmental Insights

Fiber Type Analysis

Based on fiber type, the segmentation includes single-mode fiber and multimode fiber. The single-mode fiber segment dominated the market in 2024, driven by its ability to transmit data over long distances with minimal signal loss. These fibers are widely used in oil and gas, energy, and infrastructure monitoring projects due to their superior accuracy, high sensitivity, and resistance to electromagnetic interference. Their performance in harsh and remote environments makes them a preferred choice for critical infrastructure monitoring. Ongoing advancements in single-mode fiber manufacturing and coating technologies are further improving durability and signal integrity, solidifying their market leadership across multiple high-value industrial applications.

The multimode fiber segment is projected to grow at the fastest CAGR during the forecast period, due to increasing adoption in short- to medium-range monitoring applications. These fibers are cost-effective, easier to install, and compatible with various sensing equipment, making them suitable for perimeter security, building monitoring, and localized industrial sensing projects. Growing use in civil infrastructure and transportation projects is expanding their market share. Technological improvements are enhancing bandwidth and data transmission efficiency, enabling multimode fibers to deliver reliable sensing performance in complex environments with lower installation and maintenance costs.

Operating Principle Analysis

By operating principle, the segment includes optical time domain reflectometry and optical frequency domain reflectometry. The optical time domain reflectometry segment dominated the U.S. DFOS market in 2024, driven by its capability to provide accurate fault detection, location measurement, and performance monitoring over long distances. OTDR-based systems are extensively used in oil and gas pipelines, power lines, and railway infrastructure due to their robustness and ability to operate in diverse environmental conditions. Their compatibility with single-mode fibers and proven reliability in mission-critical applications further strengthen their market position. Continuous advancements in OTDR algorithms are improving resolution and measurement speed, enhancing their value proposition for large-scale industrial and infrastructure projects.

The optical frequency domain reflectometry segment is expected to record the fastest growth, owing to its high spatial resolution and ability to detect minute changes in strain and temperature. OFDR systems are rapidly used in aerospace, defense, and advanced manufacturing environments where precision is critical. Their capacity to deliver detailed measurement data over shorter distances makes them ideal for structural health monitoring in high-value assets. Rising demand for accurate, localized sensing in smart factories and aerospace components is driving adoption, with manufacturers focusing on integrating OFDR technology into compact, efficient, and cost-effective monitoring solutions.

Scattering Process Analysis

By scattering process, the segment includes the Rayleigh scattering effect, Raman scattering effect, Brillouin scattering effect, and fiber Bragg grating. The Rayleigh scattering effect segment led the U.S. DFOS market in 2024, driven by its suitability for distributed temperature and strain sensing in diverse industries. This process provides continuous monitoring along the entire fiber length, making it ideal for structural health assessment, energy grid monitoring, and perimeter security applications. Its proven performance in long-distance monitoring and compatibility with existing fiber networks further boost adoption. Continuous improvements in data interpretation algorithms are enhancing detection accuracy, enabling Rayleigh scattering–based systems to remain the preferred choice for infrastructure operators requiring cost-effective, real-time monitoring solutions.

The Brillouin scattering effect segment is projected to grow at the fastest CAGR during the forecast period, due to its advanced capabilities in simultaneous strain and temperature measurement over long distances. It is suitable for applications in oil and gas, high-voltage power lines, and geotechnical monitoring. The ability to operate under varying environmental conditions with high accuracy makes it valuable for critical infrastructure. Advancements in Brillouin optical time domain analysis are enhancing measurement range and resolution, driving its adoption in large-scale industrial monitoring and national infrastructure safety programs.

Application Analysis

Based on application, the segmentation includes temperature sensing, acoustic sensing, and other sensing applications. The temperature sensing segment dominated the U.S. DFOS market in 2024, owing to its widespread use in power cable monitoring, oil and gas wellbore analysis, and industrial process control. DFOS systems provide precise temperature profiles along the entire sensing path, enabling early fault detection and prevention of overheating incidents. Their integration into smart grid systems and high-voltage cable networks ensures improved safety and operational efficiency. Increasing regulatory focus on preventing infrastructure failures is further driving demand for temperature sensing applications, pushing their market leadership across energy, utilities, and industrial sectors.

The acoustic sensing segment is projected to register the fastest growth, driven by rising adoption in perimeter intrusion detection, seismic activity monitoring, and leak detection. DFOS acoustic sensing systems detect minute vibrations and convert them into actionable insights for security, safety, and maintenance purposes. The oil and gas, defense, and transportation sectors are rapidly deploying these systems for real-time surveillance and safety compliance. Integration with Artificial Intelligence-powered analytics is enhancing detection accuracy, enabling predictive threat assessment, and improving the efficiency of large-scale monitoring operations.

