U.S. Immunoassay Market Size, Share, Trends, & Industry Analysis Report

By Product (Reagents & Kits, Analyzers/Instruments), By Technology, By Specimen, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM5006

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

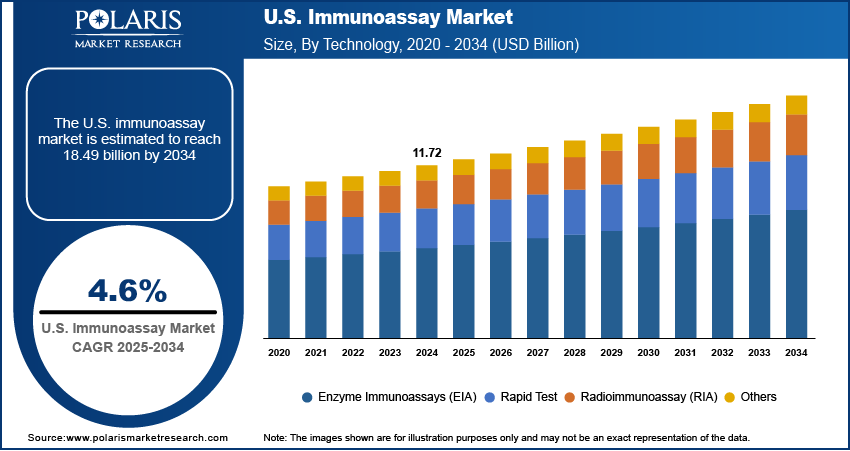

The U.S. immunoassay market size was valued at USD 11.72 billion in 2024, growing at a CAGR of 4.6% from 2025 to 2034. The market is being driven by rapidly aging population and rising cases of chronic and infectious diseases, both demanding accurate diagnostics. Simultaneously, technological breakthroughs in automation, multiplex testing, and sensitivity are transforming testing capabilities and efficiency.

Key Insights

- The reagents & kits segment accounted for USD 7.46 billion revenue share in 2024 due to their recurring demand in both clinical diagnostics and research applications.

- The rapid test segment is projected to register a CAGR of 4.2% during the forecast period, driven by the increasing demand for point-of-care testing and the need for immediate clinical decision-making.

- The blood segment accounted for USD 6.76 billion revenue share in 2024, attributed to its high diagnostic value and widespread use in detecting a broad range of biomarkers.

- The infectious disease testing segment accounted for 45.01% market share in 2024, owing to the ongoing need for rapid and reliable diagnostic tools to manage communicable diseases.

- The laboratories segment is projected to hold 31.64% share of the market by 2034, driven by the growing trend of outsourcing diagnostic services and increasing specialization in clinical testing.

Industry Dynamics

- Rising cases of chronic and infectious diseases are fueling immunoassay demand, as early and precise diagnostics become critical for effective treatment and disease management.

- Breakthroughs in immunoassay technology, such as automation, multiplex testing, and improved detection, are boosting growth by delivering faster, more accurate, and efficient diagnostic solutions for clinical and research applications.

- High costs of advanced immunoassay systems limit adoption in smaller labs, creating accessibility gaps despite growing diagnostic needs.

- Automation and AI integration can cut operational costs while improving accuracy, opening doors for scalable, affordable testing solutions.

Market Statistics

- 2024 Market Size: USD 11.72 billion

- 2034 Projected Market Size: USD 18.49 billion

- CAGR (2025–2034): 4.6%

To Understand More About this Research: Request a Free Sample Report

An immunoassay is a biochemical test that is used to measure the presence or concentration of macromolecules or small molecules in a solution using an antibody or antigen. The U.S. immunoassay market is witnessing substantial momentum, primarily driven by the growing aging population. Aging people become more susceptible to chronic conditions, infections, and degenerative diseases that require regular monitoring and early detection. According to a June 2025 report by the U.S. Census Bureau, the senior population in America (aged 65 and above) increased by 3.1%, reaching 61.2 million between 2023 to 2024. This demographic expansion reflects ongoing aging trends with important implications for healthcare demand and service needs. The demand for precise, efficient, and noninvasive diagnostic tools, such as immunoassays, grows as the population ages. Additionally, their ability to detect biomarkers at an early stage makes them essential in managing age-associated illnesses, ultimately driving wider adoption across healthcare environments.

