U.S. Industrial Microwave Heating Equipment Market Size, Share, Trends, Industry Analysis Report

By Equipment (RF Solid State Amplifiers, Magnetron), By Power, By Application – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM4893

- Base Year: 2024

- Historical Data: 2020-2023

Overview

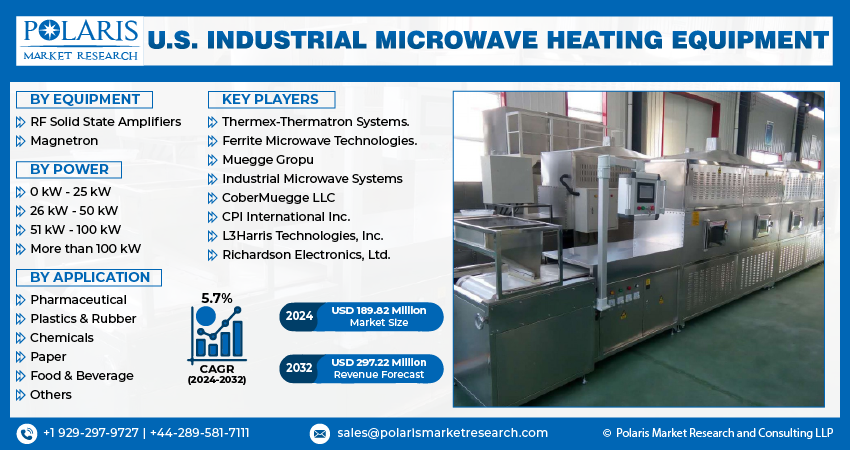

The U.S. industrial microwave heating equipment market size was valued at USD 186.82 million in 2024, growing at a CAGR of 5.8% from 2025 to 2034. Key factors driving demand are advanced industrial infrastructure, and automation and smart manufacturing trends.

Key Insights

- The RF solid state amplifiers segment is projected to register a CAGR of 8.2% during the forecast period, driven by their enhanced performance, precision control, and long-term reliability compared to conventional magnetron-based systems.

- The magnetron segment is anticipated to maintain a significant market share during the forecast period, owing to its suitability for high-output, large-scale applications such as food processing, wood drying, and rubber curing, where extreme precision is not essential.

- The 26 kW–50 kW power range segment accounted for 32.90% of the revenue share in 2024, as it effectively meets the needs of medium-scale industrial operations that demand a balance of performance and energy efficiency.

- The pharmaceutical application segment captured a 12.74% revenue share in 2024, supported by its critical need for clean, precise, and efficient thermal processing solutions to ensure product safety and quality.

Industry Dynamics

- Advanced industrial infrastructure drives the U.S. industrial microwave heating equipment market expansion.

- Automation and smart manufacturing trends are driving the U.S. industrial microwave heating equipment market demand.

- Advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods is driving the adoption of industrial microwave heating equipment.

- High initial cost of equipment and installation hinders their adoption among small and medium-sized enterprises.

Market Statistics

- 2024 Market Size: USD 186.82 Million

- 2034 Projected Market Size: USD 329.40 Million

- CAGR (2025–2034): 5.8%

AI Impact on U.S. Industrial Microwave Heating Equipment Market

- AI tools enable real-time adjustments and monitoring of heating parameters such as temperature and frequency. It leads to reduced waste, uniform heating, and improved product quality, which is critical in food and pharmaceutical applications.

- In the U.S., manufacturers adopt AI-powered decentralized microwave systems, as they help reduce transportation and labor costs.

- AI integration helps optimize energy usage, which contributes to reduce carbon emissions and helps companies comply with environmental regulations imposed by the U.S. government and global regulatory organizations. It aligns well with rising corporate and consumer demand for green technologies.

The industrial microwave heating involves the use of microwave energy to heat, dry, and process materials in sectors such as food & beverage, pharmaceuticals, chemicals, and rubber. It offers various advantages such as faster processing times, energy efficiency, and improved product quality compared to conventional heating methods.

In the U.S., industries are focusing on complying with environmental regulations and reducing carbon emissions. The government has introduced several initiatives and incentives to promote clean energy and energy-efficient equipment across sectors. Microwave heating systems consume less energy and provide precise, targeted heating, making them a preferred choice for companies aiming to reduce their environmental impact. This emphasis on sustainability and energy savings is pushing manufacturers to replace traditional heating methods with microwave-based solutions, especially in energy-intensive industries such as food, pharmaceuticals, and chemicals, thereby driving the U.S. industrial microwave heating equipment market growth.

The U.S. is a global leader in research and development, with significant investments in advanced manufacturing technologies, including RF and solid-state microwave systems. American companies and institutions continue to innovate in areas such as solid-state amplifiers, smart control systems, and energy-efficient designs. These advancements are making industrial microwave equipment more reliable, cost-effective, and suitable for a wider range of applications. The integration of advanced microwave technologies is becoming more common as U.S. industries seek smarter and more automated solutions, driving increased adoption across various sectors including pharmaceuticals, aerospace, and electronics, thereby fueling the growth of the U.S. industrial microwave heating equipment market.