End User Analysis

By end user, this segment includes oil & gas, energy & power, civil infrastructure & construction, transportation & railways, defense & security, environmental agencies, telecommunications, and aerospace & aviation. The oil and gas segment dominated the U.S. DFOS market in 2024, driven by the need for continuous monitoring of pipelines, wells, and offshore platforms to ensure safety and prevent environmental incidents. DFOS technology enables early detection of leaks, temperature changes, and structural strain, reducing the risk of costly downtime. Compliance with stringent environmental regulations and a growing focus on operational efficiency are accelerating adoption. Investment in exploration and production activities, coupled with aging pipeline infrastructure, is further pushing the segment’s leadership in the U.S. market.

The defense and security segment is anticipated to grow at the fastest pace during the forecast period, due to increasing adoption of DFOS for perimeter surveillance, border security, and critical facility protection. According to SIPRI, the U.S. spent USD 997 billion on defense, nearly 40% of global military spending and more than the next nine countries combined in 2024. China ranked second with USD 314 billion. The ability to detect intrusions, vibrations, and unusual activities over large perimeters makes DFOS a preferred choice for military and homeland security applications. Integration with advanced analytics, unmanned monitoring systems, and networked command centers is enhancing threat detection and response times. Rising investments in defense infrastructure modernization are further driving this segment’s expansion in the U.S. market.

Key Players & Competitive Analysis Report

The U.S. distributed fiber optic sensor industry is moderately competitive, fueled by consistent demand from oil and gas, energy and power, civil infrastructure, and defense applications. Leading manufacturers are focusing on advanced interrogation units, enhanced sensing algorithms, and integrated monitoring platforms to address diverse project needs. Competitive positioning is shaped by investments in AI-driven data analytics, ruggedized fiber designs for harsh environments, and multi-parameter sensing capabilities. Companies are improving operational efficiency through automated calibration systems, modular installation solutions, and cloud-based data integration. Strategic collaborations with utilities, infrastructure operators, and defense agencies are expanding market presence, while sustainability-oriented manufacturing and recyclable fiber materials are enhancing compliance with environmental and safety regulations.

Key companies in the U.S. distributed fiber optic sensor industry include Halliburton Company, Schlumberger Limited, Yokogawa Electric Corporation, OFS Fitel, LLC, Bandweaver Technologies Ltd., Hifi Engineering Inc., Luna Innovations Incorporated, Silixa Ltd., OptaSense Ltd., AP Sensing GmbH, Viavi Solutions Inc., and Furukawa Electric Co., Ltd.

Key Players

- AP Sensing GmbH

- Bandweaver Technologies Ltd.

- Furukawa Electric Co., Ltd.

- Halliburton Company

- Hifi Engineering Inc.

- Luna Innovations Incorporated

- OFS Fitel, LLC

- OptaSense Ltd.

- Schlumberger Limited

- Silixa Ltd.

- Viavi Solutions Inc.

- Yokogawa Electric Corporation

Industry Developments

July 2024: VIAVI Solutions introduced NITRO Fiber Sensing, a platform that uses advanced fiber optic technology to monitor critical infrastructure in real time. It detects threats and equipment problems early, helping reduce outages and costs.

April 2022: Schlumberger Ltd., partnered with Sintela to co-develop advanced fiber-optic sensing solutions. This aims to market this technology across energy, carbon capture, and geothermal sectors, while Sintela will serve other industrial markets.

U.S. Distributed Fiber Optic Sensor Market Segmentation

By Fiber Type Outlook (Revenue, USD Million, 2020–2034)

- Single-Mode Fiber

- Multimode Fiber

By Operating Principle Outlook (Revenue, USD Million, 2020–2034)

- Optical Time Domain Reflectometry

- Optical Frequency Domain Reflectometry

By Scattering Process Outlook (Revenue, USD Million, 2020–2034)

- Rayleigh Scattering Effect

- Raman Scattering Effect

- Brillouin Scattering Effect

- Fiber Brag Grating

By Application Outlook (Revenue, USD Million, 2020–2034)

- Temperature Sensing

- Acoustic Sensing

- Other Sensing Applications

By End User Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Energy & Power

- Civil Infrastructure & Construction

- Transportation & Railways

- Defense & Security

- Environmental Agencies

- Telecommunications

- Aerospace & Aviation

U.S. Distributed Fiber Optic Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 256.57 Million |

|

Market Size in 2025 |

USD 281.03 Million |

|

Revenue Forecast by 2034 |

USD 647.70 Million |

|

CAGR |

9.72% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 256.57 million in 2024 and is projected to grow to USD 647.70 million by 2034.

The U.S. market is projected to register a CAGR of 9.72% during the forecast period.

A few of the key players in the market are Halliburton Company, Schlumberger Limited, Yokogawa Electric Corporation, OFS Fitel, LLC, Bandweaver Technologies Ltd., Hifi Engineering Inc., Luna Innovations Incorporated, Silixa Ltd., OptaSense Ltd., AP Sensing GmbH, and Furukawa Electric Co., Ltd.

The single-mode fiber segment dominated the market in 2024, driven by its ability to transmit data over long distances with minimal signal loss and high measurement accuracy in critical infrastructure monitoring.

The acoustic sensing segment is projected to grow at the fastest CAGR, due to rising adoption in perimeter security, leak detection, and vibration monitoring across oil and gas, defense, and transportation sectors.