The expanding adoption of these assays in clinical diagnostics and research laboratories boosts the growth opportunities. Laboratories are increasingly utilizing immunoassay techniques for high-throughput screening, disease monitoring, and therapeutic drug monitoring, driven by advances in the life sciences and molecular biology. In October 2023, Quanterix's Lucent Diagnostics expanded its LucentAD line with a high-accuracy p-Tau 217 blood test for Alzheimer's. This immunoassay-based LDT detects amyloid pathology, providing a scalable solution for assessing memory impairment. These assays offer high specificity and sensitivity, making them suitable for a wide range of applications, from infectious disease detection to oncology research. Moreover, the integration of automated platforms and multiplexing capabilities has enhanced the operational efficiency and scalability of immunoassays, reinforcing their critical role in both clinical and research-based diagnostic workflows.

Drivers & Opportunities

Increasing Prevalence of Chronic and Infectious Diseases: The increasing prevalence of chronic and infectious diseases is driving the demand for immunoassays, as it boosts the need for early and accurate diagnostic solutions. In February 2024, the CDC reported that 129 million Americans (42%) have two or more chronic diseases, while 12% suffer from five or more, highlighting the growing burden of multimorbidity in the U.S. Chronic conditions such as cardiovascular diseases, diabetes, and cancer require continuous monitoring and timely diagnosis to guide treatment decisions and improve patient outcomes. Similarly, infectious diseases call for rapid identification to prevent transmission and ensure effective management. Immunoassays, known for their high sensitivity and specificity, are well-suited for detecting disease biomarkers, enabling clinicians to diagnose conditions at early stages. This growing clinical need is steadily boosting the adoption of immunoassay techniques across healthcare systems.

Technological Advancements in Immunoassay Methods: Technological advancements in immunoassay methods are accelerating the market growth by enhancing the efficiency, speed, and accuracy of diagnostic processes. Innovations such as automated platforms, multiplex assay systems, and enhanced signal detection technologies have expanded the capabilities of immunoassays in both clinical and research environments. In May 2025, Revvity launched its IDS i20 platform, a fully automated chemiluminescence immunoassay (ChLIA) system. It consolidates 20 specialty tests, including those for Alzheimer’s, autoimmune, and infectious diseases, onto one high-throughput instrument, replacing manual/semi-automated methods. These developments reduce manual errors, increase throughput, and enable the simultaneous detection of multiple analytes, thereby improving workflow efficiency in laboratories. Additionally, the integration of digital data management systems and connectivity features supports better clinical decision-making, reinforcing the adoption of next-generation immunoassay platforms in the U.S. market.

Segmental Insights

Product Analysis

Based on product, the U.S. immunoassay market segmentation includes reagents & kits, analyzers/instruments, and software & services. The reagents & kits segment accounted for USD 7.46 billion in revenue in 2024 due to their recurring demand in both clinical diagnostics and research applications. These products are essential for conducting immunoassays and are used across a wide range of test formats, such as ELISA, lateral flow, and chemiluminescent assays. The growing prevalence of chronic and infectious diseases has necessitated routine testing, thereby driving consistent consumption of reagents and kits. Additionally, advancements in assay formulations and increased availability of disease-specific kits have further boosted segment growth, making them an essential component of immunoassay workflows.

The analyzers/instruments segment is projected to grow at a robust pace in the coming years, driven by increasing demand for automation, precision, and high-throughput diagnostic systems. Clinical laboratories and hospitals are increasingly adopting advanced analyzers that efficiently process large volumes of samples, thereby reducing turnaround times and enhancing diagnostic accuracy. Technological innovations such as integration with data management software and connectivity features are further enhancing instrument functionality. This shift toward laboratory automation and standardized testing protocols is anticipated to drive the demand for immunoassay analyzers across healthcare facilities.

