U.S. Natural Stone Market Size, Share, Trends, & Industry Analysis By Type, (Marble, Granite, Limestone, and Others), By Construction Type, By Application, and By Country – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5893

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

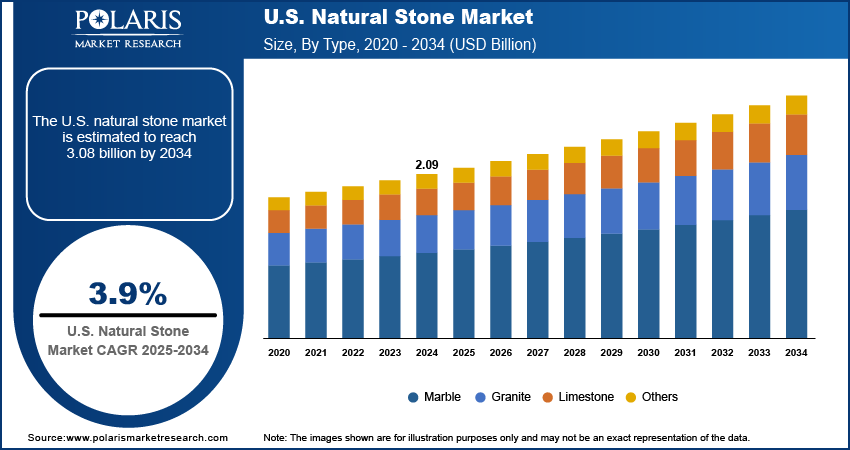

The US natural stone market size was valued at USD 2.09 billion in 2024, growing at a CAGR of 3.9% from 2025–2034. Growth in renovation and remodeling activities across the country coupled with surge in residential and commercial construction nationwide is propelling the US natural stone market growth.

The US natural stone market is experiencing steady growth due to the rising demand for high-quality construction materials across residential, commercial, and institutional projects. The increasing use of granite, marble, limestone, and slate in architectural design is supported by the long lifecycle, durability, and visual appeal. Builders and designers are integrating natural stone in high-traffic zones such as hotel lobbies, commercial building façades, and luxury residential interiors to enhance performance and design value. The material’s resilience to weathering and its ability to meet performance standards in indoor and outdoor applications continue to drive its selection across project categories.

To Understand More About this Research: Request a Free Sample Report

Federal and state-level funding for infrastructure upgrades and historical restoration is further fueling widespread adoption of natural stone. In addition, the US benefits from an active domestic quarrying and fabrication industry that supports fast turnaround times, design customization, and quality control. Manufacturers are adopting digital fabrication and automated finishing technologies to offer bespoke stone solutions that cater to evolving design preferences. Growing emphasis on aesthetic flexibility, combined with rising construction activity in metropolitan and suburban areas, is accelerating the demand for natural stone across the US.

The rising government initiatives to promote the preservation and rehabilitation of historic structures through dedicated federal and state-level funding programs, is boosting US natural stone market growth. For instance, in May 2025, the US Congress approved funding of USD 225 million for the Historic Preservation Fund (HPF) for fiscal year 2025, propelling the federal government’s long-standing commitment to cultural and architectural preservation. Restoration projects involving courthouses, libraries, museums, and other historically significant buildings require authentic materials to match original architectural elements. Natural stone, with its proven durability and historical relevance, is specified for exterior façades, columns, staircases, and public monuments.

Additionally, the commercial real estate sector in country is witnessing sustained growth in the hospitality and retail segments, particularly across urban centers, tourist destinations, and mixed-use developments. Developers and project owners are increasingly prioritizing premium building materials that deliver long-term performance and visual distinction. Natural stone is extensively used in upscale hotels, resorts, restaurants, and retail flagships due to its ability to offer varied textures, natural veining, and a sense of luxury. Stone is widely used across architectural elements such as lobby floors, reception desks, exterior cladding, and landscaping, offering durability and visual appeal.

Industry Dynamics

Growth in Renovation and Remodeling Activities Across the Country

The increasing renovation and remodeling projects across the US is boosting demand for natural stone in residential applications. According to the Leading Indicator of Remodeling Activity (LIRA), homeowners across the country spent approximately USD 463 billion on home renovations in early 2024, with a strong concentration of activity focused on kitchens, bathrooms, and living rooms. Projects typically averaged around USD 15,000 in budget, with many homeowners targeting high-return improvements such as countertop installations and hardwood floor refinishing. This growing investment underscores a well-established culture of home improvement and supports the continued integration of stone materials in remodeling efforts.

