U.S. Industrial Fans Market Size, Share, Trends, Industry Analysis Report

By Product (Centrifugal Fans, Axial Fans), By Flow Capacity, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6309

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

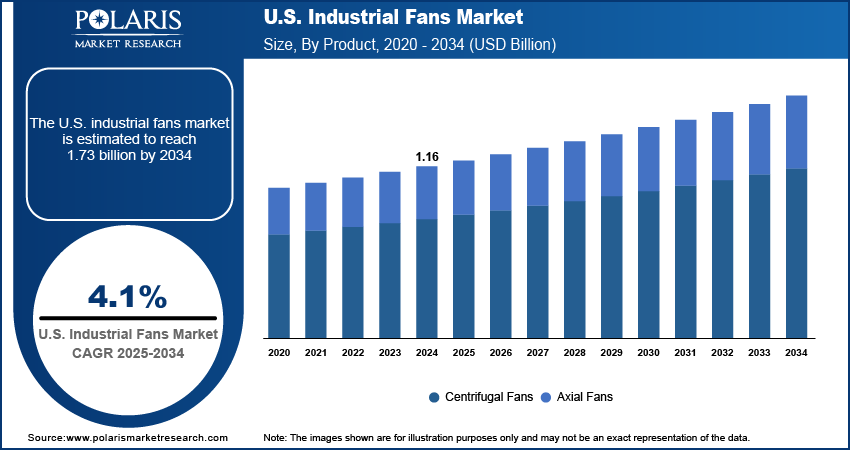

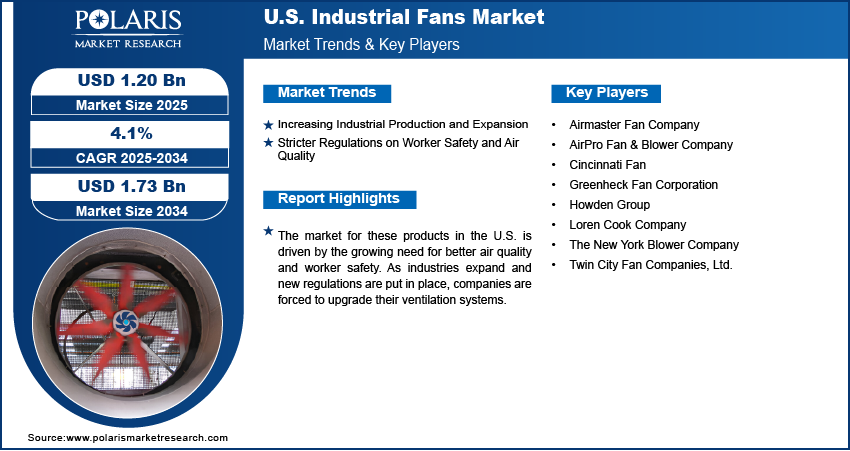

The U.S. industrial fans market size was valued at USD 1.16 billion in 2024 and is anticipated to register a CAGR of 4.1% from 2025 to 2034. The market demand is mainly driven by the growing need for better workplace ventilation and air quality across various industries. Stricter government rules for worker safety and air quality also push companies to use better ventilation systems. In addition, the push for more energy-efficient and sustainable solutions is a key growth factor, as businesses seek ways to lower their energy costs.

Key Insights

- By product, the centrifugal fans segment held the largest share of the U.S. industrial fans market in 2024. This growth was driven by their high efficiency, durability, and ability to handle harsh environments, making them ideal for heavy-duty industrial applications across sectors such as manufacturing, mining, and HVAC.

- By flow capacity, the medium flow capacity segment held the largest market share in 2024. This dominance was fueled by rising demand across mid-sized industrial facilities seeking balanced airflow solutions that offer energy efficiency, operational flexibility, and compatibility with diverse industrial ventilation systems.

- By application, the ventilation application segment held the largest market share as industrial fans are crucial for keeping workplace safety.

- By end use, the manufacturing segment is the biggest consumer of the U.S. industrial fans market.