Technology Analysis

In terms of technology, the U.S. immunoassay market segmentation includes enzyme immunoassays (EIA), rapid test, radioimmunoassay (RIA), and others. The enzyme immunoassays (EIA) segment held 54.93% share of the market in 2024 due to their broad applicability, high sensitivity, and compatibility with both manual and automated platforms. EIAs are extensively used in diagnostic testing for various diseases, such as infectious, endocrine, and autoimmune conditions. Their ability to detect low concentrations of analytes with consistent accuracy has positioned them as a preferred method in clinical laboratories. Furthermore, continuous improvements in assay design and reagent stability have strengthened their utility in large-scale testing scenarios, contributing to their dominant position.

The rapid test segment is projected to register a CAGR of 4.2% during the forecast period, driven by the increasing demand for point-of-care testing and the need for immediate clinical decision-making. These tests are especially valuable in emergency environments, outpatient clinics, and remote areas where access to centralized labs may be limited. Their user-friendly format, minimal sample requirement, and ability to deliver quick results without specialized equipment are major factors fueling their adoption. The growing focus on decentralized testing and preventive healthcare is expected to support the growth of rapid immunoassays across various healthcare segments.

Specimen Analysis

The U.S. immunoassay market segmentation, based on specimen, includes blood, urine, saliva, and others. The blood segment accounted for USD 6.76 billion in revenue in 2024, attributed to its high diagnostic value and widespread use in detecting a broad range of biomarkers. Blood specimens offer accurate insights into a patient's physiological and pathological state, making them ideal for extensive testing in areas such as cardiology, oncology, and infectious diseases. Immunoassays based on blood samples offer superior sensitivity and specificity, enabling the early detection and effective monitoring of diseases. Additionally, the standardized collection and processing procedures for blood samples contribute to their reliability and preference across diagnostic laboratories.

The urine segment is projected to capture 24.29% share of the market by 2034 due to its noninvasive nature and ease of sample collection, particularly in large-scale screening and routine health monitoring. Urine-based immunoassays are increasingly being used for pregnancy detection, drug abuse testing, and infectious disease screening. The growing awareness around preventive diagnostics and patient compliance, particularly in pediatric and geriatric populations, is enhancing the demand for urine-based testing. Furthermore, advancements in assay sensitivity have improved the detection capabilities of urine specimens, contributing to their rising share.

Application Analysis

In terms of application, the segmentation includes infectious disease testing, cardiology, oncology, endocrinology, autoimmune diseases, therapeutic drug monitoring, and others. The infectious disease testing segment accounted for 45.01% market share in 2024, owing to the ongoing need for rapid and reliable diagnostic tools to manage communicable diseases. Immunoassays play a critical role in identifying pathogens and monitoring disease progression, especially in clinical and public health environments. Their ability to deliver timely results with high accuracy is essential in controlling disease outbreaks and guiding therapeutic interventions. The demand for specific and sensitive immunoassay platforms remains consistently high across diagnostic laboratories and healthcare institutions as new infectious agents continue to emerge.

The cardiology segment is expected to grow at a robust pace during the forecast period, driven by the increasing incidence of cardiovascular disorders and a growing focus on early risk assessment. Immunoassays are widely used to measure cardiac biomarkers such as troponins and natriuretic peptides, which are vital for diagnosing acute myocardial infarction and heart failure. The growing adoption of these tests in emergency departments and critical care units, coupled with advancements in biomarker discovery, is driving the expansion of this segment. This trend is further supported by the integration of immunoassay-based testing into routine cardiac health assessments.

End Use Analysis

Based on end use, the segmentation includes hospitals, laboratories, and others. The hospitals segment accounted for USD 6.41 billion in revenue in 2024, attributed to the high volume of diagnostic procedures conducted in these settings and the availability of advanced infrastructure. Hospitals rely heavily on immunoassay-based diagnostics for patient screening, disease confirmation, and therapy monitoring, particularly in emergency and inpatient care units. Their access to skilled personnel and high-throughput analyzers enables efficient testing and informed clinical decisions. Additionally, the integration of laboratory services within hospital systems supports the continued use of immunoassay technologies for a wide range of applications.

The laboratories segment is projected to capture 31.64% share of the market by 2034, driven by the growing trend of outsourcing diagnostic services and increasing specialization in clinical testing. Independent and reference laboratories are adopting refined immunoassay platforms to meet the rising demand for precise and scalable testing solutions. These facilities often handle large test volumes and require technologies that ensure reliability, automation, and data integration. Therefore, as healthcare systems continue to highlight cost efficiency and quality, laboratories are well-positioned to recreate a central role in the expanded use of immunoassays.

