U.S. Human Growth Hormone Market Size, Share, Trends, & Industry Analysis Report

By Type (Long-acting, Short-acting & Intermediate-acting), By Route of Administration, By Age, By Disease, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6429

- Base Year: 2024

- Historical Data: 2020-2023

Overview

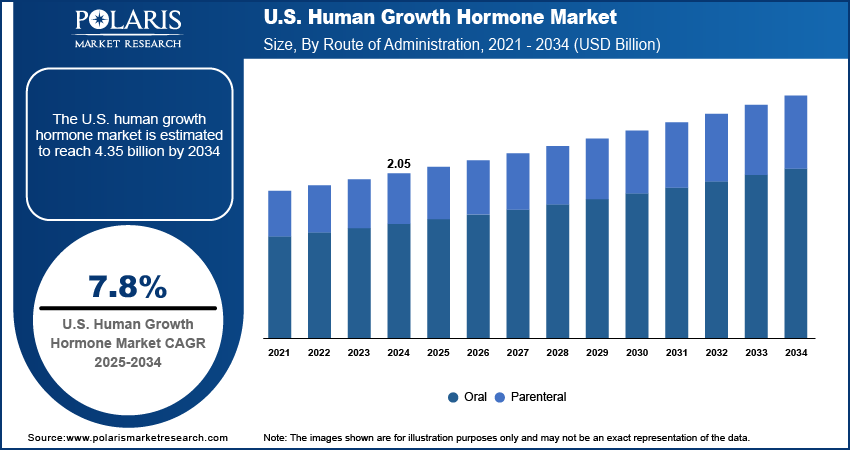

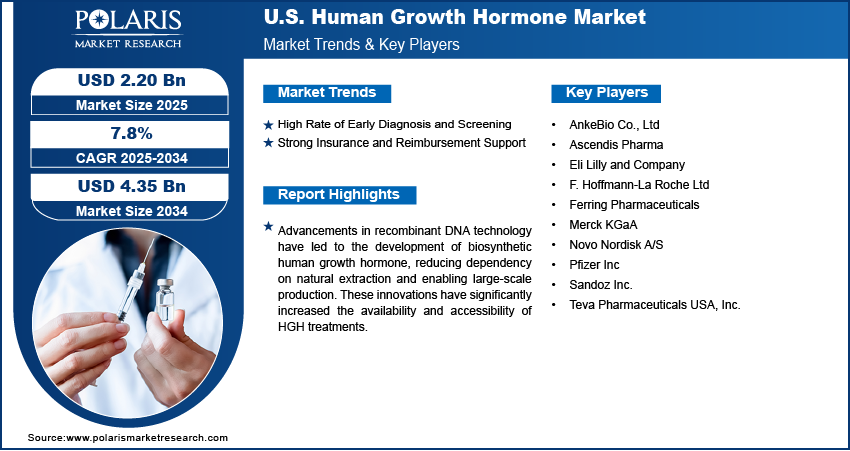

The U.S. human growth hormone market size was valued at USD 2.05 billion in 2024, growing at a CAGR of 7.8% from 2025–2034. Key factors driving demand is high rate of early diagnosis and screening, and strong insurance and reimbursement support.

Key Insights

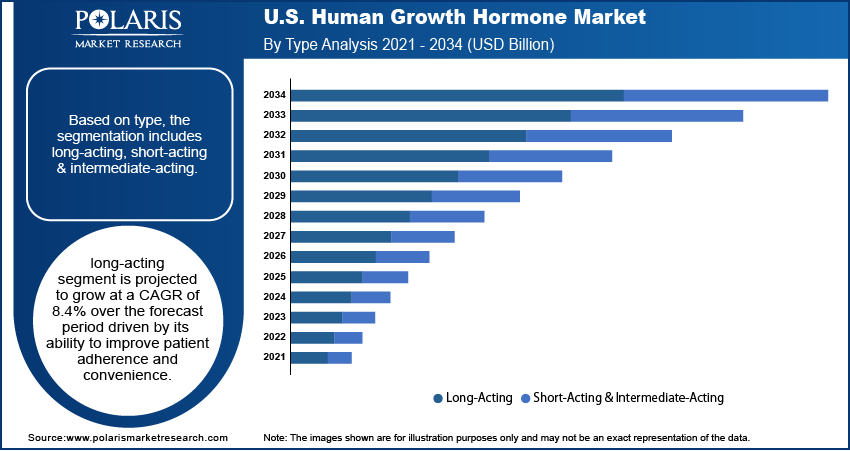

- The long-acting segment is projected to grow at a CAGR of 8.4% during the forecast period, driven by its ease of use and improved patient adherence compared to daily injections.

- The oral segment is expected to capture a notable market share in the coming years, fueled by rising demand for non-invasive treatment alternatives.

- In 2024, the adult segment accounted for 54.64% of the market revenue, supported by growing awareness of adult growth hormone deficiency and related symptoms like fatigue, weight gain, and low bone density.