Natural stone remains a top material of choice in upscale renovation projects due to its durability, low maintenance, and visual sophistication. Marble, granite, and limestone are widely used for kitchen countertops, bathroom vanities, shower walls, and decorative flooring in urban and suburban properties. Aging housing stock across key states, including California, New York, and Illinois, is further pushing homeowners to modernize interiors while maintaining a sense of timeless elegance. The availability of prefabricated slabs, growing interest in sustainable materials, and the influence of luxury design trends are supporting this shift. The rise of online remodeling platforms and home improvement financing is making these projects more accessible, driving long-term growth for stone suppliers and installers.

Surge in Residential and Commercial Construction Nationwide

Rising investment in public and private construction activity across the US is significantly driving the growth of the natural stone market. According to the Federal Reserve Economic Data (FRED), public construction spending in the US rose significantly from approximately USD 360.88 billion in March 2021 to more than USD 511.12 billion in March 2025, marking a 41.6% increase within four years. This substantial rise reflects the expanding footprint of infrastructure upgrades, transportation hubs, education facilities, and government buildings. Many of these projects specify granite and limestone due to their strength, longevity, and refined appearance.

In addition, the housing sector continues to show resilience, with developers seeking high-quality materials that balance performance and visual impact. In residential construction, natural stone is increasingly adopted for outdoor patios, garden walkways, fireplaces, and façades, as homeowners place greater emphasis on property value and outdoor living enhancements. In commercial buildings, particularly in hospitality and retail sectors, stone is used extensively in entrance areas, columns, feature walls, and flooring. Therefore, the growing funding for large-scale public works and private development projects is boosting the adoption of natural stone in the US construction landscape.

Segmental Insights

Type Analysis

The segmentation, based on type includes, marble, granite, limestone, and others. The granite segment is projected to reach significant revenue share by 2034, driven by its widespread application in areas subject to heavy use, including flooring, countertops, and public infrastructure. Granite’s strength, resistance to wear, and polished aesthetic make it a preferred material in residential and commercial projects. Its availability in a broad range of colors and textures enhances its suitability for decorative purposes. The increasing demand for premium finishes in high-end real estate and institutional buildings continues to reinforce its market share. According to the India Brand Equity Foundation, sales of luxury homes in India priced above USD 0.5 million rose by 53% across seven key cities in 2024. CBRE noted that 19,700 luxury units were sold during that year. Granite’s ability to withstand heat and its minimal maintenance requirements further support its use in various climatic zones, especially in urban construction.

The marble segment is forecasted to experience the fastest growth during the projection period. Rising consumer interest in refined interior aesthetics and custom design in luxury residences, hospitality settings, and cultural spaces is fueling this trend. Restoration of heritage sites and monuments is also contributing to stronger demand. Technological improvements in cutting and finishing, along with increased availability of regional and imported marble, are making the material more accessible beyond the high-end segment. Marble remains a sought-after choice in modern architectural projects, particularly for flooring and facades, where elegance and timeless design are prioritized.

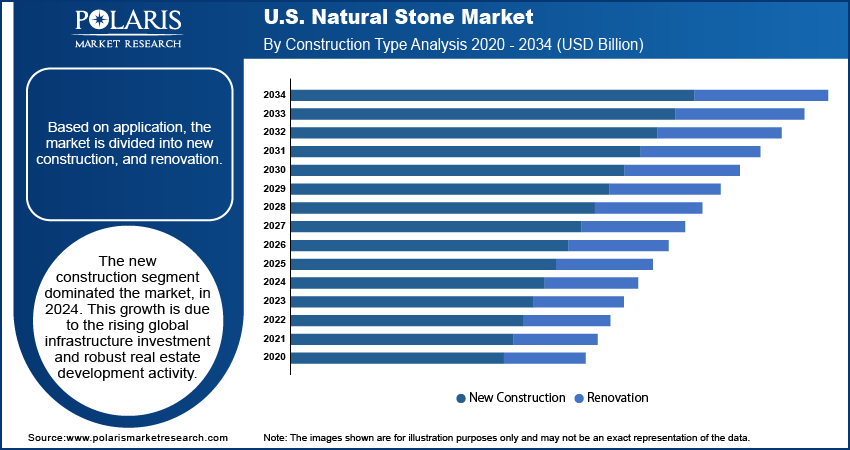

Construction Type Analysis

The segmentation, based on construction type includes, new construction, and renovation. The new construction segment dominated the market, in 2024. This growth is due to the rising global infrastructure investment and robust real estate development activity. Expanding urban populations, large-scale public projects, and private sector developments are boosting the use of Natural stone in new builds. Developers prefer natural stone for exterior finishes, landscaping, and interior detailing due to its premium appearance and longevity. For example, Blackstone, already heavily invested in Indian real estate with a USD 50 billion portfolio, aims to invest an additional USD 22 billion by 2030, reflecting the global momentum in construction.

