U.S. Generative AI Cybersecurity Market Size, Share, Trends, Industry Analysis Report

By Type (Threat Detection & Analysis, Adversarial Defense), By Technology, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6414

- Base Year: 2024

- Historical Data: 2020-2023

Overview

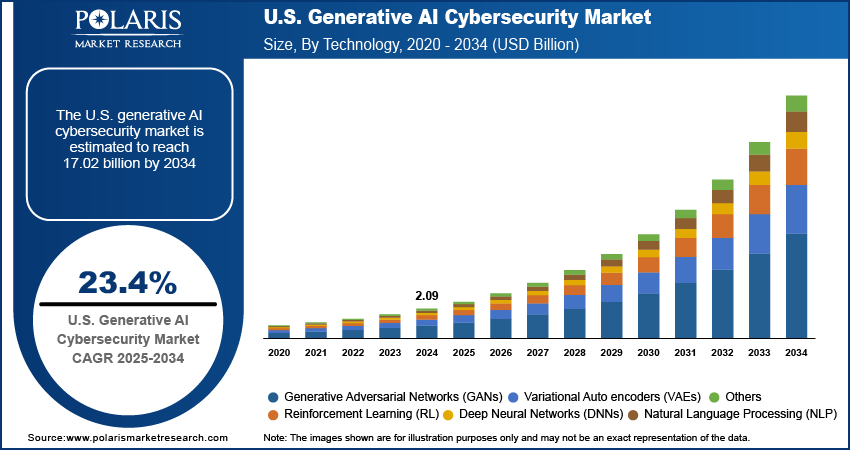

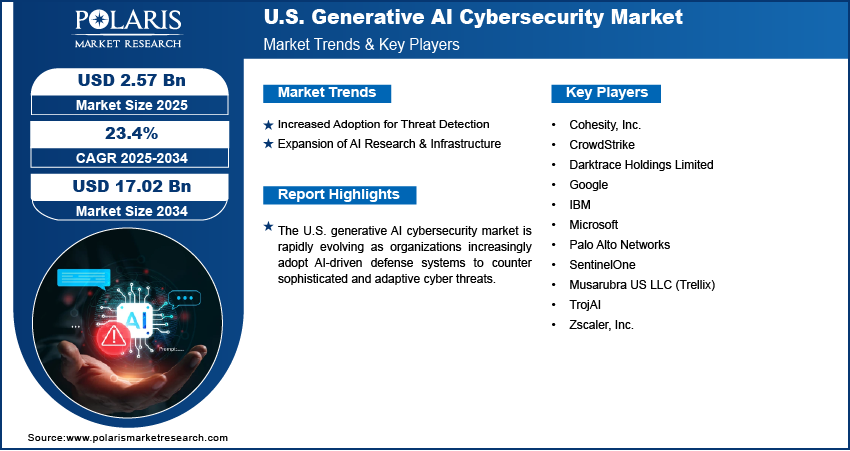

The U.S. generative AI cybersecurity market size was valued at USD 2.09 billion in 2024, growing at a CAGR of 23.4% from 2025 to 2034. Key factors driving demand include rise in targeted attacks on AI assets, stricter data regulations & compliance, increased adoption of generative AI for threat detection, and expansion of AI research and infrastructure across the U.S.

Key Insights

- In 2024, the threat detection segment held the largest market share. Its dominance is attributed to the essential need to identify and stop complex cyberattacks instantly.

- The reinforcement learning segment is projected to grow the fastest. This is due to RL systems' ability to constantly learn and adapt to evolving cyber threats on their own.

- The BFSI sector led the market in 2024. This is a direct result of its vast amounts of sensitive financial data, making it a prime target for attackers.

Industry Dynamics

- The rising complexity of cyberattacks is accelerating the adoption of generative AI for advanced threat detection and predictive breach prevention, moving beyond traditional security limits.

- A parallel need emerges to secure these advanced systems from novel threats, driving market demand, as U.S. AI research and infrastructure expand.

- A major challenge is the "black box". It is hard to trust AI's security decisions when it can't explain its reasoning or sometimes makes mistakes.

- Generative AI can automatically handle routine alerts and write reports, which helps overcome the critical shortage of skilled human cybersecurity workers.

Market Statistics

- 2024 Market Size: USD 2.09 billion

- 2034 Projected Market Size: USD 17.02 billion

- CAGR (2025–2034): 23.4%

Generative AI cybersecurity refers to the application of advanced AI models to detect, predict, and respond to evolving cyber threats by simulating attack scenarios and strengthening defense mechanisms. In the U.S., the market is gaining momentum due to the rise in targeted attacks on AI assets, which has increased the need for adaptive defense frameworks. Cybercriminals are increasingly focusing on exploiting their vulnerabilities as generative AI systems become essential in financial services, healthcare, and government operations. According to a CSIS report, in April 2025, hackers breached a U.S. banking regulator, where they exfiltrated over 150,000 emails from more than 100 staff for over a year, highlighting the critical and growing need for generative AI-powered cyber security defenses. This shift highlights the demand for intelligent cybersecurity measures that protect sensitive AI-driven data and also ensure the reliability and trustworthiness of critical systems. Additionally, the growing sophistication of these attacks is pushing organizations in the U.S. to adopt AI-powered defense strategies capable of continuously learning and evolving in response to dynamic threat landscapes.