Key Players & Competitive Analysis

The U.S. immunoassay sector is witnessing intense competition as various major players, such as Abbott and Thermo Fisher Scientific, capitalize on revenue growth by investing in automation, high-throughput systems, and emerging technologies, such as chemiluminescent immunoassays (CLIA) and multiplex testing. These strategic investments are reshaping industry trends, unlocking expansion opportunities for both established firms and small and medium-sized businesses. The rising latent demand for advanced diagnostics in neurology and oncology, where biomarker detection presents a significant revenue opportunity, drives the growth opportunities. While developed markets prioritize precision and scalability, emerging market segments demand affordable and rapid solutions, pushing companies to adapt their product offerings to meet diverse needs. Vendors are leveraging competitive intelligence to refine their strategies, focusing on AI-driven analytics, sustainable value chains, and localized manufacturing to counteract supply chain disruptions and maintain their competitive positioning. Expert insights highlight the impact of economic and geopolitical shifts on reagent sourcing, prompting a shift toward resilient production networks. Additionally, collaborations with academic institutions are accelerating innovation, aligning with future development strategies.

A few major companies operating in the U.S. immunoassay industry include Abbott; Agilent Technologies, Inc.; BD; Beckman Coulter, Inc.; Bio-Rad Laboratories, Inc.; DH Life Sciences, LLC.; Dynex Technologies, Inc.; Quanterix; QuidelOrtho Corporation; and Thermo Fisher Scientific Inc.

Key Players

- Abbott

- Agilent Technologies, Inc.

- BD

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- DH Life Sciences, LLC.

- Dynex Technologies, Inc.

- Quanterix

- QuidelOrtho Corporation

- Thermo Fisher Scientific Inc.

U.S. Immunoassay Industry Developments

- March 2025: Beckman Coulter Diagnostics' DxC 500i Clinical Analyzer, an integrated chemistry and immunoassay system, received FDA 510(k) clearance. It boosts lab efficiency with high throughput and accuracy for faster diagnostics, offering 800 chemistry and 100 immunoassay tests/hour.

- July 2024: Fujirebio (H.U. Group) launched the Lumipulse G GFAP assay (RUO) for its automated LUMIPULSE G systems. This CLEIA-based test quantifies GFAP in plasma/serum in 35 minutes, available in the U.S. and Japan, with Europe/other regions.

U.S. Immunoassay Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Reagents & Kits

- ELISA Reagents & Kits

- Rapid Test Reagents & Kits

- Western Blot Reagents & Kits

- ELISPOT Reagents & Kits

- Other Reagents & Kits

- Analyzers/Instruments

- Open Ended Systems

- Closed Ended Systems

- Software & Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Enzyme Immunoassays (EIA)

- Chemiluminescence Immunoassays (CLIA)

- Fluorescence Immunoassays (FIA)

- Rapid Test

- Radioimmunoassay (RIA)

- Others

By Specimen Outlook (Revenue, USD Billion, 2020–2034)

- Blood

- Urine

- Saliva

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Infectious Disease Testing

- Cardiology

- Oncology

- Endocrinology

- Autoimmune Diseases

- Therapeutic Drug Monitoring

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Laboratories

- Others

U.S. Immunoassay Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.72 Billion |

|

Market Size in 2025 |

USD 12.32 Billion |

|

Revenue Forecast by 2034 |

USD 18.49 Billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 11.72 billion in 2024 and is projected to grow to USD 18.49 billion by 2034.

The market is projected to register a CAGR of 4.6% during the forecast period.

A few of the key players in the market are Abbott; Agilent Technologies, Inc.; BD; Beckman Coulter, Inc.; Bio-Rad Laboratories, Inc.; DH Life Sciences, LLC.; Dynex Technologies, Inc.; Quanterix; QuidelOrtho Corporation; and Thermo Fisher Scientific Inc.

The reagents & kits segment accounted for USD 7.46 billion revenue share in 2024.

The rapid test segment is projected to register a CAGR of 4.2% during the forecast period.

The enzyme immunoassays (EIA) segment held the highest revenue share in the market in 2023.