Industry Dynamics

- Growing need for better worker safety and health boosts the U.S. industrial fans market growth. Stricter rules from government bodies such as OSHA require companies to improve workplace air quality to protect employees from contaminants and high temperatures. This leads to more demand for effective ventilation systems.

- The push for energy efficiency is another major factor. Businesses seek ways to reduce energy costs and meet sustainability goals. Modern industrial fans with features such as variable speed drives and improved motor designs help achieve this by using less power while still providing strong airflow.

- Expansion in key industrial sectors also boosts demand. As industries such as manufacturing, food & beverage, and warehousing grow, they need more and better ventilation solutions for their large facilities. This trend supports the market growth for fans used in cooling, drying, and general air circulation.

Market Statistics

- 2024 Market Size: USD 1.16 billion

- 2034 Projected Market Size: USD 1.73 billion

- CAGR (2025–2034): 4.1%

AI Impact on U.S. Industrial Fans Market

- Manufacturers in the U.S. are embedding AI-powered sensors to monitor vibration, temperature, and airflow.

- AI systems adjust fan direction and speed using real-time environmental data such as heat output, humidity, and worker movement.

- Driven by the Department of Energy mandates, manufacturers in the country use AI-based fans to comply with strict energy-saving targets.

- Smart fans integrated with IoT and AI technologies are becoming standard in various sectors such as food processing, automotive, and chemical manufacturing.

Industrial fans are mechanical devices that move air or gas in an industrial setting. They are built with strong materials to handle harsh conditions and provide high airflow and pressure. These fans are used for many purposes, such as ventilation, cooling, and managing dust and fumes in places such as factories, warehouses, and power plants.

The increasing use of automation in manufacturing and other industries is driving the U.S. industrial fans market growth. As companies adopt automated processes, they need specialized fans to cool down electronic equipment and control temperatures in specific work zones. This is especially important in data centers and clean rooms where precise air control is needed to protect sensitive technology.

Another growing factor is the demand for custom solutions. Businesses often need fans that are designed for unique environments, like those with corrosive materials or extreme temperatures. These fans must be made to fit specific needs and meet strict safety standards. For instance, the NIH has noted the importance of specialized ventilation to handle biohazards in research labs, which drives the demand for custom-built, high-performance fans.

Drivers and Trends

Increasing Industrial Production and Expansion: The expansion of key industries such as manufacturing, warehousing, and logistics is a major driver. As these sectors grow, they require more facilities that need reliable ventilation and temperature control. Industrial fans are crucial for maintaining proper airflow, which helps keep equipment from overheating and ensures a safe, productive workspace for employees. Therefore, the ongoing need for modern infrastructure in these growing sectors drives the demand for these fans.

According to a U.S. Census Bureau report from May 2025, U.S. manufactured goods exports reached $1,638.11 billion in 2024, with durable goods exports hitting an all-time high of $1,039.51 billion. This growth shows a need for greater production capacity, which propels the need for industrial fans in new and expanded manufacturing plants. This trend shows how growth in industrial output is driving the demand for industrial fan systems.

Stricter Regulations on Worker Safety and Air Quality: Government rules focused on improving worker safety and air quality are a significant driver for the U.S. industrial fans market. Agencies such as the Occupational Safety and Health Administration (OSHA) set and enforce standards to protect workers from hazards such as harmful fumes, dust, and extreme heat. Companies must follow these rules, which often means they need to invest in high-performance ventilation systems to comply. The constant updating and enforcement of these regulations create a steady demand for modern industrial fans.

The Bureau of Labor Statistics, in its "Employer-reported Workplace Injuries and Illnesses" report for 2023, noted a decrease in total recordable cases. Still, it also highlighted the ongoing need for workplace safety measures. The report shows that industries such as manufacturing and transportation/warehousing still account for a significant number of work-related injuries and illnesses, with about 17% and 21% of cases coming from these sectors, respectively. This instance shows that regulators are still focused on these areas, and that companies need to invest in devices for better air quality to protect their workers.