Stricter data regulations and compliance requirements are shaping the adoption of generative AI cybersecurity solutions in the U.S. Enterprises face increasing pressure to safeguard personal and sensitive information managed by AI systems with frameworks such as HIPAA, CCPA, and evolving federal guidelines. Generative AI cybersecurity tools are being leveraged to ensure regulatory alignment by automating compliance monitoring, risk assessments, and anomaly detection. The regulatory environment makes businesses secure AI-driven infrastructures and also creates opportunities for advanced AI-based tools that address both compliance and protection requirements simultaneously. As a result, stricter data governance is acting as a catalyst for the adoption of generative AI cybersecurity, reinforcing trust and accountability in AI applications across critical U.S. industries.

Drivers & Opportunities

Increased Adoption for Threat Detection: The increased adoption of generative AI for threat detection is driving the U.S. generative AI cybersecurity market, as organizations aim for more advanced tools to counter increasingly complex cyberattacks. Traditional security frameworks often struggle to identify evolving attack vectors, while generative AI models are capable of simulating threats, detecting anomalies, and predicting potential breaches with higher accuracy. In the U.S., where critical sectors such as finance, defense, and healthcare are frequent targets, the ability to detect threats before they escalate proactively is becoming essential. In August 2024, CrowdStrike integrated its Falcon platform with NVIDIA's NIM Agent Blueprints. This integration provides security safeguards for enterprises developing custom generative AI applications, aiming to protect the models and their underlying data during deployment. This adoption strengthens real-time response capabilities and also minimizes operational risks, making generative AI an essential component of modern cybersecurity strategies.

Expansion of AI Research & Infrastructure: The expansion of AI research and infrastructure across the U.S. is fueling the demand for generative AI cybersecurity. There is a parallel need to secure these advanced infrastructures from cyber risks, with universities, research labs, and technology companies heavily investing in AI innovation. In May 2023, the Cybersecurity and Infrastructure Security Agency (CISA) reported that the National Science Foundation allocated USD 140 million to establish seven new National AI Research Institutes, aiming to advance responsible AI innovation and strengthen U.S. R&D infrastructure and workforce development. Defense-related projects and large-scale data operations, ensuring their protection, become a strategic priority as AI-driven systems handle sensitive intellectual property. Generative AI cybersecurity tools provide adaptive protection tailored to safeguard research assets, data pipelines, and AI models from manipulation or breaches. This expansion in research and infrastructure accelerates AI innovation and also reinforces the role of cybersecurity as a critical enabler of sustainable AI growth in the U.S.

Segmental Insights

Type Analysis

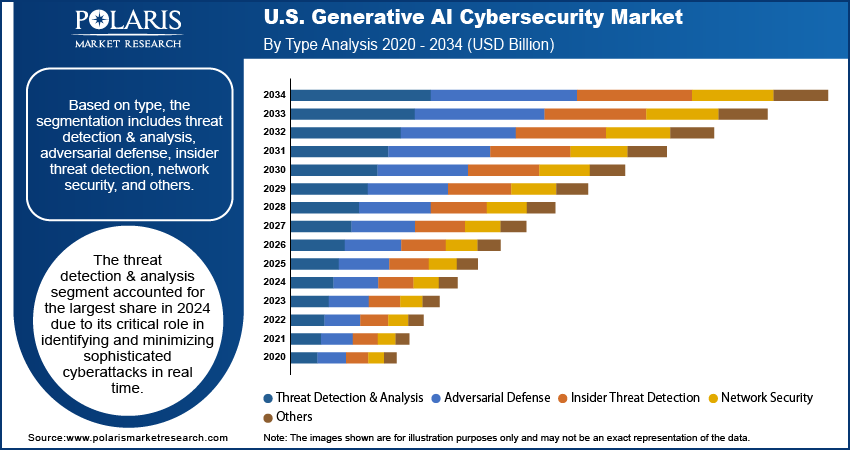

Based on type, the segmentation includes threat detection & analysis, adversarial defense, insider threat detection, network security, and others. The threat detection & analysis segment accounted for the largest share in 2024, due to its critical role in identifying and minimizing sophisticated cyberattacks in real time. In the U.S., organizations face persistent threats ranging from ransomware to state-sponsored attacks, making proactive threat detection essential. Generative AI enhances this capability by simulating potential attack scenarios, identifying anomalies, and providing predictive insights that traditional systems cannot match. Its integration across sensitive sectors such as defense, healthcare, and finance underscores its dominance, as enterprises increasingly rely on advanced AI-driven solutions to maintain resilience against a constantly evolving threat landscape.