- The online pharmacies segment held a 14.26% revenue share in 2024, as e-pharmacies emerge as a key distribution channel in the U.S. market, offering patients greater convenience, privacy, and faster delivery of hGH treatments.

Industry Dynamics

- High rate of early diagnosis and screening are driving the demand for HGH.

- Strong insurance and reimbursement support is driving the U.S. Human Growth Hormone Market

- Advancements in recombinant DNA technology have led to the development of biosynthetic human growth hormone, reducing dependency on natural extraction and enabling large-scale production.

- High treatment costs and stringent regulatory requirements restrain the widespread adoption.

Market Statistics

- 2024 Market Size: USD 2.05 Billion

- 2034 Projected Market Size: USD 4.35 Billion

- CAGR (2025-2034): 7.8%

AI Impact on the Industry

- AI enhances patient diagnosis by analyzing medical data to detect growth hormone deficiencies earlier and more accurately.

- AI-driven personalized treatment plans improve dosing accuracy and patient outcomes, optimizing HGH therapy for individual needs.

- AI-powered drug discovery and development accelerate the creation of new and improved HGH formulations, including long-acting therapies.

- AI-based monitoring tools help track patient adherence and response to HGH treatment in real time, enabling timely adjustments and better management.

- Predictive analytics using AI supports supply chain optimization, ensuring timely delivery and reducing costs in HGH distribution.

Human growth hormone is a protein hormone produced by the pituitary gland that stimulates growth, cell reproduction, and regeneration in humans. It plays a crucial role in childhood growth and continues to regulate body composition, muscle and bone growth, and metabolism in adults. Synthetic hGH is used to treat growth disorders in children and hormone deficiencies in adults.

The U.S. is a global leader in adopting new hGH formulations, particularly long-acting therapies that offer weekly or even monthly dosing. These options improve patient convenience, reduce injection frequency, and enhance adherence especially among children and busy adults. Companies like Pfizer, Ascendis Pharma, and Novo Nordisk have launched or are developing advanced hGH therapies tailored to the U.S. FDA approvals for innovative drug delivery systems and strong physician confidence in clinical trial data help speed adoption. This innovation-focused environment fuels the growth in the country.

The U.S. has a well-established pharmaceutical R&D ecosystem, with numerous clinical trials focused on improving human growth hormone therapies. Top universities, research hospitals, and biotech firms collaborate to develop long-acting formulations, oral delivery options, and biosimilars. The FDA’s clear regulatory pathways and incentives for orphan drugs make the U.S. an attractive destination for innovation. This environment helps accelerate time-to-market for new products while maintaining safety and efficacy standards. Continuous investment in R&D supports medical advancement and ensures the U.S. remains at the forefront of hGH therapy development.

Drivers & Opportunities

High Rate of Early Diagnosis and Screening: The U.S. benefits from widespread access to pediatric and adult healthcare, enabling early detection of growth hormone deficiencies. Regular check-ups, school-based health programs, and advanced diagnostic technologies help identify growth disorders at an early stage. Early diagnosis is critical for effective treatment with hGH, particularly in children, where timely intervention can significantly improve outcomes. This focus on preventive care leads to a large number of patients starting therapy early. The structured healthcare framework and proactive medical culture in the U.S. drive strong demand for hGH treatments across all age groups, thereby driving the industry growth in the country.

Strong Insurance and Reimbursement Support: Private insurance plans and government programs like Medicaid and Medicare in the U.S. offer partial or full reimbursement for human growth hormone therapies. This coverage helps reduce the financial burden on patients, especially for expensive long-term treatments. Insurance approval processes for pediatric growth hormone deficiency are well-established, encouraging parents and physicians to initiate therapy early. The strong presence of pharmacy benefit managers (PBMs) also supports access to both branded and biosimilar hGH products. This financial support system fuels treatment adoption and makes the U.S. more attractive for pharmaceutical companies, thereby positively impacting the growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes long-acting, short-acting & intermediate-acting. Long-acting segment is projected to grow at a CAGR of 8.4% over the forecast period due to their convenience and improved patient adherence. Weekly or monthly dosing reduces the burden of daily injections, which is particularly beneficial for children and busy adults. The FDA has approved several long-acting formulations, such as Pfizer's Ngenla, with more in the pipeline from companies like Ascendis Pharma. These therapies are increasingly preferred by healthcare providers due to better compliance and sustained hormone levels. Additionally, the innovation and awareness are growing, further driving the segment growth.

Route of Administration Analysis

Based on route of administration, the segmentation includes oral, and parenteral. Oral segment is expected to witness a significant share over the forecast period due to the growing demand for non-invasive treatment options. Patients often find injections uncomfortable, especially over long treatment periods. U.S. biotech firms are actively working on oral formulations, aiming to overcome challenges like bioavailability and hormone stability. If approved, oral hGH could transform the market by significantly improving treatment adherence. The U.S. regulatory environment and strong R&D investment provide a favorable foundation for innovation in drug delivery, thereby fueling the growth in the segment.