Segmental Insights

Product Analysis

Based on product, the U.S. industrial fans market segmentation includes centrifugal fans and axial fans. The centrifugal fans segment held the largest share in 2024. These fans are known for their ability to create high pressure and handle complex systems with ducts. This factor makes them perfect for moving air through filters, scrubbers, and long pipe systems. Their tough build and ability to work well in harsh conditions, such as those with dust, smoke, or other pollutants, make them a top choice for industries such as manufacturing, mining, and chemical processing. This consistent demand from heavy industries, where high pressure and reliable performance are a must, solidifies this segment's leading position.

The axial fans segment is anticipated to register the highest growth rate during the forecast period. This is mainly because these fans are good at moving large volumes of air with less power, making them highly energy-efficient. Their compact design and lower cost also make them a popular choice for a variety of applications where high pressure is not needed. The rise of new data centers and the growing need for cooling solutions in commercial buildings are major factors driving the demand for these fans. Additionally, improvements in technology and the development of quieter, more efficient axial fans are making them more attractive for use in general ventilation and air circulation.

Flow Capacity Analysis

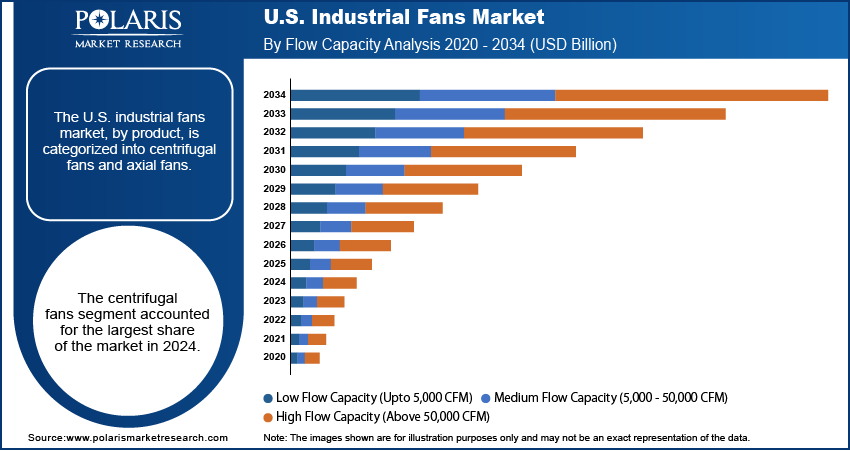

Based on flow capacity, the U.S. industrial fans market segmentation includes low flow capacity (upto 5,000 CFM), medium flow capacity (5,000 - 50,000 CFM), and high flow capacity (above 50,000 CFM). The medium flow capacity segment held the largest share in 2024. This is primarily attributed to its versatility and broad application across a wide range of industries. These fans are powerful enough for many common industrial tasks like general ventilation in workshops, warehouses, and factories, but are also energy efficient for their output. They are the go-to solution for facilities that need a balance between strong air movement and lower operating costs. This balance makes them a popular and dominant choice, especially in sectors that are not engaged in very heavy-duty or specialized processes that would require an extremely high flow rate.

The high flow capacity segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing size and scale of modern industrial facilities, such as large data centers, power plants, and advanced manufacturing complexes. These large-scale operations need powerful fans to manage heat, control air quality monitoring systems, and ensure proper air circulation throughout massive spaces. The demand is also growing for fans used in specialized applications like tunnel ventilation and industrial drying, which require a significant volume of airflow. The push for more efficient and powerful systems in these expanding industries is a key factor boosting the growth of this segment.

Application Analysis

Based on application, the segmentation includes ventilation, cooling, drying, and material handling. The ventilation segment held the largest share in 2024. Industrial fans are essential for maintaining proper airflow and air quality across a wide range of settings, from manufacturing plants to warehouses and commercial buildings. The need to remove pollutants, fumes, and excess heat, as well as to ensure a safe and comfortable working environment, makes ventilation a core function for industrial fans. Strict government regulations on workplace air quality further support this demand, forcing businesses to invest in reliable and effective ventilation systems. As almost every industrial and commercial facility needs some form of air movement and quality control, ventilation fans have a very broad and consistent market.