Technology Analysis

In terms of technology, the segmentation includes generative adversarial networks (GANs), variational auto encoders (VAEs), reinforcement learning (RL), deep neural networks (DNNs), natural language processing (NLP), and others. The reinforcement learning (RL) segment is expected to witness the fastest growth during the forecast period, driven by its ability to adapt and improve cybersecurity defenses in dynamic environments continuously. RL-based systems in the U.S. are being adopted to create autonomous security models that learn from real-time data and adjust strategies to counter emerging threats without human intervention. This is particularly valuable for protecting large-scale infrastructures such as cloud networks, financial systems, and government databases that require rapid, intelligent responses. Therefore, by enabling AI models to self-optimize and evolve with every interaction, RL is positioning itself as a transformative technology in advancing the effectiveness of generative AI cybersecurity solutions.

End Use Analysis

The segmentation, based on end use, includes banking, financial services, and insurance (BFSI), healthcare & life sciences, government & defense, retail and e-commerce, manufacturing & industrial, it & telecommunications, energy & utilities, others. The banking, financial services, and insurance (BFSI) segment dominated the market in 2024 due to the sector’s high exposure to cyberattacks targeting financial data and digital transactions. The BFSI industry is prioritizing generative AI cybersecurity as a defense mechanism, with increasing adoption of AI-driven platforms for fraud detection, risk management, and secure digital payments. Financial institutions in the U.S. face strict compliance requirements and reputational risks, making robust cybersecurity frameworks a necessity. Moreover, generative AI strengthens fraud prevention, detects anomalous transaction patterns, and secures sensitive financial information, reinforcing its critical role in protecting the integrity and trust of the U.S. financial ecosystem.

Key Players & Competitive Analysis

The U.S. generative AI cybersecurity landscape is defined by intense competition between cloud hyperscalers such as Microsoft and Google, and specialized pure-plays such as CrowdStrike, SentinelOne, and Darktrace. Key vendor strategies focus on embedding AI natively into platforms to automate threat detection and response, creating a substantial revenue opportunity. For small and medium-sized businesses, this democratizes advanced security. Competitive intelligence reveals that strategic investments and partnerships, such as CrowdStrike with NVIDIA, are critical for competitive positioning. Technological advancement is the primary driver, though economic and geopolitical shifts influence public sector adoption. Expert's insight suggests future dominance will belong to platforms that best integrate AI into the entire security system, not just offer point solutions.

A few major companies operating in the U.S. generative AI cybersecurity market include Cohesity, Inc.; CrowdStrike; Darktrace Holdings Limited; Google; IBM; Microsoft; Palo Alto Networks; SentinelOne; Musarubra US LLC (Trellix); TrojAI; and Zscaler, Inc.

Key Players

- Cohesity, Inc.

- CrowdStrike

- Darktrace Holdings Limited

- IBM

- Microsoft

- Palo Alto Networks

- SentinelOne

- Musarubra US LLC (Trellix)

- TrojAI

- Zscaler, Inc.

U.S. Generative AI Cybersecurity Industry Developments

- July 2025: Accenture and Microsoft collaborated to co-invest in generative AI for cybersecurity. The collaboration focuses on SOC modernization, automated AI security, cyber migration, and enhanced IAM to help organizations better mitigate advanced threats and optimize costs.

- August 2024: IBM integrated generative AI into its managed threat detection services. The new Cybersecurity Assistant, built on watsonx, aims to accelerate the identification, investigation, and response to critical security threats for clients.

U.S. Generative AI Cybersecurity Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Threat Detection & Analysis

- Adversarial Defense

- Insider Threat Detection

- Network Security

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Generative Adversarial Networks (GANs)

- Variational Auto encoders (VAEs)

- Reinforcement Learning (RL)

- Deep Neural Networks (DNNs)

- Natural Language Processing (NLP)

- Others

By End Use (Revenue, USD Billion, 2020–2034)

- Banking, Financial Services, And Insurance (BFSI)

- Healthcare & Life Sciences

- Government & Defense

- Retail and E-Commerce

- Manufacturing & Industrial

- IT & Telecommunications

- Energy & Utilities

- Others

U.S. Generative AI Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.09 Billion |

|

Market Size in 2025 |

USD 2.57 Billion |

|

Revenue Forecast by 2034 |

USD 17.02 Billion |

|

CAGR |

23.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 2.09 billion in 2024 and is projected to grow to USD 17.02 billion by 2034.

The market is projected to register a CAGR of 23.4% during the forecast period.

A few of the key players in the market are Cohesity, Inc.; CrowdStrike; Darktrace Holdings Limited; Google; IBM; Microsoft; Palo Alto Networks; SentinelOne; Musarubra US LLC (Trellix); TrojAI; and Zscaler, Inc.

The threat detection & analysis segment accounted for the largest share in 2024.

The reinforcement learning (RL) segment is expected to witness the fastest growth during the forecast period.