Drivers & Opportunities

Advanced Industrial Infrastructure: The U.S. has one of the most developed industrial infrastructures in the world, supporting sectors such as pharmaceuticals, food processing, chemicals, automotive manufacturing, and food and beverage. According to the U.S. Department of Agriculture, in 2021, the food & beverage industry employs 1.7 million people in the country. These industries require precise, efficient, and high-speed heating systems to improve production efficiency. Industrial microwave heating equipment offers faster processing, reduced energy use, and uniform heating, aligning perfectly with the needs of modern U.S. factories. The demand for advanced thermal technologies such as microwave heating is growing as manufacturers in the U.S. continue to upgrade their production lines, thereby fueling the growth.

Automation and Smart Manufacturing Trends: The U.S. is rapidly adopting automation and smart manufacturing practices, especially under initiatives such as Industry 4.0 and government-backed programs supporting advanced manufacturing. Industrial microwave heating systems are easily integrated into automated production lines and offer real-time monitoring, precise control, and remote operation capabilities. These features make them ideal for modern, data-driven manufacturing environments. The demand for intelligent and flexible heating solutions is rising as industries increasingly move toward digitization and automation to boost efficiency and reduce labor costs. This alignment with smart factory requirements makes microwave heating equipment highly attractive in the U.S. industrial landscape.

Segmental Insights

Equipment Analysis

Based on equipment, the segmentation includes RF solid state amplifiers and magnetron. The RF solid state amplifiers segment is projected to register a CAGR of 8.2% during the forecast period due to their superior performance, precision, and durability compared to traditional magnetron-based systems. These amplifiers offer consistent power output, better control, and longer operational life, which are critical for high-end manufacturing in industries such as aerospace, electronics, and pharmaceuticals. The U.S. manufacturers value reliability and low maintenance, making solid-state technology an ideal choice. Additionally, ongoing R&D and government support for advanced manufacturing technologies are accelerating the shift toward RF solid state systems, thereby driving the segment growth.

The magnetron segment is expected to witness a significant share during the forecast period as they are well-suited for large-scale applications such as food processing, wood drying, and rubber curing, where precise control is less critical but high thermal output is needed. Their affordability and proven reliability make them an attractive option for manufacturers seeking to upgrade from conventional heating methods without a significant capital investment. Additionally, the vast base of existing installations and operator familiarity with magnetron technology support demand in the U.S., especially among cost-conscious industries, thereby fueling the segment growth.

Power Analysis

In terms of power, the segmentation includes 0 kW–25 kW, 26 kW–50 kW, 51 kW–100 kW, and more than 100 kW. The 26 kW–50 kW held 32.90% of revenue share in 2024, as it perfectly suits medium-scale industrial operations that require both efficiency and performance. These systems are widely used in applications like food drying, chemical processing, and pharmaceutical heating, where precise temperature control and energy efficiency are essential. The push toward greener technologies and cost-saving solutions in U.S. manufacturing is further encouraging the adoption of this power segment. Companies are favoring these mid-range systems as they offer a balance between affordability, flexibility, and processing power, driving their demand in the U.S. industrial landscape.