Age Analysis

In terms of age, the segmentation includes pediatric, and adult. The adult held 54.64% of revenue share in 2024 driven by increased awareness of adult growth hormone deficiency and its symptoms such as fatigue, weight gain, and reduced bone density. More adults are being diagnosed due to better screening and patient education. Additionally, hGH is increasingly being considered in treatment plans for muscle-wasting conditions, hormone replacement therapy, and healthy aging. Insurance coverage for adult use is expanding, and endocrinologists are more actively treating hormone-related conditions in adults. These factors are driving demand in the U.S. adult hGH segment.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes hospital pharmacies, retail pharmacies & drug stores, and online pharmacies. The online pharmacies segment held significant revenue share in 2024, holding 14.26% as e-pharmacies are becoming a major distribution channel for hGH in the U.S., offering convenience, privacy, and fast delivery. Many patients prefer ordering medications online, especially for long-term therapies like hGH. The growth of telehealth has made it easier for patients to receive consultations, prescriptions, and follow-up care virtually. Regulatory support for licensed digital pharmacies and increasing trust in online retail platforms are accelerating this shift. Major online pharmacy providers are partnering with hGH manufacturers, improving supply chain efficiency. Online pharmacies is expected to grow as digital health continues to expand, thereby fueling the segment growth.

Key Players & Competitive Analysis

The U.S. human growth hormone (hGH) market is highly competitive, dominated by global pharmaceutical leaders and innovative biotech firms. Pfizer Inc. and Eli Lilly and Company hold strong positions with established hGH therapies and recently approved long-acting formulations, such as Ngenla. Ascendis Pharma is gaining traction with its long-acting pipeline products, aiming to improve dosing convenience. Novo Nordisk A/S and Merck KGaA continue to invest heavily in next-generation delivery systems and adult hGH therapies. Sandoz Inc. and Teva Pharmaceuticals USA, Inc. are leading players in the biosimilar space, increasing affordability and market access. F. Hoffmann-La Roche Ltd and Ferring Pharmaceuticals contribute through niche offerings and innovation in drug delivery. AnkeBio Co., Ltd, though based in Asia, is exploring U.S. market entry through partnerships. Competitive strategies revolve around long-acting formulations, biosimilar expansion, and patient-centric solutions, all underpinned by a favorable regulatory landscape and high treatment demand across pediatric and adult segments.

Key Players

- AnkeBio Co., Ltd

- Ascendis Pharma

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd

- Ferring Pharmaceuticals

- Merck KGaA

- Novo Nordisk A/S

- Pfizer Inc

- Sandoz Inc.

- Teva Pharmaceuticals USA, Inc.

Industry Developments

July 2025, Ascendis Pharma A/S announced that the U.S. Food & Drug Administration (FDA) has approved SKYTROFA (lonapegsomatropin-tcgd; developed as TransCon hGH) for the replacement of endogenous growth hormone in adults with growth hormone deficiency (GHD), a rare disorder resulting from decreased or total loss of growth hormone production.

July 2025, Eli Lilly and Company successful completed the acquisition of Verve Therapeutics, Inc. Verve is a Boston-based clinical-stage company developing genetic medicines for cardiovascular disease.

U.S. Human Growth Hormone Market Segmentation

By Type Outlook (Revenue, USD Billion, 2021–2034)

- Long-acting

- Short-acting & Intermediate-acting

By Route of Administration Outlook (Revenue, USD Billion, 2021–2034)

- Oral

- Parenteral

- Intravenous

- Subcutaneous

- Intramuscular

By Age Outlook (Revenue, USD Billion, 2021–2034)

- Pediatric

- Adult

By Disease Outlook (Revenue, USD Billion, 2021–2034)

- Growth Hormone Deficiency

- Pediatric GHD

- Adult GHD

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2021–2034)

- Hospital Pharmacies

- Retail Pharmacies & Drug Stores

- Online Pharmacies

U.S. Human Growth Hormone Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.05 Billion |

|

Market Size in 2025 |

USD 2.20 Billion |

|

Revenue Forecast by 2034 |

USD 4.35 Billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.05 billion in 2024 and is projected to grow to USD 4.35 billion by 2034.

The U.S. market is projected to register a CAGR of 7.8% during the forecast period.

A few of the key players in the market are AnkeBio Co., Ltd; Ascendis Pharma; Eli Lilly and Company; F. Hoffmann-La Roche Ltd; Ferring Pharmaceuticals; Merck KGaA; Novo Nordisk A/S; Pfizer Inc; Sandoz Inc.; Teva Pharmaceuticals USA, Inc.

The long-acting segment dominated the market revenue share in 2024.

The online pharmacy segment is projected to witness the fastest growth during the forecast period.