U.S. Men’s Jewelry Market Size, Share, Trends, Industry Analysis Report

By Product (Necklace, Ring, Earrings), By Material, By Category, By Distribution Channel, By Age, By Type – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM4860

- Base Year: 2024

- Historical Data: 2020-2023

Overview

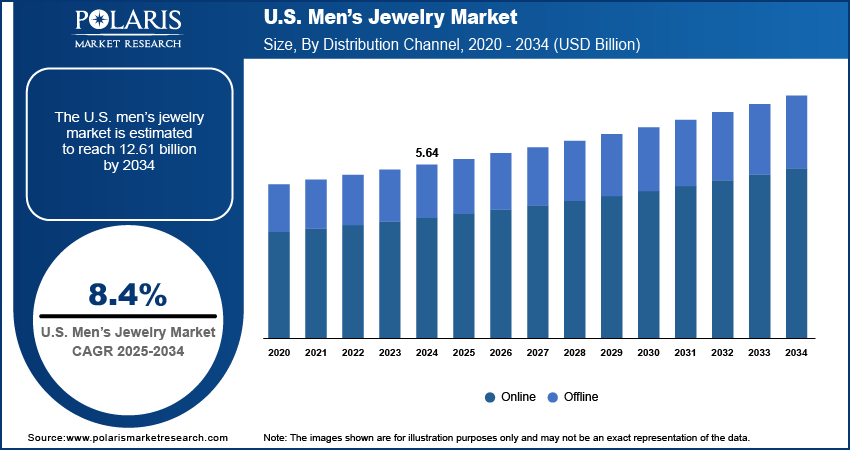

The U.S. men’s jewelry market size was valued at USD 5.64 billion in 2024, growing at a CAGR of 8.4% from 2025 to 2034. Key factors driving demand for men’s jewelry in the country include the shift in cultural norms and the growing fashion consciousness, rise of e-commerce and direct-to-consumer (DTC) brands, and growing influence of social media and pop culture.

Key Insights

- The ring segment accounted for the largest revenue share in 2024.

- The gold segment dominated the market in 2024.

- The branded segment is witnessing strong growth in the U.S., as men increasingly associate brand names with quality, craftsmanship, and personal identity.

- The online segment is expected to witness the fastest growth during the forecast period.

Men’s jewelry refers to a diverse range of decorative accessories, such as rings, bracelets, necklaces, cufflinks, and earrings. The U.S. market growth is fueled by the rapid expansion of online sales channels and digital discovery. E-commerce platforms, social media, and influencer-led marketing have revolutionized how men explore and purchase fashion accessories. Brands can reach wider audiences and tap into niche preferences with the increasing use of mobile commerce and personalized product recommendations. Moreover, online accessibility improves product visibility and also enables customers to explore new styles and trends conveniently, boosting repeat engagement and loyalty.

The shift in cultural norms and the growing fashion consciousness among men further drive the growth opportunities. Modern consumers are embracing jewelry as a mode of self-expression and style enhancement, breaking away from traditional stereotypes that associated such accessories primarily with women. This evolving mindset is supported by the broader acceptance of gender-neutral fashion and the rise of metro sexuality, encouraging men to experiment with various materials, designs, and luxury finishes. Therefore, as individuality and personal branding gain prominence, men are increasingly viewing jewelry as an integral part of their everyday and occasion-based wardrobe, further driving demand.

Industry Dynamics

- The growth of e-commerce platforms and direct-to-consumer business models has revolutionized the U.S. men’s jewelry market, democratizing access to varied designs while enhancing customer-brand interactions through digital channels.

- Social media platforms and modern cultural movements have normalized jewelry wearing among American men, elevating these accessories from niche items to essential fashion components in modern masculine wardrobes.

- The sector struggles with outdated stereotypes that limit adoption. Many consumers still view jewelry as a feminine product, creating resistance among traditional buyers.

- Growing interest in gender-neutral fashion opens new customer segments. Younger generations are embracing jewelry as self-expression, driving demand for modern designs.