The cooling application segment is anticipated to register the highest growth rate during the forecast period. This trend is driven by the increasing use of technology and machinery that generate significant amounts of heat, such as in data centers and high-tech manufacturing. As these industries expand, the need for effective and precise cooling solutions becomes more important. Industrial fans play a crucial role in lowering equipment temperatures, which helps prevent system failures and boosts performance. Moreover, a growing focus on energy efficiency and sustainability has led to the development of more advanced cooling fans that use less power, which makes them a popular choice for new and upgraded facilities looking to reduce energy costs.

End Use Analysis

Based on end use, the segmentation includes manufacturing, food & beverage, oil & gas, cement, chemical & petrochemical, power generation, mining, and others. The manufacturing segment held the largest share in 2024. Manufacturing facilities, including those for automobiles, electronics, and various goods, use fans for a number of purposes. This includes general ventilation to remove heat and pollutants, as well as more specific applications like cooling machinery and drying products on a production line. The sheer number of manufacturing plants and the importance of maintaining a safe and productive environment in these places means that the demand for industrial fans is always high. This continuous need makes the manufacturing sector the biggest consumer of industrial fans in the U.S.

The power generation end-use segment is anticipated to register the highest growth rate during the forecast period. This is largely driven by the increasing need for energy and the expansion of power generation facilities, including both traditional and renewable energy plants. Industrial fans are crucial in these settings for processes such as cooling generators, managing combustion air, and controlling temperatures within the facility. As the U.S. continues to invest in new power infrastructure and upgrades to existing plants, the demand for powerful and reliable fans for these operations grows. The high-performance and specialized nature of fans required for power generation, combined with ongoing growth in the energy sector, is boosting this segment's demand.

Key Players and Competitive Insights

The U.S. industrial fans market includes several key players who are competing on factors such as product innovation, performance, and customer service. The landscape is marked by a mix of large, well-established companies with extensive product portfolios and smaller, more specialized firms that focus on niche applications. Many companies are putting money into developing more energy-efficient and smart fans with features such as variable speed drives and IoT connectivity to meet the growing demand for sustainable and automated industrial solutions. This focus on technology and efficiency is a major part of the competition.

A few prominent companies in the industry include New York Blower Company; Greenheck Fan Corporation; Twin City Fan Companies, Ltd.; Cincinnati Fan; and AirPro Fan & Blower Company; Howden Group; Airmaster Fan Company; and Loren Cook Company.

Key Players

- Airmaster Fan Company

- AirPro Fan & Blower Company

- Cincinnati Fan

- Greenheck Fan Corporation

- Howden Group

- Loren Cook Company

- The New York Blower Company

- Twin City Fan Companies, Ltd.

U.S. Industrial Fans Industry Developments

April 2025: Greenheck launched a new line of rooftop units called Model RT. These units are designed for mixed air applications and can control both temperature and humidity at the same time.

U.S. Industrial Fans Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Centrifugal Fans

- Axial Fans

By Flow Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Low Flow Capacity (Upto 5,000 CFM)

- Medium Flow Capacity (5,000 - 50,000 CFM)

- High Flow Capacity (Above 50,000 CFM)

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Ventilation

- Cooling

- Drying

- Material Handling

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Food & Beverage

- Oil & Gas

- Cement

- Chemical & Petrochemical

- Power Generation

- Mining

- Others

U.S. Industrial Fans Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.16 billion |

|

Market Size in 2025 |

USD 1.20 billion |

|

Revenue Forecast by 2034 |

USD 1.73 billion |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.16 billion in 2024 and is projected to grow to USD 1.73 billion by 2034.

The market is projected to register a CAGR of 4.1% during the forecast period.

A few key players in the market include New York Blower Company; Greenheck Fan Corporation; Twin City Fan Companies, Ltd.; Cincinnati Fan; AirPro Fan & Blower Company; Howden Group; Airmaster Fan Company; and Loren Cook Company.

The centrifugal fans segment accounted for the largest share of the market in 2024.

The high flow capacity (above 50,000 CFM) segment is expected to witness the fastest growth during the forecast period.