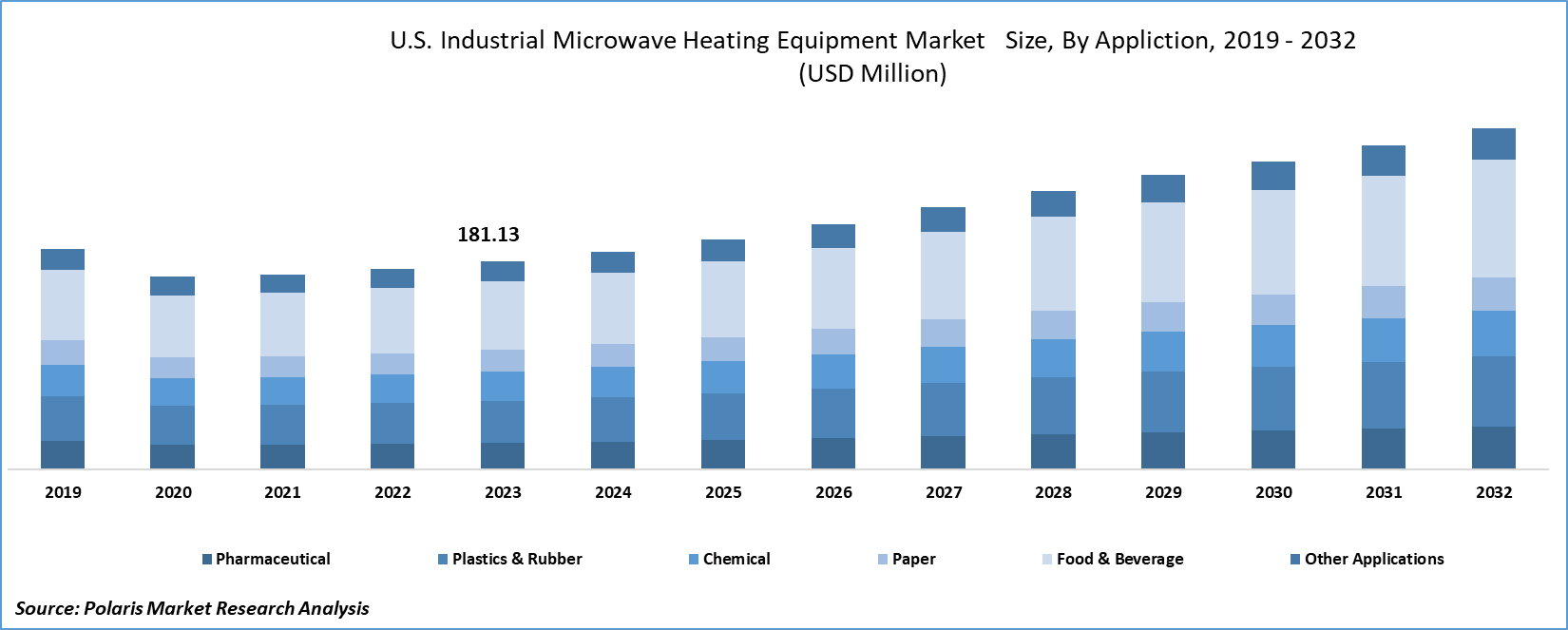

Application Analysis

In terms of application, the segmentation includes pharmaceuticals, plastics & rubber, chemicals, paper, food & beverage, and others. The pharmaceuticals segment held a significant revenue share in 2024, holding 12.74% due to its need for clean, accurate, and efficient thermal processing. Microwave systems are widely used for drying active pharmaceutical ingredients (APIs), sterilizing materials, and improving overall production speed. Pharmaceutical manufacturers rely on technologies that ensure product integrity and reduce contamination risks with strict FDA regulations and high-quality standards. Additionally, the increasing demand for faster drug development and processing timelines is pushing U.S. pharma companies to adopt advanced heating systems such as microwaves, boosting the segment growth.

Key Players & Competitive Analysis

The competitive landscape of the U.S. industrial microwave heating equipment market is defined by the presence of both global leaders and specialized domestic players offering a range of advanced heating solutions. Companies such as CPI International Inc., L3Harris Technologies, Inc., and Teledyne e2v have a strong foothold in the U.S. due to their expertise in RF and microwave technologies, particularly for high-performance industrial and defense applications. Richardson Electronics, Ltd. and CoberMuegge LLC play key roles by providing both components and complete systems tailored to U.S. manufacturing needs. Global giants such as Panasonic Corporation and Toshiba Corporation also operate in the U.S. market, leveraging their innovation and scale. The competition is driven by technological advancements, energy efficiency requirements, and the growing demand for automation. U.S.-based companies benefit from strong R&D infrastructure and a push for smart manufacturing, which continues to influence product development and strategic expansion in the market.

Key Players

- CoberMuegge LLC

- CPI International Inc

- Hitachi Power Solutions Co., Ltd

- Industrial Microwave Systems

- L3Harris Technologies, Inc.

- Muegge Group

- Panasonic Corporation

- Richardson Electronics, Ltd.

- Teledyne e2v

- Toshiba Corporation

U.S. Industrial Microwave Heating Equipment Industry Developments

In November 2023, Richardson Electronics expanded its microwave product range through a partnership with Junkosha Cable Assemblies. Drawing on Junkosha's extensive experience in the RF market, their advanced cables and interconnects for the 5G industry excel in handling higher frequencies and demonstrate efficient performance in environments characterized by high flexure and temperature variations.

U.S. Industrial Microwave Heating Equipment Market Segmentation

By Equipment Outlook (Revenue, USD Million, 2021–2034)

- RF Solid State Amplifiers

- Magnetron

By Power Outlook (Revenue, USD Million, 2021–2034)

- 0 kW–25 kW

- 26 kW–50 kW

- 51 kW–100 kW

- More than 100 kW

By Application Outlook (Revenue, USD Million, 2021–2034)

- Pharmaceutical

- Plastics & Rubber

- Chemicals

- Paper

- Food & Beverage

- Others

U.S. Industrial Microwave Heating Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 186.82 Million |

|

Market Size in 2025 |

USD 197.49 Million |

|

Revenue Forecast by 2034 |

USD 329.40 Million |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 186.82 million in 2024 and is projected to grow to USD 329.40 million by 2034.

The market is projected to register a CAGR of 5.8% during the forecast period.

A few of the key players in the market are Hitachi Power Solutions Co., Ltd; Muegge Group; Teledyne e2v; Industrial Microwave Systems; CoberMuegge LLC; CPI International Inc; L3Harris Technologies, Inc.; Richardson Electronics, Ltd.; Panasonic Corporation; and Toshiba Corporation.

The RF solid state amplifier segment dominated the market revenue share in 2024.

The pharmaceutical segment is projected to witness the fastest growth during the forecast period.