Meanwhile, the renovation segment is expected to grow at the highest rate through 2034. The aging infrastructure across North America, Europe, and parts of Asia is leading to an increase in refurbishment and remodeling activities. Natural stone is increasingly used in restoring historic structures and enhancing interiors with authentic, durable materials. Sustainability-focused renovations also support the material's adoption, given its low environmental impact and long service life. Growing homeowner interest in design upgrades and the use of high-quality, long-lasting finishes is further driving demand in residential renovation.

Application Analysis

The segmentation, based on application includes, flooring, memorial arts, wall cladding, and others. The flooring segment accounted for substantial market share in 2024 due to the widespread adoption of natural stone for flooring in residential and commercial settings, including lobbies, lounges, corridors, and patios. Materials such as granite, limestone, and marble offer the durability, variety, and aesthetic appeal sought by architects and contractors for high-traffic environments such as hotels, airports, and office buildings. Innovations in finishing techniques such as anti-slip surfaces and weatherproofing are further fueling broader adoption, particularly in outdoor and moisture-prone areas.

The wall cladding segment is projected to grow at the highest compound annual growth rate between 2025 and 2034. Rising demand for distinctive and resilient interior and exterior finishes is pushing the use of natural stone in cladding applications. Natural stone is favored for its ability to provide insulation, weather protection, and varied textures. Contemporary architecture that emphasizes natural materials and earthy tones is driving this trend across residential, commercial, and institutional sectors. Additionally, lightweight panel solutions and advancements in dry installation methods are making stone wall cladding viable in tall structures and retrofit projects.

Key Players & Competitive Analysis Report

The US natural stone market is moderately fragmented, with a diverse mix of established regional suppliers, vertically integrated producers, and specialized fabricators competing across commercial, residential, and restoration-focused projects. Companies in this space are actively focused on expanding their quarrying operations, enhancing fabrication capabilities, and strengthening distributor relationships to meet growing demand from new construction and renovation markets. Several firms are also investing in advanced cutting, polishing, and digital templating technologies to improve processing precision and turnaround time, which is increasingly valued in custom architectural projects. Product differentiation remains a key focus area, with players offering a wide range of stone types including granite, marble, limestone, travertine, and quartzite sourced from domestic and imported origins.

Prominent players operating in the US natural stone market include A&G Marble Inc., Champlain Stone Ltd., Coldspring, Cumar Inc., Fond du Lac Natural Stone, Indian Creek Stone Products, Levantina y Asociados de Minerales, S.A., Lurvey Stone & Marble, Natural Stones USA, New Mexico Travertine, Polycor Inc., Rolling Rock Building Stone, Inc., Southland Stone USA, Inc., Superior Granite and Marble, and USA Marble LLC.

Key Players

- A&G Marble Inc.

- Champlain Stone Ltd.

- Coldspring

- Cumar Inc.

- Fond du Lac Natural Stone

- Indian Creek Stone Products

- Levantina y Asociados de Minerales, S.A.

- Lurvey Stone & Marble

- Natural Stones USA

- New Mexico Travertine

- Polycor Inc.

- Rolling Rock Building Stone, Inc.

- Southland Stone USA, Inc.

- Superior Granite and Marble

- USA Marble LLC

Industry Developments

February 2023: Polycor Inc. acquired Ebel Quarries, a limestone quarrier and fabricator based in Ontario. This acquisition is aimed at meeting the rising demand for natural stone and expanding Polycor’s product offerings.

US Natural Stone Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Marble

- Granite

- Limestone

- Others

By Construction Type Outlook (Revenue, USD Billion, 2020–2034)

- New construction

- Renovation

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Flooring

- Memorial Arts

- Wall Cladding

- Others

US Natural Stone Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.09 Billion |

|

Market Size in 2025 |

USD 2.17 Billion |

|

Revenue Forecast by 2034 |

USD 3.08 Billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.09 billion in 2024 and is projected to grow to USD 3.08 billion by 2034.

The US market is projected to register a CAGR of 3.9% during the forecast period.

A few of the key players in the market are A&G Marble Inc., Champlain Stone Ltd., Coldspring, Cumar Inc., Fond du Lac Natural Stone, Indian Creek Stone Products, Levantina y Asociados de Minerales, S.A., Lurvey Stone & Marble, Natural Stones USA, New Mexico Travertine, Polycor Inc.

The new construction segment dominated the market in 2024.

The marble segment is expected to witness the fastest growth during the forecast period.