Expansion of E-Commerce Platforms: The rise of e-commerce and direct-to-consumer (DTC) brands boosts the U.S. men’s jewelry market expansion by streamlining access to diverse styles and fostering brand engagement. For instance, in May 2025, the U.S. Census Bureau reported that Q1 2025 retail e-commerce sales reached USD 300.2 billion, showing negligible change (±0.7%) from Q4 2024 levels. Online platforms allow consumers to explore curated collections, compare prices, and customize purchases from the comfort of their homes. DTC brands, in particular, bypass traditional retail channels, enabling faster innovation cycles, stronger brand storytelling, and competitive pricing. These platforms also leverage consumer data to personalize shopping experiences and build loyal customer communities. As a result, men are more inclined to experiment with jewelry that aligns with their style preferences and values.

Influence of Social Media and Pop Culture: The growing influence of social media and pop culture has accelerated the adoption of men’s jewelry in the U.S., transforming it into a mainstream fashion choice. High-visibility endorsements by celebrities, athletes, and influencers across platforms such as Instagram and TikTok have normalized jewelry as an everyday style essential for men. This shift is further reflected in consumer spending patterns. In February 2025, the U.S. Bureau of Labor Statistics reported that household expenditures on men's apparel reached USD 406 in 2023, with jewelry increasingly contributing to this category. Pop culture references in music, film, and television continue to shape consumer perception, inspiring trends that rapidly translate into purchase behavior. The constant exposure to aspirational figures and curated aesthetics encourages men to adopt jewelry as part of their identity and also reinforces its role as a powerful medium for personal expression and cultural relevance.

Segmental Insights

Product Analysis

Based on product, the segmentation includes necklace, ring, earrings, bracelet, and other products. The ring segment accounted for the largest revenue share in 2024 due to its cultural symbolism and ongoing relevance in personal and ceremonial contexts. Rings continue to be widely worn to celebrate milestones such as engagements, weddings, or personal achievements, making them an essential accessory across male age groups. The U.S. men’s jewelry market trends favor sleek, masculine ring designs with minimalistic patterns and high-quality materials, aligning well with evolving fashion sensibilities. Furthermore, the increasing integration of rings into daily wear by urban and style-conscious men continues to support steady demand for this segment.

Material Analysis

In terms of material, the segmentation includes silver, gold, platinum, diamond, titanium, steel, tungsten, forged carbon, and other types. The gold segment dominated the market in 2024, favored for its aesthetic appeal, cultural symbolism, and long-standing association with success and prestige. Its adaptability to both modern and classic designs makes it a versatile choice for a wide range of consumers. In the U.S., gold jewelry is often valued for its refined appearance, intrinsic value, and durable nature, which makes it suitable for both everyday wear and special occasions. Additionally, its non-reactive properties make it a practical option for men seeking both style and longevity in their accessories.

Category Analysis

The segmentation, based on category, includes branded and unbranded. The branded segment is witnessing strong momentum in the U.S. as men increasingly associate brand names with quality, craftsmanship, and personal identity. Branded jewelry offers added value through certifications, consistent design language, and enhanced service offerings. American consumers are drawn to the lifestyle narrative that established labels provide, often reinforced through targeted marketing, celebrity endorsements, and social media engagement. This growing brand affinity is encouraging repeat purchases and strengthening consumer loyalty, especially in the premium and mid-luxury categories.

Distribution Channel Analysis

In terms of distribution channel, the U.S. men’s jewelry market segmentation includes offline and online. The online segment is expected to witness the fastest growth by 2034, due to its digital convenience and evolving shopping behavior. E-commerce platforms offer extensive design options, competitive pricing, and seamless comparison tools, catering to tech-savvy and time-conscious consumers. Features such as virtual try-ons, secure payment systems, and flexible return policies are boosting buyer confidence. Additionally, the strong digital presence of both independent designers and established brands has broadened access to personalized and trend-driven jewelry collections.

Age Analysis

Based on age, the segmentation includes below 18 years, 18–30 years, 30–50 years, and above 50 years. The 18–30 years segment is projected to witness significant growth shaped by modern fashion consciousness and a strong inclination toward self-expression. Younger men are increasingly open to experimenting with new materials, bold designs, and personalized elements that reflect their evolving identities. Influenced heavily by digital content, influencers, and pop culture, this group is shifting jewelry from an occasional adornment to an everyday fashion essential. Their comfort with digital shopping channels also makes them a prime audience for direct-to-consumer and online-first brands.

Type Analysis

The segmentation, based on type, includes traditional and luxury. The luxury segment is projected to reach at a substantial share by 2034. The growth is supported by growing demand for exclusive, finely crafted jewelry pieces that serve as personal status symbols. High-end designs featuring premium materials and limited-edition collections resonate strongly with affluent male consumers seeking sophistication and individuality. The appeal of luxury jewelry extends beyond aesthetics, encompassing brand heritage, exclusivity, and emotional investment. Luxury items are often positioned as timeless assets, further reinforcing their appeal in milestone-driven and aspirational purchasing behavior.

Key Players and Competitive Analysis

The U.S. men’s jewelry market presents significant revenue opportunities, with competitive intelligence and strategy revealing shifts toward gender-fluid designs and minimalist aesthetics. Industry trends highlight the rising demand from small and medium-sized businesses innovating in sustainable value chains, while established players leverage strategic investments to enhance product offerings. Disruptions and trends in pop culture and social media management are accelerating adoption, creating latent demand and opportunities in younger demographics. Technological advancements in customization tools and e-commerce platforms are reshaping business segments, with revenue growth driven by direct-to-consumer models. Economic and geopolitical shifts influence material sourcing, prompting brands to localize production. Future development strategies focus on AI-driven personalization and ethical sourcing to align with consumer values. Vendor strategies highlight differentiation through craftsmanship and storytelling, while growth projections indicate strong potential in emerging market segments such as luxury streetwear. The market's evolution reflects broader business transformation toward experiential retail and digital engagement.

A few major companies operating in the U.S. men’s jewelry industry include Bernard James; David Yurman; Jaxxon; LAGOS, LLC; Miansai; Spinelli Kilcollin; STULLER, INC.; Two Tone Jewelry Mfg. Co.; Mejuri; and Gorjana.

Key Players

- Bernard James

- David Yurman

- Gorjana

- Jaxxon

- LAGOS, LLC

- Mejuri

- Miansai

- Spinelli Kilcollin

- STULLER, INC.

- Two Tone Jewelry Mfg. Co.

Industry Developments

- January 2024: David Yurman unveiled its inaugural high-end jewelry collection specifically for men. It consists of platinum cufflinks with 8.48 carats of tanzanite enclosed by a diamond, a rare diamond ring, and a ruby-decorated rose-gold chain bracelet.

- January 2024: LAGOS, a jewelry brand, launched its first-ever collection for men called "LAGOS for Men." The "Anthem" collection is a result of Founder and Creative Director Steven Lagos' vision, which is known for his Caviar beaded designs.

U.S. Men’s Jewelry Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Necklace

- Ring

- Wedding Band

- Earrings

- Bracelet

- Other Products

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silver

- Gold

- Platinum

- Diamond

- Titanium

- Steel

- Tungsten

- Forged Carbon

- Other Types

By Category Outlook (Revenue, USD Billion, 2020–2034)

- Branded

- Unbranded

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Offline

- Online

By Age Outlook (Revenue, USD Billion, 2020–2034)

- Below 18 Years

- 18-30 Years

- 30-50 Years

- Above 50 Years

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Traditional

- Luxury

U.S. Men’s Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.64 Billion |

|

Market Size in 2025 |

USD 6.10 Billion |

|

Revenue Forecast by 2034 |

USD 12.61 Billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 5.64 billion in 2024 and is projected to grow to USD 12.61 billion by 2034.

The U.S. market is projected to register a CAGR of 8.4% during the forecast period.

A few of the key players in the market are Bernard James; David Yurman; Jaxxon; LAGOS, LLC; Miansai; Spinelli Kilcollin; STULLER, INC.; Two Tone Jewelry Mfg. Co.; Mejuri; and Gorjana.

The ring segment accounted for the largest revenue share in 2024.

The online segment is expected to witness the fastest growth during the forecast period.